Accounts Payable in Accounting: Process, Duties & Automation

Accounts payable (AP) refers to the funds that a company needs to pay its suppliers for products or services bought on credit. The accounts payable department handles financial, administrative, and clerical tasks regarding AP within a company.

Automating accounts payable is an agenda for businesses for financial continuity. %70 of accounts payable teams carry out manual invoice data entry according to AP statistics. To get AP automation right, businesses need to have a good understanding of the AP’s place in accounting. This article will provide you with the information you need about accounts payable in accounting, process, duties and automation.

Accounts payable in accounting system

In accounting, the role of accounts payable involves tracking and managing the amounts a company owes to its suppliers or service providers for purchases made on credit.

Accounts payable falls under the category of liability accounting. It represents a company’s obligation to pay off a short-term debt to its creditors or suppliers. In a company’s balance sheet, accounts payable is listed as a current liability. This refers to obligations that the company expects to settle within one fiscal year or the operating cycle.

On a broader scale, accounts payable operations can be included within the accrual accounting. This approach acknowledges that payments for debts might not be immediate which necessitates their documentation as company’s accounts payable or other forms of liabilities. Accrual accounting is not limited to liability accounts.

A short example: Let’s say you run a restaurant and order produce from a local farm on credit. The farm sends an invoice to the restaurant for the delivered produce. The restaurant’s accounts payable team records this invoice as an obligation to pay the farm and shows it as a liability in the company’s financial records. The team then processes the payment according to agreed terms.

Accounts payable automation software

ERPs, especially with native integration add-ons are also commonly used in AP automation. We have analyzed the topic and 4 ERP customers in detail:

- Accounts Payable ERP Integration in ’24: 6 Ways & 5 Features

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

The AP automation tools are not limited to ERPs. For tools with AI and deep learning capabilities and in-depth analysis of their alternatives, check:

- 7 Vic.AI Alternatives to Automate Accounting in 2023

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors in 2023

- 14 Rossum AI Competitors/Alternatives in 2023

Accounts payable vs accounts receivable

Accounts payable represents the amounts a business owes to its suppliers for goods or services received but not yet paid for, showing as a liability on the balance sheet.

Accounts receivable, in contrast, denotes the amounts customers owe to the business for goods or services delivered, appearing as an asset. Both are integral to a company’s cash flow cycle.

On the balance sheet, accounts payable reduce net worth due to their nature as obligations, while accounts receivable increase net worth by indicating expected cash inflows.

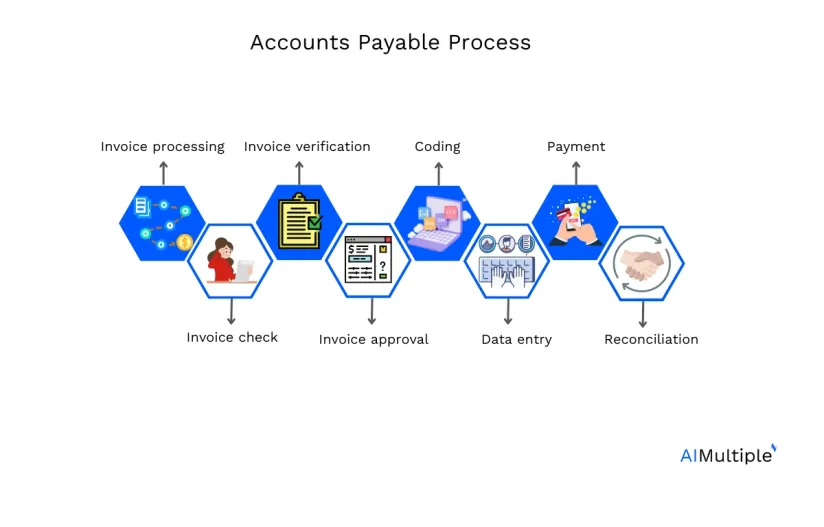

Accounts payable process

The full cycle of accounts payable process consists of 8 steps:

- Invoice processing: Transforms vendor invoices into recorded financial transactions.

- Checking the invoice: Makes sure the invoice contains all necessary details and matches purchase orders.

- Verification: Confirms that goods or services billed have been received or rendered.

- Approval: Obtains authorization from the appropriate personnel to proceed with payment.

- Coding: Assigns relevant general ledger account numbers to the invoice for financial categorization.

- Data entry: Inputs invoice details into the accounting system for tracking and management.

- Payment: Executes the transfer of funds to the supplier to settle the amount.

- Reconciliation: Matches the invoice, payment, and internal records.

For a detailed analysis of each component in accounts payable process, check our article:

Accounts Payable Process in ’24: 8 Steps, Challenges & Tools

What are the duties of accounts payable department?

The accounts payable department focuses on a range of tasks including the calculation and recording of business transactions, and the thorough processing of invoices. The departmental role in accounts payable workflow involves:

- validating financial details for maintaining accurate records

- addressing any inconsistencies in invoice items, prices

- obtaining necessary approvals

- making sure that the correct information and data are in place for invoice payments

- verifying all calculations and totals on invoices to prevent errors

- reviewing vendor files to avoid duplicate payments and assign unique voucher numbers for tracking

- documentation such as vouchers, invoices, and related correspondence

- preparing vouchers, detailing critical information such as invoice numbers, dates, vendor details, item descriptions, and amounts

- checking accounting policies and procedures

- reconciling bank statements to make sure all transactions align with the company’s financial records

Accounts payable turnover ratio & metrics

Key Performance Indicators (KPIs) serve as metrics to evaluate the efficiency of the department’s operations. These indicators help in identifying areas that require improvement.

One critical KPI in this domain is the Accounts Payable Turnover Ratio, which measures how quickly a company pays off its suppliers. The formula for this ratio is the total supplier purchases divided by the average accounts payable amount during a specific period (See Figure 1). A higher turnover ratio indicates that the company is paying its suppliers at a faster rate. A lower ratio may signal potential cash flow issues.

Sample calculation: Let’s say your company has the following figures for a given year:

- Let’s consider your company had total supplier credit purchases of $600,000 over a year. At the beginning of the year, the accounts payable was $50,000, and by the end of the year, it increased to $70,000.

First, calculate the average accounts payable for the year with this formula:

Beginning AP + end year AP/ 2 = $50,000 + $70,000/2 = $60,000.- Now, use the accounts payable turnover formula:

- $600,000/ $60,000 = 10

- This means the company pays off its average accounts payable to suppliers 10 times during the year.

- Now, use the accounts payable turnover formula:

Other important KPIs include:

- Invoice processing time: The average time taken from receiving an invoice to processing payment.

- Cost-per-invoice: This metric calculates the total cost associated with processing each invoice.

- Error rate: The percentage of invoices that contain errors.

- Electronic invoicing percentage: The proportion of invoices processed electronically.

Automating accounts payable

Statistics show that accounts payable automation takes time, and businesses value the different components. There are many ways to automate accounts payable process like:

- Data management tools

- Data extraction technologies:

- Document scanning

- Optical Character Recognition (OCR)

- Machine/deep learning. For detailed analysis of application of AI in accounts payable, check: 10 AI Applications in Accounts Payable (AP) Processes for 2024

- Machine learning

- Payment processing

- General purpose automation tools like RPA

FAQ on Accounts payable & balance

What is an accounts payable balance? The accounts payable balance represents the total money a business owes to its suppliers or creditors for goods and services received but not yet paid for. This figure appears as a liability on the company’s balance sheet.

How does a business pay off its accounts payable balance? A business pays off its accounts payable balance by issuing payments to its suppliers or creditors according to the terms agreed upon at the time of purchase. These payments are recorded as decreases in the accounts payable account.

Where does the accounts payable account appear in financial statements? The accounts payable account is shown under current liabilities on the balance sheet. It reflects the company’s short-term obligations to pay its suppliers and creditors.

What happens if the accounts payable balance increases? An increase in the accounts payable balance indicates that a business is purchasing more goods or services on credit without making corresponding payments. While this might improve short-term cash flow, it also increases the company’s liabilities.

Can a high accounts payable balance be a bad sign? While a high accounts payable balance can indicate effective credit management and cash flow optimization, it might also suggest potential cash flow issues or reliance on credit for operational expenses. It’s crucial to analyze this in the context of the business’s overall financial health.

Further reading

Comments

Your email address will not be published. All fields are required.