Most of my decade-long consulting career involved serving financial services firms and helping finance leaders. I selected top generative AI finance use cases with their real-life examples. See how these examples support automating routine tasks and empowering new services:

- For financial services firms

- For finance units in non-financial firms

- For banking: check out generative AI use cases in banking.

Finance functions in non-financial firms

1-Automation of accounting functions

Specialized transformer models help finance units in automating functions such as auditing, accounts payable including invoice capture and processing. With deep learning functions, GPT models specialized in accounting can achieve high rates of automation in most accounting tasks.

Financial services firms

2-Conversational finance

Generative AI models can produce more natural and contextually relevant responses, as they are trained to understand and generate human-like language patterns. As a result, generative AI can significantly enhance the performance and user experience of financial conversational AI systems and chatbots by providing more accurate, engaging, and nuanced interactions with users.

Conversational finance provides customers with:

- Improved customer support

- Personalized financial advice

- Payment notifications

- Document generations like investment summaries or loan applications.

For instance, Morgan Stanley employs OpenAI-powered chatbots to support financial advisors by utilizing the company’s internal collection of research and data as a knowledge resource.

For more on conversational finance, you can check our article on the use cases of conversational AI in the financial services industry. To explore the many ways conversational AI can enhance customer service operations, look at our dedicated article on conversational AI for customer service.

3-Generating applicant-friendly denial explanations

AI plays a significant role in the banking sector, particularly in loan decision-making processes. It helps banks and financial institutions assess customers’ creditworthiness, determine appropriate credit limits, and set loan pricing based on risk.

However, both decision-makers and loan applicants need clear explanations of AI-based decisions, such as reasons for application denials, to foster trust and improve customer awareness for future applications.

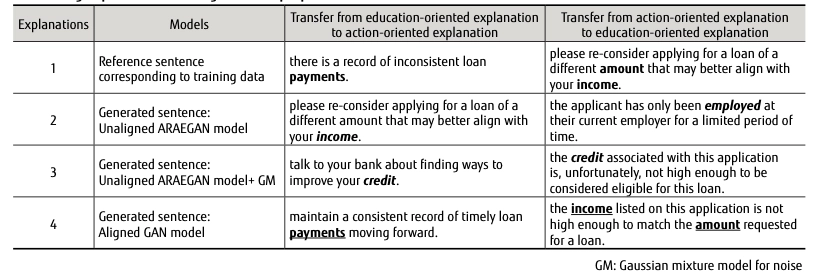

A conditional generative adversarial network (GAN), a generative AI variant, was used to generate user-friendly denial explanations. By organizing denial reasons hierarchically from simple to complex, two-level conditioning is employed to generate more understandable explanations for applicants (Figure 3).

Real-life example on script generation

In a case study, the investor relations team anticipates a strong market reaction to the company’s quarterly financial results and needs to prepare a comprehensive script and potential investor questions for the earnings call.2

An analyst imports financial data from the current and previous quarters into a spreadsheet and uses a generative AI tool. The AI is given context from past earnings calls and specific insights to generate relevant commentary.

The AI tool generates a script for the earnings call, including likely investor questions and responses. The analyst formats this content into a Word document, highlights key investor questions, and prepares it for managerial review and the CFO’s preparation.

Back office

4-Legacy software maintenance

Banks still rely on software from the past (e.g. 70s or 80s) written in legacy programming languages like COBOL. It is hard to find developers for legacy languages but these software need to be maintained. Generative AI models can be fluent in all languages and can speed up development and reduce technology costs which make up ~10% of a typical banks’ costs.3

Explore more on how generative AI can contribute to software development and reduce technology costs, helping software maintenance.

5-Application modernization

Banks want to save themselves from relying on outdated software and have ongoing efforts to modernize their software. Enterprise GenAI models can convert code from old software languages to modern ones, and developers can validate the new software, saving significant time.

Employees at Goldman Sachs confirm that generative AI is a strong aspect of application development and enhancement.4

6-Document analysis

Generative AI can be used to process, summarize, and extract valuable information from large volumes of financial documents, such as annual reports, financial statements, and earnings calls, facilitating more efficient analysis and decision-making.

Explore more on generative AI in data and document processing.

7-Financial analysis and forecasting

By learning from historical financial data, generative AI models can capture complex patterns and relationships in the data, enabling them to make predictive analytics about future trends, asset prices, and economic indicators.

Properly fine-tuned generative AI models can improve:

8- Macroeconomic simulations

Generative models can simulate different economic conditions and their impact on financial markets, helping policymakers and financial institutions plan for various future scenarios.

9- Market predictions

By analyzing large volumes of data, generative AI can improve the accuracy of financial forecasts, including stock prices, interest rates, and economic indicators.

Real-life example

An Asian financial institution is running a PoC to provide prompt-to-report functionality to 2,000 analysts and users.5

10-Financial report generation

Automated reporting

Generative AI can automatically create well-structured, coherent, and informative financial reports based on available data. These reports may include:

- Balance sheets

- Income statements

- Cash flow statements

This automation streamlines the reporting process and reduces manual effort, ensuring consistency, accuracy, and timely delivery of reports.

11- Scenario-based reporting

AI can create different regulatory scenarios and generate reports to help financial institutions ensure they meet all necessary compliance requirements under various conditions.

Learn AI text generation use cases and real-life examples.

12-Fraud detection

Generative AI can be used for fraud detection in finance by generating synthetic examples of fraudulent transactions or activities. These generated examples can help train and augment machine learning algorithms to recognize and differentiate between legitimate and fraudulent patterns in financial data.

The enhanced understanding of fraud patterns allows these models to identify suspicious activities more accurately and effectively, leading to faster detection and prevention of fraud. By incorporating generative AI in fraud detection systems, financial institutions can:

- Improve the overall security and integrity of their operations

- Minimize losses due to fraud

- Maintain consumer trust

Explore how generative AI legal applications can help take actions against fraudulent activities.

Real life example

Mastercard needed a faster, more accurate way to detect fraudulent transactions as fraudsters exploited stolen payment card data. Using generative AI, Mastercard scanned transaction data across millions of merchants, predicting and detecting compromised cards, helping banks block them faster and prevent fraud.

Results:

- Doubled detection rate of compromised cards.

- Reduced false positives in fraud detection by up to 200%.

- Increased merchant fraud detection speed by 300%.

13-Responding to regulator requests

As highly regulated industry players, banks get regular requests from regulators.

Real-life example

Banks are running PoCs to see if they can use LLMs to respond to simple and less critical queries from regulators. 6

14-Portfolio management

Dynamic portfolio management

Another financial application of generative AI can be portfolio optimization. By analyzing historical financial data and generating various investment scenarios, generative AI models can help asset managers and investors identify optimal asset and wealth management, taking into account factors such as:

- Risk tolerance

- Expected returns

- Investment horizons.

15-Customized indices

These models can simulate different market conditions, economic environments, and events to better understand the potential impacts on portfolio performance. This allows financial professionals to develop and fine-tune their investment strategies, optimize risk-adjusted returns, and make more informed decisions about managing their portfolios. This ultimately leads to improved financial outcomes for their clients or institutions.

16-Risk management

Stress testing

Generative AI can simulate extreme market conditions that have not occurred in the historical data, allowing financial institutions to better prepare for rare but high-impact events.

17-Credit risk modeling

AI models can generate synthetic borrower profiles to test the robustness of credit risk models, improving the accuracy of credit scoring and default predictions.

18-Anomaly detection

Generative AI models can be trained to understand the normal patterns of transactions and generate data points that represent outliers or anomalies. This helps in identifying potentially fraudulent activities or unusual transaction patterns that might indicate money laundering.

19-Synthetic data for training

Since real fraudulent transactions are rare, generative AI can create synthetic examples of fraudulent activity, helping to train better detection algorithms.

20-Synthetic data generation

Since customer information is proprietary data for finance teams, it introduces some problems in terms of its use and regulation. Generative AI can be employed by financial institutions to produce synthetic data that adheres to privacy regulations such as GDPR and CCPA.

By learning patterns and relationships from real financial data, generative AI models are able to create synthetic datasets that closely resemble the original data while preserving data privacy.

Financial institutions can leverage synthetic datasets for various purposes without exposing sensitive customer information, such as:

- Training machine learning models

- Conducting stress tests

- Validating models.

This way, financial institutions can develop and test models without risking customer privacy or breaching data regulations.

Real-life example on synthetic data generation

Morgan Stanley faced the challenge of optimizing wealth management operations and enhancing advisor-client interactions through advanced AI tools while maintaining data security and minimizing errors.

They partnered with OpenAI to implement a generative AI platform for synthesizing research data. They piloted the tool with 900 advisors and planned a broader rollout.

The AI tool enhanced advisors’ ability to process large volumes of data efficiently. Morgan Stanley is scaling the platform while addressing risks such as AI errors and data security issues.7

For more on synthetic data, you can check our articles comparing synthetic data and real data, or comparing synthetic data and data masking methods for data privacy.

21-Algorithmic trading & investment strategies

Synthetic data for simulations

Generative AI models, like Generative Adversarial Networks (GANs) or Variational Autoencoders (VAEs), can model complex financial relationships and generate synthetic data that mimics real market conditions. This synthetic data can be used to test and optimize trading algorithms, reducing the reliance on historical data alone.

22-Scenario analysis

These models can simulate various market scenarios, helping traders and portfolio managers understand potential risks and returns under different conditions.

According to Dimension Market Research, the size of the global market for generative AI in trading is projected to be USD 208.3 million by 2024 and USD 1,705.1 million by 2033. In 2024, the market is expected to grow at a compound annual growth rate (CAGR) of 26.3%.8

23-Product development

Customized investment portfolios

Generative AI can analyze individual investor profiles, preferences, and financial goals to generate personalized investment portfolios. This is particularly useful for robo-advisors and wealth management platforms.

Tailored insurance products

AI can create personalized insurance products based on individual risk profiles, generating unique terms and pricing structures for different customers.

24-Underwriting & pricing

Dynamic pricing models

Generative AI can help insurers and lenders develop dynamic pricing models that adjust in real-time based on new data, market conditions, and individual customer behavior.

Risk assessment

AI can generate different risk scenarios, helping underwriters assess potential outcomes and set appropriate premiums or interest rates.

Common applications

25-Financial question answering

By leveraging its understanding of human language patterns and its ability to generate coherent, contextually relevant responses, generative AI can provide accurate and detailed answers to financial questions posed by users.

These models can be trained on large datasets of financial knowledge to respond to a wide range of financial queries with appropriate information, including topics like:

- Accounting principles

- Financial ratios

- Stock analysis

- Regulatory compliance

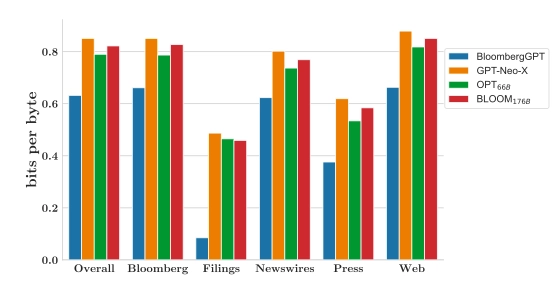

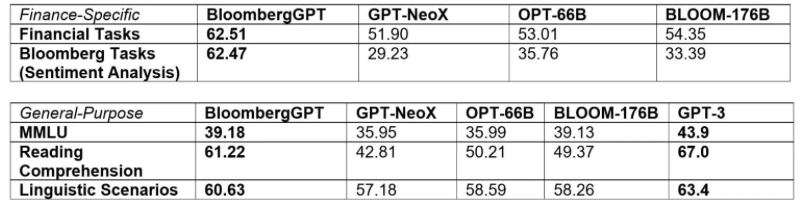

For example, BloombergGPT can accurately respond to some finance related questions compared to other generative models.

Learn how to use chatGPT for your business.

26-Sentiment analysis

Sentiment analysis, an approach within NLP, categorizes texts, images, or videos according to their emotional tone as negative, positive, or neutral. By gaining insights into customers’ emotions and opinions, companies can devise strategies to enhance their services or products based on these findings.

Financial institutions can benefit from sentiment analysis to measure their brand reputation and customer satisfaction through social media posts, news articles, contact centre interactions or other sources.

For example, Bloomberg announced its finance fine-tuned generative model BloombergGPT, which is capable of making sentiment analysis, news classification and some other financial tasks, successfully passing the benchmarks.

Check out our article on stock market sentiment analysis to learn more.

Best practices for applying generative AI in finance industry

When integrating generative AI into finance, here are 7 aspects to take into account:

- Strategy & vision: Define a clear, long-term strategy for integrating generative AI that aligns with the company’s overall business objectives.

- Domains & use cases: Focus on high-impact areas within finance, such as forecasting or customer interaction, where generative AI can provide the most value.

- Deployment model: Choose the right AI deployment model (cloud, on-premise, or hybrid) based on security, scalability, and data privacy needs.

- Funding: Ensure adequate funding for AI initiatives, including investment in technology infrastructure and AI tools.

- Talent: Build a team of skilled professionals with expertise in AI, data science, and finance to implement and manage AI solutions effectively.

- Risk: Assess and manage risks associated with AI, such as data privacy, biases in algorithms, and compliance with regulations.

- Change management: Prepare for organizational change by promoting AI literacy, fostering collaboration, and addressing resistance to AI adoption.

Benefits of generative AI in finance industry

- Improved financial condition: The application of generative AI in the finance industry has the following effects:

- Budget cycle time is 33% faster.

- Uncollectible balances decreased by 43%.

- 25% off expenses each time an invoice is paid.11

- Efficient research: EY claims that while investment banking experiences more efficient research and financial modeling, corporate and SMB banking gains from improved risk management and business lending, and consumer banking experiences an improvement in service delivery and customer interaction.12

- Business partnering: Generative AI helps finance teams provide more accurate insights and forecasts by analyzing vast amounts of financial data quickly. It enhances collaboration between finance and other business units by generating detailed reports, scripts, and answers for key discussions, enabling better decision-making.

- Mitigating risks: AI can identify potential risks by analyzing historical data, detecting anomalies, and flagging irregular patterns in financial transactions. It also helps in scenario modeling and stress testing, ensuring more robust risk management and compliance with regulations.

Generative AI challenges in finance industry & tips to overcome them

Here are some reasons why some financial professionals hesitate adopting generative AI tools in finance:

- Data accuracy : “Although AI greatly enhances the processing and generation of data, it may be prone to significant data quality issues.” as the European Central Bank states. There is a chance that the biased and inaccurate data used to train foundation models will produce output with more errors. When feeding foundation models, data quality and accuracy are crucial factors.13

- Bias in Models: AI models can inherit biases from the data they are trained on, leading to unfair or skewed decisions, particularly in areas like credit scoring or investment recommendations.

- To detect such AI bias, businesses can adopt a responsible AI platform.

- Limited generalization: Business can either rely on off-the-shelf large language models or fine-tune LLMs for their use cases. Off-the-shelf models may not perform well in specific, highly specialized financial contexts without proper fine-tuning, which could result in inaccurate or irrelevant outputs.

- Adopt LLMOps tools to build, test, monitor and fine-tune your LLMs better.

- Hallucinations: Generative AI can produce inaccurate or fabricated information, which is risky in finance where decisions rely on precise data, leading to poor investment advice or regulatory breaches.

- Apply LLM security tools and extractive AI to overcome this issue and ensure model accuracy.

- Regulations: The financial sector is highly regulated, and AI must comply with strict standards regarding transparency, accountability, and data usage, posing challenges in ensuring compliance with evolving legal frameworks.

- Deploy AI governance tools and build an AI inventory to ensure AI compliance.

- Data Security: Financial data is sensitive, and ensuring that AI systems handle it securely, preventing breaches or misuse, is crucial to maintain client trust and avoid regulatory penalties.14

Explore 10 major LLM risks and their impact.

Spending on generative AI & market expectations

Financial simulations and forecasts produced with the aid of enterprise generative AI are beneficial for trading, portfolio management, and financial markets. Despite its many advantages—including time savings, large data sets, and computations—it could malfunction and expose sensitive data, posing security risks. These challenges can specifically affect finance processes and the overall finance function.

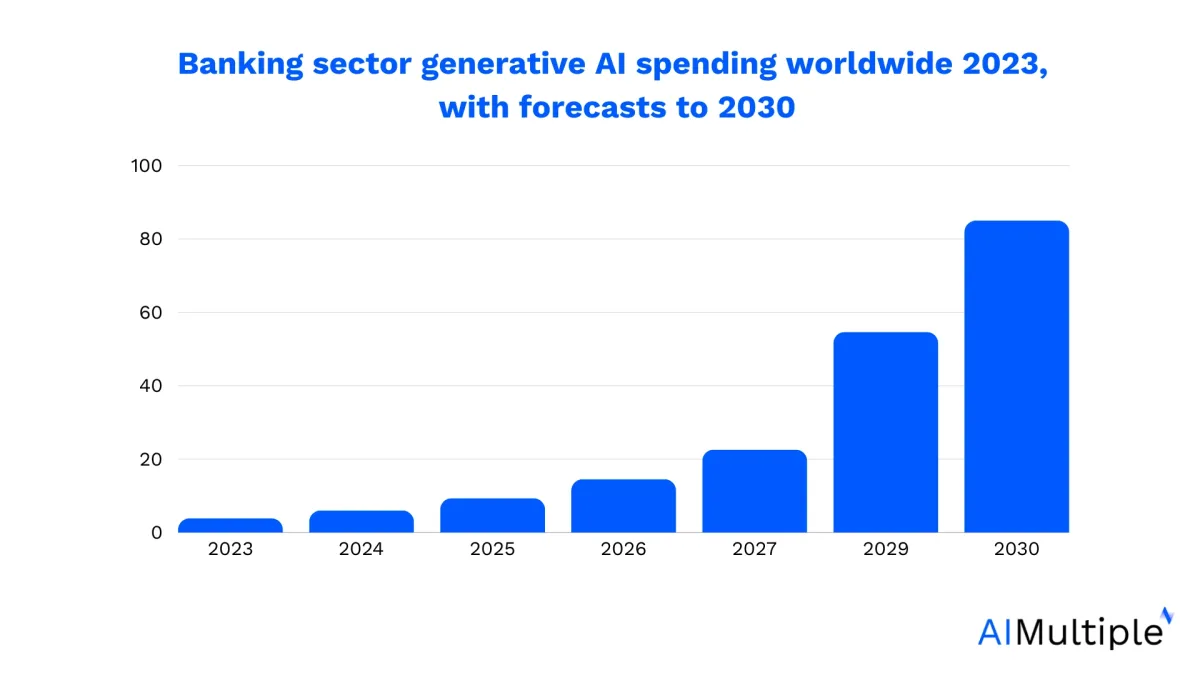

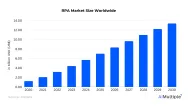

- By 2030, the banking industry is expected to spend 84.99 billion US dollars on generative artificial intelligence (AI), growing at a remarkable compound annual growth rate of 55.55 percent.15

- It is anticipated that J.P. Morgan will invest $17 billion in generative AI this year, up 10% from $15.5 billion in 2023. Professionals with experience in AI and machine learning are working on a taskforce to find applications in various business verticals.17

- According to the McKinsey Global Institute (MGI), the use of Gen AI in the banking industry could result in an annual value addition of $200 billion to $340 billion, or 2.8 to 4.7 percent of the total industry revenues. This value addition would primarily come from increased productivity.18

For additional insights into automation in the financial sector, explore our article on Intelligent Automation in Banking & Financial Services.

Conclusion

Generative AI is reshaping the finance industry by enabling more efficient data processing, personalized customer experiences, and improved risk analysis. While its applications show promise in fraud detection, forecasting, and regulatory reporting, successful adoption depends on addressing concerns around data quality, compliance, and model transparency.

External links

- 1. “Generating User-Friendly Explanations for Loan Denials Using Generative Adversarial Networks.” Fujitsu Global. Accessed 2 January 2024.

- 2. “Generative AI in the Finance Function of the Future”. BCG. Retrieved September 4, 2024.

- 3. What Generative AI Means For Banking.

- 4. Goldman Sachs Deploys Its First Generative AI Tool Across the Firm - WSJ. The Wall Street Journal

- 5. What Generative AI Means For Banking.

- 6. What Generative AI Means For Banking.

- 7. Case Study: Adoption of Generative AI in Wealth Management at Morgan Stanley - AIX | AI Expert Network. AIX

- 8. “Generative AI in Trading Market Is Expected To Reach a Revenue Of USD 1,705.1 Mn By 2033, at 26.3% CAGR | DMR”. Wall Street Journal. Retrieved September 4, 2024.

- 9. “BloombergGPT: A Large Language Model for Finance“, arXiv. Accessed 2 January 2024.

- 10. Introducing BloombergGPT, Bloomberg’s 50-billion parameter large language model, purpose-built from scratch for finance | Press | Bloomberg LP.

- 11. Generative AI for Finance | IBM.

- 12. How artificial intelligence is reshaping the financial services industry | EY - Greece. MIT OpenCourseWare

- 13. The rise of artificial intelligence: benefits and risks for financial stability.

- 14. The Rise of Generative AI | J.P. Morgan Research. J.P. Morgan

- 15. “Banking sector gen AI spending worldwide 2023, with forecasts to 2030.”. Statista. Retrieved September 2, 2024.

- 16. Statista, & Juniper Research. (March 20, 2024). “Estimated value of the banking sector’s generative artificial intelligence (AI) spending worldwide in 2023, with forecasts from 2024 to 2030 (in billion U.S. dollars)” [Graph]. Statista. Retrieved September 18, 2024

- 17. Can investment management harness the power of AI? | J.P. Morgan Asset Management .

- 18. The future of AI in banking | McKinsey. McKinsey & Company

Comments

Your email address will not be published. All fields are required.