Accounting software has automated data entry tasks and workflows however enterprise accounting remains manual and expensive. Recent advances in large language models (LLMs) and AI used in AP functions show the potential to significantly increase automation rates in accounting.

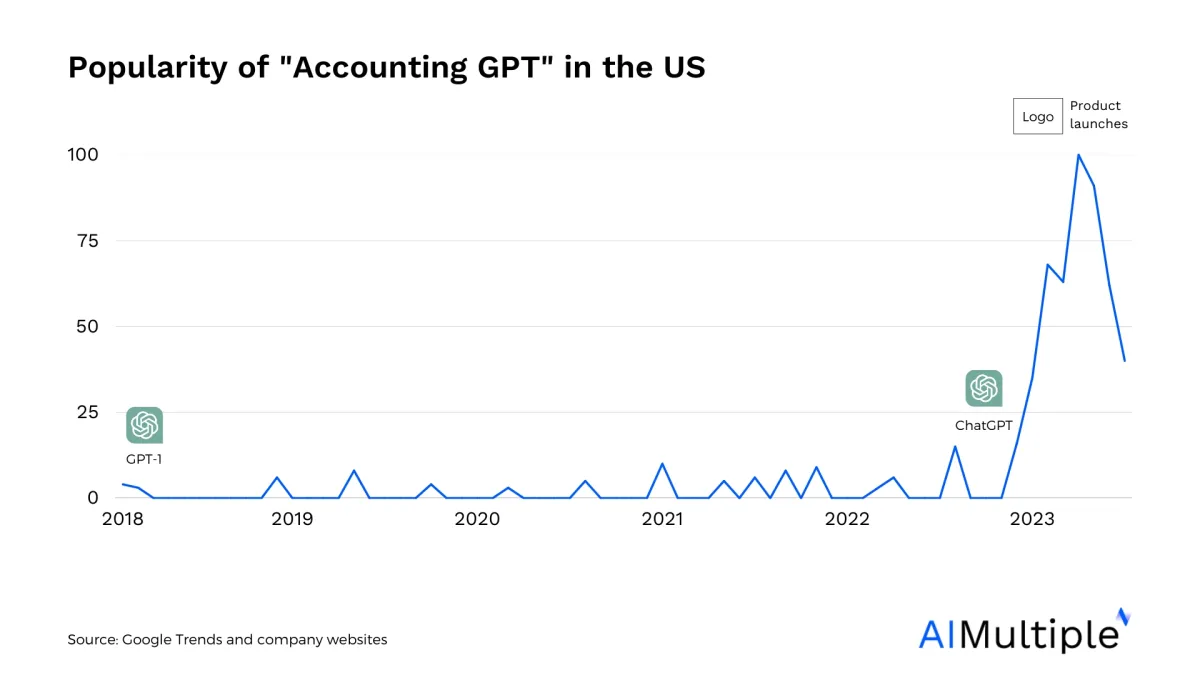

AI tools, specifically language models using GPT technology can automate various aspects of the accounting process. Therefore, interest in the use of GPT models in accounting has increased steadily (see Figure 1).

Since these are novel developments, most business leaders are not aware of generative AI technology’s potential in accounting. Therefore, we explain GPT technology and outline its applications in accounting in this article.

What is GPT technology?

GPT technology, short for Generative Pre-trained Transformer, is a type of advanced natural language processing (NLP) model designed to generate human-like text by mimicking the context, syntax, and semantics of natural language. GPT technologies as LLMs can be broadly classified under two categories: foundation models and specialized models.

OpenAI’s ChatGPT, GPT 4o and BERT are some of the well-known foundation models. Foundation models have been popular after the release of ChatGPT, a conversational chatbot built upon the GPT architecture. Foundation models are trained using text data from websites, books etc.

How does GPT accounting work?

Specialized models (also called vertical or horizontal AI models) like artificial intelligence models focused on accounting are optimized for specific tasks. This is achieved by either training a model from scratch or or fine-tuning an existing foundation model for specific tasks or applications, such as:

Specialization lowers training costs and enables specific capabilities (e.g. predicting cost centers of invoices) thanks to more specialized training data.

In the AP domain, most critical data for training (e.g. invoices, company codes) remain in ERP systems. GPT models require this data for finetuning. Most ERPs are offering API-based or other integrations. You can explore their AP offering and integration options:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Sage Accounts Payable (AP) Automation

Learn also more on horizontal AI / vertical AI solutions.

Benefits of leveraging GPT in accounting

Enhanced decision-making

GPT models can analyze financial data and generate insights, forecasts, and recommendations that can inform better decision-making for businesses. This allows companies to optimize their financial strategies, mitigate risks, and identify growth opportunities.

Process automation benefits

Increased efficiency

GPT models can automate various tasks, such as financial report generation, invoice processing, and expense categorization, which can significantly reduce manual work, save time and therefore increase efficiency within the accounting function. This can

- Free up time for accounting professionals to focus on more strategic and value-added activities.

- Lead to cost savings for businesses by reducing the need for additional staff or outsourcing accounting tasks.

Increased speed

LLMs powered by deep learning, can analyze data rapidly and accurately. This makes automated processes faster, delighting stakeholders.

Improved accuracy

GPT’s ability to process large amounts of data quickly and consistently helps minimize human errors that may occur in manual accounting processes. By automating routine tasks and reducing the risk of errors, GPT-based solutions can contribute to more accurate financial records and reporting.

Improved customer support

GPT-based language models can serve as a virtual assistant to help clients with accounting-related queries (e.g. regarding status of customer payments) offering immediate and personalized advice. This can lead to more responsive and effective customer support, which can improve client satisfaction and retention.

Improved employee and supplier support

Employees rely on suppliers in their work. GPT models can answer employees’ or suppliers’ questions regarding contracts, payments or deliveries. This ensures immediate, automated responses without creating low-value added distractions for the operations team.

12 GPT Accounting Use Cases

Accounts payable

1- Invoice and expense processing

Traditional accounting software relied on OCR and rules-based automation. These solutions made limited use of AI technology.

GPT-based LLMs can go beyond that to extract relevant information from financial documents, such as invoices, receipts, and expense reports, streamline the categorization of expenses and the reconciliation of transactions.

2- Fraud detection

Fraud detection is critical in the auditing process as as well as regular business operations. Large Language Models can examine complex financial statements quickly and correctly, which helps auditors find peculiarities and possible areas of risk.

Tax compliance

LLMs powered by GPT architecture have the potential to help businesses manage their tax obligations by providing tailored advice based on their unique circumstances. It can calculate tax liabilities, identify potential deductions or credits, and assist in preparing tax filings. By doing so, GPT models can reduce the risk of errors and ensure compliance with tax regulations.

3- Indirect tax audits

Large companies generate hundreds of thousands of Indirect tax documents (called Value Added Tax in most jurisdictions) every year. Issues in these documents can lead to significant fees and can be analyzed at scale by generative AI models.

4- Direct taxes

Direct tax documents are fewer in number but they are still long and detailed documents where mistakes can lead to millions in excess taxes or fees. LLMs are good tools for checking such documents or producing initial versions

Audit

5- Contract analysis

Contracts are the backbone of business relationships and issues in contracts can lead to unexpected fees. Despite attempts to simplify contracts, contracts remain diverse and complex. GPT models can be used to

- Analyze contracts for unexpected fees or other anomalies

- Identify steps to simplify contracts. Contract simplification is a marathon and correctly prioritizing contracts can speed up contract simplification

6- Auditing other documents

GPT can support auditors by analyzing financial transactions and documents to detect anomalies or errors. It can evaluate large datasets to identify unusual patterns or discrepancies, reducing the manual workload of auditors.

7- Process analysis

GPT models can compare a company’s current practices vs. best practices to generate insights and recommendations for strengthening internal controls and risk management practices, ensuring compliance and minimizing potential financial risks.

8- Results preparation

A critical component of auditing is informing the relevant stakeholders in detail, explaining necessary next steps. Stakeholders vary in the time they can spend to analyze findings and LLMs can easily generate outputs with differing levels of detail via their summarization capabilities.

9- Customer support and advisory services

GPT can be utilized as a virtual assistant to answer clients’ queries related to accounting, bookkeeping, and financial management. By processing natural language input, it can provide relevant and contextualized guidance on accounting matters, suggest best practices for record-keeping, and help clients navigate complex tasks about financial regulations.

Controlling and reporting

10- Financial data analysis and forecasting

GPT-based solutions can process and analyze historical financial data to identify trends, key performance indicators, and areas of improvement. By leveraging this information, businesses can generate forecasts for future financial performance, helping businesses make informed decisions and optimize their financial strategies. GPT can also provide detailed explanations and recommendations to support decision-makers.

11- Financial report generation

GPT-based LLMs can automate financial reporting, such as income statements, balance sheets, and cash flow statements, by processing raw accounting data. Beyond generating these reports, these machine learning models can create accompanying narratives that summarize the key points, trends, and financial highlights, making it easier for stakeholders to understand the company’s financial position.

12- Training and education

GPT-based language models can be employed to develop interactive educational content in the field of accounting. This can include creating courses, tutorials, case studies, or other learning materials to help students and professionals enhance their accounting knowledge and skills. GPT can also assist with exam preparation, providing practice questions and personalized feedback to improve understanding and performance.

If you need help in finding vendors in this domain, we can help:

Comments

Your email address will not be published. All fields are required.