We’ve written about accounts payable automation and invoice automation before, where we highlighted that AP processes can be mostly automated and shared criteria to select the right vendor. Automation is necessary for accounts payable because manual processing of accounts payable is

- expensive since manual processes require labor which is costly.

- prone to excessive payments due to duplicate invoices, missing early payment discounts

- leads to dissatisfied employees and suppliers: No one likes a slow manual process.

Among the ways to automate accounts payable, machine learning makes sense when a process cannot be reduced to rule-based activities. Explore tasks within AP where businesses can leverage AI and the benefits of implementing AI into accounts payable processes:

AI Applications in Accounts Payable (AP AI)

Automation

1. Data Capture

Businesses receive large numbers of invoices every day. Traditional tools like OCR (optical character recognition) may not always keep up. They struggle with unclear formats, handwriting, or unusual layouts. Human review is often still needed.

AI, especially machine learning models, helps improve this. It can learn from past invoice data and adjust to new formats over time. This makes the data capture process faster and more accurate. When trained on company-specific data, the models become even more useful.

AI tools can also read invoices, purchase orders, and delivery notes to identify product codes, quantities, and more. This helps confirm that goods were delivered as expected.

2. Cost Coding

Large organizations use complex cost categories. These categories often change with market trends and reporting needs. Rule-based systems are hard to update and easy to break.

Machine learning offers a better solution. It learns from historical entries to map costs to the correct categories, even when the categories evolve. This creates a more flexible system that requires less manual input.

3. Approver Identification

Invoices need approval, but the person responsible can change from case to case. Traditional systems rely on fixed rules, which may not work well in dynamic teams.

AI can review past data to predict who should approve a given invoice. This keeps workflows moving without constant manual updates, helping editors and finance teams route approvals more smoothly.

4. Document Categorization

Invoices often come with other documents, like contracts, credit notes, or reminders. AI uses a mix of OCR, natural language processing (NLP), and machine learning to read and understand these attachments. It can then sort them into the right categories for easier access and future use.

This helps organizations turn paper-based records into searchable digital files. It also reduces the effort needed to find details later in the process.

If you want to learn more end-to-end automation examples through the combination of various technologies, feel free to check our hyperautomation and hyperautomation applications articles.

5. Three-Way Match

In AP, the three-way match compares an invoice with a purchase order (PO) and a goods receipt. If all three agree, payment is approved.

AI makes this process more efficient. RPA bots (robotic process automation) can check emails for new invoices. OCR tools read invoice data. AI models then match invoice details with POs and delivery records. If there’s a problem, the system flags it. This reduces delays and mistakes in the matching process.

6. Other Repetitive Tasks

Many AP tasks are repetitive—filing invoices, attaching supporting documents, or sending them to the right people. These jobs are rule-based and don’t need much judgment.

AI and automation tools can:

- Find key data in documents

- Enter data into systems

- Spot exceptions

- Route files to the right people

Even when companies have different compliance needs, AI can be adjusted to follow their specific rules.

Analytics

7. Forecasting Inputs

Accounts payable data plays a role in cash flow planning. Using historical trends, AI-powered analytics can help finance teams estimate future spending. These forecasts support better decisions for budgeting and cash management.

Compliance

8. Sanctions Screening

Many businesses still screen vendor data manually, even though regulations are stricter now. This method is slow and prone to error1

AI can support responsible use of data by improving screening accuracy. For example:

- RPA tools can automate the input of names into watchlists

- NLP can help analyze documents for risks

- AI can store evidence to help users during review stages

This makes screening more reliable and faster.

9. Fraud Detection

Fraud in accounts payable can take many forms:

- Fake invoices sent by outsiders

- Employees creating false bills

- Altered or stolen checks

- Exaggerated expense claims

- Unauthorized bank transfers

- Kickback arrangements

AI tools can spot unusual patterns in invoices or payments. When something looks off, the system alerts decision-makers. Combined with master data management (MDM), AI can catch small changes—like new payment details—that may signal fraud.

10. Error Detection

Human errors—like duplicate entries, missing invoices, or bad data—are common in AP and costly.

AI models can scan invoices to detect errors or duplicates. By doing this early, they prevent delays and losses. AI doesn’t replace audit professionals but can support them by flagging potential issues before they grow.

Though fraud transaction detection and identification of errors are important AI applications in audit, they are not the only ones. Feel free to check our article where we examined AI applications in the audit industry.

Benefits of AI in AP

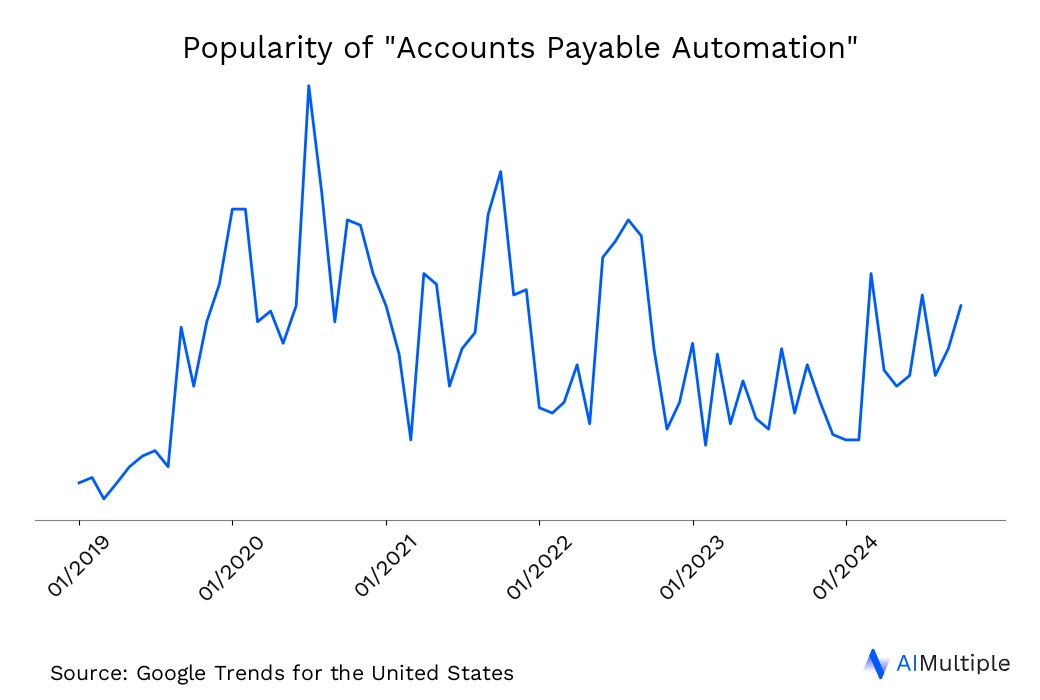

Accounts payable market is expected to grow strongly, rising to $1.9B by 2025 with a CAGR of 17%,2 despite fluctuating interest in the market.

Common benefits of artificial intelligence in account payable process are:

- Faster resolution cycles & increased focus on more value-added activities: APautomation enables organizations to handle invoice processing much faster than an employee would do manually. Faster invoices resolution frees the accounts payable team’s time so that they can focus on more value-added tasks.

- Improved financial planning: AI makes forecasting faster and more accurate than humans. Insights from historical data such as recurring invoices help businesses decide when to release cash or take early-payment discounts.

- Reduced errors & improved compliance: Manual processing of invoices involves various compliance and security risks. Appointing machines to handle these processes reduces the number of people who access the document and reduces the likelihood of human errors that may lead to compliance issues.

- Cost savings: Due to all reasons we listed above, along with the elimination of high paper storage and retrieval costs in account payable processes, organizations that fully automate accounts payable processes can save significant amounts. Full automation can save on average of 4% of expenses when compared to organizations that manually process invoices.

Recommended reading

Most AP automation will take place within your ERP system. You can learn more about how AP automation can be improved within your ERP:

- Accounts Payable Automation in Dynamics 365

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation

- Sage Accounts Payable (AP) Automation

Leading AP solutions & their alternatives:

- 7 Vic.AI Alternatives to Automate Accounting

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors

- 14 Rossum AI Competitors/Alternatives

Data-driven lists for:

FAQ

How is AI used in accounts payable?

By the help of generative AI, AI in accounts payable automates tasks like invoice coding, fraud detection, and duplicate checks. It learns from past data to suggest GL codes, spot errors, and improve cash flow planning. This frees up AP teams to focus on higher-value work, just as AI helps journalists organize content and spot key details.

Comments

Your email address will not be published. All fields are required.