Thanks to machine learning and document data extraction, companies can validate invoices submitted outside the company’s Electronic Data Interchange (EDI).

By adopting these technologies, companies can minimize manual document processing. Therefore they can reduce costs and errors while increasing compliance and employee satisfaction.

According to our interviews with project managers from the Big 4 and solution providers in the space, an average Fortune 500 processes a few millions of documents manually per year. Adopting the latest automation technologies can result in saving hundreds of millions of dollar annually.

In this article, we will provide you with everything you need to know about accounts payable automation.

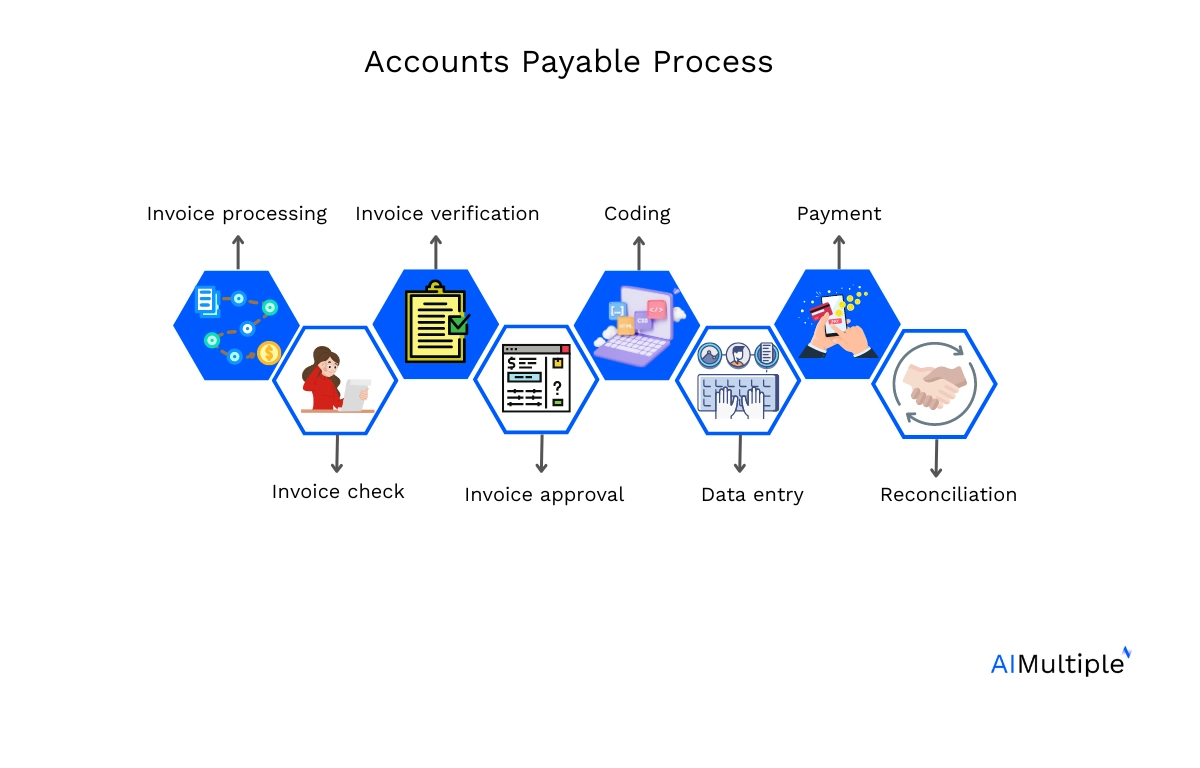

What is the Accounts Payable (AP) process?

Accounts payable (AP) process includes receiving, invoice processing, and paying out invoices from suppliers that provided goods or services to the company. In accounting systems, such transactions are written under accounts payable account, until the payment is made.

An AP department is responsible for

- Keeping track of the transactions

- For example, invoices need to be stored for ~10 years in some EU jurisdictions like Germany

- Making payments on time

- Ensuring payments are compliant to company policies and relevant laws and regulations (e.g., not making payments to Specially Designated Nationals And Blocked Persons List – SDN)

- Ensuring payments’ reconciliation. Company’s General Ledger (GL) includes all transactions along with the accounts those transactions belong to.

- For example, classifying an operating expense as a capital expense would have implications in both taxation as well company’s bottom line results.

What are the steps to be automated in accounts payable?

Almost all accounts payable process steps can be automated. Here is a step-by-step summary of an AP process for invoices received outside the company’s Electronic Data Interchange (EDI). We focused on this because this process is much simpler when structured data is received through the EDI.

Manage vendor data

Even before invoices arrive, most companies expect procurement teams create master data records for suppliers to ensure that accounts payable team is aware of whom they should make payments to.

Receive the invoice

When a purchase is made, the supplier needs to prepare an invoice. An invoice needs to include

- sender and sender’s detail such as VAT ID and address

- recipient and its address

- the items purchased along with prices and VAT rates

Additionally, it can also include details such as payment terms, the purchase order, original offer etc. Recipients store invoices to keep track of expenses and for VAT returns.

For the reception of invoices, there are several alternative channels:

- Invoice-to-pay portals such as Tungsten

- Supply portals between businesses and vendors

- Hybrid platforms allowing combination between PDF and XML formats such as ZUGFeRD

- Portable Document Formats (PDF)

- E-mails

The received invoices need to be scanned and sorted in order. They are also archived in the company’s database in case the related transaction details are required in the future.

Capturing and validating the data stored in the invoice

Capture and validation are important steps of invoice automation. Since the 90s, OCR solutions were able to provide a text output for images which facilitated manual capturing. However, clerks still needed to match the text to the fields they were looking for in the document. Now invoice capture solutions can achieve ~80% no touch automation rates, providing structured data as output.

However, large companies still end up with millions of invoices sent mostly through email in the form of pdf or image attachments. These tend to be from smaller suppliers or suppliers that rarely work with that company. The data in these invoices needed to be manually captured in the past.

Validation is also crucial because problems are far easier to fix early. For example, many EU companies do not perform real-time checking of invoices for VAT compliance. When a compliance issue arises after the payment is made, the supplier is likely to be less motivated and slower to respond. Re-issuing an invoice requires manual effort and companies are much faster to do it before they receive the payment for the invoice.

Create accounting entry

Once validations are completed, accountants need to create new ledger entries based on the invoice. General Ledger (GL) entry, or journal entry, includes details in the invoice such as the amount, cost center and the cost code.

For orders with Purchase Orders (POs), this can be automated with ease as the PO includes the account that made the purchase. However, when the invoice lacks a purchase order, accountants need to assign one to it manually. However, if all data in the invoice is captured, a machine learning model can be built to predict accounts from invoices.

Clear GR/IR

The 2-way and 3-way matches explained in the validation phase do not always get completed due to various issues explained above. Then, accounts payable team tries to clear unmatched records periodically by manually analyzing them. Having improved extraction increases match rate and reduces GR/IR clearing issues that need to be resolved manually.

Make payments on time

Businesses need to process all payments before the due date on the invoice. Late payment can result in fees and reduced supplier trust which impacts future procurement. Softwares can automate processes such as invoice approval process, and create time for accounts payable department to focus on payment times more.

Finish period end tasks

Some IR/GR clearing activities and other accounting related activities need to be delayed until the period end. With increased automation in the previous steps, these issues can be resolved earlier.

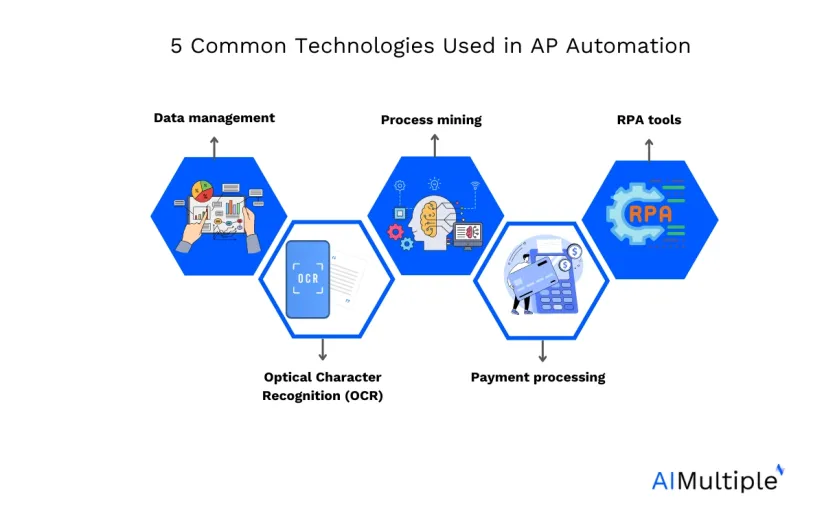

Which technologies are involved in AP automation?

AP automation is a developing technology that aims to enhance the accounts payable process by reducing manual processing of repetitive tasks. While automating AP processes, businesses benefit from the broad group of technologies listed below:

- Data management

- Data extraction technologies including

- Document scanning

- Optical Character Recognition (OCR)

- Machine/deep learning to assign data to specific labels (e.g., supplier address)

- Machine learning to automate tasks like matching invoices to accounts

- Payment processing

- General purpose automation tools like RPA can help automate rule-based parts of the process

Why do businesses need AP Automation?

Although AP processes seem simple, the increasing number of transactions in businesses raises the complexity and resource requirements of AP teams. By automating this process, companies can reduce cycle times, give employees more time for more intellectually challenging tasks, reduce human errors and increase employee satisfaction.

Shorter cycle times

Late payments can risk supplier relationships of companies. Thus, it is vital to make payments on time and keep cycle times short. AP automation prevents these late payments and reduces cycle times. Ardent Partners reports that AP automation can reduce the cycle time to 4 days, while the manual process takes 17 days for most companies.1 They also indicate that this is the main reason why only 4% of businesses pay all of their invoices on time.

Cost savings

By just eliminating manual tasks, AP automation can provide significant cost savings for a company. Besides, it can reduce costs by optimizing vendor portfolios, avoiding duplicate payments, and taking advantage of early payment discounts.

Preventing manual errors

As human-made invoices are prone to errors, duplicate payments can always occur. AP automation can reduce these errors and help companies to maintain this process smoothly.

Fraud detection

Manual accounts payable processes have lower visibility because companies mostly operate these processes in paper forms. Without digitalization, it would be harder to follow up AP processes, and it makes these processes more open to fraudulent actions. AP automation might detect fake invoices and reduce the possibility of internal or supplier fraud to protect the company.

Employee satisfaction

Nobody wants to spend their work time punching in numbers from a document. Automation enables employees to focus on higher value added tasks.

How to choose an AP automation solution?

Integration capabilities

AP systems need to be integrated to a company ERP or accounting system like NetSuite. Understanding the company’s experience with accounting system integration helps evaluate the timeline for the integration.

ERPs are all-in-one solutions. They are still open to improvement in specific areas. For instance, AP solutions like PairSoft natively integrates with NetSuite and provide:

- comprehensive subscription model with no licensing requirements.

- option to make payments without the need to open specific bank accounts.

Some other ERP solutions with AP automation are:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Sage Accounts Payable (AP) Automation

High level of automation

The automation software should increase automation to an acceptable level. A good measure of automation is the no touch processing rate. Leading solutions in the market claim ~80% no touch automation rates.

User-friendly interface

As in any solution, having a user-friendly interface is vital for companies. Employees can become familiar with such software faster and use them more appropriately. AP automation solutions are the same. The UI will be used as clerks fix issues in the extracted data and other exceptions.

Electronic payments

According to Moody’s, payments added $296 billion to GDP in the 70 countries from 2011 to 2015.2 This number is expected to be higher today. Businesses prefer electronic payment strategies for improved efficiency in payment processes, increased command over their cash flows, and enhanced protection against fraudulent activities.

What are top AP Automation solutions?

For some of the AP solutions with in-depth analysis, check:

- 7 Vic.AI Alternatives to Automate Accounting

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors

- 14 Rossum AI Competitors/Alternatives

If you have questions on AP automation, feel free to contact us:

External Links:

External Links

- 1. Five benefits to automating your accounts payable process. Ascend Software

- 2. ”The Impact of Electronic Payments on Economic Growth” Retrieved on February 5, 2023.

Comments

Your email address will not be published. All fields are required.