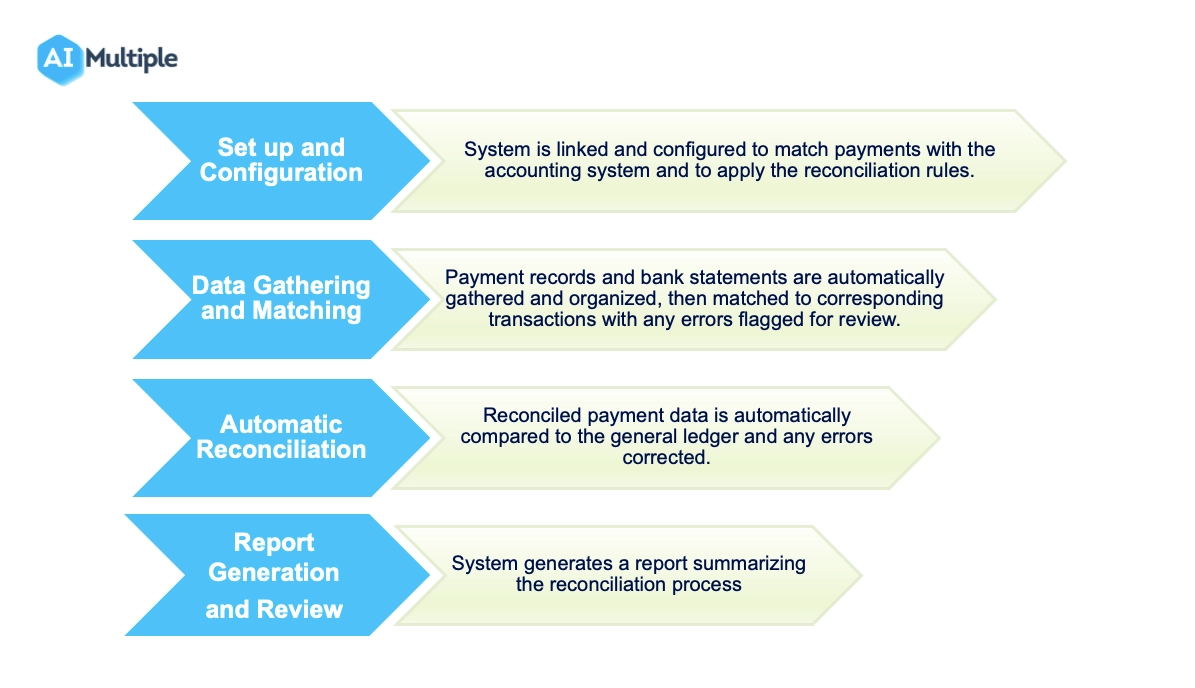

Figure 1. Automated payment reconciliation process in 4 steps

Companies have to be able to reliably monitor their payables to minimize fraud and ensure healthy supplier relations. However, this is not straightforward as there are:

- Time delays associated with ACH payments or wire transfers

- Overdue payables

Manual reconciliation using spreadsheets, e-mail, and manual examination of accounts is challenging and prone to error.

Automated payment reconciliation addresses these challenges by leveraging rules and in some cases machine learning to match and reconcile financial transactions. However, the right automated payment reconciliation software will depend on a company’s complexity of financial transactions, its industry and its existing financial software stack. An in-depth understanding of this technology can help executives pick the right solution for their business.

In this article, we will delve into the technical details of

- How automated payment reconciliation works

- Why businesses should implement it to streamline their financial close operations and improve their bottom line.

- 5 benefits of automation

What is payment reconciliation?

Payment reconciliation is an accounting procedure that compares your bank statements and internal receipts for reconciling your payments. A payment reconciliation is necessary for balancing accounts, identifying fraud, and ensuring business continuity.

The reconciliation of accounts is performed either during the financial close season, or every day. Payment reconciliations can become time-consuming and slow down monthly finances for the accountants. As companies grow, the time needed to reconcile recurring transactions increases.

Balance sheet reconciliation vs. payment reconciliation

Balance sheet reconciliation and payment reconciliation are two important but different processes that are used to ensure the accuracy and consistency of a company’s financial records.

- Balance sheet reconciliation is the process of comparing and adjusting the balances in a company’s balance sheet accounts to ensure that they match the underlying transactions and are accurate.

- Payment reconciliation is the process of matching payments made by a company to the corresponding invoices or other records of the payments to ensure that all payments have been properly recorded and applied to the correct accounts.

Types of payment reconciliation

There are several types of payment reconciliation, some of the common ones include

- Bank reconciliation

A company’s bank account records are compared to its own financial records to ensure that all transactions are accounted for and to identify any discrepancies or errors. - Credit card reconciliation

The transactions on a company’s credit card statement is compared to its own records to check that all charges are valid. - Accounts payable reconciliation

Comparing the amounts a company owes to its vendors to the amounts recorded in its own financial records to ensure that all payables are accounted for. - Accounts receivable reconciliation

Comparing the amounts a company is owed by its customers to the amounts recorded in its own financial records. - Payroll reconciliation

The amounts a company pays its employees are matched to the amounts in its own financial records. This is done to make sure that all payroll transactions are recorded and to find any mistakes or discrepancies.

What is automatic payment reconciliation?

Automatic payment reconciliation (i.e. auto-reconciliation) is a system that enables faster processing of your finances through the alignment of your bank and accounting information. Automating payment reconciliation is closely related to Accounts Payable Automation.

A payment reconciliation software

- Pulls financial record information from systems or captures it from documents (e.g. invoice data capture)

- Reconciles payments between buyers and sellers, or other involved parties

- Ensures accuracy and completeness

- Helps identify errors in the financial management process.

Why do businesses need automated payment reconciliation?

A majority of US companies, 58%, still manually reconcile their accounts.1 As a result, companies might have contradictory internal and external reports or they have transactions that haven’t been recorded in the general ledger.

- 63% of payment decision makers polled the most time-consuming and labor intensive area is reconciling data from different gateways/processors.

Businesses could benefit automated payment reconciliation because it can save them time, money, and reduce errors in their reconciliation process.

How does payment reconciliation work?

Automated payment reconciliation simplifies the process of aligning internal and external records in 4 steps. (See Figure 1)

1. Setup and configuration

Setting up the system by linking the payment processing system to the accounting system and configuring the reconciliation rules. This can include setting up automated rules to match payments to transactions based on criteria such as date, amount, and reference number.

2. Data gathering and matching

Transactions (e.g. invoices, bank transfers, credit card transactions) have codes assigned to them which makes it easier for machines to reconcile them. These codes act as unique identifiers for each transaction, allowing machines to quickly match and compare them to other transactions in the system. Intelligent Document Processing (IDP) technologies including OCR and NLP can be used to extract those codes from documents.

Automatically extracted records can then be matched. If the data sets are simple, matching can be done using Excel VBA programs. However, when the data sets are complex, machine learning methods may be used. For example, the software’s job scheduling feature can be used for reconciling payments at the end of each day or month. Any discrepancies or errors that are found will be flagged for review.

3. Automatic reconciliation

The reconciled payment data is then automatically compared to the general ledger. OCR and NLP techniques are used to read each code in an entry, compare it to the invoice, and then reconcile it. Any discrepancies or errors are corrected without the need for manual intervention.

4. Report generation and review

The system generates a report summarizing the results of the reconciliation process, which can be reviewed and approved by the appropriate parties. Any unresolved discrepancies or errors will be automatically documented and addressed in a timely manner.

Benefits of automated payments reconciliation

1.Improved Accuracy

Automated systems can compare large amounts of data quickly and accurately, reducing the chances of human error and increasing the reliability of the reconciliation process.

2. Increased Efficiency

Automated matching reduces the need for manual work and allows staff to focus on the remaining problematic transactions, freeing up resources for other tasks.

3. Better Reporting

Automated systems can generate detailed reports that provide a clear and concise overview of the reconciliation process, making it easy to identify areas of concern and track progress over time.

4. Greater Visibility

Auto reconciliation provides real-time visibility into the reconciliation process, allowing businesses to identify and address issues as they arise.

5. Better Data Management

Automated systems can help to improve data management by eliminating the need to manually enter, organise and store data. This can reduce the risk of data loss and improve the accuracy of records.

5. Compliance

Automated payment reconciliation can help businesses to meet compliance requirements by:

- Ensuring that all transactions are recorded and reconciled accurately.

- Providing detailed records of all transactions.

This helps businesses adhere to industry regulations by giving them the necessary documentation and accurate records to comply with laws and regulations.

Additionally, it prevents companies from incurring penalties for noncompliance and provides a record for auditing purposes.

For more on AP automation

To explore different technologies that your business can leverage for AP automation, read our in-depth articles:

- In-Depth Guide to Accounts Payable (AP) Automation

- Accounts Payable (AP) Automation Tools Benchmarking

- 5 AI Applications in Accounts Payable (AP) Processes

- Automated Invoice Validation: Benefits & Use Cases

- 20 AP Automation Case Studies: Analysis of Benefits & Use Cases

- General Ledger Software: Benefits and Key Features

External Links

- 1. “Staffing Critical Functions: 2022 Benchmarking Report”. Robert Half. Retrieved 19 January, 2023.

Comments

Your email address will not be published. All fields are required.