We relied on features, pricing data and our Principal Analysts’ 5 years of experience leading an AP automation company to select the top AP automation tools. See our rationale for selecting each tool by following the links below:

- PairSoft for nonprofit organizations and NetSuite / Sage Intacct users

- AvidXchange

- BILL for SMEs in the US

- Hyland for enterprises with extensive need of document processing

- Kofax

- Rossum for invoice processing for startups and midmarket firms

- Sage Intacct

- SAP Concur for global reach & travel and expense management

- Stampli

- Tipalti for global payments

Companies want to simplify their invoicing processes and be compliant. Thus, accounts payable (AP) automation is a critical process for any business looking to reach this goal.

The AP automation market is expected to grow strongly in the next few years due to an increasing demand for digitization of finance and accounting processes. A survey shows AP automation expenditure to rise to $1.9B by 2025 with a CAGR of 17%.1

However, this is an area where companies have invested for years without achieving substantial savings. A study show that 50% of automation initiatives fail.2

In this article, we explain different AP automation solutions to help decision-makers identify the right tools for their company.

AP automation tools

| Vendor | ERP Integration | Pricing Model | Mobile Accessibility | Global Payment Capabilities |

|---|---|---|---|---|

| PairSoft | Blackbaud Dynamics Dynamics 365 Sage Intacct Netsuite Oracle | Subscription | ✅ | ✅ |

| AvidXchange | Acumatica Oracle Blackbaud Dynamics Sage Quickbooks | Per Invoice | ✅ | ✖ |

| BILL | Quickbooks Oracle Xero Sage Dynamics | Subscription | ✅ | ✅ |

| Hyland | Dynamics SAP Lawson Oracle | Tiered Pricing | ✖ | ✖ |

| Kofax | Dynamics SAP Oracle Netsuite | Subscription | ✅ | ✅ |

| Rossum | Xero Quickbooks Sage SAP Netsuite Workday | Per Invoice | ✖ | ✖ |

| Sage Intacct | Sage + other ERPs* | Per Invoice | ✖ | ✅ |

| SAP | SAP & other ERPs* | Subscription | ✅ | ✅ |

| Stampli | Dynamics Oracle SAP Quickbooks Acumatica Dealertrack | Tiered Pricing | ✖ | ✖ |

| Tipalti | Oracle Xero Sage Quickbooks Dynamics | Subscription | ✅ | ✅ |

| Vendor | Number of Reviews | Rating | Number of Employees |

|---|---|---|---|

| PairSoft | 109 | 3.7 | 156 |

| AvidXchange | 385 | 4.4 | 1,751 |

| Bill.com | 1,622 | 4.1 | 2,981 |

| OnBase by Hyland | 200 | 4.2 | 4,035 |

| Kofax Invoice Processing Agility | 11 | 3.6 | 4,035 |

| Rossum | 86 | 4.5 | 159 |

| Sage Intacct | 5,026 | 4.4 | 14,149 |

| SAP Concur | 8,699 | 4.1 | 121,379 |

| Stampli | 1,326 | 4.5 | 300 |

| Tipalti | 460 | 4.5 | 1,284 |

Source: Vendor websites.

AP Automation software

1- PairSoft

PairSoft offers a native integration solution for Netsuite and Sage Intacct for document management and AP automation.

Pros

- Customizable workflows for invoice processing and approvals.

- Strong document management capabilities.

- The ability to adjust scanning sizes.

- For Netsuite, it provides:

- an all-inclusive subscription model without license requirements

- customizable workflows

- the ability to make payments without opening specific bank accounts.

- For Sage Intacct, its PaperSave tool provides:

- electronic workflows

- unstructured search

- and flexible invoice capture in various formats.

Featured solutions: Document management capabilities, custom workflows integrations, subscription model that offers a package that includes support, data, and software usage without the need for additional licenses.

Real-life case study

Recovery Healthcare faced an issue with managing a growing volume of physical invoices and a manual paper-based process. They needed a solution that integrated with their NetSuite system to automate their document management.

PairSoft helped by digitizing and automating their accounts payable records. They enabled cloud-based storage and management. This eliminated the need for physical copies and allowed easy access to electronic versions of documents within the existing NetSuite interface.

Choose PairSoft for native ERP integrations and inclusive subscription model.

2- AvidXchange

AvidXchange specializes in AP automation for mid-market businesses and banks, providing features like invoice capture, payment workflows, and processing.

Pros

- Competitive pricing on invoice capture.

- Cash rebates through vendor card payments.

- Strong support for banking sector.

Business Type: Banks and financial institutions.

Featured solutions: Invoice capture, payment approval workflows, payment processing

Real-life case study

Robert High Development faced issues with their paper-based accounting system, which led to inefficiencies in invoice processing, document storage, and payment delays.

AvidXchange helped by automating their accounts payable process, integrating it with their Acumatica ERP system. This solution digitized invoices, streamlined payment approvals, and allowed subcontractors to receive payments electronically.

3- BILL

BILL.com automates AP for small businesses, focusing on invoice capture, approval, and payments.

Pros

- Ideal for small businesses and micro-businesses.

- Strong integration with NetSuite.

- Simplifies financial workflows with both AP and AR automation.

Featured solutions: Centralized AP inbox, AI data capture, automated workflows, security features.

Real life case study

Ignite Medical Resorts faced challenges managing accounts payable across 23 facilities, each functioning as a separate legal entity. The manual processes for handling invoices and payments were inefficient, especially during rapid growth and weather-related emergencies.

BILL helped by automating accounts payable and expense management, reducing manual tasks, and simplifying receipt capture. This allowed the small team to handle all 23 locations. BILL also integrated with Sage Intacct; the transaction codes flow through the ERP system automatically.

4- Hyland

Hyland’s OnBase platform supports AP automation with document management, workflow automation, and records management. Hyland is mostly the right ap automation solution for large enterprises with extensive document management needs.

Pros

- Comprehensive document management.

- Customizable workflows.

- Strong integration capabilities.

Featured solutions: Document management, workflow automation, records management.

Real-life case study

North American Mining Company struggled with a paper-based, decentralized accounts payable system, processing nearly 360,000 invoices manually each year. This led to inefficiencies and a lack of visibility in invoice management.

Hyland’s OnBase solution automated their accounts payable process by digitizing invoices and centralizing operations. It enabled automatic data extraction, increased invoice processing, and helped the company recognize early payment discounts and saved $5 million in a year.

5- Kofax

Kofax provides AP automation with advanced OCR and AI-driven data extraction. Kofax can be suitable for businesses from any scale depending upon the needs.

Pros

- Advanced OCR capabilities.

- AI-driven data extraction.

- Strong focus on automation.

Featured solutions: OCR, AI-driven data extraction, workflow automation.

Lacks: Specific cash management functions.

Real-life case study

Pfizer experienced inefficiencies with its in-house invoice and workflow processing systems, which struggled to handle operations across multiple countries during the company’s global expansion. This created delays and cost issues.

Tungsten Automation (Kofax) helped Pfizer by implementing an integrated SAP-based invoice automation solution, which streamlined operations and saved Pfizer $2 million annually.

6- Rossum

Rossum is an AI-powered document processing platform that extracts and processes data from various document types without relying on fixed layouts. It offers cognitive data capture, a validation interface for data verification, and learns automatically from user interactions.

Pros

- Implementing Rossum’s platform reduced manual data entry effort by 75%, saving 27.5% of the time per document in a case study with the Master Trust Bank of Japan.

- Requires less initial setup and training compared to traditional OCR solutions.

- Rossum canrecognize and understands the context of information. Later, it can adapt to document layouts without pre-defined templates and learns from user corrections and feedback.

Featured solutions: cognitive capabilities, ease of use, deep learning

Real-life case study

Wolt needed to process 100,000+ invoices yearly from 2,000+ suppliers in various languages and formats, which was impossible to handle manually. They required a solution to automate their accounts payable (AP) process and manage diverse invoice layouts.

Rossum provided an AI-powered system that integrated with Wolt’s ERP that can automate data extraction and validation. The solution reduced manual tasks and improved processing efficiency across different regions. Rossum claims it reduced 44% average error rate.

7- Sage Intacct

Suitable for medium-businesses.

Pros

- Deep integration with Sage Intacct.

- Automated invoice processing.

- Real-time financial insights.

Featured solutions: Invoice processing, approval workflows, vendor payments.

Real-life case study

Operation HOPE, a nonprofit organization, faced challenges with manual, paper-based accounts payable processes. They needed a solution that could consolidate accounts payable across different time zones and provide deeper financial insights.

Sage Intacct helped by implementing AP Automation and GL Outlier Detection, where bills are scanned, data is extracted, and reports are processed without time zone delays. This eliminated administrative tasks. The system provided a foundation for strategic planning.

8- SAP Concur

SAP Concur offers AP automation suitable for large enterprises with global operations.

Pros

- Comprehensive travel and expense integration.

- Strong reporting and analytics.

- Global reach.

Featured solutions: Travel and expense management, AP automation, reporting.

Real-life case study

Gonzaga University faced challenges with a manual, paper-based system for managing expenses and invoices, leading to inefficiencies and limited visibility into spending data. They needed to streamline their accounts payable processes and improve access to critical financial data.

SAP Concur helped by automating Gonzaga’s travel, expense, and invoicing processes, allowing for remote work, and provide better insight into spending for more informed decision-making.

9- Stampli

Stampli provides a collaborative AP automation platform with invoice processing functions. This can be utilized by mid-sized businesses needing customizable AP workflows.

Pros

- strong invoice processing capabilities

- customizable workflows.

- wide variety of ERP integrations.

Featured solutions: Invoice processing, approval workflows, ERP integration.

Real-life case study

LTC Ally faced challenges scaling their accounts payable operations due to the unique accounting needs of each nursing facility they onboarded, leading to complexity. They needed a solution to integrate new facilities quickly without increasing staff proportionally.

Stampli helped by automating the AP process, integrating with Sage Intacct, and using AI to reduce manual work, allowing LTC Ally to onboard more facilities while maintaining accuracy and speeding up invoice processing.

10- Tipalti

Tipalti steps forward in international payments and offers a comprehensive AP automation solution. Thus it is suitable for mid-sized and large businesses with a global presence.

Pros

- Strong international payment options.

- Handles complex workflows.

- Enhanced fraud protection and tax compliance.

Business Type: Mid-sized and larger businesses with a global presence.

Featured solutions: Invoice management, payment processing, global payments.

Real-life case study

Linkvertise faced challenges managing a growing number of daily payments to over 1,000 digital creators, while also addressing concerns about fraud detection. They needed to scale their payout system and ensure transactions were secure and efficient.

Tipalti helped by automating the payout process, consolidating payments into daily batches, and implementing fraud detection tools. This allowed Linkvertise to handle increasing transaction volumes and expand its operations without disruptions.

AP automation software screening

There are around 150 AP automation tools available on the market. To help you with your decision-making, we reduced the number of suppliers according to two, publicly-verifiable parameters:

- Number of employees: Revenue correlates with employee count. So, we target 100+ employee companies.

- References: We choose vendors with significant market presence. The vendors we evaluated have at least 100 reviews on review platforms like G2, SoftwareReviews, and Capterra or have at least one Fortune 500 reference.

AP automation tools were chosen for this study based on the criteria listed above. We listed the vendors alphabetic order.

9 Key features to look for in AP automation

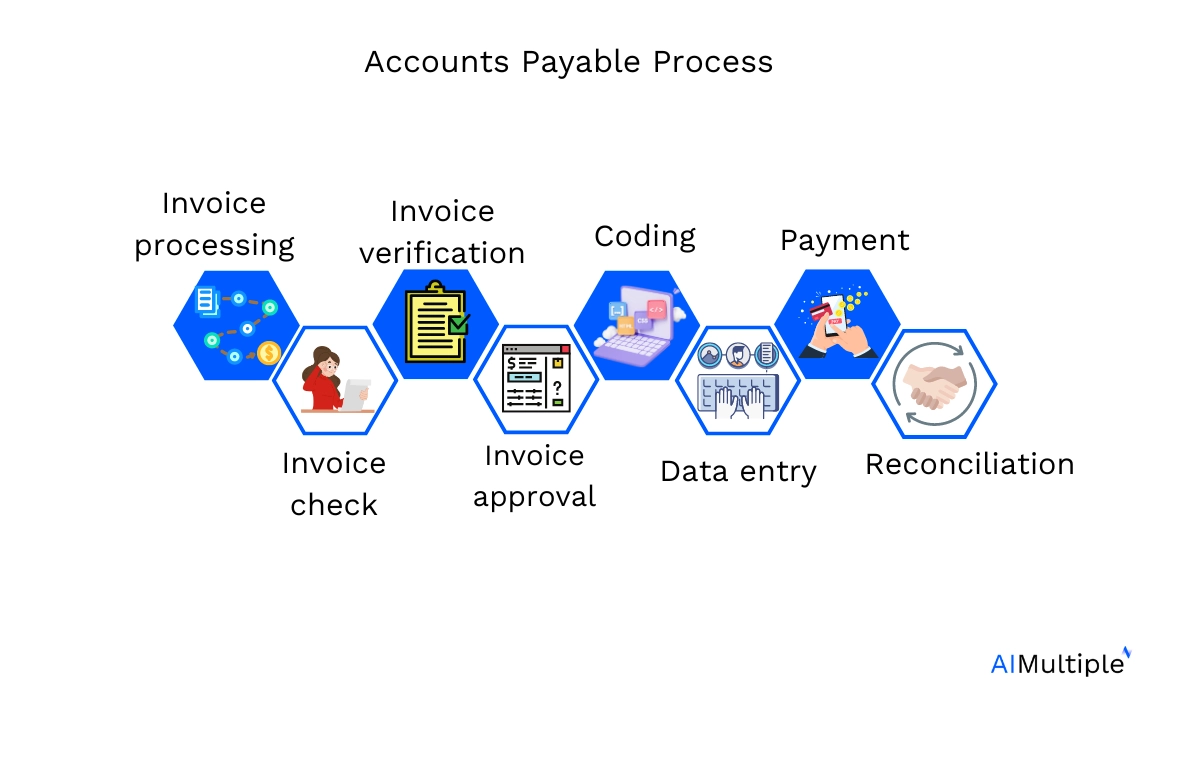

Figure 1. AP automation process

With the increasing popularity of automation tools, businesses need to understand which tools are the best fit for their specific needs. According to the same report, the AP automation solutions market is highly dispersed as a result of the diverse needs of companies such as:

- Total invoice volume

- Legal requirements by different countries

- Matching purchase order (PO) requirements to invoices

- Integration requirements

- Internal policy

The constant expansion into adjacent markets has led to an oversaturation of services and also left consumers confused by the sheer number of available options.

After our analysis, we identified 9 essential features of AP automation tools that are critical in addressing the needs of an organization:

1. ERP Integration

ERP (Enterprise Resource Planning) native integration with AP automation allows for a seamless flow of data between the two systems resulting in more efficient and accurate financial management.

We analyzed the results of native integration between ERP and AP in following articles with user reviews and case studies:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Sage Accounts Payable (AP) Automation

In sum, when an ERP system is integrated with AP automation, these functionalities enhance:

- document management with end-to-end encryption & search indexing

- analytics features

- use of OCR

- workflow between different SaaS applications

- search features

2. OCR capture

OCR or “Optical Character Recognition” is a technology that allows a computer to:

- Scan

- Read

- Turn the text into machine-readable text

which can then be edited, searched, or indexed.

OCR is important in AP automation because it allows the software to automatically extract data from invoices and other bills. This eliminates the need for manual data entry and reduces errors.

In AP automation, OCR technology is used to extract relevant data from invoices, such as

- Vendor name

- Invoice number

- Total amount due

The extracted data is then used to automatically match the invoice with a purchase order (PO) and validate the amount.

3. Three-way matching

Three-way matching compares the invoice, PO, and receiving document to ensure that the goods or services have been ordered, received, and invoiced correctly.

- Invoice matched with PO (invoice number, vendor name, item/service description)

- Invoice matched with receiving document

- Compare receiving document with PO to ensure goods/services were delivered as ordered

Three-way matching adds an extra security layer over two-way matching by ensuring payment’s hold before it has been received by the warehouse.

4. Approval automation

According to market research,3 Automating validation is the primary purpose of most AP automation tools because during the approval process, local requirements and regulations, such as applying VAT, need to be checked to ensure that only valid invoices are paid.

Invoice approval (i.e., validation) process involves:

- Capturing invoice data

- Matching invoices with purchase orders (PO)

- Validating data

- Approving invoices for payment

OCR is typically used for automating invoice approval and workflow management, which ensures that the invoice is complete and accurate.

There can be a personalized PO matching set up by software that can:

- Create guidelines to check if an invoice is linked to a PO

- Use criteria such as the supplier or the amount of the invoice

- If the invoice has a PO, the invoice will automatically be filled with the PO’s information.

Once the invoice has been validated, it is routed to the appropriate personnel for approval. This process can include multiple levels of approval, depending on the organization’s policies and procedures.

5. Duplicate and fraud identification

Duplicate identification identifies and flags duplicate invoices. This can be done by matching invoice data, such as vendor name, invoice number, and invoice amount, with previous invoice records.

- Fraud identification is a component of anti-money laundering (AML) initiatives that allow the system to detect and flag potentially fraudulent activity in financial transactions by analyzing invoice data and identifying any irregular patterns or anomalies.

- Machine learning algorithms can be used to identify unusual patterns or anomalies in invoice data as part of fraud identification.

- AML monitors financial transactions for suspicious activity such as large or frequent transactions, transactions involving known criminal organizations or individuals, and transactions that do not seem to have a legitimate business purpose.

- AML includes regulations requiring financial institutions and other regulated entities to implement AML programs, including the development of policies, procedures, and internal controls to detect and report suspicious activity, as well as to maintain records and file reports with the relevant authorities.

With this feature

- The risks of financial losses are reduced

- The accuracy and integrity of financial data are improved

6. Indirect tax validation

Automating the tax validation process can help organizations to maintain compliance with tax regulations and laws.There are over 12,000 different rules for taxes in the US. These rules can change often and without warning.4 Additionally, product taxability varies by area. By automating the process, organizations can ensure that all transactions are checked against the latest tax rules and regulations, reducing the risk of non-compliance and potential fines

Indirect tax (i.e., sales tax, value-added tax, excise tax) validation checks for compliance with indirect tax laws and regulations. It helps ensure

- The correct amount of taxes is calculated and applied to invoices

- The taxes are remitted to the appropriate government agency.

This feature also helps identify and prevent errors or discrepancies in the tax calculation process, which can result in financial penalties or other legal issues.

7. Payment scheduling

Automated payment scheduling allows companies to schedule payments to be made to vendors automatically.

Use cases include:

- Setting up recurring payments for bills received regularly, such as rent or utility bills

- Scheduling payments for individual invoices based on the terms of the invoice and the contract, such as the due date, early discount payments, etc.

- Prioritizing bills based on importance and urgency. This involves categorizing, batching, and prioritizing important payments.

Automated payments leverage payments API that enables the exchange of data between different ERP systems and the AP solution. Benefits of payment APIs include:

- Tracking payments directly from the software

- Allowing communication and exchange of information with other systems such as banks and payment processors

- Enabling electronic payments, such as ACH, wire transfers, or credit card payments

- Generates and sends electronic invoices

- Reconciles payments with invoices and financial records to reduce errors and improve efficiency.

8. Account coding

Account coding suggestions help users assign the correct financial codes to invoices and other financial transactions. The suggested codes can include GL (general ledger) codes, cost center codes, and other codes that are used to classify and track financial transactions.

This feature can use AI or ML algorithms to analyze the invoice data and suggest the most likely codes based on the invoice’s content and other factors.

9. Automated amortization

Debt amortization is dividing the cost of a debt, such as a loan, over a period of time. Automated amortization breaks down the periodic payments into interest payments and principal payments, while showing the remaining balance of the loan over time.

For example, if a company takes out a loan of $100,000 and purchases equipment with it to use over five years, it can amortize it to have a detailed view of how the loan expense with the income generated by it matches over time.

FAQ

What is AP automation?

AP automation refers to the process designed to automate and manage the tasks involved in the accounts payable (AP) process. This includes invoice processing, payment execution, cash management, and maintaining comprehensive records within the accounting system.

How does automation software improve invoice processing?

AP automation software enhances invoice processing by digitizing invoices, extracting data automatically, and matching invoices to purchase orders. This reduces manual input, minimizes errors, and speeds up the overall accounts payable process.

What are the key features of an AP automation solution?

A comprehensive AP automation solution includes features like electronic invoice capture, automated invoice approval workflows, real-time financial reporting, tax compliance tools, and integration with existing ERP systems and accounting systems. It also supports spend management platforms to optimize financial operations.

How can accounts payable automation software benefit my business?

Accounts payable software streamlines the AP process, reduces processing costs, minimizes errors, and improves vendor relationships. It also allows AP staff to focus on more strategic tasks rather than manual data entry. Additionally, the best AP automation software integrates seamlessly with ERP systems, enhancing the overall efficiency of the accounts payable process.

What are ERP integrations in AP automation?

ERP integrations in AP automation refer to the seamless connection between accounts payable automation software and enterprise resource planning (ERP) systems. This integration ensures that financial data flows smoothly between systems, enhancing accuracy, efficiency, and real-time visibility into the accounts payable process.

How does AP automation software handle tax compliance?

AP automation software handles tax compliance by automatically calculating and applying tax rates to invoices, ensuring compliance with local and international tax laws. It also provides detailed reports for audit purposes, helping businesses stay compliant with tax regulations.

What is the role of an AP automation tool in cash management?

An AP automation tool plays a critical role in cash management by providing real-time visibility into outstanding invoices, due dates, and payment statuses. This helps businesses manage their cash flow more effectively, ensuring timely payments and optimizing working capital.

How do AP automation tools improve the overall accounts payable process?

AP automation tools improve the overall accounts payable process by reducing manual tasks, enhancing accuracy, speeding up invoice processing times, and providing real-time insights into financial data. This leads to a more efficient and streamlined AP processes, allowing businesses to manage their payables more effectively.

What is a spend management platform, and how does it integrate with AP automation?

A spend management platform is a software solution that helps businesses manage and control their spending in the accounting system. When integrated with AP automation, it provides a comprehensive view of spending patterns, enforces budget controls, and ensures that all expenditures are accurately recorded and processed. This integration enhances financial oversight and decision-making.

Disclaimer

AIMultiple is data-driven. Check out this list to learn more about AP automation software by evaluating 140 services based on comprehensive, transparent, and objective AIMultiple scores.

If you have any additional queries regarding AP automation tools and best practices, do not hesitate to get in touch with us:

This article was drafted by former AIMultiple industry analyst Kübra İpek.

External Links

- 1. Market Guide for Accounts Payable Invoice Automation Solutions.

- 2. Sundaram, Shakar (29 June 2022). “What’s the true cost of failed automation?”. Latent Bridge. Retrieved 17 January, 2023.

- 3. Market Guide for Accounts Payable Invoice Automation Solutions.

- 4. “State-by-State Guide to Sales Tax Nexus Laws”. Sovos. Retrieved January 17, 2023.

Comments

Your email address will not be published. All fields are required.