Automated Invoice Validation: Benefits & Use Cases in 2024

Invoice approval process is a critical part of accounts payable management. Late or wrong invoices can lead to late fees, missed discounts, wrong payments or even lost customers.

However, manual invoice validation is time-consuming for AP departments. Approval process for an invoice is on an average 16 days.1. Therefore, many businesses are turning to automation of invoice validation to help them stay on top of their payments.

However, most executives are not aware of the critical aspects of invoice validation and therefore may choose suboptimal automation solutions. In this article, we’ll talk about invoice validation, its benefits, and how automation for AP processes can make the accounts payable department of a business run more smoothly and efficiently while keeping financial data correct.

What is invoice validation?

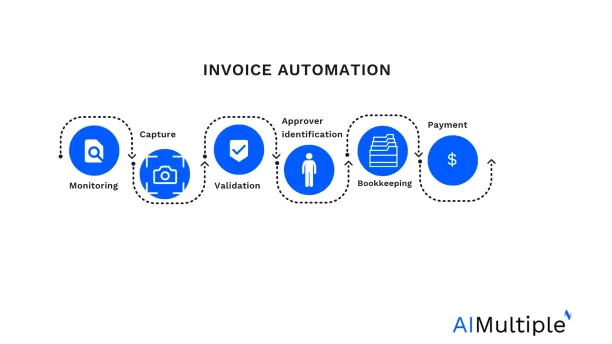

Invoice approval is part of invoice processing which includes (See Figure 1):

- Invoice monitoring and invoice capture for all channels like EDI, email and paper invoices arriving via post

- Invoice validation which includes three-way matching between the invoice, the PO, and delivery receipt

- Approver identification and invoice approval process

- Bookkeeping (i.e. Recording the invoice in the ERP or other systems).

- Payment processing and archiving

Figure 1: Invoice Processing

Invoice validation involves checking invoice against company’s internal data to ensure that it is a valid invoice. Evaluations include

- Two-way match: cross-checking invoices against purchase orders (POs) to ensure that the invoice corresponds to a PO. It involves checking the amount of goods purchased, SKUs, prices and terms. Any changes that were not agreed upon, would need to be discussed with the supplier.

- Three-way-match takes place if invoices are also cross-checked against goods received

- Fraud detection: cross-checking invoices for duplicity or fraud. For example, a supplier that claims to have changed its bank account number could be a fraud attempt.

- Workflow identification: Using limits to to decide whether to manually process invoice. Invoices that are abnormally large compared to a suppliers’ usual invoices may need to be manually verified to prevent wrong payments.

- Compliance verification involves checking invoices against indirect taxation (e.g. VAT) rules. For example, most jurisdictions require that certain information like a company’s address have to be present on invoices.

Why is automating invoice validation important?

4 out of 5 critical needs of big corporations’ AP departments are:2

- Timely visibility

- Reducing manual payment workflows

- Reducing exposure to compliance issues creating delays and confusion

- Fraud protection

Automated invoice workflow involves the automated analysis of invoices to ensure that all transactions are correct. Therefore, automated invoice workflows contributes to all of these goals.

What are the benefits of invoice validation automation?

Reduced errors

Invoice validation should reduce payment errors, but data entry errors and system discrepancies are inevitable in manual AP workflows; 25% of invoice errors tend to go unnoticed throughout the manual workflow.3

Reduced fraud

Invoice fraud triggered by internal or external parties costs $300,000/year to an average mid-market business.4

Automation of invoice validation reduces invoice fraud because:

- Extensive automated data collection from documents provides relevant data. For example, a human AP clerk may not notice that a company’s name has been changed by one character. However, these traces of potential fraud are easy for machines to identify.

- Fraud detection models monitor invoices for potential fraud.

- Transaction logs are stored for audit trails

Reduced duplicate payments

In the manual workflow, invoices could mistakenly be processed twice, resulting in duplicate payments. The automated approval digitally logs the payment details. So duplicate payment attempts trigger warnings and can be easily prevented. The vendor can also be simultaneously informed of the duplicate invoice.

Easier audits

Audit trails which include automated decisions and their rationale facilitate audits.

Faster process and improved cash flows

Approval process becomes faster with automation. This allows companies to capture more early payment discounts and improve their cash flows.

Other automation benefits such as increased efficiency are also among the benefits of automated invoice processing. For example, invoice validation automation reduces the amount of time and effort required to manually review and approve invoices, freeing up staff to focus on higher value-added activities such as examining invoice exceptions in high-value invoices.

How does automated invoice validation work?

The technologies used in automated invoice validation process include: OCR, fuzzy search, machine learning based IDP software to identify relevant invoice data from documents.

For some of AP automation tools with invoice processing capabilities, check:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

- 7 Vic.AI Alternatives to Automate Accounting in 2023

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors in 2023

- 14 Rossum AI Competitors/Alternatives in 2023

If you have further questions about invoice processing, you can reach us:

External Links

- 1. Bartels, Greg. (Aug 4, 2021). “How Long Does It Take to Process an Invoice?“. IPS Blog. Retrieved December 27, 2022.

- 2. “The 2021 McKinsey Global Payments Report | Financial Services“. McKinsey & Company. Retrieved December 19, 2022.

- 3. “Report: Lost in transaction – the hidden cost of accounting vat errors in the Nordics“. Qvalia. Retrieved December 27, 2022.

- 4. “The Financial Professional Census“. Medius & Censuswide. Accessed June/26/2023

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.