AI-powered CRM systems leverage machine learning, natural language processing (NLP), and data analytics to enhance the capabilities of traditional CRM. The adoption of AI in CRM is driven by the need for more personalized customer experiences and efficient data management.

According to the research by Freshworks, only 12% of CRM users actually use a CRM AI tool in their processes. Research also shows that 40% of buyers want to invest in a CRM platform that is suited for their needs and accelerate their productivity.

Many users believe that AI-powered tools are too expensive or not particularly useful, given their current price. Thus, we still need to have more time to observe AI’s actual impact on sales processes.

Take a look at:

- The top companies offering AI-powered CRM tools

- Why using AI-driven CRM software can benefit your business

- Real-world examples of how businesses use AI in CRM systems

Please note that we might use the terms “AI-powered CRM” and “CRM automation” interchangeably.

What are the leading vendors that offer CRM automation use cases?

CRM vendor market includes a wide range of solutions to support businesses. You can have a sortable list of more than 300 CRM software options. Here are the leading CRM vendors that leverage AI technologies in their CRM solutions:

| Vendors | Number of reviews* | Average rating | Low-code / no-code development | Predictive lead scoring | Next action recommendations | Call data entry & collection automation |

|---|---|---|---|---|---|---|

| Creatio | 390 | 4.6/5 | ✅ | ✅ | ✅ | ✅ |

| Pipedrive | 4,948 | 4.3/5 | ✅ | ✅ | ✖ | ✅ |

| Salesforce Sales Cloud | 36,475 | 4.3/5 | Low-code | ✅ | ✅ | ✅ |

| ClickUp | 13,118 | 4.6/5 | ✅ | Not provided | ✖ | ✅ |

| HubSpot Sales Hub | 11,340 | 4.4/5 | Not provided | ✅ | ✖ | ✅ |

| Zoho CRM | 9,661 | 4.1/5 | ✅ | ✅ | ✅ | ✅ |

| ActiveCampaign for Sales | 2,317 | 4.3/5 | ✅ | ✅ | ✅ | ✖ |

| Freshsales | 1,761 | 4.3/5 | ✖ | ✅ | ✅ | ✅ |

| Quickbase | 1,724 | 4.5/5 | ✅ | ✅ | ✖ | ✖ |

| monday.com CRM | 1,096 | 4.5/5 | ✖ | ✅ | ✖ | ✅ |

| SAP Sales Cloud | 858 | 4.1/5 | ✅ | ✅ | ✅ | Not provided |

| Zendesk Sell | 548 | 4.1/5 | Low-code | ✅ | ✖ | ✅ |

*Based on the total number of reviews on software review platforms G2, Capterra, and Trustradius.

Note: With the sponsors at the top, we sorted the list based on number of reviews in a descending order.

If you plan to invest in a CRM solution, check out our benchmark on CRM software in the market.

Top 3 CRM AI Tools

1. Creatio

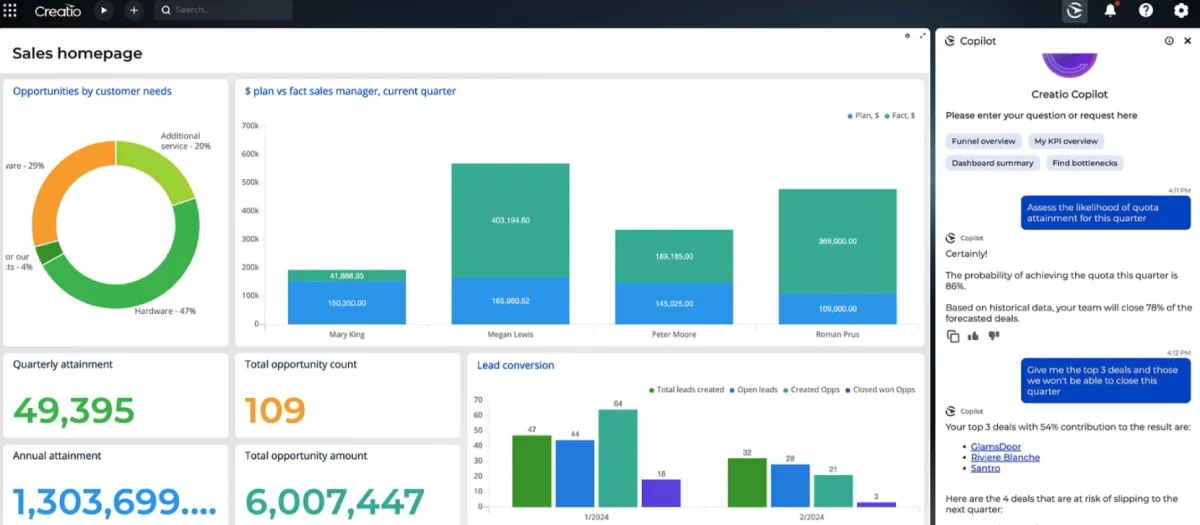

Creatio features a unique no-code composable architecture, allowing users to automate workflows and CRM AI processes with significant flexibility. It comprises three integrated products focused on marketing, sales, and customer service, all built on the Studio Creatio platform.

Source: Creatio Copilot analyzing a sales pipeline1

AI Related Features:

- Next Action Recommendations: Provides suggestions for subsequent steps based on data analysis and predictive models.

- Call Data Entry & Collection Automation: Automates the entry and collection of call data to reduce manual workload.

- Predictive Lead Scoring: Uses AI to evaluate and prioritize leads based on their conversion likelihood.

- Advanced Analytics & Reporting: Offers deep insights and detailed reports generated through AI-driven analytics.

2. Pipedrive

Pipedrive uses AI to enhance sales workflows, making them more efficient and effective. The AI Sales Assistant is particularly noted for saving time, identifying patterns, and recommending high-potential deals and next actions. The platform also features tools for email creation and summarization, designed to enhance communication and productivity.

Source: Pipedrive Email Summarization 2

AI Related Features:

- AI Sales Assistant: Enhances efficiency by identifying patterns, recommending high-potential deals, and suggesting next actions to prioritize.

- AI Email Creation Tool: Crafts personalized emails from simple prompts, improving communication efficiency and response rates.

- AI Email Summarization Tool: Condenses lengthy emails into brief summaries, aiding quick comprehension and decision-making.

- Predictive Lead Scoring: Utilizes AI to score leads based on their conversion potential.

- Call Data Entry & Collection Automation: Automates the process of entering and collecting call data to save time.

3. Salesforce Sales Cloud

Salesforce Sales Cloud integrates trusted AI directly into its CRM system, offering various tools to automate and enhance sales processes. The platform’s AI assistant, known as Einstein, aids in prospect research, email drafting, and daily planning.

AI Related Features:

- Einstein GPT for Next Action Recommendations: Provides AI-driven suggestions for the next steps in the sales process.

- Call Data Entry and collection Automation automates the capture and synchronization of relevant customer and sales information from emails and calendars.

- Conversation Mining: Analyzes sales calls to uncover trends and customer sentiments, helping refine sales strategies.

- Predictive Lead Scoring: Employs AI to forecast which leads are most likely to convert.

- AI-Powered Email Generation: Auto-generates personalized emails using CRM and external data, streamlining communication.

Why should businesses integrate AI into their CRM tools now?

There are four main reasons for CRM automation:

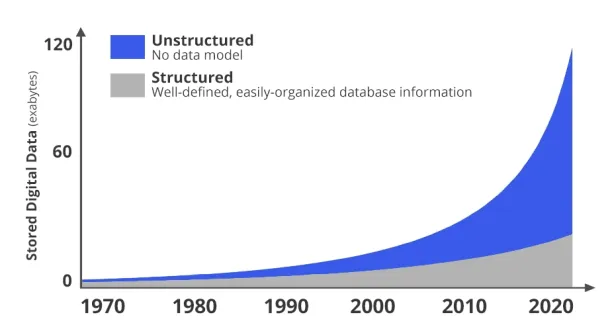

1. The increasing volume of unstructured data without AI/machine learning.

With the growing number of transactions, the size of customer data also increases. This increase can help businesses understand their customers better, as they can process more information about them.

However, it also means that they need to work more to extract relevant information because the majority of the data remains unstructured. While it is challenging to understand unstructured data, which constitutes around 90% of the total data, CRM AI tools can convert unstructured data to structured data.

After converting to structured data, machine learning algorithms can detect patterns and provide vital insights for businesses. Considering the growing amount of data, CRM AI technology offers scalable solutions for companies and enables them to handle a higher volume of data rapidly and with fewer errors.

2. The increasing need for data scientist talent

The growing demand for data analysis in CRM ai systems has spiked the need for data scientists, specialists skilled in extracting insights from intricate data. However, hiring such talent can be pricey and challenging due to their limited availability. This gap is efficiently bridged by no-code/low-code AI platforms. These platforms empower businesses to integrate AI into their CRM without the need for deep technical expertise, automating tasks like lead scoring and customer segmentation, thus offering an non-technical employees flexibility while customizing CRM platform.

3. The increasing complexity of relationships

Besides the growing volume of data and IT employees, the business processes and relationships also become more complicated with the increasing transactions. This complexity makes it harder to understand company relationships and analyze customer patterns accurately. According to Xant, sales representatives spend over half of their time spent in CRM for trying to manage CRM tasks more effectively. AI technology can easily surpass this challenge by automating most of these tasks and offering valuable insights.

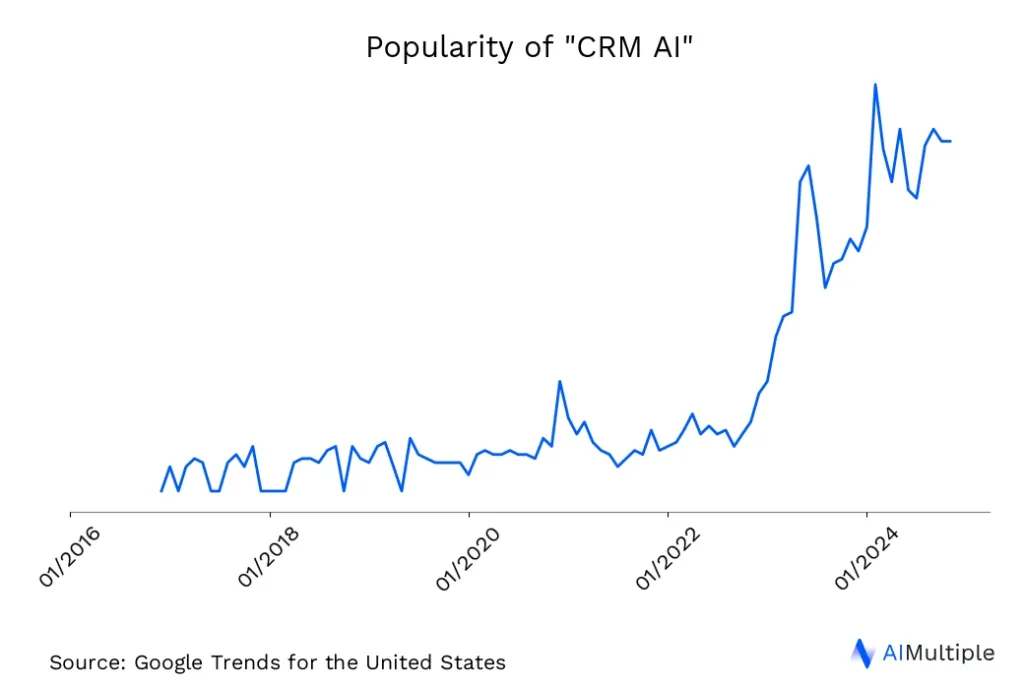

4. The increasing popularity

As seen above, the interest in AI CRM tools is increasing. We can relate this increase to the following reasons:

- The advances of AI enable this technology to be integrated into the CRM tools, and these tools are becoming more preferred by businesses.

- The impact of CRM AI tools is observed better as processes become more complex, and the amount of data increases.

What are some AI applications in CRM?

Interface.ai reports that 87% of sales teams are dissatisfied with their CRM. This is due to manual tasks performed in processes or difficulty in using CRM tools. Thus, the integration of AI might help businesses improve their CRM processes and reduce human intervention while performing specific tasks like manual data entry. As a result, employees can focus more on higher value-adding activities and improve their productivity.

Sales

Sales forecasting

Sales forecasting is one of the most critical and wide-spread features of CRM tools. With AI, these tools can provide more accurate forecasts. CRM AI can detect patterns in customer sales data and offer valuable insights about sales predictions. With these forecasts, businesses can make their plans accordingly and optimize their sales processes.

For instance, Salesforce released Einstein GPT, a generative AI technology, and integrated it into their CRM AI systems to automate processes such as real-time analyses to predict sales.

Check out our article to learn more about generative CRM and its applications.

Predictive lead scoring

AI tools can analyze customer sales data, including demographic data, geographic data, activity data, and web behavior, to determine their buying readiness. Companies can analyze won versus lost deals to detect trends that can inform predictive lead scoring methods. Feel free to read our research on the topic to learn more.

Customer churn reduction

As most company revenues come from existing customers, it is critical to prevent customer churn for businesses. AI-powered tools can go through customer data to analyze specific patterns and identifying the reasons for customer churn. As a result, companies can take concrete actions to reduce customer churn effectively.

Marketing

Lead qualification

Sales representatives spend only 32% of their time selling or pitching tasks and 20% of their working hours for managing their CRM-related tasks like producing reports and other administrative duties. Businesses should create more time for their sales teams in sales processes and reduce their workload for their other responsibilities.

During lead qualification processes, AI-powered CRM tools can automate the majority of analyzing needs. They can leverage chatbots and email bots to understand leads’ needs and inform the sales teams to improve their performance. With insights gained from these bots, companies can optimize their sales processes.

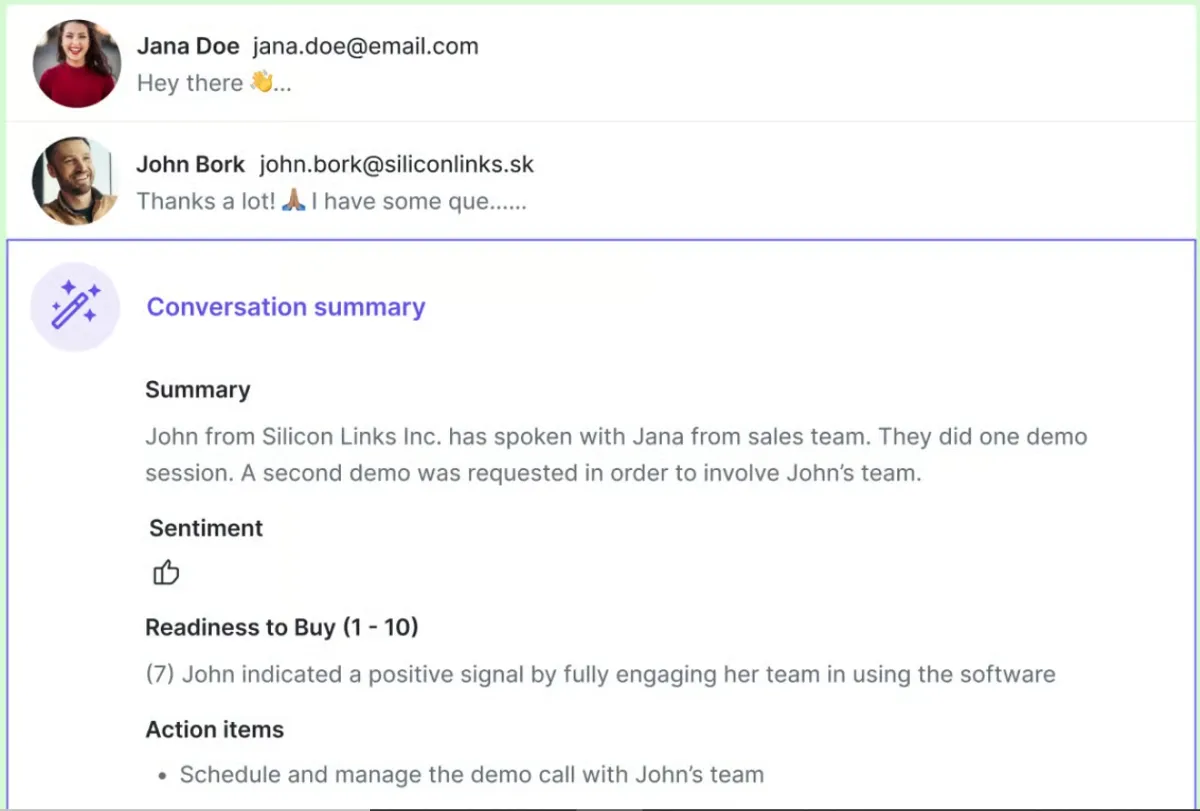

Sentiment analysis during calls

In sales, understanding customer sentiment is critical for developing trust with them. As it is harder to build trust without face-to-face interaction, HubSpot Research shares that only 3% trust salespeople. AI can offer a solution to solve this problem. AI-powered tools can analyze customer interactions during calls and assess emotional states using sentiment analysis.

As an example, Cogito offers real-time conversational analyses to evaluate customer emotions, how effective the calls are, and how best to respond to them. According to the company, understanding customers’ emotional states helps businesses increase their revenue per customer by 10%, according to the company.

Accelerated content production

With the integration of natural language generation platforms, CRM tools can automatically organize personalized emails, reviews, and client reports. This characteristic can also be used in preparing descriptions for specific products, landing pages, social media posts, and news articles. Wordsmith, developed by Automated Insights, can be implemented in CRM tools and automate employee emails, as seen on this page.

Recommendation systems

While CRM systems use data to understand customers better, AI can discover their needs or desires to offer a personalized experience. Customer data to understand such patterns includes their information like age, gender, region, as well as their sales history and online interactions. As a result, your company can offer a personalized experience to your customers and recommend products based on their needs. Salesforce shares that personalization can improve sales by 10%.

Virtual Assistants

We can group virtual assistants leveraging CRM data in two main categories:

- In-Office Tasks: Virtual assistants can handle simple in-office tasks like managing schedules meetings, taking notes, and notifying follow-ups in a CRM system.

- Intelligent Call Routing: Based on CRM data, AI can interpret natural language queries for customer segmentation and handle customer interactions to support call centers in simple customer tasks.

Data

Data cleaning

Customer data can include many irregularities, anomalies, duplicates, and other errors, which may cause inaccurate predictions. According to Dun & Bradstreet, 91% of data in CRM systems is incomplete, 18% is duplicated, and 70% becomes outdated every year. To improve decision-making quality, an AI-integrated CRM system can:

- Detect potential issues

- Clean the duplicated data

- Notify the users to correct the errors

- Look for incomplete data in other systems

- Suggest actions to update potentially stale data

Data entry

While data entry is one of the most repetitive and tiresome tasks in businesses, CRM AI takes it over and allow employees to focus on higher-value adding tasks. Data entry includes entering customer data in the desired format and automatically capturing data from SMSs, calls, emails, images, etc. with document capture, image recognition, and speech recognition technologies.

What is AI-powered CRM?

AI-powered CRM (Customer Relationship Management) refers to CRM systems that integrate artificial intelligence technologies to automate, optimize, and enhance customer management processes. These systems use AI to analyze data, predict customer behavior, and provide personalized experiences.

How does AI improve CRM performance?

AI enhances CRM performance by automating repetitive tasks, providing predictive analytics, improving customer segmentation, and offering personalized recommendations. It can also optimize workflows and identify trends or opportunities through advanced data analysis.

What are some examples of AI features in CRM?

Chatbots: Automate customer support with real-time responses.

Predictive Analytics: Forecast customer behavior and sales trends.

Sentiment Analysis: Monitor and evaluate customer feedback.

Sales Automation: Prioritize leads and automate follow-ups.

Personalization: Tailor marketing campaigns based on customer preferences.

How can AI-powered CRMs help with customer retention?

CRM AI systems analyze customer behavior and predict churn, enabling proactive engagement strategies. They also personalize communication and offer timely support, improving customer satisfaction and loyalty.

Transparency statement:

Numerous tech companies sponsor AIMultiple, sponsors receive links from AIMultiple research.

Comments

Your email address will not be published. All fields are required.