Product Market Research: 8 Essential Steps & Real-Life Examples

~90% of companies state that they listen to the voice of their customers while developing new products.1 One of the efficient ways to hear from customers is to conduct market research. Product market research stands as a beacon, guiding businesses in creating products that resonate with their target customers. This article dives into the essential steps of conducting effective product market research, explores various methods, and brings to light real-life examples of successful product market research.

Essential steps for conducting product market research

1- Evaluating company assets and product development possibilities

Before diving into market research, it’s imperative for a business to take stock of its internal capabilities and how these align with potential product development opportunities. This initial step is a foundational one, requiring a thorough assessment of the company’s resources, strengths, and limitations.

For example, a tech company with a strong background in software development might explore avenues in the latest app technologies, whereas a retail business with a robust supply chain might consider expanding its product line.

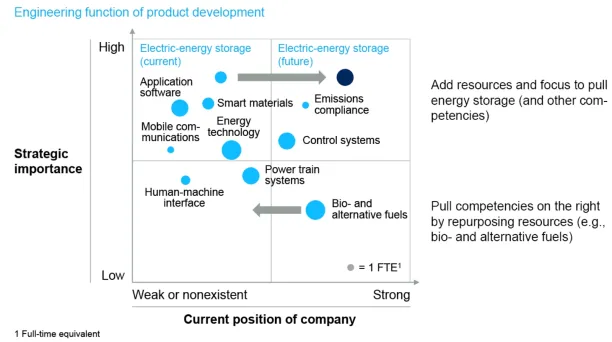

Here is a strategic map to help your company prioritize its investments and innovation efforts based on the current and future significance of different competencies (see figure below).

Source: McKinsey2

2- Deciding on the target markets

Once you evaluate the strengths and capabilities of your company, you can decide on the target market and audience. This involves defining the specific group of customers for whom the product is intended. Understanding the demographics, psychological factors, pain points, and needs of this target market is essential for tailoring the research.

For those interested, here is our article on retail market research trends and some real-life examples.

3- Crafting informed research questions

The next step is to prepare the questions that you wish to hear from your target audience. The foundation of successful product market research is in formulating insightful and targeted questions. This step is particularly crucial when designing surveys, as the quality of questions directly impacts the relevance and usefulness of the data collected.

Check out our comprehensive article on the best practices of conducting market research.

4- Choosing the right market research vendors

The selection of a market research vendor can significantly influence the outcomes. Businesses need to ensure that the vendor’s expertise aligns with their specific research needs, especially in constructing and administering effective surveys.

If you are looking for a market research software, check out our vendor deep dive.

You can also check out our data-driven list of market research tools.

5- Finding the right survey sharing channels

This involves determining where and how to distribute the surveys to reach the target audience effectively. Channels might include online platforms, email, social media, in-person venues, or a combination of these, depending on where the target market is most accessible. Bear in mind that market research or survey tools can also handle this process.

6- Determining data collection methods

Selecting the most appropriate tools and techniques for gathering and interpreting market data is as crucial as determining your questions, target market, and audience. Although there are various methods, surveys, due to their adaptability and broad reach, often become the method of choice for businesses seeking comprehensive and direct consumer feedback.

7- Analyzing and interpreting results

The data obtained, particularly from surveys, should be meticulously analyzed to extract meaningful insights. This step transforms raw data into actionable intelligence about consumer preferences and market trends.

If you are looking for a survey analysis tool, check out our vendor benchmark.

8- Communicating market research findings

Effectively presenting the research findings to stakeholders is a critical part of conducting market research itself. The insights, especially those derived from surveys, should be communicated clearly to inform strategic decisions.

Product market research methods

Product market research process can be broadly categorized into two main types: primary and secondary research.

Primary market research

Primary market research involves gathering fresh data directly from sources. This method is proactive and tailored to specific research needs. The primary objective is to collect data that is relevant, in-depth, and directly related to the research question. Methods used in primary market research include:

- Online Surveys: Surveys are pivotal in product market research. They provide direct insights from the target audience, are cost-effective, and can be scaled to reach a broad demographic. Besides, they are useful for conducting both qualitative research and quantitative research. The richness and validity of the data garnered from well-designed surveys are unparalleled in gauging consumer sentiment and preferences.

- Individual interviews: These offer nuanced understandings of consumer attitudes, supplementing the quantitative data from surveys with qualitative depth. Companies can also understand how to attract potential customers through these individual meetings.

- Focus groups: This refers to gathering a group of people to discuss and react to something, such as a product or campaign. It’s particularly beneficial for understanding reactions and attitudes, and more useful for exploratory research.

Secondary market research

Secondary research uses data that already exists and has been collected by other initiatives. It’s often quicker and less expensive than primary research. This method includes:

- Public sources: Publicly available data like government reports and industry analyses offer a contextual backdrop for primary data and competitive analysis.

- Social media channels: Social media platforms (e.g., Instagram, X, LinkedIn) are a rich source of secondary market research data. They provide real-time insights into customer sentiment, emerging trends, brand perceptions, and competitor activities.

Product market research real-life examples

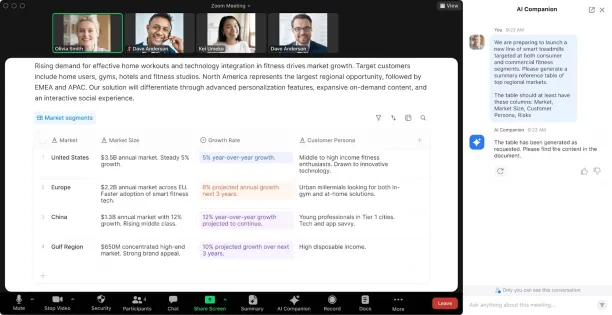

Zoom Docs

Source: Zoom3

Zoom Docs, announced at Zoomtopia 2023, is a testament to Zoom’s market research-driven product development.4 Addressing the complexities of hybrid work, Zoom Docs integrates AI-enhanced document and collaboration tools within Zoom’s ecosystem, aligning with the identified needs for more streamlined and efficient workplace solutions. This innovation, as a park of Zoom’s marketing strategy, is set for release in 2024, and it reflects Zoom’s commitment to evolving its services in response to changing work dynamics.

Warby Parker

Warby Parker, founded in 2010, revolutionized the eyewear market with a direct-to-consumer model that undercut traditional optical boutiques.5 Their innovative Home Try-On program allowed customers to test frames at home, addressing common pain points in buying glasses online. This consumer-centric approach, combined with their expansion into physical retail locations and the integration of an AR Virtual Try-On feature, showcases Warby Parker’s commitment to evolving with market trends and consumer needs, offering a broad range of stylish, affordable eyewear options.

Lush Cosmetics

Lush Cosmetics, driven by market research and a commitment to environmental sustainability, has innovatively tailored its product development strategy.6 Emphasizing on eco-friendly practices, Lush’s products predominantly use fresh, vegetarian ingredients, with a large vegan selection. Their unique approach extends to packaging, focusing on reducing waste through ‘Naked’ products like solid shampoo bars and reusable packaging options, including knot-wraps made from recycled materials. This strategy, reflecting consumer preferences for ethical and sustainable products, has significantly strengthened Lush’s brand value and appeal in the cosmetics industry.

If you need help in market research, we can help:

External Links

- 1. “Digital Product Development 2025“. PwC. Retrieved December 25,2023.

- 2. “A capabilities strategy for successful product development“. McKinsey. July 13, 2017. Retrieved December 25,2023.

- 3. “Zoom Docs“. Zoom. October 3, 2023. Retrieved December 25,2023.

- 4. “Zoom Docs“. Zoom. October 3, 2023. Retrieved December 25,2023.

- 5. “How does Warby Parker work? Here’s a step-by-step guide to ordering new prescription glasses.” Mashable. September 6, 2023. Retrieved December 25,2023.

- 6. “Lush Cosmetics Gets Naked“. Packaging World. November 14, 2019. Retrieved December 25,2023.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.