4 Steps To Find The Best Software Reviews/Insights in 2024

There are numerous platforms for supporting a business software purchase decision, including:

- Industry analysts that historically relied on their own product assessments. These days, they combine their reviews with reviews from software companies in their assessment, review, or software advice.

- Review platforms where users review business software with detailed reviews, including both positive and negative reviews. Most of the time, users submit reviews for $10-15 Amazon vouchers.

There are numerous examples of both in the market. However, which one is the right one for the solution that you are seeking? Whether you are a tech buyer looking for solutions or a vendor looking for the right software review site to feature your product, it is better to focus, rather than spend your time on multiple platforms looking for best software reviews.

We provide a quantitative way to measure the influence of industry analysts and review aggregators in a specific category. And the answers are:

- For AI solutions: AIMultiple (We provide our analysis below for RPA, chatbots, synthetic data, data annotation and AI consulting)

- Solutions for SMEs: Capterra, G2 or Trustradius (We have not examined this in detail so left this at a higher level but can do if we get comments about this)

- Solutions for enterprises that do not include AI: This is a broad area and we have not examined it in detail. If we are right about “AI eating software”, this category will shrink over time anyway.

This is how we ran our analysis:

1- Define what constitutes the best

To identify the best of anything, we first need to define what it is. We need to focus on measurable metrics since we want to have an objective, data-driven assessment to compare business software platforms. Popularity is an important measure for the quality of any non-artistic content. It is measurable so it can be a good proxy for the best advice on software decisions.

For both industry analysts and review aggregators, most of their traffic is from search engines. According to similarWeb, as of February 2022, these are the shares of traffic these websites receive from search engines (excluding any paid search engine traffic):

- Trustradius: 86%

- Capterra: 80%

- AIMultiple: 80%

- G2: 78%

- Everest Group: 59%

- Gartner: 53%

- Forrester: 42% though this is below 50%, it is still the largest source of traffic for Forrester.

2- Identify how people search for your solution

Google is the most common tool for people to ask questions and to be able to assess the popularity of any solution. Google still commands 75% of the market share in the search engine market for most countries excluding China and Russia.1

Therefore, looking at where Google users go to after their Google search would show us the relative popularity of different software review websites.

3- Measure the traffic of software review sites

SEMrush and Ahrefs provide detailed estimates on how many visitors each webpage (i.e. url) receives from Google. They use the interest in search queries as well as the rank of individual webpages in search queries for these estimates.

For our assessments below, we used SEMrush’s domain analytics feature. We measured traffic that is generated by queries that contain the target keyword or its synonyms. For instance, in conversational AI labeling, we filter queries that contain either conversational AI or chatbot so that we don’t miss out any relevant traffic.

This analysis needs to be done at the country level since Google ranks of individual web pages change from country to country. We decided to look at top 5 global economies and excluded China since:

- We are not familiar with how to get estimates on the Chinese web traffic since we don’t target that market yet.

- Most review platforms and industry analysts prioritize non-Chinese markets and content.

- Success in China depends heavily on Chinese content production and we did not want to evaluate these companies on that metric.

So we looked at the data from the United States, Japan, Germany, India, and the UK which are the top 5 countries by GDP if we exclude China.2

4- Identify the top software review websites

We have run the same analysis for a few emerging AI related solution areas below twice:

- in October/2020 using the last months’ traffic (i.e. September 2020).

- in January/2022 using the traffic for December/2021

For clarity and transparency, we are also sharing our analysis. Feel free to use it for your own analysis. The graphs that you see below are using the up to date version of analysis which contains December 2021’s data.

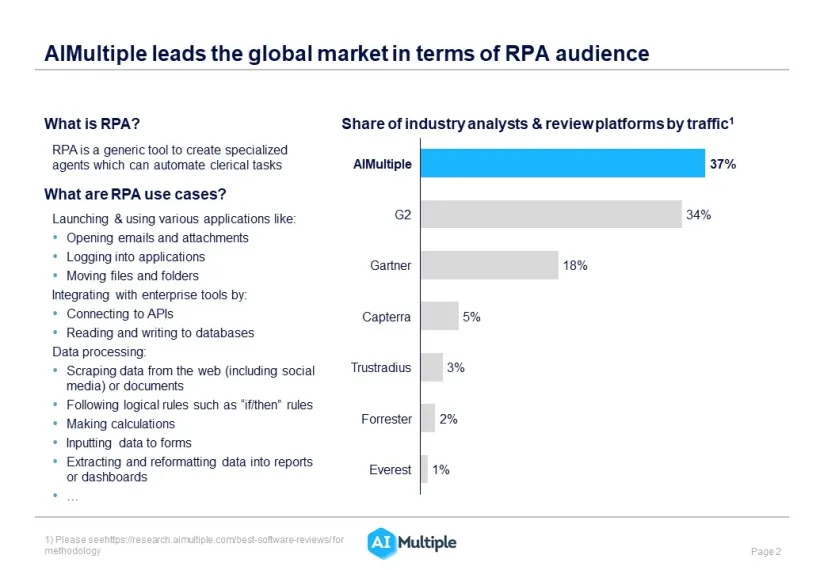

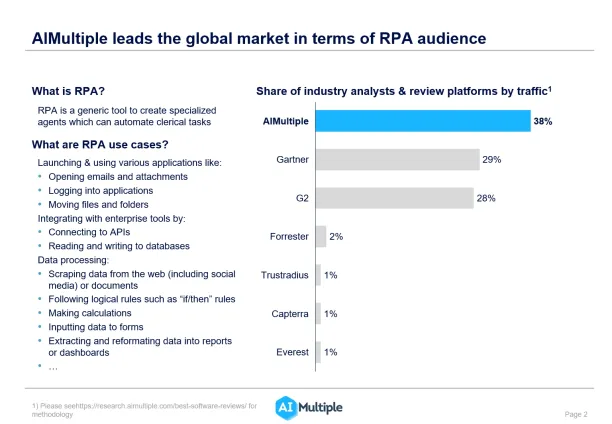

Robotic process automation (RPA)

RPA has been an emerging technology for a few years. In fact, it was claimed to be the fastest-growing segment of the global enterprise software market in 2018 by Gartner.

Figure 1. RPA Market Leadership

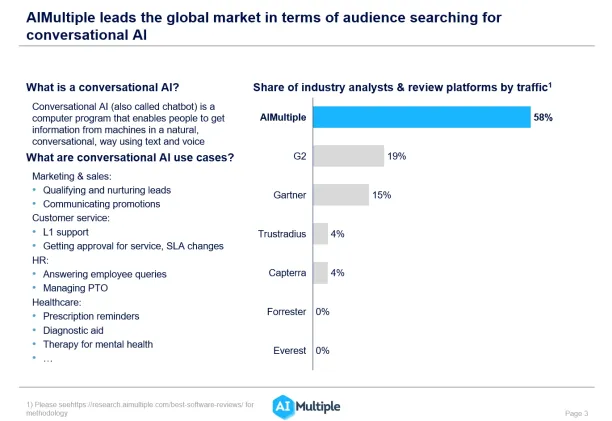

Conversational AI

According to Deloitte, Conversational AI was the field of AI that reached the highest number of patents in 2020.3 Same report also shows that chatbots (subdivision of conversational AI) are the most common uses of artificial intelligence models currently and Deloitte suggests that the adoption rate of chatbots will be doubled in the following years.

Figure 2. Conversational AI Market Leadership

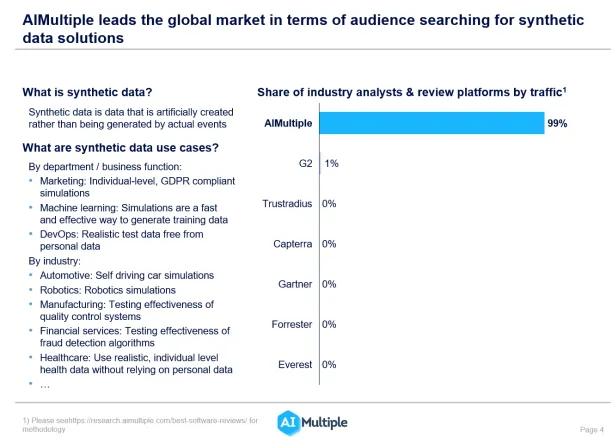

Synthetic data

Synthetic data has numerous applications such as training AI systems for cases where training data is missing or authorization of third-party access to data may not be preferred. Synthetic data is an emerging topic, therefore, we don’t see many online reviews and industry analysts active in the market. Our share of voice in the market is almost 100%.

Figure 3. Synthetic Data Market Leadership

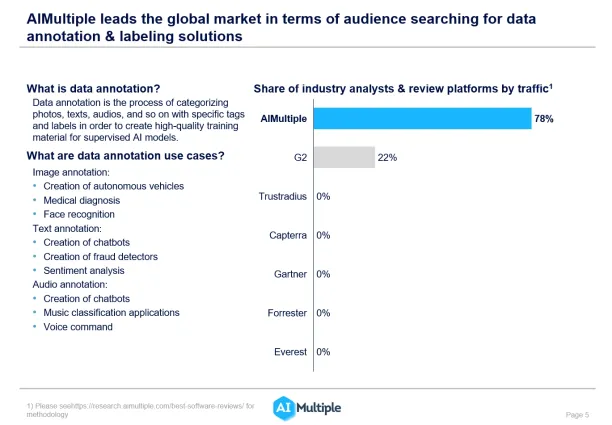

Data annotation/labeling

Humans are the ingenuity behind machine intelligence. Some of the most commercially successful machine learning approaches (e.g. deep learning) rely on humans to annotate data so machines can learn from many examples.

In our analysis, we looked at the traffic for both data labeling and data annotation since these terminologies both used for similar purposes. Results show, AIMultiple takes almost 80% of the traffic.

Figure 4. Data Annotation/Labeling Market Leadership

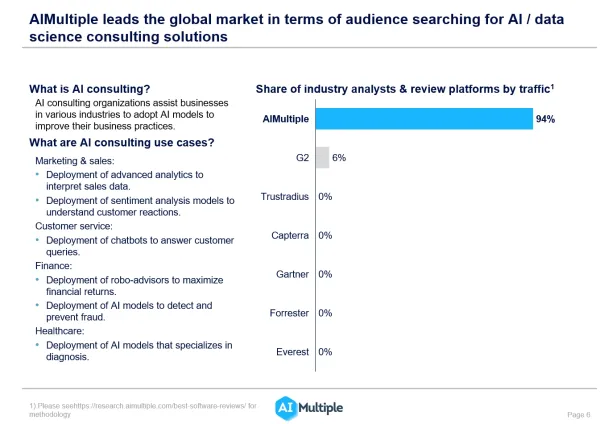

Data science / AI consulting / consultant

Machine learning models require both domain and machine learning expertise to build. There are numerous consultants helping companies build such models and these consultants are commonly called AI consultants or data science consultants.

This is another area where AIMultiple globally leads the competition by a wide margin compared to other review sites as the below figure suggests.

Figure 5. AI/Data Science Consulting Market Leadership

Limitations

This analysis is quick to complete however it has a few shortcomings:

- Software vendors or buyers from China need to look at the Chinese market and follow a different methodology.

- We only focused on the keywords that describe a solution. For example, for the RPA market we looked at the traffic for keywords that include either “rpa” or “robotic process automation”. Other keywords such as “UiPath” also include traffic relevant to this market. However, most of that traffic is captured by vendors and it is harder to analyze since we would need to do the same analysis for hundreds of vendor names. Therefore, we have chosen to accept this limitation.

Feel free to read our research on these areas (RPA, conversational AI, chatbots, synthetic data, types of data annotation, and AI consulting ) or check out the top vendors in these areas:

- RPA

- Comprehensive guide to conversational AI

- Chatbot platforms

- Synthetic data generators

- Image annotation

- Audio annotation

- Text annotation

- AI consulting

Or reach out to us if you are looking for vendors in a different area:

External Links

- 1. “Google market share countries 2023.” Statista. Accessed 2 January 2024.

- 2. “List of countries by GDP (nominal).” Wikipedia. Accessed 2 January 2024.

- 3. Weier, Kevin. “The future of conversational AI.” Deloitte. Accessed 2 January 2024.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.