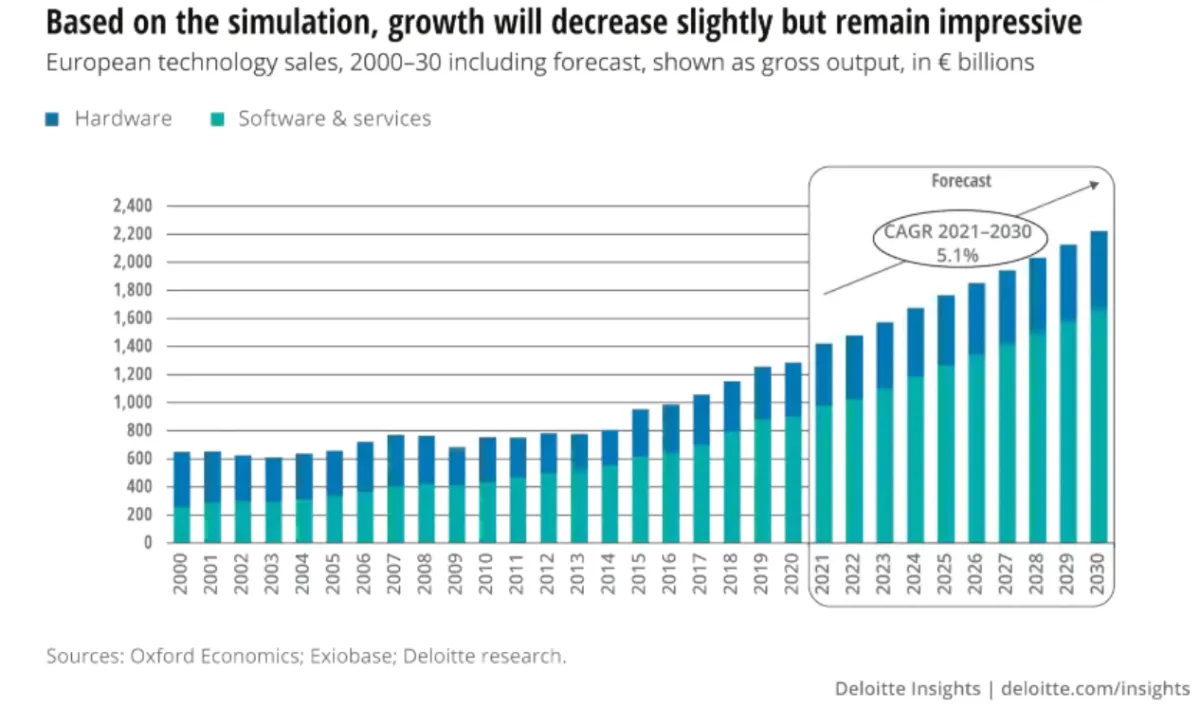

Technology industry is one of the world’s leading sectors. Each year, its share in global and regional GDPs is increasing (see Figure 1).

In this environment of advanced technologies and competition, it is important than ever to have a correct outlook of the sector. For this, tech industry analysis is a must for a successful technology sector leader. In this article, we will explain tech industry analysis, its benefits to tech companies, and trends in it for now and future.

Figure 1. Sales growth rate of tech sector in Europe

Source: Deloitte

What is technology industry analysis?

This analysis of industry is the process of evaluating the various factors that affect the performance of companies in the technology sector. This can include:

- Analyzing market trends, competitors, and the overall economic environment

- Evaluating the financial performance of individual companies and assessing their growth potential

For achieving this, industry analysts utilize statistics, market data, and economic trends.

The goal of tech industry analysis is to gain insight into the industry, identify opportunities for growth and investment, and make informed business decisions. This analysis is used by entrepreneurs and investors when deciding whether to invest in a new business or put capital into an existing technology-based business such as software companies.

Why is technology industry analysis important for businesses?

Technology industry analysis is important for tech companies particularly in the B2B sector because it provides:

- Insight into market trends and the overall economic environment, which can help businesses identify opportunities for growth and investment

- Evaluation of the performance of their competitors and adapt their strategies accordingly

- Awareness for informed decisions about product development, pricing, and marketing

- Understanding to identify potential risks and challenges and develop strategies to mitigate them

- Information for identifying new customer segments and finding new ways of reaching them

- Help for businesses in the B2B sector identify new partners and suppliers that can help them grow their business

Top 7 technology trends

1. Artificial intelligence

AI is a current and future technology trend because of its ability to automate and improve many industries and business processes. By analyzing large amounts of data and learning from it, AI can help companies:

- Make better decisions

- Improve efficiency

- Reduce costs

In 2022, 52% of businesses reported that they invested more than 5% of their digital budgets to AI, compared to 40% of businesses in 2018.1

Some of the popular branches in AI technology include:

2. Blockchain technology

Blockchain is a future technology trend because of its ability to provide a secure and decentralized way of storing and sharing data. One of the key features of blockchain technology is that it is immutable, meaning that once data is entered into the blockchain, it cannot be altered or deleted.

Another key feature of blockchain technology is that it is decentralized, meaning that there is no central authority controlling the network. This makes it resistant to tampering, hacking, and other forms of cyber-attacks.

Many industries invest in blockchain technology, including:

- Supply chain: to maintain supply chain management and reduce counterfeiting

- Finance: to improve transparency, enhance security, speed up and reduce costs in transactions

- Insurance: to automate claims processing thanks to smart contracts

3. Process automation

Process automation refers to the use of technology to automate repetitive and time-consuming tasks. Today, the process automation trends are:

- Robotic process automation (RPA)

- Intelligent automation

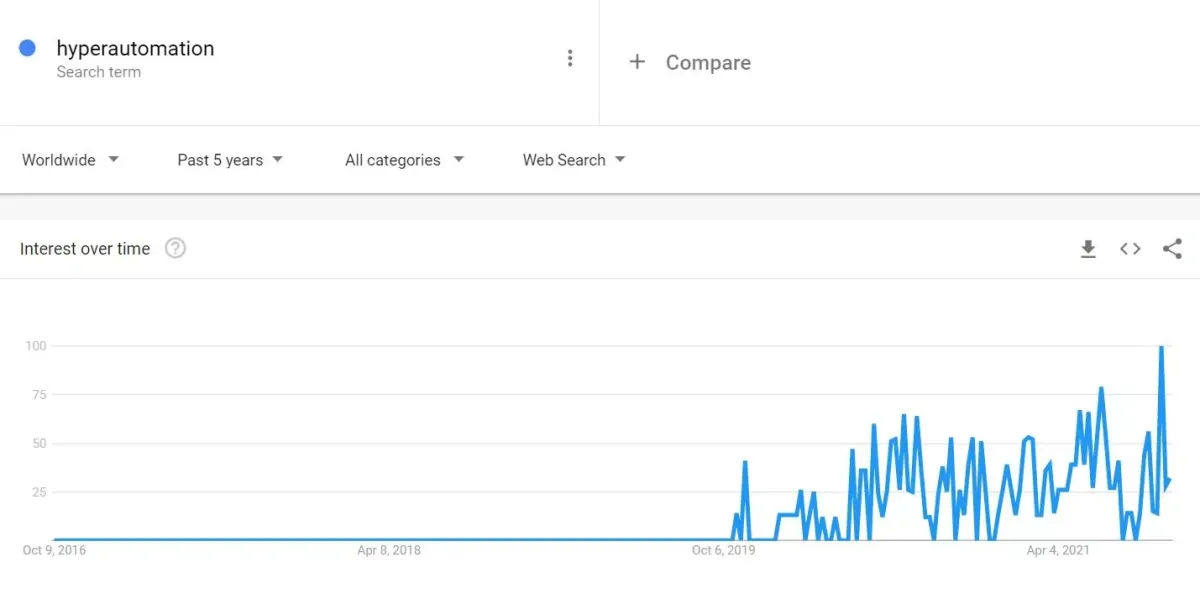

- Hyperautomation (see the trend in Figure 2)

- Digital workers

Figure 2. Google search trend for the term “hyperautomation”

Source: Google Trends

With the increasing amount of data and the need for faster and more accurate decision-making, process automation is a trend in helping organizations to become more competitive and successful. It offers improved efficiency, reduced costs, and increased accuracy in many industries and business processes.

4. Industry cloud platforms & everything-as-a-service

Everything-as-a-service (XaaS) contains:

- Software-as-a-service

- Infrastructure-as-a-service

- Data-as-a-service

- Platform-as-a-service

- Hardware-as-a-service

- Insurance-as-a-service

Tech leaders consider XaaS to be essential for their digital transformation efforts and as a means to create new solutions and business models that will enable them to succeed in the new normal after the pandemic.2

Cloud computing is quickly becoming the go-to platform for implementing XaaS and fostering innovation by providing capabilities such as AI, intelligent edge services, and advanced wireless connectivity. A growing number of companies are adopting a hybrid, multi-cloud approach to:

- Gain access to leading technologies

- Control costs

- Enhance reliability and resiliency

- Decrease dependency on a single vendor

However, as they often contain sensitive data, such as personal information and financial data, cloud platforms are vulnerable to cyber attacks.

- They are typically accessible from anywhere, which can make them vulnerable to remote attacks.

- Cloud platform users are responsible only for the security of their own data and applications, which can lead to security gaps if proper security measures are not implemented.

5. Data privacy enhancing technologies

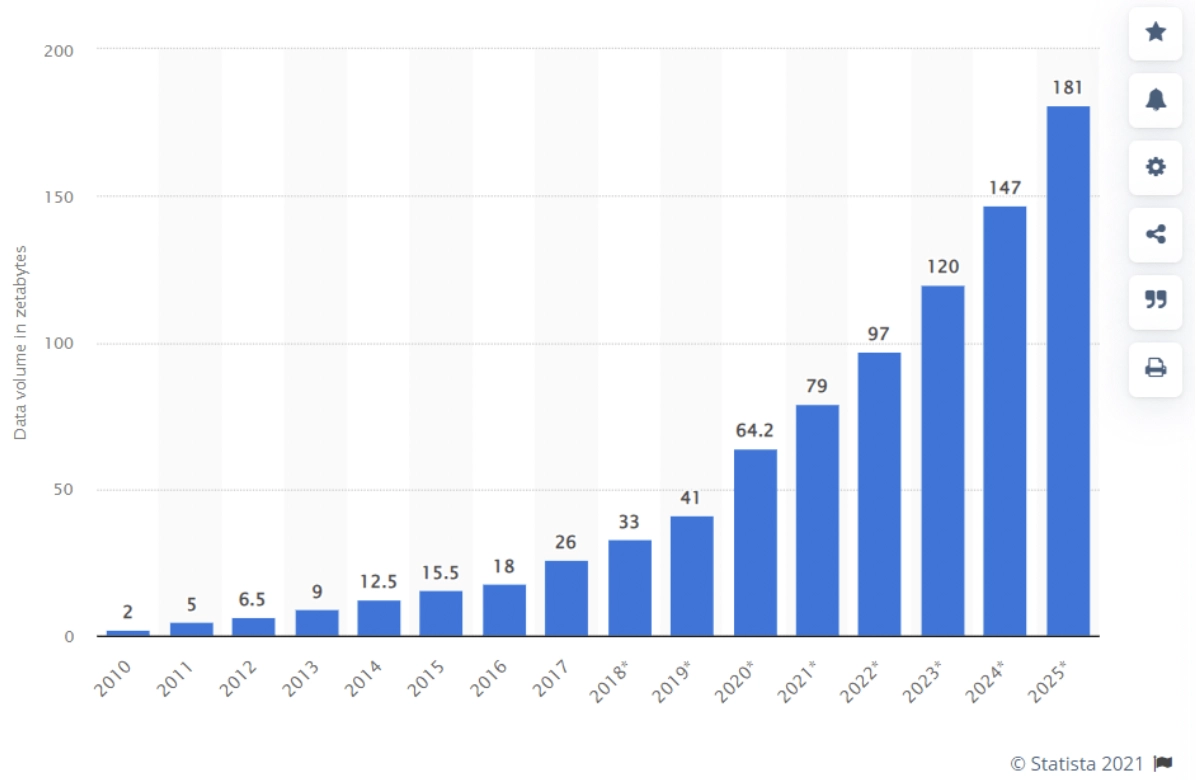

Figure 3. Data volume in zettabytes.

Source: Statista

Figure 3 illustrates a significant increase in the amount of data being generated, which presents opportunities for companies to utilize this data to gain insights, enhance their offerings, and monetize the information. On the other hand, this brings challenges to businesses in terms of protecting their data.

Cybersecurity is a practice of protecting computer systems, networks, and sensitive data from unauthorized access and digital attacks. An IBM report says that, in 2022, the average cost of a data breach in the US was more than 9 million dollars.3

Cybersecurity technologies include:

- Firewall: Monitors and controls incoming and outgoing network traffic based on predetermined security rules and policies.

- VPN: Provides a secure, encrypted connection between a device and a network, allowing users to securely access network resources remotely.

- Identity and access management (IAM): Controls and manages access to systems, resources, and sensitive data based on user identities and roles.

- Encryption: Encodes data so that it can only be read by authorized parties. It includes different methods like homomorphic encryption, differential privacy, and zero-knowledge proofs.

Other technologies for enhancing data privacy include:

- Data masking techniques: Used by businesses to protect sensitive information in their data sets. Some examples are pseudonymization, data minimisation, obfuscation

- Synthetic data: Artificial creation of data from the real data to protect the real data

- Federated learning: A machine learning technique that trains an algorithm across multiple decentralized edge devices or servers holding local data samples, without exchanging them

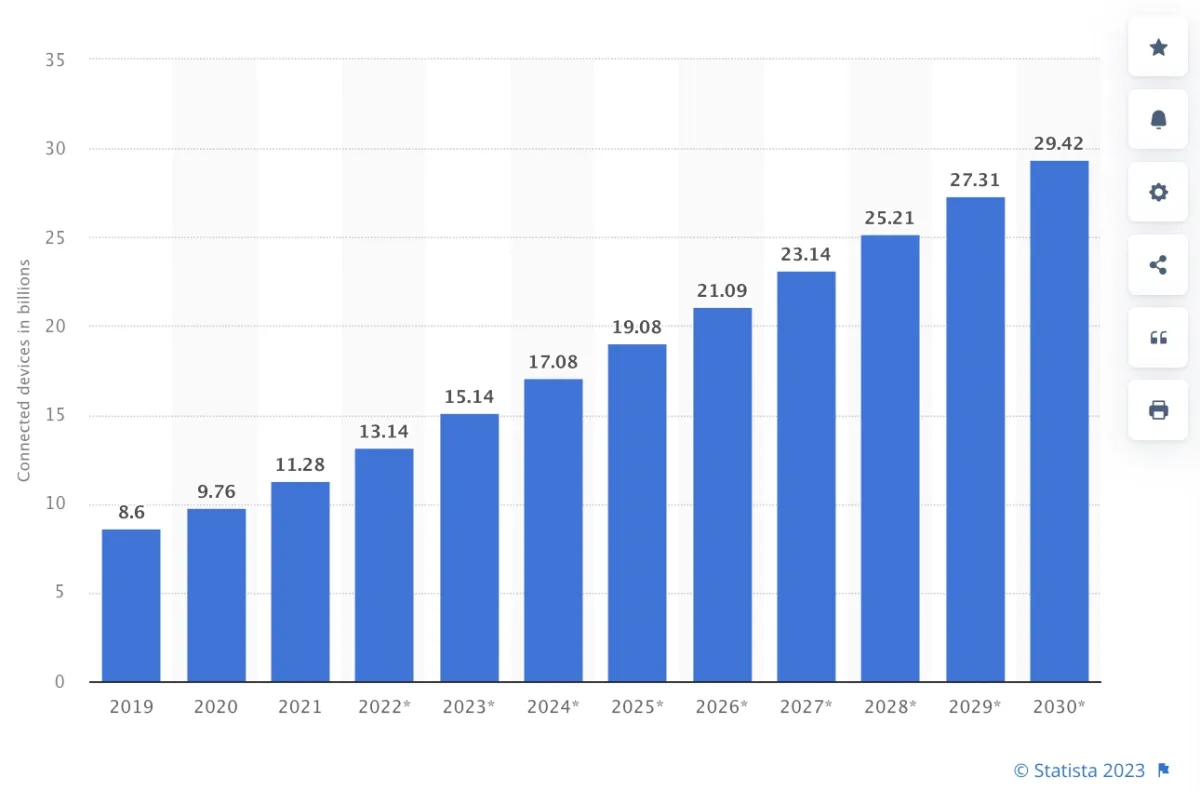

6. Internet of things (IoT)

The Internet of Things (IoT) refers to the growing network of physical devices, vehicles, buildings, and other objects that are embedded with sensors, software, and connectivity, allowing them to collect and exchange data. Each year, the number of IoT connected devices are increasing worldwide (see Figure 4).

Figure 4. Number of IoT connected devices worldwide

Source: Statista

Examples of IoT devices include:

- Smart devices such as smart sensors, drones, self-driving vehicles

- Smart cities with infrastructure and devices such as smart lighting, traffic management, and air quality monitoring that can improve the efficiency and livability of cities

- Wearable devices such fitness trackers, smart watches, and other wearables that can track and monitor health and fitness data

IoT devices are used across many sectors such as:

- Healthcare: to enable constant monitoring and accurate diagnosis via real-time data collection from patients

- Finance: to provide security, real-time monitoring, fraud detection, improved analytics, etc.

- Agriculture: to enable risk management and enhanced product quality

- Manufacturing: to provide remote control of production, quality control, and a safer work environment

7. Digital twins

A digital twin is a digital replica of a physical object or system, such as a building, a piece of equipment, or a city. It is created by combining data from various sources like sensors, simulations, and historical data, and is used to model and analyze the object or system’s performance, behavior and physical characteristics.

A digital twin allows for:

- Real-time monitoring and analysis of the object or system

- The ability to test and simulate different scenarios

- Making predictions about future performance

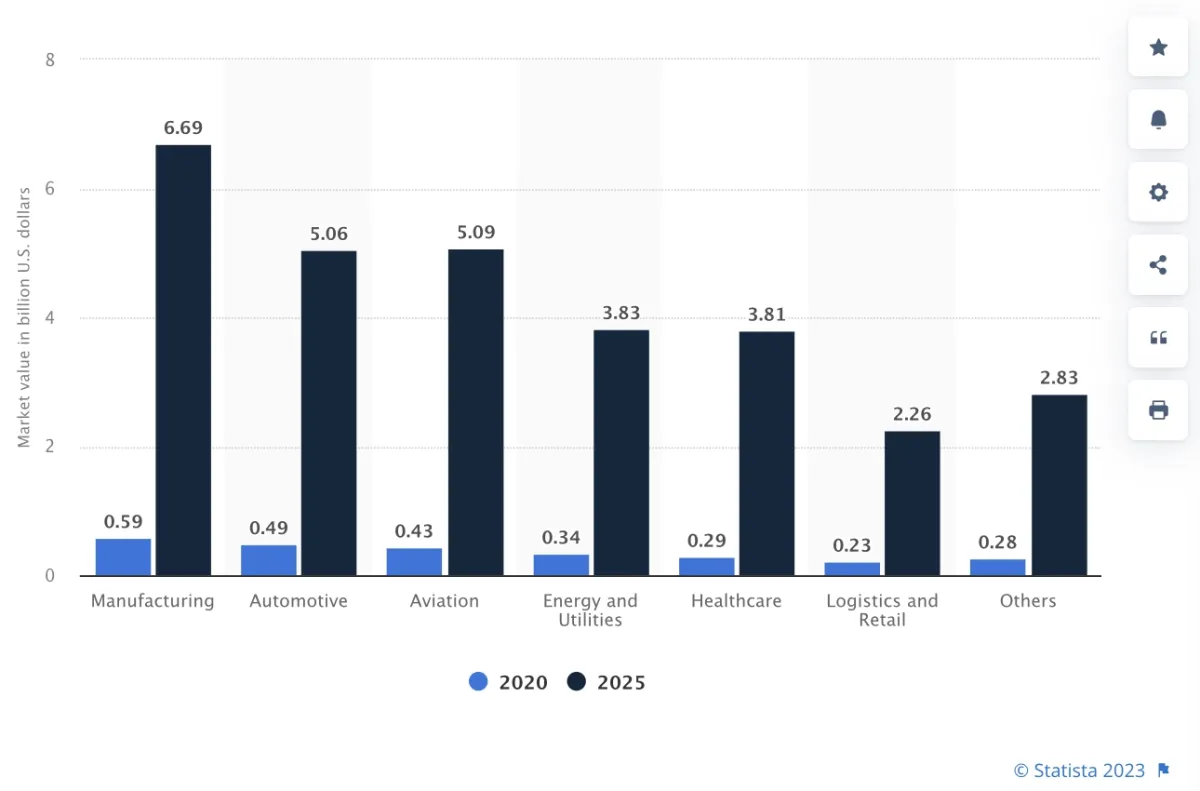

Thus, it can be used in a variety of industries, including manufacturing, construction, transportation, and healthcare. It is expected that its share in these sectors will grow higher by 2025 (see Figure 5).

Figure 5. Global digital twin market size by industry

Source: Statista

Digital twins are beneficial for sectors such as:

- Insurance: To improve core insurance practices such as underwriting, claims processing and fraud detection

- Supply chain: To optimize overall supply chain processes and plan transportation and facilities

- Healthcare: To create replicas of a healthcare facility, human body, medicines and devices for experimenting safely

External Links

- 1. The state of AI in 2022—and a half decade in review | McKinsey. McKinsey & Company

- 2. “2022 technology industry outlook.” Deloitte, 4 May 2022, https://www2.deloitte.com/content/dam/Deloitte/us/Documents/technology-media-telecommunications/2022-technology-outlook.pdf. Accessed 22 January 2023.

- 3. Cost of a data breach 2024 | IBM.

Comments

Your email address will not be published. All fields are required.