According to the FBI, insurance fraud (excluding health insurance) costs more than $40 billion annually in the U.S. alone.(Insurance Fraud. FBI. Accessed: February/11/2025.) Technological tools such as artificial intelligence (AI), the Internet of Things (IoT), machine learning, and blockchain can be used by insurers to more effectively detect and prevent insurance fraud.

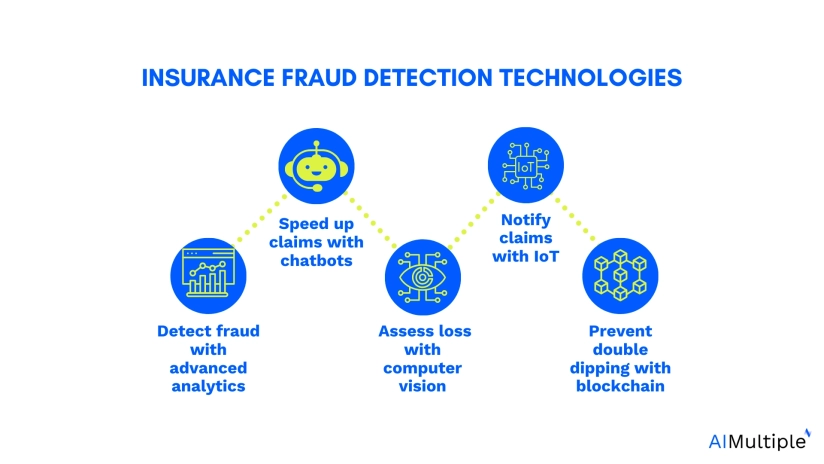

Explore AI tools usage in insurance fraud detection and the top 5 insurance fraud detection technologies with their use cases for insurers:

1. Detect fraud with advanced analytics

Insurers use machine learning (ML) models to identify patterns in past fraudulent claims. These models classify cases as either fraud or non-fraud and, over time, learn to flag suspicious claims for further review. These predictive analytics can be used for detection of potential future fraudulent claims.

Unsupervised ML models can also help detect fraud, especially with new scams. While supervised models rely on known fraud patterns, unsupervised models can spot unusual activities that might signal fraud.

Behavioral analytics offer another way to fight fraud. By tracking actions like browsing history and location, insurance professionals can assess whether a policyholder’s claim is genuine.

Real-life example: Advanced analytics can help prevent fraudsters from inflating claims, such as adding past damages to new ones. They also help catch false claims where fraudsters alter details, knowing that certain situations aren’t covered by insurance.

2. Speed up claims with Chatbots

NLP-powered chatbots streamline the claims process. Policyholders can submit the first notice of loss (FNOL) with a chatbot, speeding up the process without needing a human expert. The chatbot guides them to submit photos and videos of the damage, reducing the chance for fraudsters to manipulate unstructured data.

Real-life example: With immediate FNOL submission, fraudsters can’t alter the facts, lowering the risk of false claims.

You can read our article on the Top 3 Insurance Claims Processing Automation Technologies to learn more about claims processing automation.

3. Assess the cost of loss with Computer Vision

Computer vision models infer meanings from visual input such as images and videos. These models can assess the cost of the loss by evaluating videos and photos taken to submit an FNOL. Consequently, the insurance company has an idea of the repair cost of the damage.

Real life use case: Computer vision models help insurers to assess damage data more precisely. Therefore, it prevents inflated repair claims, where fraudsters use false invoices about the maintenance procedure to get more money from the insurance company.

4. Notify claims with IoT

Insurers can be alerted of a claim instantly because of the connected universe of smart devices. For example, in the event of a car accident, the insurance provider will be notified without the policyholder having to contact them. As a result, claims processing begins as soon as the damage occurs, giving fraudsters little time to manipulate data in their favor.

Insurers can also cross-check data from the vehicle’s memory with the policyholder’s FNOL details, like location and speed.

Real life use case: Similarly to chatbots, IoT prevents insurers from false claims since fraudsters have less time to change historical data in their favor.

You can read Top 6 Insurance IoT Use Cases to learn more about the usage of IoT in the insurance industry.

5. Prevent double dipping fraud with blockchain

Blockchain is a secure, real-time ledger system that helps insurers track claims. It can prevent fraudsters from submitting the same claim to multiple insurers. Therefore, it is beneficial for a number of insurance practices.

Real life use case: Blockchain prevents double dipping, in which insureds file a claim with more than one insurance company. The distributed ledger technology of blockchain could prevent repeated transactions for the same claim from being approved. Only the claim with the most approvals would be regarded valid, while the others would be dismissed.

AI tools used in insurance fraud detection

Artificial Intelligence (AI) is transforming how insurers detect fraud. AI systems can analyze large amounts of data quickly, spotting patterns that humans might miss. These systems learn from past insurance claims and identify suspicious activity, helping insurers prevent fraud before it happens.

Machine Learning (ML)

ML is a key part of AI in fraud detection. ML models can learn from previous fraudulent claims to recognize signs of fraud in new ones. The more data these models process, the better they get at predicting fraud. For example, if a claim shows patterns similar to past fraud cases, the system will flag it for review.

Natural Language Processing (NLP)

NLP, a type of AI that helps machines understand human language, can also be used to analyze claims. NLP tools can scan claim descriptions for inconsistencies or suspicious wording. If something doesn’t match previous insurance claims or seems out of place, NLP can signal a potential fraud.

Real-life example:

AI systems have been used successfully to stop fraudsters who try to inflate claims. For example, AI can spot when someone submits multiple claims for the same damage or exaggerates the severity of an incident.

You might want to check our AI fraud detection article.

You might also want to see our fraud detection software and fraud protection software lists to find tools that improve your fraud prevention.

Finally, our list of insurance suites can guide you to find insurance fraud detection software.

Comments

Your email address will not be published. All fields are required.