According to Forbes, an average manufacturer experiences 800 hours of equipment downtime annually, which makes more than 15 hours weekly.1

Downtime insurance provides coverage for lost income and additional expenses incurred as a result of unexpected downtime. Therefore, it helps businesses recover from financial losses and get back up to start running as quickly as possible, especially with these 5 best practices:

| Best Practice | Challenge Addressed | How It Offers a Solution |

|---|---|---|

| 1. Implement effective risk management practices | Risk of unexpected downtime due to equipment failure, natural disasters, etc. | Helps proactively identify and mitigate risks (e.g., backup systems, regular maintenance). |

| 2. Purchase appropriate downtime insurance coverage | Financial losses from downtime; unpreparedness for unexpected disruptions | Ensures financial protection through compensation for lost income and extra expenses. |

| 3. Review and update coverage regularly | Insurance policy becoming outdated or misaligned with business needs | Keeps protection up-to-date with evolving risks and changing operational conditions. |

| 4. Keep good records | Difficulty proving losses during insurance claims | Facilitates a smoother claims process and ensures full recovery of eligible losses. |

| 5. Communicate with the insurance company | Delays or complications in the insurance claims process | Ensures timely support and faster resolution during downtime through prompt communication. |

In this article, we will:

- explain what downtime insurance is and why it is important

- list types of downtime insurance

- investigate the factors that impact the availability and cost of downtime insurance

- learn how to deal with downtime problems

What is downtime insurance, and why is it important?

Downtime insurance is a type of insurance that provides coverage for lost income or additional expenses that a business incurs as a result of unexpected downtime or interruption of its operations. This can include coverage for losses resulting from things like

- power outages

- natural disasters

- equipment failures

- other unexpected events that cause the business to be unable to operate for an extended period of time.

Check out our risk management article and explore what are the most common 6 dangers and how to deal with them.

Downtime insurance is important for businesses that rely on continuous operations to generate revenue. These firms can have a significant financial impact because of unexpected downtime.

For example, a manufacturing company that experiences a power outage may lose revenue due to the inability to produce goods. A hospital forced to evacuate due to a natural disaster may incur additional expenses for temporary housing and transportation for patients. Downtime insurance can help businesses in such unwanted situations.

Cloud Downtime Insurance

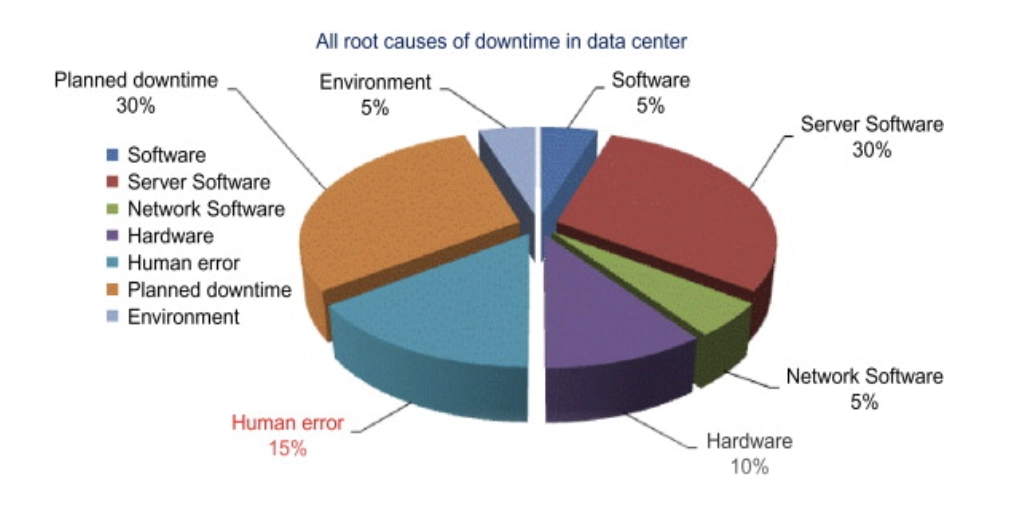

Figure 1. Causes of downtime in a data center

Source: Cloud Data Centers and Cost Modeling: A Complete Guide to Planning, Designing, and Building a Cloud Data Center2

Downtime occurs when a cloud provider stops working or has reduced functionality. This can happen due to:

- Maintenance

- Hardware or software failures

- Network issues

- Power outages

- Natural disasters

For businesses relying on cloud services, downtime can disrupt operations, reduce productivity, and cause financial losses.

Cloud service providers often offer downtime insurance as an optional add-on. Coverage varies based on the provider and policy. Some plans cover specific disruptions, like hardware failures or natural disasters. Others offer broader protection.

Typical downtime insurance policies may cover:

- Lost income

- Additional expenses (e.g., renting temporary equipment, transportation costs)

- Other business interruption-related losses

The exact coverage depends on the policy and the business’s needs.

Types of downtime insurance

Downtime insurance policies can provide coverage for various losses resulting from business interruption. Common types of coverage include:

- Lost income, which compensates a business for the revenue it would have earned had the interruption not occurred

- Additional expenses, which cover the costs of things like temporary equipment rentals or transportation expenses incurred as a result of the downtime.

- Other types of coverage may also be included, depending on the specific policy and the business needs.

The specific events (e.g, natural disasters or equipment failures) covered by a downtime insurance policy will depend on the policy and the specific circumstances of the interruption.

Factors that impact the availability and cost of downtime insurance

Several factors that can impact the availability and cost of downtime insurance include:

1. Insurance underwriting and risk assessment: Insurance companies use underwriting and risk assessment processes to determine the availability and cost of downtime insurance. Insurance underwriting involves evaluating the risk of insuring a business and picking the premium that should be charged for coverage.

Risk assessment involves identifying and analyzing the potential risks that a business may face and determining the likelihood and potential impact of those risks.

2. Industry and location: The industry in which a business operates and the company location can also impact the availability and cost of downtime insurance.

For example, a business that operates in an area prone to natural disasters may have difficulty finding affordable downtime insurance. Additionally, firms in industries with higher risks of downtime may have a harder time finding coverage or may face higher premiums.

3. Size and complexity of the business: The size and complexity of a company can also impact the availability and cost of downtime insurance. Large, complex businesses may be more difficult to insure due to the potential for significant losses during downtime.

4. Quality of the business’s risk management practices: Insurance companies may also consider the quality of a business’s risk management practices when determining the availability and cost of downtime insurance. Businesses that have effective risk management practices in place may be seen as less risky to insure. Therefore, they may have an easier time finding coverage or may face lower premiums.

5. Economic conditions: Economic conditions, such as the state of the insurance market and the overall economic climate, can also impact the availability and cost of downtime insurance. During economic uncertainty, insurance companies may be more cautious about taking on new risks and may therefore be more selective about the businesses they insure or may charge higher premiums.

Overall, the availability and cost of downtime insurance can vary depending on a variety of factors. Businesses must understand these factors and to consider them when evaluating downtime insurance options.

How to deal with downtime problems: risk assessment and insurance

There are several things that businesses can do to mitigate downtime problems and leverage downtime insurance:

1. Implement effective risk management practices

By identifying and mitigating potential risks, businesses can reduce the likelihood of experiencing downtime. This can include implementing backup systems, conducting regular maintenance on equipment, and developing contingency plans for unexpected events.

2. Purchase appropriate downtime insurance coverage

Businesses should carefully evaluate their downtime insurance needs and choose a policy that provides appropriate coverage for their specific circumstances. This can help ensure that businesses are properly protected during unexpected downtime.

3. Review and update coverage regularly

Businesses should review and update their downtime insurance coverage regularly to ensure that it meets the changing needs of the business. This can include reviewing the types of coverage provided, the exclusions and limitations of the policy, and the overall level of protection.

4. Keep good records

In the event of a business interruption, businesses need to have accurate records of their financial information and other relevant details. This can help facilitate the claims process and ensure that businesses receive the full extent of their coverage.

5. Communicate with the insurance company

In the event of a business interruption, businesses need to communicate with their insurance company as soon as possible. This can help ensure that the claims process goes smoothly and that businesses receive the support they need to recover from the interruption.

FAQs

What is downtime in security?

Downtime in security happens when cloud services, customer relationship management services, or enterprise technologies go offline due to network crashes, platform failures, or public cloud failure. This disrupts mission-critical resources, causing lost revenue and business interruption.

To manage risks, businesses use cloud downtime insurance or technology downtime insurance. Parametrix Insurance offers the first cloud downtime product, compensating customers at an agreed hourly coverage rate with no long waiting period.

While cloud service providers like Google Cloud use proprietary cloud monitoring systems, businesses need third-party services to independently verify uptime and quantify downtime peril. Many cyber insurance policies don’t cover multiple claim events beyond at least eight hours.

Ecommerce service providers and chief technology officers should explore carrier management, software as a service, and platform as a service to protect company revenue streams and intangible and tangible assets. As Neta Rozy said, better monitoring systems and reliable data can help bridge the huge coverage gap in traditional insurance.

External Links

- 1. Unplanned Downtime Costs More Than You Think. Forbes

- 2. Wu, Caesar, and Rajkumar Buyya. Cloud Data Centers and Cost Modeling: A Complete Guide To Planning, Designing and Building a Cloud Data Center. Elsevier Science, 2015. Accessed 18 December 2022.

Comments

Your email address will not be published. All fields are required.