4 Insurance Practices that can be Improved with NLP in 2024

The insurance industry generates large amounts of text data due to claims, insurance policies, and customer relationships. This makes it difficult for insurance CIOs to take advantage of their unstructured data using traditional techniques. Emerging technology that understands and analyzes contextual data contained in texts can be beneficial to insurance practices.

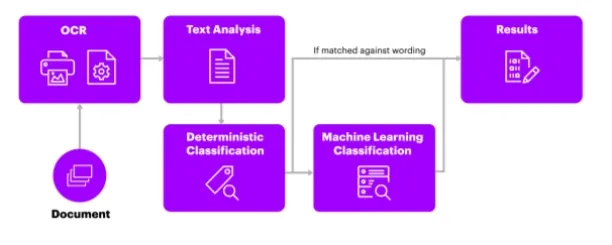

Natural language processing (NLP) meets insurance industry needs (see Figure 1) and automates many insurance processes, resulting in increased operational efficiency, reduction in premium prices and increased profit margins.

In this article, we will go over the top 4 insurance practices that can be improved with NLP, such as claims processing, underwriting, fraud detection, and customer service.

Figure 1: What does NLP offer for insurance firms?

1. Claims Processing

Claims processing is an insurance practice that can be completely transformed thanks to NLP-driven chatbots and optical character recognition (OCR) models. Such a development can increase the operational efficiency of insurance companies as well as customer satisfaction.

Chatbots

In the past, customers had to wait for experts to arrive to start claims processing. Today, however, NLP-driven chatbots can guide customers to take videos and photos of the damage, which can be instantly converted into a first notice of loss (FNOL).

This new way of handling claims increases the operational efficiency of insurance companies. By assessing the claim almost immediately, they reduce the likelihood of fraudulent claims. It also ensures customer satisfaction as people expect quick responses from insurance companies when they have an unpleasant experience.

OCR

OCR is another technique that is used to increase the operational efficiency of insurance companies. Due to compliance requirements and regulations, insurers always work with paper-based documents. OCR derives information from such texts and automates the process of data capture from paper-based documents. Consequently it helps to derive information from FNOL, police reports etc. and automates claims processing.

Recommendation: Decrease likelihood of fraudulent claims by quickly adapting to customer demand with chatbots and OCR technologies.

2. Underwriting

Better assessment of the textual information reported by customers can improve the underwriting process. For example, when patients visit a doctor, they report how they feel about their health condition, such as pain in a certain part of the body, nausea, dizziness, etc. NLP can categorize these complaints and determine the correlation between some symptoms and the likely cost of treatment for the insurance company.

Recommendation: Improve your understanding of the risk associated with a client’s profile by using NLP to extract information from internal and external sources such as medical history etc.

3. Fraud Detection

The FBI estimates that insurance fraud excluding health insurance cases cost more than $40 billion annually in the U.S. alone. The pressure on insurance companies is great, and since they are financially damaged by the fraud, they share this burden with their customers in the form of higher premiums. It is a loss-loss situation for everyone.

NLP models can be used to analyze past fraudulent applications to identify and detect applications with similar characteristics. Moreover, NLP is a useful tool for investigative procedures. Investigators always have to deal with a large amount of written documents in order to uncover the fraud. In such cases, NLP can Save investigators’ time time and help to complete the investigation in less time by providing classification of the documents.

Recommendation: Use NLP to analyze past fraudulent applications to identify and detect applications with similar characteristics. Save time for investigators by using NLP to extract information from large amounts of written documents in order to uncover the fraud.

4. Customer Service

According to IBM, 75% of the time customer service consists of answering simple questions that can be easily found on the website. This is a source of great waste. This means that even a relatively simple algorithm that understands the information on the insurance company’s website and answers customers based on the keywords they enter can significantly increase efficiency. Such an application of NLP leads to a more efficient use of the labour force for the company.

Recommendation: Improve customer satisfaction by leveraging NLP to understand the sentiment of customers or to automate simple question-answering systems.

Further readings

These three articles we’ve selected will help you quickly transform your insurance company.

- Ultimate Guide to Insurance as a Service in 2022: Insurance as a service is assisting many incumbents quickly adopt their core manual insurance processes such as underwriting and claims processing thanks to its subscription-based digitization support of insurtech companies.

- Impact of the Low/No-Code Platforms on the Insurance Sector: Low/no code platforms help insurers build effective insurance practice models without requiring knowledge of writing code. For many insurers, such platforms are the only way to adapt to the rapidly changing insurance industry.

- Ultimate Guide to Cloud Computing in the Insurance Sector: Cloud platforms help insurers adopt new technological advancements with relatively low cost and ease of deployment. Therefore, they serve incumbents to stay in the competition.

You can also download our whitepaper to acquire the most recent guides on conversational AI:

Finally you can check our top insurance suites and top NLP services lists.

If you want to learn more about NLP or insurance trends, we can help. We can also find a vendor that supports your digitalization process to adopt the new era of insurance.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.