How AI Can Improve Fraud Detection & Prevention in 2024?

Digital technologies offer more convenient ways to perform our daily tasks. We buy the things we need via online platforms, pay our electricity bills via banking applications, take out an insurance policy with just a few clicks and so on. On the other hand, online platforms also offer anonymity to thieves.

Despite the high profits from online crimes, the probability of going to jail is low for online fraudsters due to greater anonymity. Criminals do not hesitate to embrace new technologies, and so should businesses to protect their stakeholders. This article explores how companies can more effectively detect and prevent fraud by using AI/ML models.

How can AI/ML help fraud detection?

Fighting against fraud by using AI/ML models is more efficient compared to manual fraud detection and prevention for the following reasons:

- Effective data interpretation: As datasets get larger, AI/ML models are more effective compared to humans because they have better computational capacity. For fraud detection, interpreting a large dataset is crucial as larger datasets provide better insights into customer preferences and behavior, as well as fraud trends. Therefore, AI/ML models help companies distinguish fraud from regular transactions.

- Respond quickly: Detecting fraud is one thing, preventing it is another. Preventing fraud requires a rapid response, and automating processes through the use of AI/ML models enables a 7/24 fast response. After analyzing a large dataset, algorithms can automatically reject a transaction if the data indicates it is fraudulent.

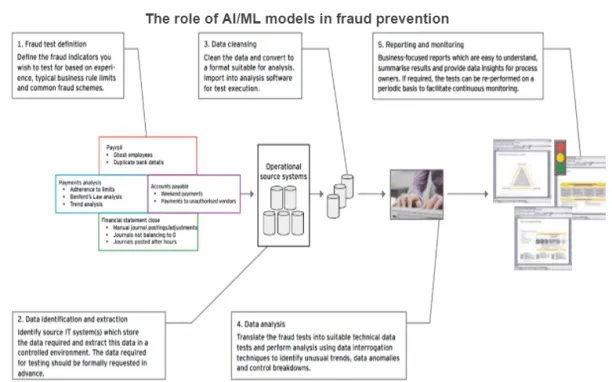

Figure 2: How AI/ML models help fraud prevention

Why is effective fraud detection important?

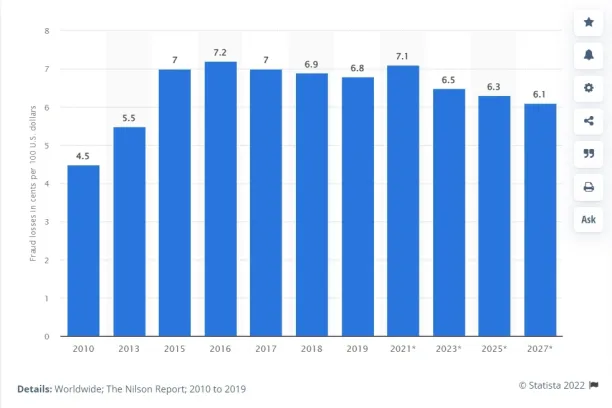

Figure 3: Global credit card fraud per 100 U.S. dollars of card sales

Each year, insurance fraud in the US cost more than $40 billion. As shown in Figure 2, we pay about 7 cents more per $100 credit card purchase due to fraud. In 2016 global card fraud cost $23 billion and total fraud cost about $600 billion, or 0.8% of global GDP. Businesses pass on some of these high costs to their customers in the form of higher prices. Consequently, preventing and detecting fraud benefits everyone in society except the criminals.

What are the best practices for detecting and preventing fraud with AI?

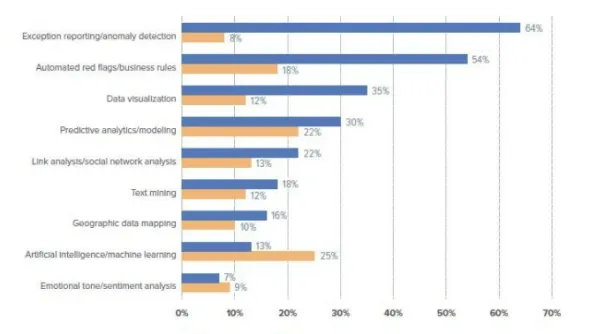

Figure 4: Data analysis methods that detect fraud

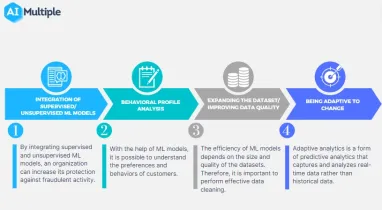

The four key fraud detection and prevention practices can be listed as follows:

Integration of supervised and unsupervised ML models

By integrating supervised and unsupervised ML models, an organization can increase its protection against fraudulent activity.

A supervised model is trained on an extensive set of properly labeled data. During fraud detection, each transaction is classified as either fraud or non-fraud. Over time, the ML model creates an algorithm that distinguishes fraudulent transactions. The problem is that we live in a dynamic world where everything changes. Online thieves are good at inventing new fraud techniques. In such cases, supervised models can be ineffective because they are exposed to a phenomenon that they are not familiar with.

Unsupervised models are trained using unlabeled data. Therefore, unsupervised models can be better at detecting new types of fraud techniques. These models detect behavioral anomalies by identifying transactions that do not conform to the majority.

Behavioral profile analysis

With the help of ML models, it is possible to understand the preferences and behaviors of customers. By analyzing the data about the amount of money customers spend, where they spend it, the goods or services they tend to buy, the places where they make transactions, etc. companies can determine whether a transaction is fraudulent or not.

If there is an unusual pattern in customer spending, the company can notify the customer and ask for further authentication to continue the purchase or decline the transaction if the calculated risk is too high.

Expanding the dataset and improving data quality

The efficiency of ML models depends on the size and quality of the datasets. Therefore, it is important to perform effective data cleaning. Each transaction potentially increases the size of the dataset, but it is important to store data from different times to version the data and ensure the performance of the ML model.

When fraudsters develop a new fraud technique, it is crucial to introduce it into the supervised ML model to become immune to this new type of fraud.

Being adaptive to change

Adaptive analytics is a form of predictive analytics that captures and analyzes real-time data rather than historical data. As we mentioned earlier, fraudsters are finding new ways to defraud systems making some of the existing fraud detection methods obsolete. In this regard, it is logical to prioritize some fraud methods by reviewing recent trends. In this regard, adaptive analytics can be an effective weapon.

Similarly, data versioning can be an effective tool for prioritizing newer fraud techniques. By deleting old historical data that are no longer relevant, organizations can more effectively deploy their resources against current fraud trends.

What are the challenges of using AI/ML in fraud detection?

When a test result falsely indicates that a certain condition or characteristic is present, it is referred to as a false positive.

The equivalent for fraud detection is when you buy an item ML models refuse transaction because they think you are hacked. Statistics suggests that type one errors are not rare phenomenon. According to IBM, 25% of rejected e-commerce sales transactions are false positives. Undoubtedly, such events cause inconvenience to customers.

Let’s say a person decides to change his life and to do outdoor activities like hiking and camping that he has never done before. With this motivation, he tries to order some items, e.g., a tent, shoes, etc. However, when behavioral profile analytics recognizes an inconsistency by comparing previous transactions of him and refuses to make the purchase. Then he suddenly gets a call from the bank and learns that his credit card is blocked to protect him from hackers.

It is advisable to firms that consider the false positive cases in order to enhance customer satisfaction.

If you need a fraud detection/prevention software, you can check our fraud detection and fraud protection software lists.

You might also want to see our AI platforms, AI developments and AI consultants lists to deploy AI models more easily.

Finally, you can also read our insurance fraud article to learn more about detecting it. If you wonder how your company improve fraud detection, we can help:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.