In 2024, the global insurance industry’s premium income increased by approximately 9%, totaling ~$8 trillion, highlighting strong demand and escalating digital investments.1 At the same time, the global insurance chatbot market is projected to reach a value of $5238 million by 2033, indicating the rapid growth of chatbots in the insurance industry industry.2

We have compiled the 5 most popular insurance chatbots, case studies, and best practices to demonstrate the benefits of these tools for insurers’ operations.

Top 5 insurance chatbots in insurance

| Vendor | Average Score | Integration Capabilities | Key Features |

|---|---|---|---|

| Boost.ai | 4.8 based on 39 reviews | Zendesk, Salesforce, Microsoft Teams | 24/7 policyholder support, automated ID&V |

| Cognigy.AI | 4.8 based on 34 reviews | Salesforce, Guidewire, Duck Creek | Pre-built insurance workflows |

| Tars | 4.6 based on 212 reviews | Web embeddable, WhatsApp, SMS | Lead qualification templates, media uploads for damage claims |

| IBM watsonx Assistant | 4.3 based on 376 reviews | Policy admin systems, SAP, Oracle | AI Agents with generative-AI, secure data handling |

| Solvemate by Dixa | 4.1 based on 407 reviews | Creatio CRM, any REST API | CRM handover, Contextual Conversation Engine |

*Sorting is based on the average score.

Top 5 case studies of insurance chatbots

1. GEICO Mobile’s Virtual Assistant

GEICO’s virtual assistant (available on iOS and Android) addresses policy questions, billing issues, digital ID cards, and claims submissions around the clock.3

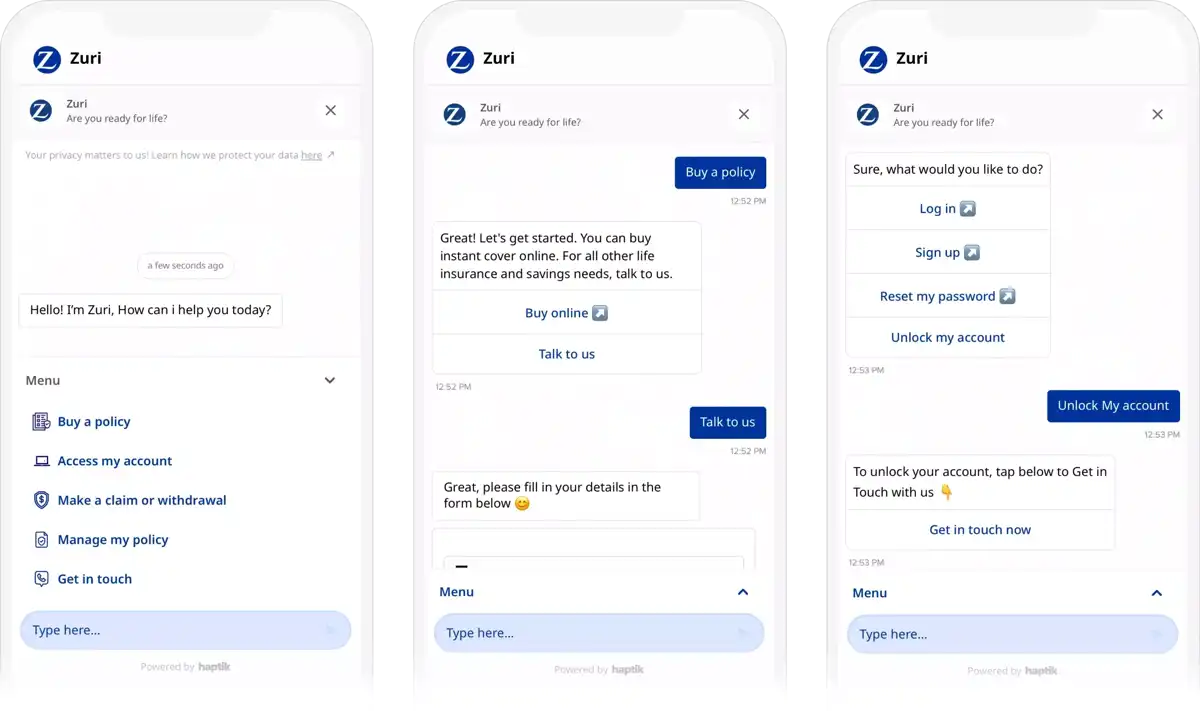

2. Zurich’s Zuri

In October 2020, Zurich launched “Zuri” (developed through Spixii), which resulted in 25 percent of website visitors engaging with it and resolving 50 percent of inquiries without needing a phone call, achieving a Net Promoter Score (NPS) of 70 within just six weeks.4

Figure 1. Zurich’s Zuri’s conversations with a customer.

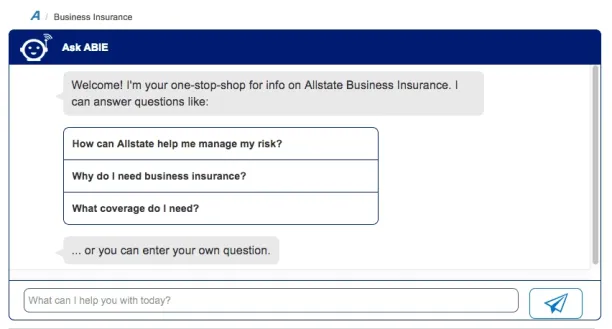

3. Allstate’s ABIE

Allstate’s “ABIE” (Allstate Business Insurance Expert) was introduced in May 2018 to assist small-business clients. Available through the business-insurance section on Allstate.com, ABIE manages 25,000 inquiries each month, learns from these interactions, and has greatly decreased the number of support calls to agents.5

Figure 2. Allstate’s ABIE.6

4. Progressive’s Flo

Progressive’s mascot-themed “Flo Chatbot” (available on Facebook Messenger and web) allows users to initiate auto-insurance quotes, verify deductibles, and inquire about claim statuses. Introduced in 2017 on Microsoft Azure, Flo became the first top-10 U.S. insurer to offer quoting through Messenger, amassing 4.8 million followers and simplifying the purchasing process funnel.7

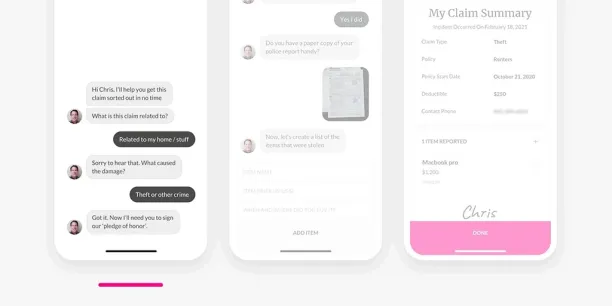

5. Lemonade’s AI Jim

Lemonade’s in-app chatbot, “AI Jim,” automatically processes nearly 40 percent of claims instantly. In December 2016, AI Jim set a record by completing a claim payout in just 3 seconds and currently manages around one-third of all claims from start to finish before forwarding them to human adjusters.8

Figure 3. Lemonade’s AI Jim is handling pet insurance claims.

Insurance chatbot best practices

Deep system integration

Integrate chatbots directly with policy administration systems (Guidewire, Duck Creek) and claims platforms to facilitate seamless FNOL and status updates.

Security and compliance

Implement end-to-end encryption, role-based access, and ensure adherence to GDPR, PCI DSS, HIPAA (where applicable), and local insurance regulations.

Domain-tailored NLP models

Train models to recognize insurance-specific intents such as “file claim,” “premium adjustment,” and “coverage exception” to improve accuracy in intent recognition.

Context-preserving handoffs

Incorporate clear escalation paths from bot to human agents, transferring complete conversation context to prevent customer frustration.

Conversational jargon simplification

Substitute or clarify technical terms (“endorsement,” “co-insurance”) with user-friendly language and quick-link buttons.

Analytics-driven iteration

Regularly review deflection rates, transcript logs, and CSAT scores; revise chatbot flows monthly based on drop-off points and new product launches.

Omnichannel deployment

Deploy across web, mobile app, WhatsApp, SMS, and voice to connect with policyholders through their preferred channels.

Accessibility and inclusivity

Ensure compatibility with screen readers, provide IVR support for visually impaired users, and simplify flows for cognitive accessibility.

Stakeholder training and change management

Conduct internal pilots, educate service teams on bot hand-offs and fallbacks, and clearly communicate capabilities and limitations.

Governance and version control

Sustain a centralized content repository with versioning for quick updates in response to regulatory or product changes.

FAQ

What is an insurance chatbot and how does it enhance customer experience?

An insurance chatbot is an AI-powered conversational interface, often leveraging natural language processing and machine learning algorithms, that automates routine customer interactions and answers questions about policy details or the claims process. Unlike traditional chatbots, modern AI agents provide a human-like conversation across multiple channels (web, mobile, SMS), offering immediate assistance and payment reminders outside business hours to both new and existing customers.

How do chatbots in the insurance industry improve customer satisfaction?

By handling repetitive tasks such as answering FAQs, addressing billing questions, and processing policy lookups insurance chatbots enable insurers to reduce costs and free up human agents for more complex tasks. They collect valuable customer data and use predictive analytics to personalize customer experience, guiding customers through health insurance or auto claims with contextual recommendations and rapid responses that exceed rising customer expectations.

Can an AI chatbot solution integrate with legacy systems and existing business needs?

Yes. Leading insurance chatbot platforms connect seamlessly to policy administration, claims, and billing systems so data-driven insights flow between conversational AI and back-end systems. This integration not only alerts human agents when needed but also ensures compliance and security of customer data, enabling insurers to modernize operations without discarding their core insurance processes.

What measurable benefits do insurance providers see from deploying AI-powered chatbots?

Insurance companies report up to 50 percent reduction in call volumes and 30 percent faster FNOL handling times, thanks to chatbots automating the initial claims process and payment reminders. These cost savings, combined with improved customer engagement and the ability to scale support for potential customers, drive strong ROI and accelerate digital transformation across the insurance sector.

Further reading

- Generative AI in insurance

- Chatbot Applications with Examples

- SAP Conversational AI (Joule) Use Cases

External Links

- 1. Allianz | Allianz Global Insurance Report 2025: Rising demand for protection. Allianz SE

- 2. Insurance Chatbot Market Ready to Hit USD 5,238.4 million by 2033 .

- 3. Meet GEICO Mobile's Virtual Assistant: Insurance Made Easy | GEICO.

- 4. Zurich International Case Study.

- 5. Allstate deploys AI chatbot to assist small business clients | Insurance Business America. Insurance Business

- 6. Allstate Insurance Creates Chatbot to Help Small Businesses. Heretto

- 7. Progressive gives voice to Flo’s chatbot, and it’s as no-nonsense and reassuring as she is - Source.

- 8. Lemonade Sets a New World Record | Lemonade Blog.

Comments

Your email address will not be published. All fields are required.