6 Ways IoT will Change the Insurance Sector in 2024

The rapid proliferation of internet of things (IoT) devices will change the insurance sector in both positive and negative ways (see Figure 1). The constantly monitored environment provided by the IoT has the potential to make the insurance sector as we know it obsolete in the long term, as a large proportion of physical risks can be detected and prevented before they occur. On the other hand, new risks are emerging, such as cyber threaths. Cyber risk insurance could be the future of the insurance

Also, Insurance is inherently a data-centric business. The core of insurance practice is the pricing of risk. Consequently, any innovation, such as IoT, that increases data availability can be used as a source of efficiency for insurance companies. In this article, we assess the six areas where the Internet of Things (IoT) will have a significant impact on the insurance sector to prepare insurance executives for the near future.

Figure 1: Positive and Negative Ways IoT Impacts Insurance

1. Better knowledge of your customers’ behavior.

IoT improves underwriting and risk assessment processes.

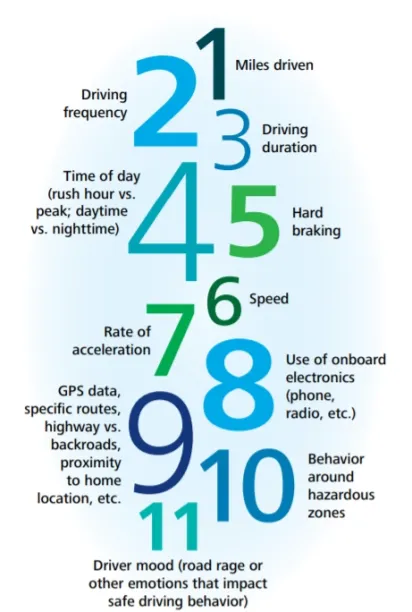

Take the case of car insurance. Insurers used to evaluate statistics such as age, gender, mileage and car model to determine the premium. However, thanks to the IoT, it is now possible to review statistics such as driving speed, driving time, number of full brakes per kilometer, drivers’ classic routes (highway vs. crowded narrow city streets) and drivers’ engagement with their cell phones (see Figure 2).

Undoubtedly, such information about the customer provides insurance companies with a more effective risk assessment and underwriting experience.

Figure 2: New Data Sources for Car Insurers

2. Efficient claim processing

Claims processing is one of the most important operations in the insurance sector, impacting both customer satisfaction and insurance company profitability. The Coalition Against Insurance Fraud reports that fraudulent claims cost approximately $80 billion per year. On the customer satisfaction side, Accenture cites that insurance customers expect quick responses. IoT improves both processes thanks to instant communication between devices.

Let’s look again at the case of car insurance to illustrate the positive impact of the IoT on claims processing. In the past, when a car accident occurred, the policyholder had to call the insurance company to fill the first notice of loss (FNOL) . Depending on the extent of the accident, this process took some time. For example, the policyholder could pass out and not inform the insurance company quickly. The more delayed claim increases the probability of fraudulent claim as well as unsatisfied customers. Traumatized people might not want to deal with allerting insurance company.

Today, claims processing is different. When airbags deploy, telemetry automatically alerts the insurance company. This speeds up first notice of loss (FNOL) process, resulting in greater customer satisfaction and less fraud.

3. Customized insurance practices

More data about customers means better risk assessment. As a result, insurance companies no longer need to divide people into risk categories to hedge their operational risks. For this reason, special customer insurance policies known as pay-as-you-go (PAYG) policies are being added to the menu of insurance companies. PAYG premiums are calculated depending on the use of the insured items. For example, the more often you park your car, the less you pay for its insurance.

4. Loss of business

The interconnectedness of smart devices and their rapid proliferation are eliminating some risks that have been insured for centuries due to the risk-averse nature of humans. This phenomenon could potentially threaten the future of the traditional insurance sector.

For example, we tend to insure our houses in the event of a fire. However, thanks to smart homes, telematics can detect a gas leak and shut off the flow of gas before a fire occurs. Similarly, a smart factory can monitor the performance of working machines and prevent loss before a disaster occurs; reduce the need for business insurance.

Thanks to the IoT, a significant proportion of risks can be identified and eliminated before they cause damage. Every insurance company naturally sets a price that support to make a profit, but the new, relatively risk-free world may mean that insurance companies do not add margin to the price of risk, forcing at least some of them to exit the market.

5. New insurance areas

It is true that the rapid increase in the number of connected smart devices is reducing some of the risks we used to face. But it also introduces a systematic risk that can be insured against. The more people depend on smart devices, the more vulnerable they are to cyberattacks. Insuring against cyber risk would be the future of the insurance sector.

You can read our Top 9 Cybersecurity Best Practices for Corporations article to improve your cybersecurity posture.

6. Greater risk of data privacy and security issues

A massive flow of data implies more information about customers’ personal lives. Consequently, the risk of data leaks, hacker attacks, and simply being persuaded to share data with insurance companies increases.

Privacy

While telematics captures data that helps insurance companies assess risk, it also likely captures other information that could be useful to other companies in other industries or that is simply completely private to the customer. In such cases, data misuse can occur. The customer can become the target of personalized sales efforts that inevitably exploit their privacy and threaten everyone’s quality of life if the problem remains unresolved.

Security

The massive collection of data thanks to the IoT also makes cyberattacks more likely because the return of hacking is greater. Consequently, ensuring data security will be both costly and an important issue for insurance companies.

It is important to know that many insurance companies outsource their IT services through cloud computing services, which reduce their IT expenses and their control over data and data security. Especially with public clouds, data security is not adequately protected. As a result, the lower short-term cost of clouds that comes from not having to develop hardware can cost insurance companies more in the long run.

Convincing Customers

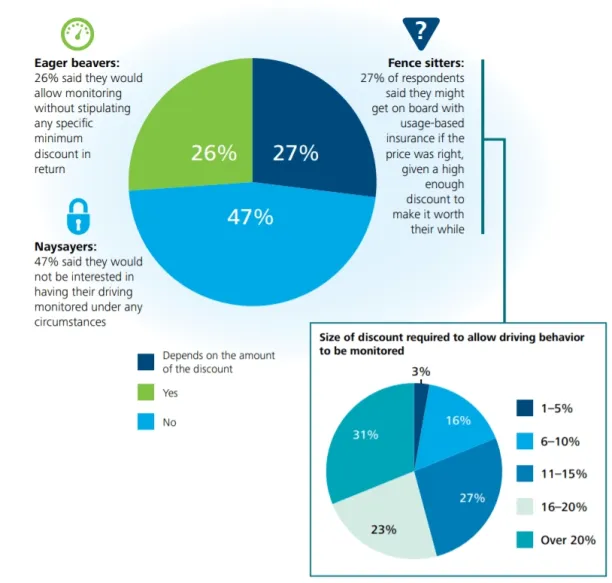

Ensuring data security is one thing, convincing customers is another. Obviously, we live in a world of perceptions, and the truth is not necessarily important or understandable to us. As you can see from Figure 3, 47% of drivers think they would not want to share their driving data under any circumstances, and 27% of them would consider sharing data in exchange for a discount. 9% of respondents expect a discount of more than 20%.

Still, the next generations may have a different attitude toward data sharing. It is clear that it is a challenge for insurance companies to convince customers.

Figure 3: Percentage of those who would allow driving to be tracked via smart devices

Further readings

You can check our other articles on the use of digital technologies in the insurance sector:

- 4 Insurance Practices that can be Improved with NLP: NLP models automate many insurance practices, from claims processing to fraud detection, and are therefore vital to your insurance company’s operations in times of low profit margins.

- 3 Ways Blockchain will Change Insurance Sector: Blockchain ensures data security and can therefore be an important tool for insurers. Blockchain technology is used in the insurance sector in core areas such as claims processing, fraud detection and underwriting.

- Top 6 Digital Transformation Applications in Insurance: This article highlights some automation areas that are transforming the insurance sector.

To find innovative insurtech companies you can read our Top 7 Innovative Insurtech Companies of 2023: Detailed Guide article.

To find vendors/tools that help your business IoT capabilities you can check our top IoT software and top IoT companies lists.

Finally you can check our top insurance suites list.

If you need the assistance of an Insurtech for your digital transformation, we can find the right one.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow onNext to Read

4 Use Cases & 2 Challenges of IoT in Real Estate in 2024

Top 4 Use Cases of 5G IoT in 2024

IoT Security in 2024: What is it? & Challenges

Insightful read. Throws light on the IoT’s role in effecting the insurance sector…

Hello Alza Business! Thank you for your feedback. If you’d like to learn about other technologies transforming the insurance sector, we have other articles here: https://research.aimultiple.com/category/insurtech/

Comments

Your email address will not be published. All fields are required.