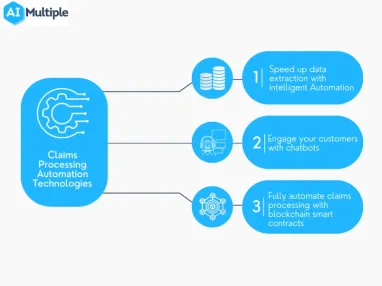

Top 3 Claims Processing Automation Technologies in 2024

Efficiency of claims processing significantly affects the success of insurance companies since:

- According to Deloitte, claims processing makes up around 70% of insurers’ costs.

- The efficiency of claims processing is negatively related to the amount of insurance fraud, which costs the insurance sector billions of dollars each year.

- Customers can see the “true face” of insurance firms during the claims processing.

- Processing claims entails interacting with frequently unhappy people who had an undesirable experience. Thus, if their final claims processing experience is unsatisfactory, EY discovered that nearly 90% of insurance clients consider switching their insurance provider.

Despite these shortcomings, the adoption of automation technology, which can remedy them, in the insurance sector is lagging behind other sectors. One of the reasons for this is that almost 30% of insurance executives have difficulties making agile technology-related investment decisions due to lack of information they have.

In this article we aim to close the information gap. So we introduce the top 3 claims processing automation technologies.

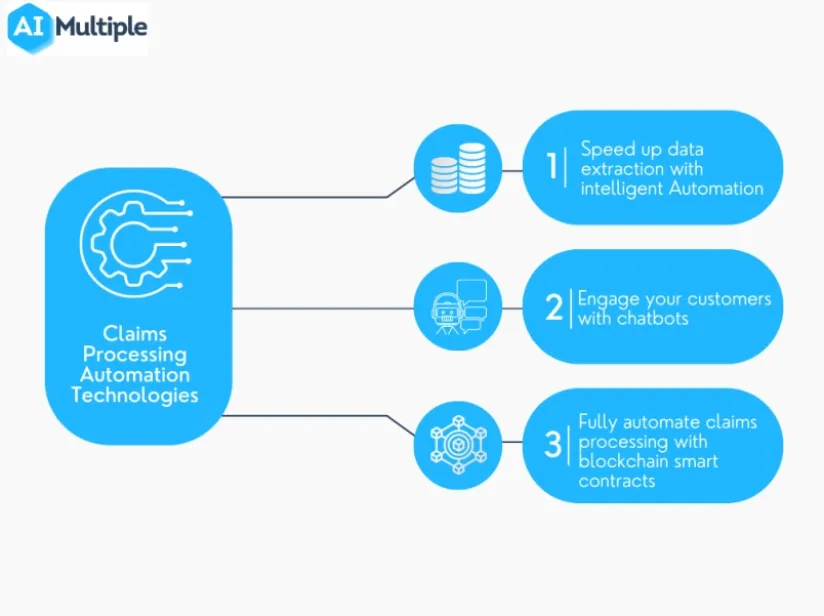

1. Intelligent automation

Intelligent automation is an effective claims processing automation tool since it combines RPA bots with some AI capabilities such as NLP and OCR for the filing of documents or data extraction from existing documents.

Intelligent automation augments workforce for the following 4 claims processing related tasks:

1. First notice of loss

The policyholder gives the insurer detailed accident and informational data in the first notice of loss (FNOL) such as the:

- Policy number,

- Date, time, location etc. of the accident,

- Type of the loss

- Expert, doctor, police reports and so on.

It is crucial to gather all the data, claims information, and supporting documentation from a customer and validate it quickly.

OCR technology is needed in order to extract and understand all document types and digitize all of them under one document. Intelligent automation thus becomes a practical technique for insurance companies.

2. Claims document processing

NLP-capable bots are another useful tool for insurers. The context of the papers can be understood by NLP. As a result, data uploading to the claims system and document classification can both be automated.

Thus, insurers may devote time to activities that offer greater value, such developing new policies for their product line.

3. Claims adjustment

During claims adjustment, intelligent automation can make sure that all pertinent information and supporting documentation has been obtained, checked and sent to claims adjuster. Intelligent automation bots can determine a remote or physical adjustment based on a computation of the adjustment’s difficulty. If the claim incorporates outsourced adjustment services to help with cost control, bots can expedite the hand-off process.

4. Fraud detection

It is crucial to include fraud detection processes into the whole claims management lifecycle, regardless of whether you employ internal AI fraud detection technologies or cloud computing solutions provided by insurtech companies as an outsourcing approach. You must incorporate data collection into your fraud protection system in this regard.

Intelligent automation can enhance insurers’ fraud protection capabilities since it speeds up the data integration process.

Aon Italy1 , a multinational insurance group used RPA to transform its digital infrastructure and automate core processes. Benefits were:

- Cost reduction and revenue increases, due to easier collaboration with clients and prospects,

- Error reductions,

- Time savings in the underwriting process,

- And easing the workload of the company’s 1600 employees.

2. Chatbots

Insurance chatbots are effective AI driven claims processing automation tools due to following benefits:

- Chatbots can engage with customers 7/24 and can understand and respond in many languages. Thus, chatbots can reduce costs by ridding the company of the need to hire more employees to answer customer queries and enabling higher efficiency.

- Chatbots provide ease of claims and FNOL submission. For instance, policyholders do not need to wait for company representatives to fill the FNOL.

- According to McKinsey,younger people expect more digital interactions with insurers. In this regard, chatbots can be deployed as a complementary part of the conversational commerce strategies of insurance companies.

Chatbots can automate following 4 tasks of claims processing:

- Submitting FNOL: Customers can engage with chatbots that are deployed on messaging apps or mobile apps of insurance companies to fill FNOL. In this regard, chatbot can ask questions about the details of the loss and incident and guide policy holders to download claim supportive photographs and videos.

- Update claim details: Customers can amend their claims more easily with the help of an insurance chatbot if necessary. A chatbot or a consumer can both initiate such an update. If more information is required, the chatbot can decide ahead of time and alert the consumer. The relevant information can then be updated by the client. On the other hand, the consumer has the option of asking the bot to make an update.

- Track claims: Customers can use straightforward, conversational enquiries like (FAQs) or thoughtfully crafted input options to learn what stage their claim process is in. But beyond that, chatbots give a client the ability to know when they can anticipate the process to end through predictive analysis.

- Notify customers concerning the status of the claim: Chatbots can notify customers during the ach stages of the claims processing such as:

- Initial claim investigation.

- Policy check.

- Payment calculation to customer.

- Payment arrangement.

If you want to begin your conversational commerce initiative but cannot find a suitable chatbot vendor, you can read our 50+ Chatbot Companies To Deploy Conversational AI article.

3. Blockchain

Underwriting, risk assessment, and fraud detection are some of the many insurance procedures that benefit from the transparent data storage technology known as blockchain. However, because of the possibilities of smart contracts, claims processing may be the insurance practices that blockchain affects favorably the most.

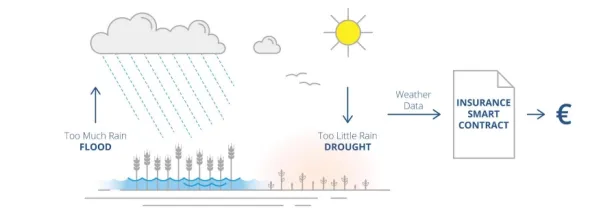

Smart contracts are automatically activated when predetermined code on the blockchain is triggered by an event such as flood. To verify the activity, blockchain uses third party data sources or IoT devices that are called oracles.

Blockchain technology almost totally automates the entire claims processing since submitting FNOL, initial claims investigation and policy checking steps of the claims processing are eliminated.

The Example illustrated on Figure 3 can help us to understand how blockchain ensures claims processing automation. Consider you were a farmer and bought a business insurance policy that provides coverage for the natural disasters such as flood and drought that affect your harvest.

A smart contract that defines a specific annual rainfall amount as a description of a drought and a specific daily rainfall amount as a description of a flood is signed by you and the insurance company. Let’s say that the insurance company and the farmer both consider daily precipitation totals of 500 millimeters or more to be natural disasters.

A third data provider such as the meteorological station next to the field integrated the smart contract as an oracle. Smart contract is initiated whenever an oracle records rainfall of more than 500 millimeters. The system submits FNOL and alerts the insurance provider. Additionally, since both parties had previously reached an agreement, procedures like policy checking became completely unnecessary.

Although as of today only a few insurance companies utilize blockchain technology for automating claims processing, in the near future we expect more companies to adopt it, since the number of IoT devices that integrate with insurance companies are on the rise and customer expectations about fast and digital processes might force insurance companies to adopt this technology.

Figure 3: Claims processing automation with blockchain.

If you want to read how companies apply blockchain technology into their workflows you can read our 7 Blockchain Case Studies from Different Industries article.

If you need more information about claims processing automation you can reach us:

External Links

- 1. “Integrating an automated, integrated digital future.” IBM. Revisited on May 9, 2023.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.