Financial Services CRM in 2024: Key Features & Suggestions

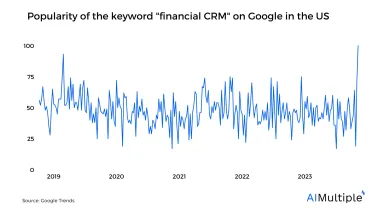

Figure 1. The popularity of the keyword “financial CRM” on Google search platform in the last 5 years.

As the number of customers for financial advisors grows, so does the amount of data they manage. However, about ~70% of these advisors report that their companies confront significant challenges in efficiently leveraging data and technology.1 According to a study, ~50% financial advisors consider Customer Relationship Management (CRM) tools their most valuable software.2

This article will discuss the essential features and benefits of adopting CRM software in the financial services industry. Furthermore, it provides specialized recommendations to help businesses select a finance CRM system that best matches their specific demands and business objectives.

What is CRM for financial services?

Customer Relationship Management (CRM) in financial services refers to the strategies, technologies, and practices that financial institutions use to manage and analyze customer interactions and data throughout the customer lifecycle. It’s aimed at improving customer service relationships, retaining customers, and driving sales growth.

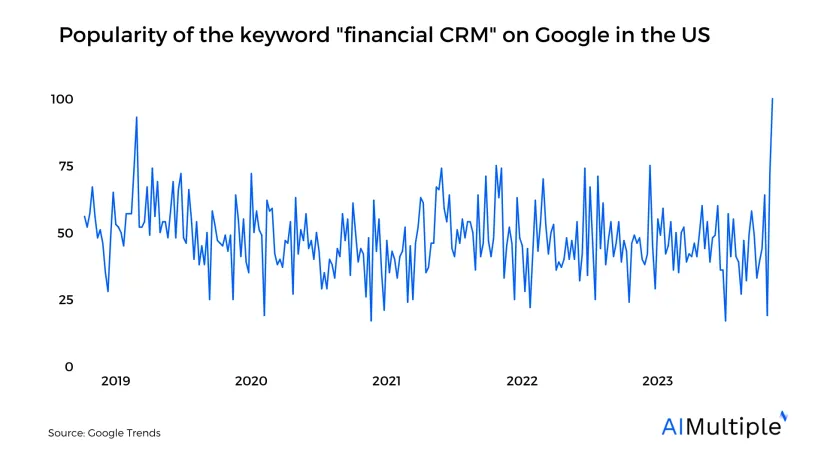

Figure 2. CRM usage in financial services industry

CRM in the financial sector can be used by:

Banks: A bank might use a customer relationship management system to track a customer’s accounts and transaction history. This would allow the bank to offer personalized banking solutions to each customer based on their financial history and preferences. For example, if the bank notices that a customer regularly exceeds their checking account balance, they might offer them a credit card or overdraft protection.

Consultants: Financial consultants can use CRM to manage their client relationships and track the advice they’ve given. For instance, a consultant could use a CRM to keep track of each client’s financial goals, risk tolerance, and progress towards their goals. This would allow the consultant to provide personalized advice based on the client’s unique circumstances and needs.

Loan and mortgage companies: These organizations can use CRM systems to manage loan or mortgage applications and track repayments. For example, if a customer’s mortgage term is nearing its end, the company can send automated reminders about renewing or restructuring their mortgage.

Fintechs: Fintech companies often deal with a large volume of customer data and transactions, so a CRM system can be crucial. For example, a peer-to-peer lending platform might use CRM to track each user’s lending and borrowing history, credit risk, and repayment schedules. This allows them to personalize their service offerings and to monitor and manage risks.

Check out our article to learn more about CRM best practices.

9 key features of CRM for financial services

Workflow automation

More than 60% of financial organizations want to invest in workflow automation technology. Workflow automation in CRM software helps to streamline and automate routine tasks. For example, once a customer completes a transaction, the CRM can instantly send a confirmation email. Workflow automation can also aid with work assignments, issuing reminders for follow-ups, and alerting managers about specific customer operations.

Integration with third-parties

Integrating financial services CRM systems with other software platforms, such as core banking systems, trading platforms, and regulatory databases, is essential for the financial services industry. These interfaces provide real-time updates and maintain data consistency across all platforms. Businesses can use it to improve customer service, maintain regulatory compliance, and make more informed choices.

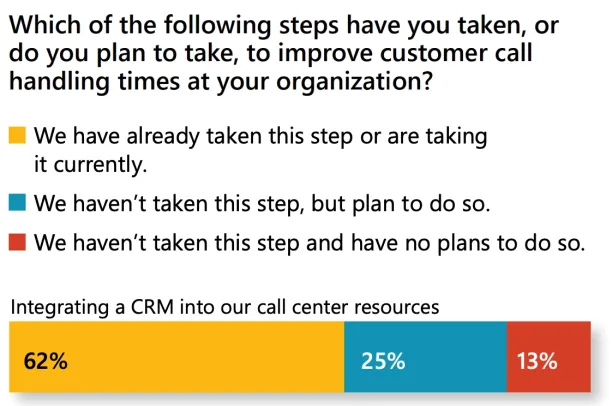

Contact center automation

Source: Microsoft

Figure 3. Percentage of financial services firms implemented CRM systems

~40% of the companies in the financial service industry don’t use CRM in their organizations (See Figure 2). Contact center automation in finance CRM software involves automating customer interactions to streamline operations and improve customer service. It utilizes AI and machine learning to intelligently route customer queries to the appropriate channels or representatives. This leads to increased efficiency, improved customer satisfaction, and enhanced regulatory compliance.

Check out our comprehensive article to learn how a CRM system might benefit call centers.

Lead management

Companies can monitor prospective consumers (leads) and direct them toward the sales funnel by identifying prospects, keeping track of their interactions, determining which ones are most likely to convert, and nurturing those relationships until the leads turn into customers. The CRM system can assist in managing the numerous touch points frequently involved in this process, such as calls, meetings, and emails.

Low-code no-code development

Low-code or no-code development platforms, instead of traditional computer programming, enable non-technical users to construct application software through graphical user interfaces and setup. Businesses can adapt their CRM to their unique demands using this aspect of a CRM solution without having substantial programming knowledge.

For those interested, here is our article on no-code CRM.

Mobile access

Users have on-the-go access to CRM data and feature thanks to mobile access. As a result, team members may update data, address consumer inquiries, check their duties, and more anytime, anyplace, which can greatly increase productivity and responsiveness.

Data privacy

Given the sensitive nature of financial data, a CRM system for financial services must have robust data privacy features. This could include encryption of data both at rest and in transit, access controls to limit who can view or edit certain information, and compliance tools to help meet data privacy regulations such as GDPR or CCPA.

360° customer view

A 360-degree customer view involves collecting and integrating data from all touch points to create a complete picture of each customer. This can include transaction data, interaction history, personal information, preferences, etc. This feature can help improve customer relationships and service, predict customer needs, and personalize marketing efforts.

Internal audit

Internal audit features allow you to track and record all changes made within the system, such as updates to a client’s contact information or changes to a client’s portfolio. These audit trails are crucial for accountability, accuracy, and in some cases, regulatory compliance. They help identify who made a change, when, and what exactly was changed, which can be useful in resolving disputes or investigating suspicious activity.

Benefits of using a financial services CRM software

1- Increased efficiency in sales processes through automation

Sales force automation

CRM systems enable financial institutions to automate various sales-related operations, including:

contact management

lead tracking

sales forecasting.

This assists companies in finance industry to streamline their sales pipelines, improve lead conversion rates, and increase revenue.

Marketing automation

Businesses can automate repetitive marketing operations by utilizing the marketing automation capabilities of financial CRM software. This covers:

customer segmentation

social media posting

email marketing.

As a result, companies can ensure constant interaction with customers, customize marketing initiatives, and increase the return on their marketing expenses.

Service automation

CRM software can automate service operations, including ticketing, customer queries, and scheduling. This improves the speed and efficiency of customer service and increases customer satisfaction, leading to increased loyalty and repeat business.

2- Easy process management

Performance management

Financial CRM software provides businesses with tools for tracking and analyzing employee performance in real time. This includes monitoring sales activities, tracking customer interactions, and evaluating performance against set targets. This data-driven approach allows businesses to identify areas of improvement and make informed decisions to enhance overall performance.

Document flow management

Businesses can manage document flows with CRM more effectively. This includes storing, sharing, and tracking important documents such as contracts, proposals, and customer correspondence. Such centralized document management reduces the risk of errors, increases accountability, and ensures all team members have access to the latest information.

3- Enhanced collaboration among employees

A financial CRM software can create a more collaborative work environment by providing a central platform where all customer information is stored. This means that every employee, regardless of their department, can access the same customer data and history. It fosters better communication among team members, ensures everyone is on the same page, and eliminates the silos that often occur in larger organizations.

Suggestions for finding the right CRM for financial services

Suggestion 1: Consider the level of customization required

How much customization is required for your CRM software? If your company has specific requirements, pick a CRM that enables advanced customization, from custom fields for particular data to unique user interfaces. The availability of no code development tools will also enable your team to create distinctive features and apps for the CRM without having to rely too heavily on IT.

For those interested in no-code CRM software benefits, here is our article.

Suggestion 2: Check for training and customer support capabilities

A complex CRM system may have a steep learning curve, so training support can be invaluable. Make sure the CRM vendor offers thorough training materials to assist your employees in quickly becoming proficient with the system. Additionally, make sure they offer great customer assistance to address any potential issues. For instance, you can compare the customer support ratings of the vendors on B2B review platforms such as G2.

Suggestion 3: Pay attention to compliance management

Financial services companies have to comply with numerous regulations. Therefore, look for a CRM that includes robust compliance management tools. If your business operates in multiple regions, the CRM should also be capable of handling different compliance standards, like GDPR for Europe and CCPA for California, USA.

Suggestion 4: Think about long-term scalability

Choose a CRM system that can scale with your business. As your organization grows, your CRM needs may change. Therefore, the CRM system you choose should be flexible and adaptable to accommodate these changes. Consider factors like the scalability of the system, the vendor’s history of updating and improving their software, and the system’s ability to accommodate new integrations or modules.

Suggestion 5: Check out our financial CRM software benchmarking

We have researched the features and capabilities of financial CRM software and analyzed the vendors in the market. We have determined criteria such as the number of B2B reviews on review platforms such as G2, Capterra, and Trustradius and conducted listed on the top financial CRM software in the market based on their:

features

capabilities

market presence

ratings on B2B platforms.

You can check out our benchmarking study to find the best vendor that satisfies your organization’s needs.

For those interested, here is our data-driven list of CRM software.

If you need help in your vendor selection process, we can help:

External Links

- 1. “2022 banking and capital markets outlook.” (PDF). Deloitte. Retrieved May 25, 2023.

- 2. “Most valuable software according to financial planning and investment advisory firms worldwide in 2022“. Statista. April 2022. Retrieved May 25, 2023.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.