Venturing into the evolving sphere of market research, the article uncovers a range of key statistics that capture the sector’s state and trends. It’s a deep dive into how market dynamics are being reshaped, highlighting leading role of the U.S., the rise of AI, and the evolving nature of customer engagement to help companies develop their marketing strategies accordingly and gain a competitive advantage in the market.

Global market research industry stats

1- The global market research industry generated over $84 billion in revenue in 2023.1

2- The U.S. holds the majority of the market research industry’s market share with 55%.2

3- In 2022, the U.S. led global market research revenue with a share of ~72%, and the UK was the second-highest at ~11%.3

4- In 2022, Norway experienced the quickest expansion in the European market research sector, with a growth rate of ~12%, and Ireland came in second with a growth rate of ~6%.4

5- A study reveals that in the US, the UK, and the Netherlands, the average response rates for online surveys are 46%, 36%, and 33%, respectively.

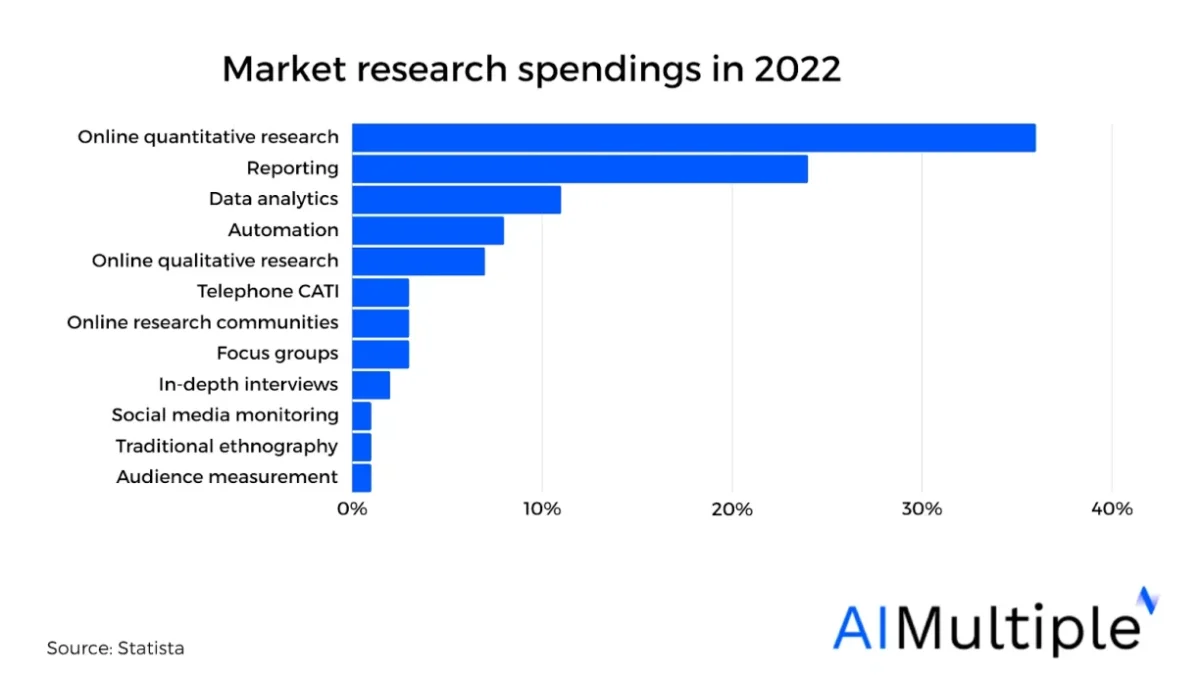

6- Most market research spendings are made for online/mobile quantitative research (36%), followed by reporting (24%), and analytics (11%).5

Figure 1. Percentage of market research spendings

7- The greatest portion of market research expenditures in the US is allocated to CRM systems at 18%, with market measurement at 17% and UX research at 14%.6

8- Social media monitoring accounts for 2.7% of global market research revenue.7

9- A recent report indicates that, as of 2023, the market research companies employ approximately 129,000 employees in the US.8

10- Global market research revenue is growing at an annual rate of 8.4%.9

11- The annual revenue of the market research industry is projected to increase at a compound growth rate (CAGR) of 2.5%, reaching $35 billion over the next five years.10

If you wish to use a market research tool, here is a guide comparing the top tools on the market.

For those interested, here is also our data driven list of market research tools.

Market research trends

12- In the U.S., the majority of research funding based on the research methods is invested in quantitative research, accounting for 59%, with reporting at 24% and qualitative research at 18%.11

13- In 2022, media and broadcasting sectors were the top clients for market research firms in the United States, comprising 29% of research sales, with pharmaceutical companies following at 13%.12

14- In the global market research industry for 2022, social media analytics were employed by 36% of companies, while mobile-first surveys were regularly utilized by 28%.13

15- In the field of market research, online surveys are a preferred tool for companies, with ~90% using them to gain deeper insights from customer feedback.

If interested, here is our data-driven list of survey participant recruitment services and AI survey tools.

16- Market research indicates that surveys are utilized by 95% of B2B firms to gauge customer feedback.

17- Given that over 75% of health consumers anticipate care that is more accessible and tailored to their needs, market research plays a crucial role in directing the creation of innovative healthcare products and services.

For more on healthcare market research trends and real-life examples, check out our article.

18- Grundfos, a water pump manufacturer, improved its market research approach by implementing real-time feedback surveys, leading to 1,000 customer follow-ups, a +9 increase in employee ratings, and tripling the growth rate among satisfied customers.

19- By employing market research to enhance customer service and understand client needs, American Express achieved a 400% increase in customer retention.

20- Market research indicates that companies utilizing multiple distinct sales channels tend to achieve a larger market share.

Market research services statistics

21- 90% of marketers believe that marketing efforts need to be more closely aligned with the needs of customers.

22- ~85% of marketers agree on the significance of customer experience for their success, but merely 14% believe they are highly capable in this aspect.

23- In market research, having a large number of survey respondents does not automatically equate to high-quality data.

Check out the challenges of conducting online surveys and our solutions.

24- Only 24% of market research professionals incorporate customer feedback data into their decision-making processes.

25- Merely 30% of market researchers are certain about their understanding of AI‘s influence on the industry.14

26- 80% of market research professionals believe that AI will have a positive influence on the industry.15

Check out our article on how ChatGPT help creating surveys for market researchers.

27- 7% of market researchers see AI as a threat for their jobs.16

28- 40% of market researchers anticipate that within 10 years, AI will be able to interpret survey results as effectively as humans.17

29- 95% of market research professionals consider advanced data analysis as the top AI technology expected to significantly impact the industry.18

30- ~70% of market research professionals believe that within 10 years, AI will be capable of accounting for the emotional aspects of consumer behavior.19

Further Reading

External Links

- 1. Market research: global revenue 2023| Statista. Statista

- 2. Market share market research industry by country| Statista. Statista

- 3. Leading market research countries worldwide| Statista. Statista

- 4. Europe market research fastest growing markets| Statista. Statista

- 5. Market research spend by survey type U.S. 2022| Statista. Statista

- 6. Market research spend by research project type U.S.| Statista. Statista

- 7. Market research: global revenue 2023| Statista. Statista

- 8. Market Research in the US - Market Research Report (2015-2030). IBISWorld

- 9. Market research: global revenue 2023| Statista. Statista

- 10. Market Research in the US - Market Research Report (2015-2030). IBISWorld

- 11. Market research spend by research method U.S. 2022| Statista. Statista

- 12. Market research: leading client sectors in the U.S.| Statista. Statista

- 13. Market research industry: emerging research approaches used| Statista. Statista

- 14. “How AI will reinvent the market research industry.” Qualtrics.

- 15. “How AI will reinvent the market research industry.” Qualtrics.

- 16. “How AI will reinvent the market research industry.” Qualtrics.

- 17. “How AI will reinvent the market research industry.” Qualtrics.

- 18. “How AI will reinvent the market research industry.” Qualtrics.

- 19. “How AI will reinvent the market research industry.” Qualtrics.

Comments

Your email address will not be published. All fields are required.