7 Vic.AI Alternatives to Automate Accounting in 2024

With the advancement of machine learning / AI and cloud SaaS, accountants have access to a range of tools that can streamline and automate finance processes. These tools can:

- simplify the accounting process

- save time

- reduce errors

These grow the impact of AI in accounting. Case in point: PwC declaring its 1 billion dollar investment in generative AI capabilities.1

The downside of too many online accounting software applications is not knowing which one to choose. Vic.AI could be a good choice because of its benefits in improving business data accuracy and real-time reporting.2 However, users may want to look for alternatives, for example, to have access to more integration pr pricing options. This article will explore these alternatives.

Top 7 alternatives to Vic.AI

Table is sorted in alphabetical order.

| Vendors | Focus | Number of Employees | Ratings & Reviews | Pricing |

|---|---|---|---|---|

| AccountsIQ | Accounts Payable AI | 74 | 4.5/5 based on 95 reviews | Essentials: €199 p/mo Growth: €450 p/mo Enterprise: Custom |

| Airbase | Accounting Software | 396 | 4.8/5 based on 1535 | N/A |

| AppZen | Accounting Software | 285 | 4.2/5 based on 36 reviews | Custom |

| BILL | Accounting Software | 2929 | 4.2/5 based on 1115 reviews | Corporate: $79.00 Team: $55.00 Essentials:$45.00 |

| Hypatos | Accounts Payable AI | 83 | 4.8/5 based on 21 reviews | €500.00 p/mo |

| Sage Intacct | Accounting Software | 1114 | 4.2/5 based on 3286 reviews | N/A |

| Stampli | Accounting Software | 222 | 4.8/5 based on 945 reviews | Custom |

While choosing the top Vic.AI competitors for our analysis, we considered the following metrics:

- Focus: The solution needs to either

- claim to provide end-to-end AP automation like Vic.AI. Such vendors are listed on our AP AI vendor list. This is for enterprise buyers that are aiming to have maximum automation.

- provide one of the top accounting software. This is for SMEs that are less concerned with automation rate and are searching for an easy-to-use and popular accounting solution.

- Number of Employees: Increase in employee numbers is positively correlated with product market share and companies with larger market share tend to produce more effective products.

- Artificial intelligence in accounts payable is an emerging technology category and companies that offer these solutions tend to be startups and scaleups. Therefore, we set a relatively low number of employees (i.e. 50+) for vendors to be included in this list.

- When selecting accounting software, largest 2 companies in terms of number of employees were selected

- References: Enterprises require vendors with enterprise experience. The vendors we analyze have at least one Fortune 500 reference.

- Reviews: User reviews are also correlated with product success. They were not used in selecting products but were used to provide more input about product popularity and customer satisfaction.

Overview of Vic.AI

Vic.AI leverages artificial intelligence (AI) to automate various accounting tasks (Figure 1).

Selected capabilities

Data extraction: It uses machine learning algorithms to extract data and eliminate the need for manual data entry from:

- invoices

- receipts

- other financial documents

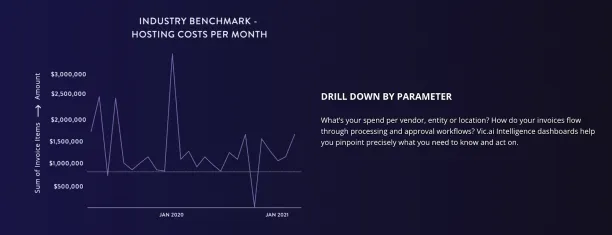

Insights: Vic.AI offers real-time insights into financial data, allowing accountants to monitor key metrics and identify trends. (Figure 2) With its customizable dashboards, users can access the information they need without digging through piles of paperwork or complex spreadsheets.

Anomaly detection: Vic.AI’s AI technology can also detect anomalies in financial data, helping accountants identify potential errors or fraudulent activities.

Pros:

Improved data accuracy: By automating data entry and reconciliation, the tool reduces the chances of human error that can occur during manual processes.4

Efficiency: Users report reduced time for accounting activities such as invoice processing. For example, adopting Vic.AI reduced time spent by a global school operator for invoice processing by %60.5

Cons:

Despite its merits, users have lamented the following about Vic.AI:

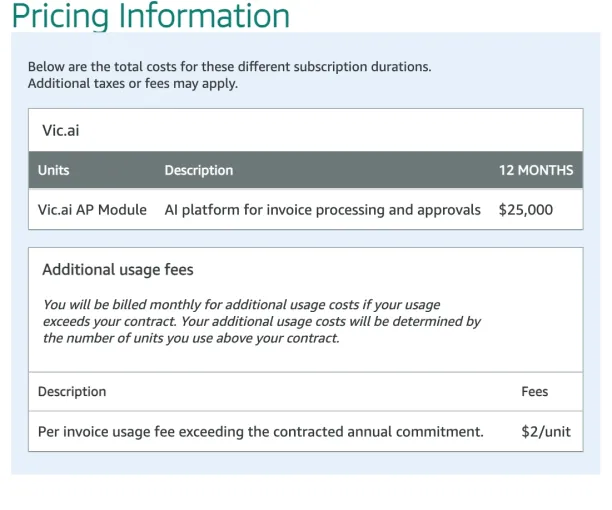

Cost:

- SMEs including startups might not be able to afford Vic.AI because of the costs (Figure 3). Long terms cost savings aside, the initial setup cost is $25,000.

- Enterprises: Per unit cost of $2/invoice is expensive as enterprises tend to pay tens of cents per invoice. We will clarify this if Vic.AI team shares their enterprise pricing model.

Integration Problems: As reviews show, Vic.AI is integrated with a lot of popular online accounting software, but it might not work with less popular or proprietary systems. (Figure 4)

User Ratings:

G2: 4.8/5 based on 23 reviews.8

Capterra: N/A

7 Vic.AI alternatives

Overview of AccountsIQ

AccountsIQ is cloud-based accounting software that is used by more than 4000 businesses and accounting firms around the world, including PwC, BDO, and Grant Thornton. It offers features such as:

- Audit trail

- Payment processing

- Accounts payable automation

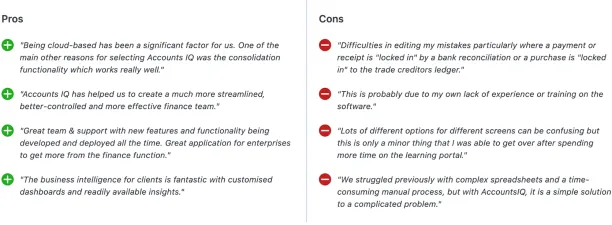

Pros:

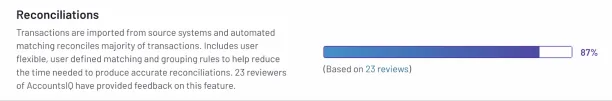

Journal entry automation: According to 25 reviews in G2, AccountsIQ improves efficiency in auto-completing journal entries. (Figure 5)

Reconciliations: According to 23 reviews in G2, AccountsIQ provides an effective service in reconciliations. Transactions are brought in from source systems, and most of them are matched up automatically. Includes variable matching and grouping rules that can be set by the user. This helps reduce the time needed to make accurate reconciliations. (Figure 6)

Cons:

Difficulties in using the software (Figure 7)

Limited flexibility. At least 3 reviewers voiced out that the software is not flexible enough12 in areas such as:

- Invoice layouts

- Posting journals

- Updating and deleting entries

User Ratings:

G2: 4.4/5 based on 59 reviews13

Capterra: 4.7 based on 25 reviews14

Overview of Airbase

Airbase offers services in processes such as accounts payable automation and expense management.

Pros:

Expense reports. Based on 428 reviews of Airbase, eases and accelerates creating expense records for first-time users. 15

Integration. At least 190 reviews of users of Airbase suggests that software offers integration with accounting and financial management softwares. 16 (Figure 8)

Cons:

- Inefficiencies in mobile application. Reviews show that several users are not happy with the service provided by the mobile application due to crashes and slowdowns. 17 (Figure 9)

User Ratings:

G2: 4.8/5 based on 1380 reviews. 18

Capterra: 4.8/5 based on 54 reviews. 19

Overview of AppZen

AppZen provides AI software that is designed to deliver AP and expense audits for modern finance teams. It offers:

Pros:

Digital Receipt Management. As 11 AppZen users reported, the software offers different ways to quickly digitize receipts. Also, it can automatically read receipts to create entries for expenses report. 20

Better Workflow. Based on 10 reviews, the software is easy to take care of and run. It eases processes regarding timesheets, invoices, and expense reports. 21

Cons:

Integration: At least 4 AppZen users disliked the integration capabilities of the software with expense reports (Figure 10) and other cloud softwares. 22

User Ratings:

G2: 4.2/5 based on 36 reviews. 23

Capterra: N/A

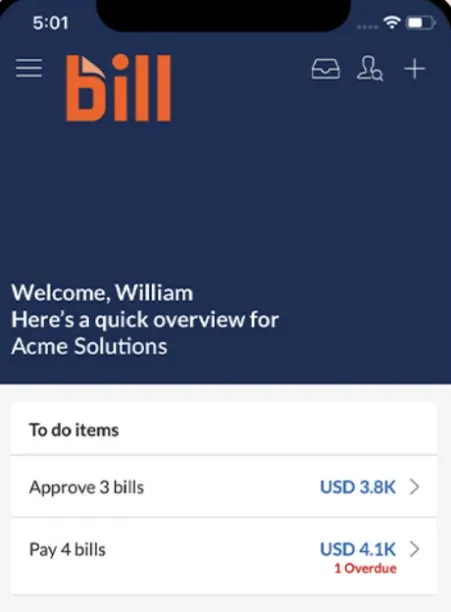

Overview of BILL

BILL, an alternative accounting software to Vic.AI, offers features such as:

- Integration in accounting and payments

- Invoice management

- Invoice processing

- Analytics

Pros:

- The software offers a streamlined bill approval process. Users say the process can be done in any location and saves a significant amount of time.

- Bill offers a feature-rich mobile app, allowing users to handle processes on the go. (Figure 11).

Cons

Customer service: Many reviewers claim that Bill’s customer support is hard to reach and not qualified enough to solve problems.25

Speed: Reviewers commonly suggested that it takes too long to bill and receive payments.26

User Ratings:

G2: 4.3/5 based on 650 reviews27

Capterra: 4.2/5 based on 46528

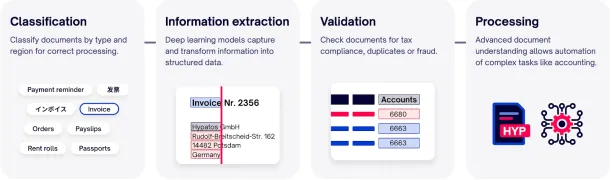

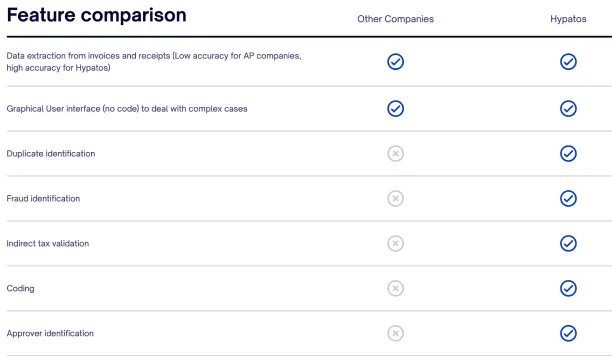

Hypatos Overview

Hypatos is a provider of deep learning technology for document processing and automation. (Figure 12) The company offers solutions in:

- Accounts payable

- Accounts receivable

- Travel & expenses

Pros:

Responsive customer support: Reviewers shared that Hypatos customer support is efficient and reachable.29

For more on Hypatos’ claims of its unique advantages, see Figure 13.

Cons

Implementation time: Some users experienced long implementation times.(Figure 14)

User Ratings

G2: 4.6 based on 10 reviews.32

Capterra: 5.0 based on 11 reviews33

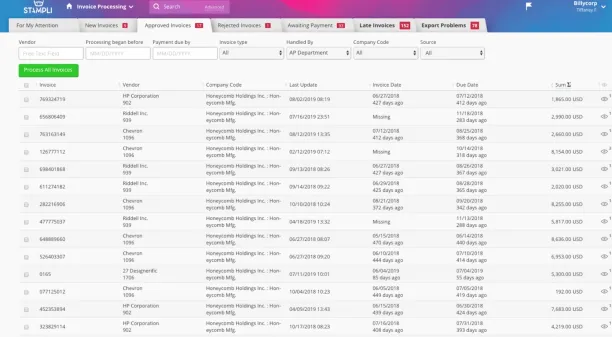

Overview of Stampli

Stampli is an accounting platform, offering accounting services such as invoice processing, invoice management, analytics and more.

Pros:

Collaboration: The tool makes it easier for the accounts payable team, approvers, and vendors to collaborate and work together in one place. This speeds up the process of approving invoices (Figure 15)

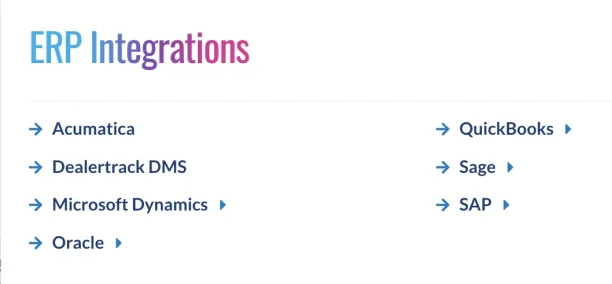

Integrations: Enterprise resource planning (ERP) software is a complete business solution that helps organizations organize, connect, and make data flow between business processes. Including important ones, (Figure 16) Stampli offers integration with 47 ERP accounting softwares.34

Cons

Difficult to use: Some users expressed opinions on how hard it is to sometimes navigate in software.35

User Ratings:

G2: 4.7/5 based on 64 reviews36

Capterra: 4.7/5 based on 14 reviews37

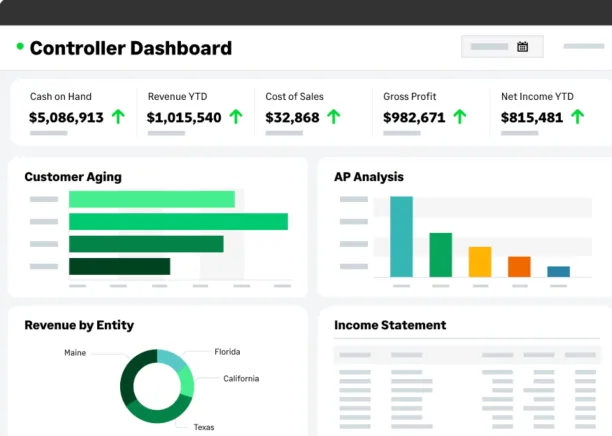

Overview of Sage Intacct

As another competitors of Vic.AI, Sage Intacct is a cloud accounting and financial management software. It offers similar services such as accounts payable and receivable automation, reporting and more.

Pros:

Real-time financial reporting: Sage Intacct’s screens and reporting tools allow you to see how your business is doing and what its financial metrics are in real time. (Figure 17)

Sage solution family: It is part of Sage’s extensive set of software with native integrations to other Sage software. (Figure 18)

Cons:

- Performance problems: Sometimes, depending on the amount of data there the system can run slowly or have other problems.

- Integration: The comprehensive character of the software can also result by disadvantage since the users face with confusion and have hard time to integrate.

User Ratings:

G2: 4.3 /5 based on 2.232 reviews39

Capterra: 4.2/5 based on 374 reviews40

Other solutions

For other solutions analyzed in detail, check:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors in 2023

- 14 Rossum AI Competitors/Alternatives in 2023

If you have further questions regarding the topic, reach out to us:

References:

External Links

- 1. ”PwC US makes $1 billion investment to expand and scale AI capabilities” June 20, 2023. Retrieved on June, 20, 2023.

- 2. ”Vic.AI”June 20, 2023. Retrieved on June, 20, 2023.

- 3. ”Real-time Processing Insights for Finance Teams” June 20, 2023. Retrieved on June, 20, 2023.

- 4. ”ACCOUNTING AI SOLUTION EMPOWERS CLOUD-BASED ACCOUNTING FIRM THROUGH FASTER INVOICE PROCESSING” June 20, 2023. Retrieved on June, 20, 2023.

- 5. ”GLOBAL SCHOOL OPERATOR PROCESSES INVOICES 60% FASTER WITHIN THE FIRST 3 MONTHS WITH AP AUTONOMY” June 20, 2023. Retrieved on June, 20, 2023.

- 6. ”Vic.AI” Retrieved on June 20, 2023.

- 7. ”Vic.AI Reviews 2023” Retrieved on June 20, 2023

- 8. ”Vic.AI Reviews 2023” June 20, 2023. Retrieved on June, 20, 2023.

- 9. ”AccountsIQ Features” Retrieved on June 20, 2023.

- 10. ”AccountsIQ Features” Retrieved on June 20, 2023.

- 11. ”AccountsIQ Reviews” Retrieved on June 20, 2023.

- 12. ”AccountsIQ Reviews & Product Details”. G2. Retrieved on June 20, 2023.

- 13. ”AccountsIQ Reviews & Product Details”. Retrieved on June 20, 2023.

- 14. ”AccountsIQ Reviews.” Retrieved on June 20, 2023.

- 15. ”Airbase Reviews & Product Details” Retrieved on July 3, 2023

- 16. ”Airbase Reviews & Product Details” Retrieved on July 3, 2023

- 17. ”Airbase Reviews & Product Details” Retrieved on July 3, 2023

- 18. ”Airbase Reviews & Product Details” Retrieved on July 3, 2023

- 19. ”Airbase Reviews” Retrieved on July 3, 2023

- 20. ”AppZen Features” Retrieved on July 3, 2023

- 21. ”AppZen Features”Retrieved on July 3, 2023

- 22. ”AppZen Reviews & Product Details” Retrieved on July 3, 2023

- 23. ”AppZen Reviews & Product Details” Retrieved on July 3, 2023

- 24. ”BILL Reviews & Product Details”

- 25. ”BILL Reviews & Product Details”Retrieved on June 20, 2023.

- 26. ”BILL Reviews & Product Details” Retrieved on June 20, 2023.

- 27. ”BILL Reviews & Product Details.” Retrieved on June 20, 2023.

- 28. ”BILL Reviews.”Retrieved on June 20, 2023.

- 29. ”Hypatos Reviews & Product Details” G2. Retrieved on June 20, 2023.

- 30. ”Accounts Payable” Retrieved on June 20, 2023.

- 31. ”Hypatos Reviews & Product Details” Retrieved on June 20, 2023.

- 32. ”Hypatos Reviews & Product Details” Retrieved on June 20, 2023.

- 33. ”Reviews of Hypatos” Retrieved on June 20, 2023.

- 34. ”Accounting Systems & ERP Integrations.” June 20, 2023. Retrieved on June, 20, 2023.

- 35. ”Stampli Reviews & Product Details” June 20, 2023. Retrieved on June, 20, 2023.

- 36. ”Stampli Reviews & Product Details” Retrieved on June 20, 2023.

- 37. ”Stampli Reviews.” Retrieved on June 20, 2023.

- 38. ”Sage” Retrieved on June 20, 2023.

- 39. ”Sage Intacct Reviews & Product Details” Retrieved on June 20, 2023.

- 40. ”212 Software Products” Retrieved on June 20, 2023.

Comments

Your email address will not be published. All fields are required.