ReadSoft, now part of Tungsten Automation, is one of the brands that pioneered intelligent accounts payable automation. However, there are new solution providers that claim to offer higher levels of automation. The nature of services offered in automation, such as:

- invoice data extraction

- line item reading & three-way matching

- customization capabilities

varies according to the approach of vendors and the scale of services involved. These factors can play an important role in the choice of AP automation where there are there are many competitors:

- Accounts payable AI platforms (Stampli, AccountsIQ, AppZen, Vic.AI)

- Tens of Accounts payable software

It can be hard to know which solution to pick. Therefore, we explore some of the best competitors of Tungsten ReadSoft for mid-market and enterprise companies, highlighting their key features and integrations.

Top 10 alternatives to ReadSoft

The table is listed in alphabetical order.

| Vendors | Number of Employees | Number of Reviews | Rating |

|---|---|---|---|

| Basware Purchase to Pay | 1,636 | 130 | 4.1 |

| Emburse | 831 | 5,249 | 4.5 |

| Esker | 556 | 55 | 4.6 |

| OnBase by Hyland | 4,035 | 200 | 4.2 |

| Hypatos | 83 | 83 | 4.8 |

| MediusFlow | 647 | 91 | 4.4 |

| Beanworks AP Automation | 113 | 212 | 4.6 |

| Rossum | 159 | 86 | 4.5 |

| Sage Intacct | 14,149 | 5,026 | 4.4 |

| SAP Concur | 121,379 | 8,699 | 4.1 |

While choosing the top Tungsten ReadSoft alternatives for our analysis, the following metrics are considered:

- Focus area: All of the alternatives fall under the accounts payable software category.

- References: Enterprises require vendors with enterprise knowledge. The vendors we analyze have at least one Fortune 500 reference.

- Reviews: User feedback is tied to the success of a product. While they didn’t play a role in the product selection process, reviews were used to gain additional insights into product popularity and customer satisfaction.

- Number of employees: The market share of a product goes up as the number of employees goes up, and companies with bigger market shares tend to make better goods.

Overview of Tungsten ReadSoft

Tungsten ReadSoft offers automated solutions for document process automation. Its most widely used application is for invoice automation, where it helps organizations streamline the business processes of receiving, processing, and paying invoices. The company was acquired by Kofax in 20141 , and Kofax transformed into Tungsten Automation in 2024.

Capabilities

- Invoice automation: Tungsten ReadSoft’s primary capability is processing invoices. It can handle multiple invoice formats, automatically extract relevant data, and route the invoices for approval and payment.

- Data capture: Using OCR technology, ReadSoft cannot only extract important invoice details, but can also extract data from various types of documents.

Pros

Integration: The software can integrate with a variety of ERP systems, allowing the automated transfer of data and facilitating end-to-end invoice processing.

Workflow automation: ReadSoft can automate many of the steps in the invoice validation workflow, reducing the need for manual intervention. For further pros company claims to have, see:

Improved time and accuracy. A case study on Myhealth Medical Group reveals that the use of software can eliminate problems caused by manual invoice data entry.

Cons

Lacked ability in different fonts: ReadSoft can face trouble in process of reading the non-standart fonts.

Customization limitations: ReadSoft can lack the flexibility and customization needed for their specific use cases.

Hyland OnBase

Hyland’s OnBase software offers services to automate accounts payable (AP) processes and helps accounts payable department workflows cut down on mistakes.

Pros

Invoice processing: A case study on Canal Barge shows that OnBase helped the company improve efficiency in areas of invoice tracking, visibility, and approval. The software offers services such as automatic notification when there is an invoice to approve and automatic capture of invoice data.

Invoice capacity: A case study on North American Mining Company reveals that, with the use of OnBase, the AP department was able to handle higher volumes of invoices with fewer human-resource. When merged with improvement in visibility, the company was able to identify and leverage early-payment discounts and save $5 million annually.2

Cons

Support: OnBase lacks both in-use and customer support. The response times of customer support is criticized.

Complex: In terms of licensing, configuration modules, and setup, the software can be quite complex.

Hypatos

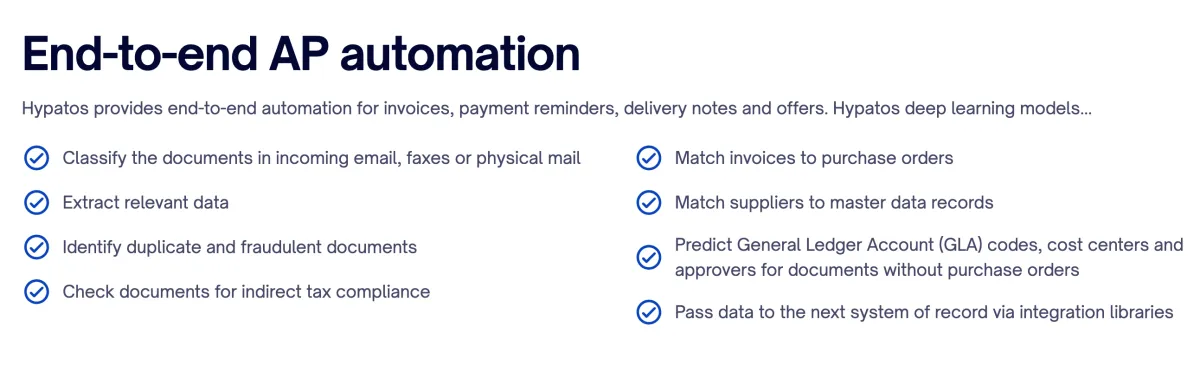

Hypatos offers a deep learning powered end-to-end automation solution for accounts payable.

Pros

Financial efficiency: Companies can miss out on early payment discounts and lose significant amounts of their AP spending on things like duplicate or fraudulent bills that they could have avoided paying for. Hypatos’ AP automation offers to solve situations as such by providing payment reminders, and identification of duplicate and fraudulent documents.

Labor efficiency: Different enterprises may require different data points from documents. For example, an enterprise may want to capture line items of invoices. These items provide the IDs and amounts of what has been bought. Hypatos’ continual learning makes it easy to get new data fields from documents as the model can learn from user input.

Cons

The free trial of the software gives access to limited data.

Medius

Medius is a leading global provider of cloud-based spend management solutions such as automating accounts payable, e-procurement, and other related services.

Pros

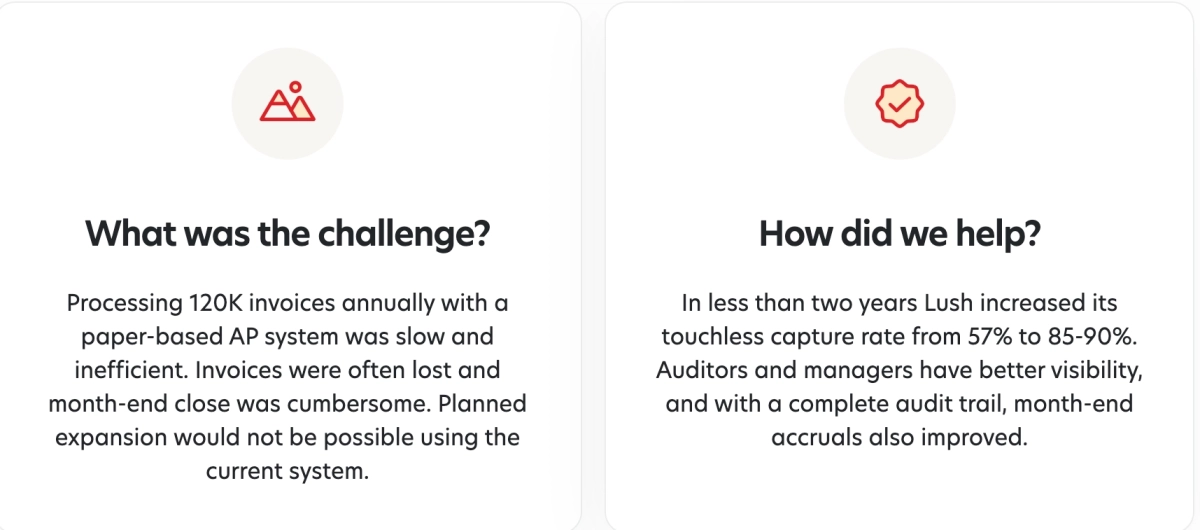

Frees up time for accounts payable teams: Møbelringen, a retail company was operating with a system based on paper. Their AP team had to match bills to POs by hand. Since about 80% of bills were based on POs, this process was too long. Medius’ accounts payable automation solution eliminated the paper-based system and increased the touchless rate which freed the AP team’s time.

Visibility: Medius by allowing audit trails and month-end accruals, allows managers to track invoices better. In that terms, the software helped Lush, a cosmetics company that was having trouble to keeping track of the invoices monthly.

Cons

Slow-downs: In instances where there are large-volume of payments Medius can slow down significantly.

Complex functions: Medius can become overwhelming when using functions such as search function, reporting, and uploading complex details.

Quadient Accounts Payable Automation by Beanworks

Beanworks, acquired by Quadient in March 2021, was the first company to build the platform.3

Pros

Prevents duplicates: Beanworks possess high level of duplicate blocking capabilities.

Integration: Quadient offers a wide scale of integration with other accounting and financial management software.

Mobile use: The software offers mobile solutions with features such as parsing and capturing receipts.

Cons

Unable to handle large numbers: The software is able to handle 80 invoices per page. Large organizations and enterprises might find this number insufficient.

Inefficiencies in approval workflow: When changes are necessary for approval channels, Quadient’s automation capacity may fall short and lead to manual intervention. Making changes can be time-consuming in approval channels also because one-confirmation might lead all the way back to the beginning point on the interface.

Rossum

Rossum is an AI company that offers a platform for extracting data from invoices and receipts.

Pros

Reduced manual document entry: Rossum can nearly eliminate manual data entry. A case study with Kiwi suggests that Rossum contributed to Kiwi’s scalability, by eliminating the need for error-prone and time-consuming process of manual PDF entry. Kiwi’s accounts payable staff used Rossum to process invoices. Moreover, they used software’s interface to pair vendors and cost center records.4

Ease of integration: Rossum can integrate with various ERP and accounting systems. This reduces the need for significant changes in a company’s IT structure. 13 reviews on G2 show that users are happy with the feature.

Cons

Insufficient data extraction: Rossum can face trouble in extracting data from different kinds of documents.

Language issues: Rossum can face trouble in recognizing different languages.

Other solutions

For ERP related solutions analyzed in detail:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Sage Accounts Payable (AP) Automation

For accounts payable AI related solutions:

External Links

- 1. ReadSoft - Wikipedia. Contributors to Wikimedia projects

- 2. North American Mining Company Case Study | Hyland.

- 3. Quadient - Wikipedia. Contributors to Wikimedia projects

- 4. Customer Story - Kiwi - Rossum.ai. Rossum

Comments

Your email address will not be published. All fields are required.