Accrual automation technology has revolutionized the way companies manage their financial records. Instead of relying on manual processes and spreadsheets, businesses can now use intelligent software to automatically recognize and record expenses as they are incurred.

Organizations that have implemented automation in their financial processes have reported significant time savings, with an average of 34% reduction in time spent on manual tasks.1 Moreover, accrual automation technology also brings real-time visibility into a company’s financial position.

Explore key features and tips for implementing and using accrual automation in your organization.

What are the 2 types of accruals?

- Accruals for revenues: Accrued revenue (or deferred income) are recorded as revenues regardless of whether cash has been received.

- Accruals for expenses: Used to recognize expenses when they are incurred, rather than when they are outright paid out.

What is accrual automation?

Accrual automation allows businesses to automatically recognize and record expenses in their financial records as they are incurred, rather than when they are paid.

For example, for an organization using an automated accrual system, the system would automatically recognize and record the sale in fiscal period 1, despite the fact that payment will not be received until fiscal period 2. The same process would apply for expenses incurred in a certain fiscal period, but not set to be paid until a later period.

This ensures that a company’s financial statements will reflect the true economic activities of the organization, regardless of when cash is received or disbursed.

Accrual reporting typically includes:

- A listing of all accruals – expenses – that have been made, including the amount, date, account, and any other relevant information.

- A summary of the total accruals that have been made, grouped by account, period, or other relevant criteria.

- Reports that provide insight into the company’s financial performance, such as income statements, balance sheets, and cash flow statements.

What are the benefits of accrual automation?

Manual accrual is considered inaccurate, time-consuming, and has limited scalability by many business owners.

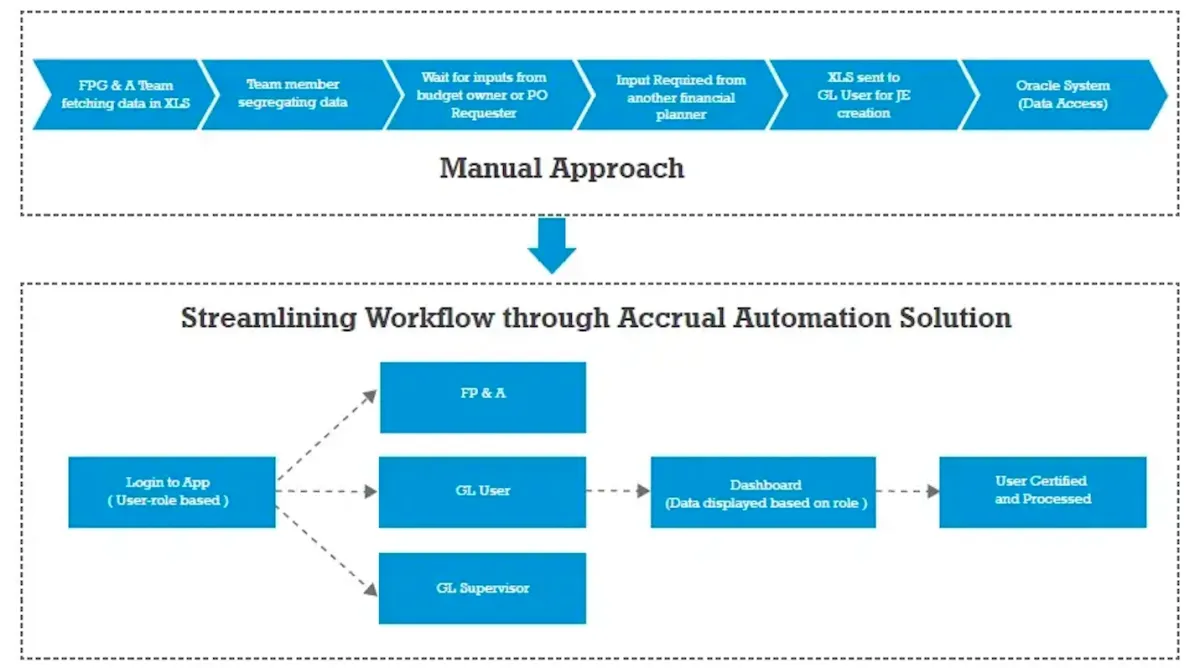

Figure 1. Manual vs. Automated Accrual Workflow Source: RapidValue Solutions

According to Software Advice, the top three reasons cited for implementing accrual automation include:

- Efficiency: Automation can speed up the accrual process, reducing the amount of time and effort required to perform the task.

- Accuracy: Automated systems can reduce the potential for errors that may occur during manual accruals by removing the need for manual data entry and calculations, ensuring that accrued revenues and expenses are recorded in the correct fiscal period’s accounts.

- Scalability: Automation allows for the easy scalability of manual accruals, allowing companies to handle a larger volume of transactions without needing to increase the number of employees performing the task.

90% of accounting teams reported facing significant challenges with their accruals process.2 Accrual automation technology can benefit companies in:

- Achieving complete coverage of accruals by automating the process of contacting all vendors, rather than limiting confirmations to high-risk vendors only.

- Centralizing accrual data by consolidating information from ERP system and confirmations from vendors, creating a comprehensive view of accruals.

- Improving auditability and reducing risk by storing accrual activities in a manner that is compliant with industry standards and suitable for auditor review.

How does accrual automation work?

Figure 2. Accrual Automation Steps

- The software automatically collects data from various sources such as ERP systems, accounting software, and vendor invoices, consolidating it into a single location.

- The collected data is analyzed to identify accruals that need to be recorded, such as unpaid invoices or deferred revenue.

- The identified accruals in the company’s financial systems are recorded, ensuring that they are accounted for in the correct period.

- The software provides real-time visibility into accruals, including accrual balances, and generates various reports like accrual aging reports for management and auditors.

Key features of accrual automation

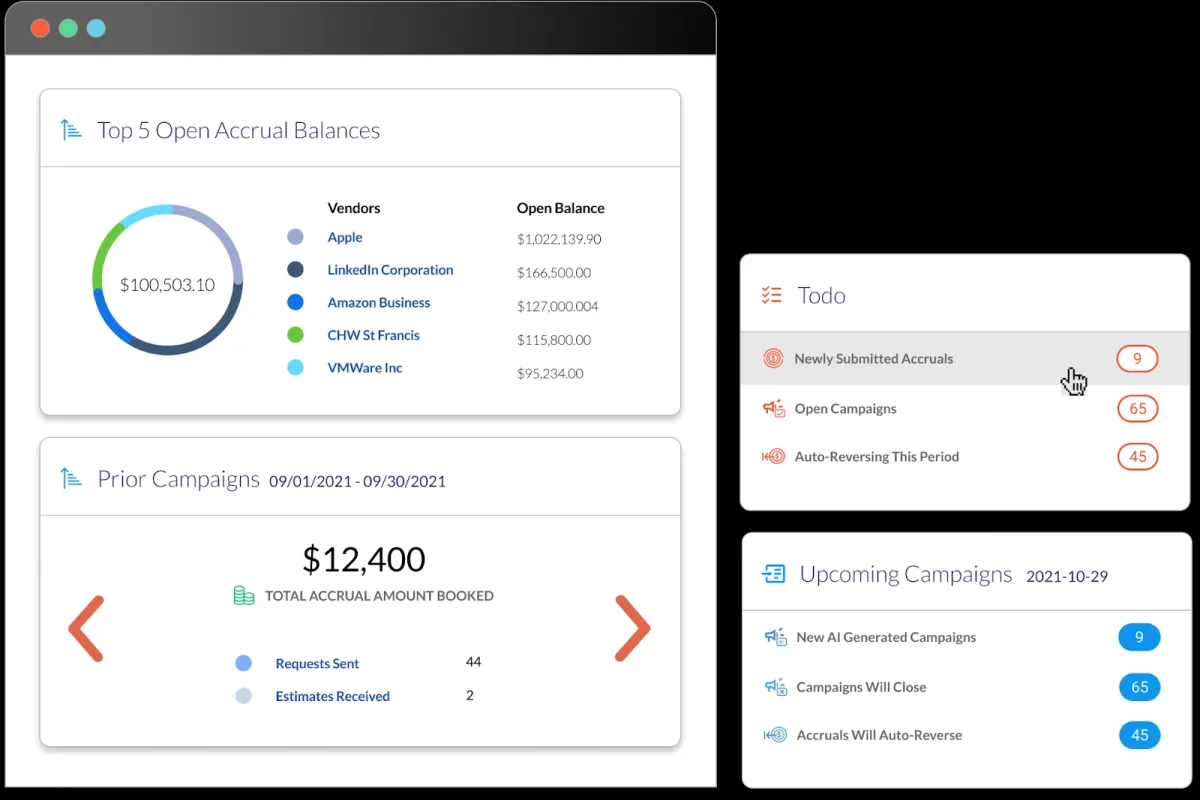

Figure 3. Automated Accrual Tool Demo Source: Accrualify

- Estimated accrual figures can be generated based on open POs (purchase orders) and previous information for every supplier.

- Disintegrated financial transactions are linked by seamlessly matching invoices to estimated figures for accruals.

- A representative can be assigned from either inside or outside the company to a campaign for accruals. These campaigns allow for easy requests for projected accruals.

- Accruals can be associated with multiple accounts for expenses, subsidiary companies, departments, or specific locations.

- The automated accrual roll-forward provides reporting capabilities that enable viewing the balance and fluctuations of accruals across different reporting periods.

- Clutter in reporting is eliminated by automatically reversing projected figures for accruals from one period to the next.

6 points to consider in accrual automation

1. Identify business-specific needs

The specific needs and requirements of the business should be identified, such as

- The types of accruals that need to be tracked

- Any specific reporting or compliance requirements.

2. Ensure seamless system integration

Determining how the accrual automation software will integrate with existing financial systems, such as ERP or accounting software, is significant for ensuring smooth data flow and minimal disruption to existing processes.

3. Use high-quality, structured data

Ensuring that the data used for accrual automation is accurate, structured, machine readable, and complete plays an important role in implementation, as any errors or inconsistencies in the data may result in inaccurate accruals being recorded.

4. Plan for scalability and customization

The software should be customizable and can be scaled up as the business grows by handling the expected volume of transactions.

5. Prioritize data security

Ensuring that the software has built-in security features to protect sensitive financial data and comply with regulatory requirements.

6. Support for regulatory and audit compliance

The controls and reports generated by the solution are tailored to meet the auditory & regulatory compliance requirements specific to the location of the business.

For more on financial automation

To explore different technologies that your business can leverage for AP automation, read our in-depth articles:

- Accounts Payable (AP) Automation Tools Benchmarking

- 5 AI Applications in Accounts Payable (AP) Processes

- 20 AP Automation Case Studies: Analysis of Benefits & Use Cases

- 4 Steps to Automated Payment Reconciliation

Comments

Your email address will not be published. All fields are required.