NetSuite is an ERP system that also offers accounting software including a comprehensive suite of tools in finance automation:

- accounts payable

- accounts receivable

- account reconciliation

Netsuite’s AP automation capabilities, including the automation rates and ease of use of these tools can be improved with add-ons like Pairsoft.

This article outlines how to use Netsuite effectively in AP automation analyzing key features of Netsuite, case studies, reviews and tools with native NetSuite integration capabilities.

Oracle NetSuite overview

It is important for businesses to automate the accounts payable process efficiently to maintain continuous financial operations. Implementation of AP automation accounts for 41% of the incoming agenda of businesses. 71% of AP leaders consider smart systems are a critical factor in influencing AP performance.1

NetSuite Inc., headquartered in Austin, Texas is an American company specializing in cloud-based enterprise software, is one of the leading figures in cloud ERP. In November 2016, Oracle Corporation acquired NetSuite in a deal valued at around US$9.3 billion.

AP features offered by NetSuite, take a quick look at:

AP automation for NetSuite includes:

- accounting and financial management

- customer relationship management (CRM)

- inventory management

- human capital management

- payroll

- procurement

Features & key capabilities of NetSuite AP automation

NetSuite’s accounts payable (AP) system automates:

- supplier invoice management including invoice processing, reviews and approvals

- payments

This automation improves control over the complete procure-to-pay cycle.

Accounts payable dashboard

NetSuite offers a configurable dashboard. Key performance indicators (KPIs), and alerts are also included in the services offered. Through these tools, businesses can track vital information such as open purchase orders (POs), invoices pending approval, due dates for invoices, scheduled payment process, and more.

Vendor records

Netsuite AP automation allows businesses to keep extensive records for each supplier including:

- contact details

- e-mail addresses

- banking information

- purchase orders

- historical payments, and credit memos.

You can also compare received invoiced data with vendor information to identify fraud or mistakes. This functionality is also called vendor or supplier master data management (MDM).

Purchase order automation

Through NetSuite, businesses can monitor purchase requests, and have them automatically forwarded to the relevant managers for assessment. Once approved, these requests can be converted into purchase orders. By matching vendor invoices to purchase orders and receiving documents (i.e. three way match), you can prevent overpayments or duplicate payments & transactions.

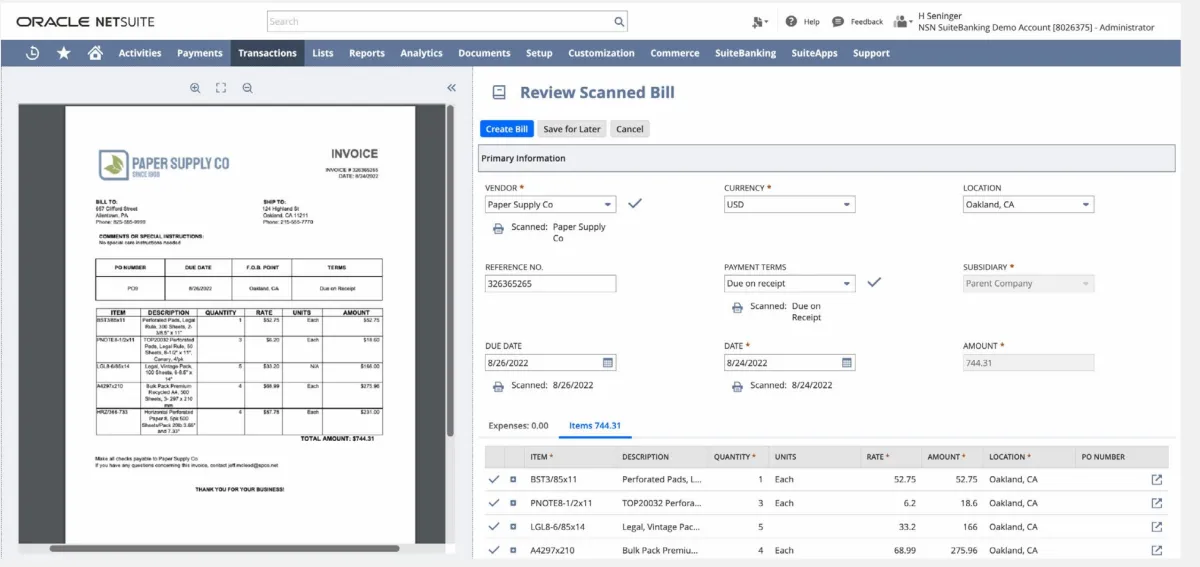

Invoice capture

You can upload digital invoices to NetSuite either by dragging and dropping them or by capturing them through email. These invoices are then scanned, and key details such as vendor name, purchase order number, ordered items, quantities, and prices are converted into digital text. NetSuite uses AI in AP automation to automatically generate a bill record by learning from past data to pre-fill relevant fields. A side-by-side display of the actual invoice and the NetSuite interface can simplify the review & verification process for AP staff, and reduce manual data entry.

Source: NetSuite2

Figure 2. A sample of invoice capture & process on Oracle NetSuite.

Invoice matching & approvals

Vendor invoices are aligned with corresponding POs and receiving documents to verify the accuracy of details such as unit pricing, quantity, and total amounts. These vendor bills are then directed to the relevant staff members for a final review and approval. Automated reminders and a mobile approval application are provided to facilitate application usage.

Payment automation

NetSuite allows arrangement of payments through various methods like cash, check, credit card, or electronic transfer, timed according to invoice due dates, or implementation of custom rules to take advantage of early-payment discounts. You can also set up and authorize recurring invoices for regular expenses like utilities or subscriptions, as long as they meet predetermined limits. NetSuite also provides payment processing services for HSBC clients.

Reports

Businesses can utilize standard AP reports, configurable reporting segments, and saved searches for in-depth analysis across various dimensions, such as expense category, department, location, or any other pertinent criteria. The report allows monitoring payments based on date, status, and vendor.

For overall information and to have idea how the product works, see:

Native integrations

Sponsored: All-in-one solutions such as Netsuite can have shortcomings in several areas such as pricing and ease of use. Add-ons with native integration can simplify the user experience. For instance, PairSoft’s native integration with Netsuite can enhance:

- Document management with end-to-end encryption & search indexing

- Analytics features with downloadable reports

- Simple pricing: NetSuite AP module users need to buy subscriptions for invoice viewers and approvers. PairSoft’s subscription combines support, data and software usage. Therefore, businesses get predictable prices and don’t need to buy subscriptions for users that will only view or approve invoices.

- Freedom of bank choice: Unlike NetSuite AP, PairSoft users don’t have to open an HSBC account to make payments

Additionally, PairSoft can connect other ERP systems with the help of a universal ERP connector.

Pros of NetSuite

Integration: Customers commonly mention the integration and customization capabilities of NetSuite, particularly the benefits of its regarding the accounting system.3

For overall picture on what customers praise about Netsuite, see:

Source: G2

Figure 4: NetSuite Pros.

Cons

Some of the users complained about bad experiences with

For an overall picture on what customers do not like about NetSuite:

Figure 5: NetSuite Cons

NetSuite pricing structure

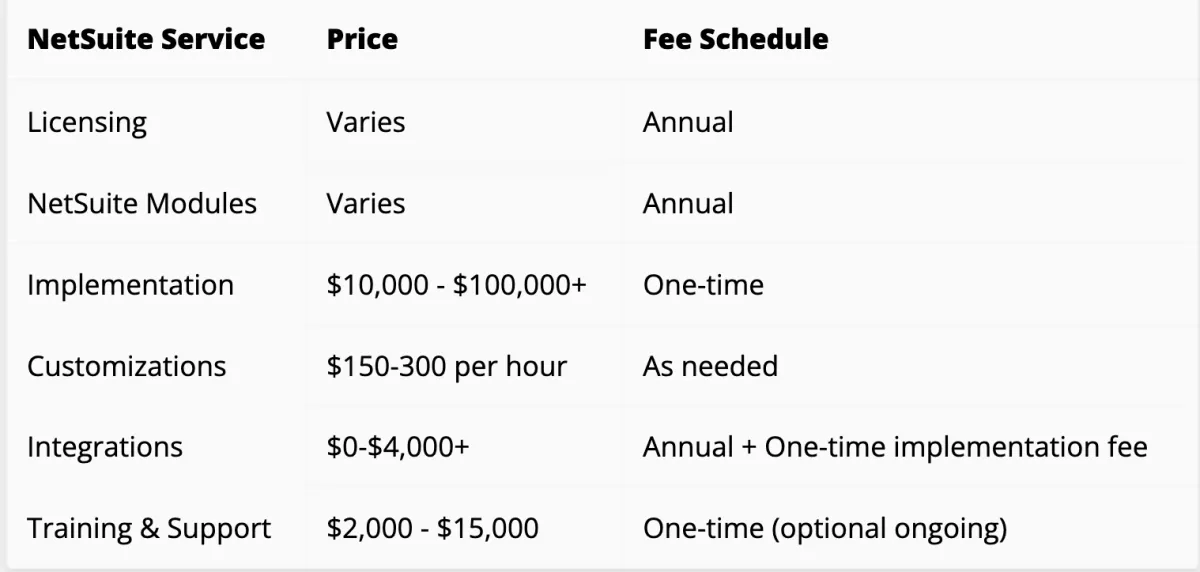

Netsuite doesn’t share its pricing publicly. However, secondary sources state that the starting price for the platform is around ~$100 per user each month, in addition to a monthly licensing fee of ~$1,000. Yet, this base price is just an estimate, and actual expenses may differ considerably.6

According to another secondary source, the pricing is as follows:

Source: SCS Cloud7

Figure 3: NetSuite Pricing

Case studies of Netsuite AP automation

Veckridge Chemical

Veckridge, aiming to transform into a progressive distributor, launched NetSuite in 60 days. Additionally, Veckridge incorporated NetSuite AP Automation to process bills. Now, NetSuite automatically generates a bill upon receiving an order, using the PO data already in the system. The company’s staff have also utilized these tools for tasks such as automatically calculating sales commissions and updating customers on their orders.8

Brex

Brex, having expanded with several subsidiaries including one in Canada, needed an ERP system capable of handling multi-entity accounting. NetSuite OneWorld fulfills this need by enabling Brex to gather data from various business units, establish unified processes, and meet the international accounting and compliance norms.

Additionally, it facilitates cost allocation across different offices, like distributing rent expenses based on headcount, as noted by one of the founders. The founders also emphasize the integration capabilities of NetSuite that brings major components to handle into a singular module.9

T3 Micro Supercharges

T3 Micro aimed to eliminate the need for physical signatures on invoices & guarantee timely payments to vendors. NetSuite allowed the company to establish an automated approval system and accelerate vendor payments. Later, some users found the new system challenging due to its two-factor authentication requirement. NetSuite connected T3 Micro with their partner, Tipalti, whose vendor payment solution effectively resolved the authentication issue.10

Further Reading

- In-Depth Guide to Accounts Payable (AP) Automation

- Accounts Payable (AP) Automation Tools Benchmarking

- 5 AI Applications in Accounts Payable (AP) Processes

- Automated Invoice Validation: Benefits & Use Cases

- Finance Automation: What It Is, Best Tools & 6 Processes

- Enterprise Invoice Processing: 4 Guidelines & 3 Solutions

- 7 Vic.AI Alternatives to Automate Accounting

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors

- 14 Rossum AI Competitors/Alternatives

External Links

External Links

- 1. “ Ardent Partners’ Accounts Payable Metrics that Matter in 2023” Retrieved on January 25, 2024.

- 2. “ NetSuite AP Automation” Retrieved on January 25, 2024.

- 3. NetSuite Reviews 2025: Details, Pricing, & Features | G2.

- 4. NetSuite Reviews 2025: Details, Pricing, & Features | G2.

- 5. NetSuite Reviews 2025: Details, Pricing, & Features | G2.

- 6. Netsuite Accounting Software Review and Pricing in 2025.

- 7. NetSuite Pricing | SCS Cloud.

- 8. “Veckridge Chemical Venerable Chemical Distributor Builds Competitive Edge With NetSuite” Retrieved on January 25, 2024.

- 9. Brex, the Fintech Star, Looks Back on Its Switch From QuickBooks to NetSuite | NetSuite. Oracle NetSuite

- 10. T3 Micro Supercharges its Use of NetSuite | NetSuite. Oracle NetSuite

Comments

Your email address will not be published. All fields are required.