What is the Procure to Pay Cycle? 7 Processes to Know in '24

Procurement is important to the success of any company. Management of materials and services; cost planning, and negotiating the best pricing, purchasing, supply chain management and accounts payable affect practically every facet of a business, from production to customer satisfaction. An organization’s complex workflow from initial need to final payment can be managed using the procure-to-pay procedure.

The procure-to-pay cycle is prone to bottlenecks and inefficiencies because it is complicated and involves different units of the business and stakeholders. Businesses need procure-to-pay suites and APAI solutions that fulfill their complex procurement requirements.

To gain insights on the topic and decide on which solutions to use, businesses need to have in-depth knowledge of the P2P cycle. This article will examine the steps included in the P2P cycle and their importance in businesses’ workflows.

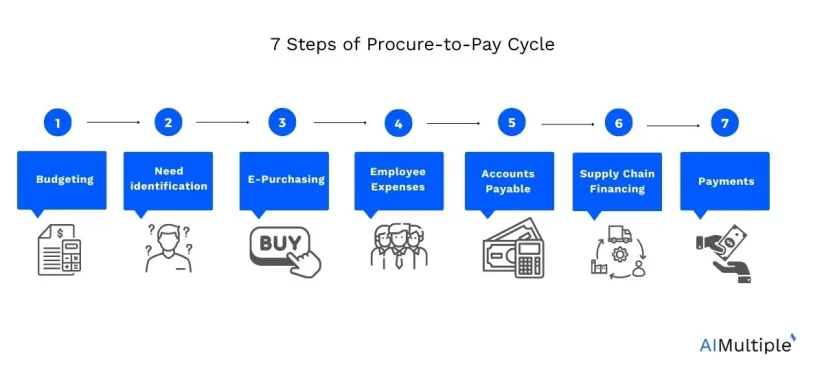

Procure to pay cycle: Process steps

1- Budgeting

Budget management is an integral part of the procure-to-pay (P2P) cycle, guiding all procurement activities. Starting from the very beginning of the cycle with the “need identification” phase to creation of POs, receiving supplies and accounts payable stages, real-time budget tracking ensures financial health of the business and ensures timely payments.

2- Need identification:

Organizations need to identify the goods/services required and allocate a budget accordingly. Leveraging historical transactions, procure to pay solutions can provide forecasting and automation capabilities.

3- E-purchasing:

E-purchasing in P2P cycle includes steps:

- creation of requisition

- Sending purchase orders (PO). This is an optional step as in most companies not every order is accompanied by a PO.

- Receiving goods or services

P2P solutions allow users to create requests for products and services. Following a rule-based approval & verification path, these requests are then approved and transformed into purchase orders (POs). POs can be forwarded to suppliers through multiple mediums like email, portals, or electronic data interchange (EDI). The culmination of this procedure is supplier’s receipt of the order.

4- Employee expenses

Expenditure by employees is part of the procure-to-pay (P2P) cycle and is the focus of employee spend management. These may involve things like travel, meals or supplies. Employees may need to acquire clearance for some expenses before they’re actually incurred and this process can begin as early as the requisition stage. Aside from ensuring that business costs are properly recorded and reimbursed, effective expense management further provides more visibility into spending trends. This may be used to inform future budgeting and policy decisions.

5- Accounts payable

Along with the successful delivery of orders, suppliers send invoices with the detailed information on services/products and the amounts payable. P2P platforms facilitate invoice delivery via multiple mediums as in the delivery of the order.

With the invoice received, rigorous checks are usually in place to validate that the invoice needs to be paid. These can include:

- Matching invoice and PO (2 way match)

- Matching invoice, PO and received goods or services (3 way match)

- Sanctions screening

- Fraud detection

These steps are essential for compliance and aid in avoiding fraudulent or incorrect payments.

6- Supply chain financing (SCF)

Supply Chain Financing (SCF) is a set of financial solutions that optimize cash flow by allowing businesses to lengthen their payment terms with suppliers while providing suppliers the option to get paid early. SCF helps both vendors and suppliers, by providing services like invoice discounting and reverse factoring that both parties can benefit from; businesses can keep the money longer and suppliers can receive quicker payments. Thus, SCF during the P2P phase can improve the cash flow between vendors and suppliers. With the effective use of SCF, better contract terms can be negotiated, working capital can be optimized for both sides, and the supply chain can be more reliable.

7- Payments

The role of payments in the procure-to-pay (P2P) cycle is a crucial one, as it marks the final step in completing the procurement process.

The payment stage ensures that suppliers are compensated for the goods or services provided. It fulfills the contract or purchase order.

Payment systems need to be

- Efficient: Banking and card fees can add up to significant fees

- Auditable: For identifying fraud and running efficient audits, an auditable payment system is a must.

- Fast: To take advantage of early payment discounts and to maximize supplier satisfaction, the payment system needs to complete the payments quickly.

P2P cycle enablers

1- Analytics

Analytics in P2P examines the entire procurement workflow, providing insights into supplier performance, spending patterns, and potential areas for cost-saving or improvements. This data-driven process ensures continuous optimization and informed decision-making for future procurement activities.

2- Workforce management

The goal of workforce management in the P2P cycle is to allocate the human resources effectively in carrying out the various phases of procurement, from need identification to payment processing. To ensure efficiency in the process, it is important to assign skilled workers to the appropriate tasks, such as contract negotiation, supplier management, and invoice processing. When employees are managed effectively, businesses can reduce cycle times and strengthen connections with their suppliers.

3- Inventory management

Inventory management guarantees that the required amount of products or supplies are ordered and stored in a P2P process. In need identification step, the right amount of inventory levels are determined to meet the demand. In creating accurate POs, inventory management continues to be crucial in order to avoid problems of overstocking or understocking. As the orders are received, inventory management systems update in real-time and guarantee that the payments are issued only for products that have been properly received and stocked.

4- Supplier information management

Use of supplier information management (SIM) and master data management (MDM) in the procure-to-pay (P2P) cycle can help with better decision making. A well-managed supplier database aids the procurement process by facilitating the selection of vendors that meet quality, cost, and delivery requirements. To ensure compliance and promote stronger relationships, SIM and MDM systems can monitor and assess supplier performance in real time, as orders are placed and received. The AP process is simplified; errors and fraud are reduced when businesses have up-to-date contact and payment information for their suppliers.

An innovation in this domain is a blockchain technology application to create a transparent, efficient and auditable medium of data exchange between suppliers and buyers. Though this is an emerging technology application, it has the potential to reduce fraud and mispayments.

FAQ

What does a P2P cycle mean?

A P2P cycle is a series of phases that an organization takes to purchase and pay for goods and services. It involves everything from identifying needs to completing the payment process.

Which stages does the P2P cycle include?

The key stages in the procure to pay cycle are:

- budgeting

- need identification

- e-purchasing

- employee expenses

- accounts payable

- SCF (supply chain financing)

Why is the P2P cycle important for businesses?

The P2P cycle is essential for keeping supplier relationships, ensuring on-time delivery of goods and services, and facilitating financial planning.

What are the benefits of automating P2P cycles?

P2P processes automation through procure to pay software such as P2P suites offers benefits such as:

- faster purchase requisition and purchase order creation

- simplified invoice approval

- enhanced AP and purchasing process

- reduced of manual tasks

- improved vendor and supplier relationships

- cost savings

How to automate P2P cycles?

To automate the procure to pay (P2P) cycle, businesses can invest in inclusive P2P suites that manage the entire procurement process. These automated systems streamline everything from budgeting to electronic invoicing, making the entire process efficient and reducing errors. When procurement software fall short, they can be supported by APAI solutions, reinforcing their inclusive character.

By automating procure to pay processes, businesses can optimize different dynamics such as performance of procurement department, purchase requisitions, vendor payment.

For further questions regarding the topic, reach out to us:

Comments

Your email address will not be published. All fields are required.