Three-Way Match Automation: 6 Steps & 7 Benefits in 2024

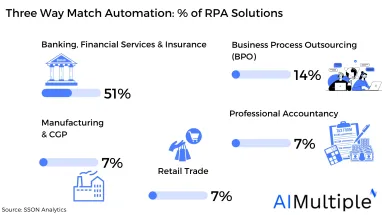

There has been a rise in the adoption of AI technologies in finance and insurance sectors. These sectors are also where RPA technology is seen the most (Figure 1).

Financial processes are suited to automation is because they are rule-based, repetitive, and regimented. The three-way match process, for instance, falls in that category. The process, a subtask within accounts payable, always reconciles the purchase order, the invoice, and the packing slip before making payment.

Thanks to process automation, businesses can streamline their invoice approval and payment process.

In this article, we will explain what the three-way matching process is, the challenges of a manual three-way matching process, and how three-way match automation works.

What is the three-way matching process?

The three-way match is a straightforward process in accounts payable. The AP team compares the invoice, the purchase order (PO), and the goods receipt note to ensure that the:

- Invoice amount is equal to the purchase order amount

- Correct item has been delivered

- Payment should thereby be released

In the case of a discrepancy between these three essential documents, the AP department halts the purchasing process and aims to resolve the issue.

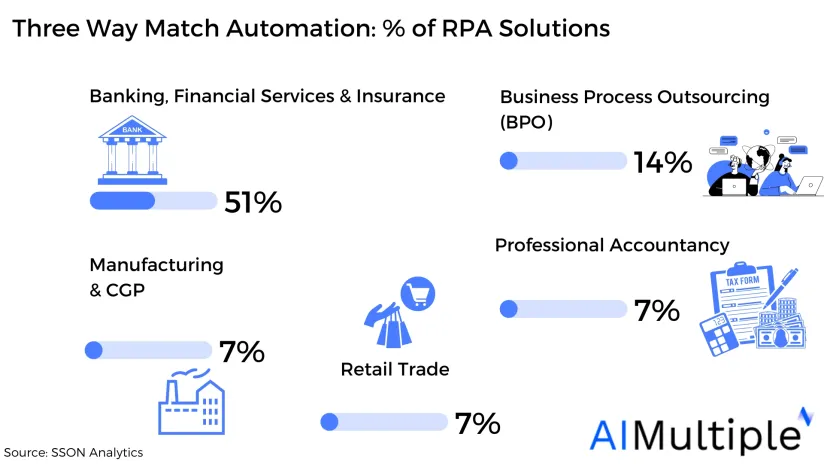

The three-way match process is especially important to small businesses, as they are twice1 as likely as large businesses to receive a fraudulent invoice (Figure 2).

How to automate three-way matching?

The three-way matching process can be automated via AI technologies, notably RPA, OCR, and NLP. These tools will:

- Monitor the company’s email for incoming invoices

- Trigger the matching process

- Reconcile invoices, POs, and delivery slips

- Release the payment process after ensuring that the documents match (thanks to intelligent document processing tools)

The rule-based, internal control process can also flag anomalies and inform the accountants for further approval of unreconciled line items. Most modern accounting software today offer automated 3 way matching process in their stack.

ERP’s with AP automation features can help provide three-way-match automation. We analyzed some of them in-depth:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

6 steps of three-way match automation

1. Receiving invoices

RPA bots can monitor the company’s email for incoming vendor invoices. Once the invoice is captured, its data is then transported and wrangled onto a standardized template.

2. Locating invoices

OCR bots read the invoice content to determine its origin. Once the vendor’s contact information is identified, the invoice will be put in their profile on the CRM.

This step is where the fraudulent invoices, coming from unknown vendors without previous supplier relationships, are sniffed out. Failure to verify invoices results in huge financial losses. In Australia, for instance, 1 in 5 small businesses lose an average of $15.5K to invoice fraud.

3. Matching invoices

RPA bot will crossmatch the invoice number with the PO number. The entries on the two documents are then cross-matched against each other. Points of interest include the payment schedule, invoice price, etc.

4. Flagging exceptions

Via business rules engines, tolerances can be set for exceptions. For example:

- “If the invoice amount is 10% higher than PO’s, stop payment and alert an employee.”

Or if the discrepancy is less than 10%, a partial payment can be made, along with an automated email to the vendor asking to clarify why the invoice price is 10% higher than the PO amount. Finally, if everything is in order, a full payment could be released, pending delivery confirmation.

5. Matching delivery receipt

The last document to match is the vendor’s delivery receipt. Sometimes, goods take longer to be received. If that’s the case, the orchestrator can automatically schedule the workflow to start once the vendor’s GRN (Goods Received Note) has been lodged.

Assuming the receiving report is present, the three-way match processing can be completed between the AP team and the receiving department. In this step, all three documents should have the same information, such as:

- Vendor name

- Vendor contact information

- Price and quality

- Product description

- Payment schedule

6. Payment release

If all details match, payment(s) can be made and the three-way matching in accounts payable is considered done.

NLP and ML algorithms can read the payment schedules on the supplier invoice and the purchase order and arrange the recurring payments.

What is the difference between the two-way match and three-way match in accounts payable process?

In two-way match, you verify both the invoice and the payment order. In three-way matching, the accounts payable team verifies line items on the supplier’s invoice, purchase order, and packing slip.

What are the challenges of three-way matching process?

1. Collaborations

Three-way matching involves collaboration between the:

- Purchasing department

- Warehouse

- Finance department

- Supplier

The high number of agents at play make collaboration difficult and time-consuming. And because three-way matching is sequential, one department’s discrepancy discovery should be flagged in all systems instantly.

2. Human error

Because three-way matching calls 4 different departments to action, false positives should be minimized to avoid operational disruptions in their workflows. For instance, if the warehouse accidentally cross matches an item’s delivery slip with a different item’s PO number, and finds a natural discrepancy, other teams will waste their time enquiring about a non-issue.

3. Delays

In invoice approval process, for instance, the multi-faceted collaboration between teams, and the probability of human errors, can delay the full or partial payment by the AP team. In return:

- The vendor’s cash flow will be negatively affected

- The supplier relationships will be strained

- And early payment discounts will be eliminated

4. Inefficient

In large companies, the accounts payable department processes 640-8002 vendor invoices monthly. This requires an equivalent number of three-way match. The employees’ time could be spent on value-adding tasks, such as to improve payment processes, instead of on manual invoice matching, checking the invoice details, and confirming the order receipts.

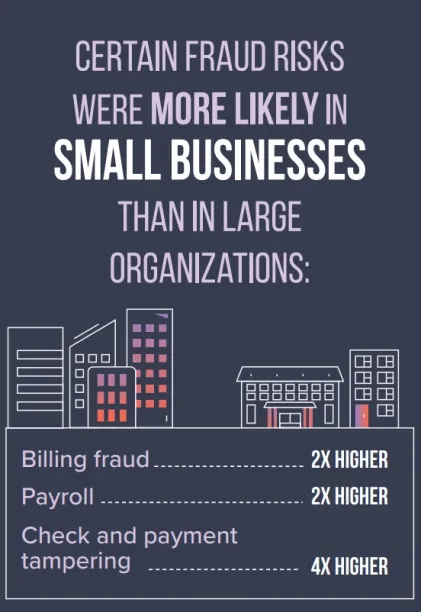

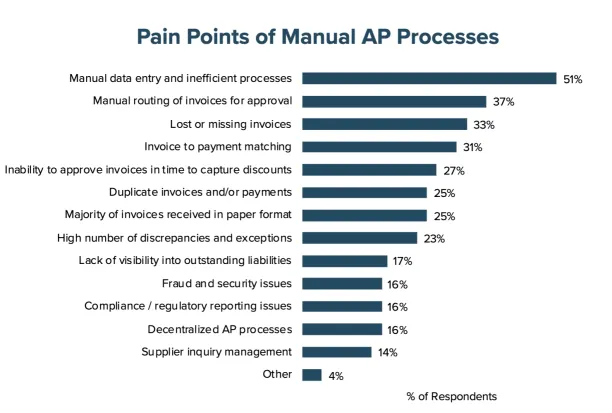

51%3 of respondents believe manual data entry is the main paint point in AP processes, followed by manually approving invoices, lost invoices, and invoice-to-payment matching (Figure 3).

5. Limited scope

The traditional 3 way match process verifies vendor invoice with the corresponding purchase order and the receiving report. Approval of other terms, such as payment details, payment method, or the delivery timeline (if it hasn’t yet been delivered) are as important.

Moreover, solely looking at the current invoice and purchase order receipt tells only half a picture:

- Previous vendor relationships

- Future potential discounts

- Service level agreements (SLA)

- Expiring contracts, etc.

should also be paid attention to.

What are the benefits of three-way match automation in accounts?

The benefits of three-way match automation are mostly the same as automating other financial processes:

- Human error is eliminated

- Fraudulent invoices are detected

- Duplicate payments for the same invoice are avoided

- On-time payments will improve vendor relationships

- Companies can benefit from early payment discounts

- Auditing becomes easier as all documents are accessible digitally

- Companies can reduce the opportunity cost of having their AP teams do a manual matching process

WeWork case study

WeWork, a co-workspace provider, automated 4 their 3-way matching of almost 3,000 invoice payments. Given their global scope, one of their main challenges was determining where the invoice was coming from. The AP automation solution is now integrated into their existing processes, ERP, and CRM systems. This means that as each invoice arrives, intelligent bots read and categorize it in real-time.

Automation has alleviated their need of having 1505 accounts payable specialists in their AP team and is helping them save money: prior to automation, each invoice reconciliation cost them $20-24.

For more on FinTech

If you want to learn more about other financial processes that are being automated, read:

- KYC Automation: 5 Technologies That Increase Transparency

- Top 4 Benefits & Use Cases of Asset Management Automation

- How Can Automation Help Your Order to Cash (O2C) Process?

If you believe you’re ready to automate a financial process in your business, we have data-driven of FinTech solution providers.

We will help you in your vendor selection process:

External Links

- 1. “Report to the Nations.” ACFE. 2020. Retrieved on December 19, 2022.

- 2. “How many Invoices can be Processed in a Day?” AmyGB. August 12, 2022. Retrieved on December 19, 2022.

- 3. “2020 Payable Insight Report.” Endava. April 1, 2020. Retrieved on December 19, 2022.

- 4. “Automating AP and enhancing Workday Procurement across 18 countries.” Order. Retrieved on 19 December, 2022.

- 5. “3 Reasons Your Company Needs 3-Way Matching Automation.” Order. June 29, 2021. Retrieved on December 19, 2022.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.