Accounts Payable Process in '24: 8 Steps, Challenges & Tools

Accounts payable is one of the most important links in the chain of financial operations of every business. Also as an essential element of P2P cycle, an efficient AP is important for:

- cash management

- customer experience

- vendor relationship

Maximizing the efficiency accounts payable process with the automation is an important agenda for the business. For instance, an IDC’s report shows, 70% of AP teams in mid-sized businesses enter vendor invoice data manually.1 The first step in making the AP process efficient is to understand the components of the process. In this article, we will help you to have an idea about the subject by explaining the components of the AP process in detail, providing challenges, and accounts payable tools

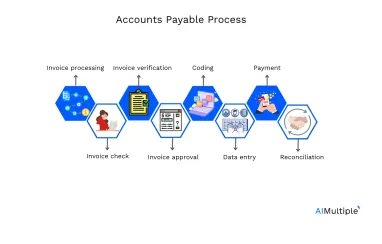

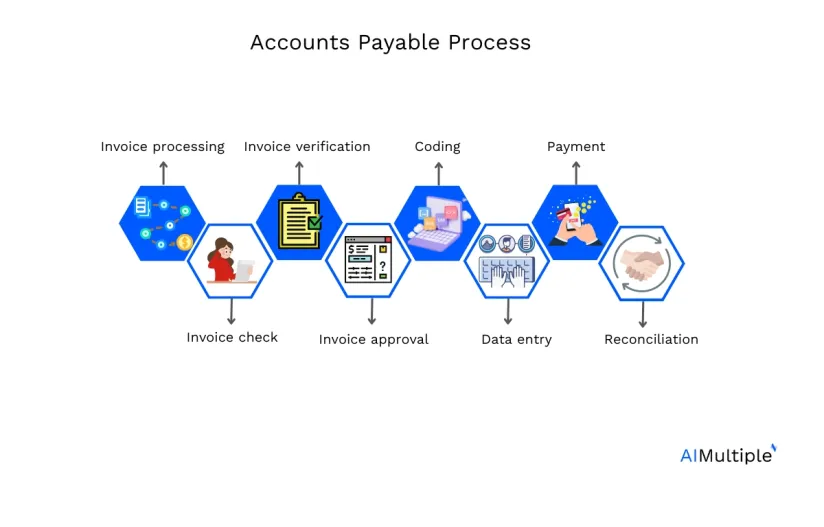

Full cycle of accounts payable process: 8 steps

Full accounts payable cycle includes steps such as invoice receipt and approval to vendor payment, managed by the accounts payable department. The process facilitates an effective management of financial transactions.

1. Invoice processing

The first part of the AP process invoice processing and consists of 3 major parts:

- invoice receipt and checking process

- invoice verification

- invoice approval

2. Checking the invoice

The first thing the AP department does is to make sure the invoice has all the necessary information such as the vendor’s name, the date, a unique invoice number, description of what was bought or the service provided, the amount due, and payment terms.

3.Verification

The team then compares the details on the invoice with the company data. If there was a purchase order (PO) issued for the purchase, they check that the line items, quantities, and prices on the invoice match what’s on the PO. They also make sure that the goods or services were actually received or provided. Thus, this matching process can be either 2 or 3 ways. This process often refers to a delivery receipt or a confirmation from the person who requested the purchase.

4. Approval

Once it is verified, it needs to be approved for invoice payments. This usually involves someone in authority, often a manager or department head, who checks that the purchase was necessary and that everything matches up.

For more on invoice processing:

Figure 1.

5. Coding

Coding involves assigning a specific code to an invoice that links it to a particular budget or cost center within a company. This step determines where the expense will be recorded in the company’s financial flow. First, the AP department receives the invoice and prepares it for processing. Later, the department identifies the type of expense coded in the invoice.

Each expense account corresponds to a specific category in the company’s database. Thus, the department selects the account code the expense type belongs to. Later, this code is assigned to the specific invoice. This way, tracking the expense & data entry becomes much easier.

6. Data entry

After coding, the invoice is ready for the data entry process. Simply put, in the accounts payable process, this means inputting the details of an approved and coded invoice into the company’s database.

The process starts with gathering all necessary details from the invoice, such as the vendor name, invoice number, amount, and the specific budget code it’s linked to. Then, the AP department uses the company’s financial database to input these details. After a thorough check to confirm everything is correct, the data is saved and updated and finally the company’s accounts reflect the new amount owed to the vendor.

7. Payment

Payment in accounts payable process is divided into two major sections.

Payment scheduling

Payment scheduling is a process where a company decides on the timing to settle an invoice. Two aspects are important in this process:

- the vendor’s payment conditions

- company’s financial status

First, the company examines the terms agreed upon with the vendor. This process mainly typically includes a specified timeframe for payment and post-invoice receipt. Next, the company checks its financial strength to make sure paying this bill won’t stop it from covering other expenses. Using the necessary data, businesses pick a payment date that meets the vendor’s deadline and works with its budget.

Payment authorization & execution

When it’s time to settle an invoice, a business first selects the most suitable payment method, which could vary from:

- issuing a check

- executing a bank transfer

- using a credit card etc.

The method of execution depends upon the agreement between the vendor and the company. After the execution of payment, the company records this in its financial books. This step shows that the final payment is done and lowers the money owed by the companies and helps businesses to keep track of money accurately and make sure all spending is noted.

8.Reconciliation

After a payment is made, the accounts payable team first compares the payment details on the company’s bank statement with their own records of the payment & regarding data. This step, called reconciliation, is like double-checking to ensure the amount paid matches exactly what was intended and that it went through correctly. This helps businesses to prevent mistakes or fraud.

Challenges regarding AP process

The accounts payable (AP) departments struggle with numerous tasks, often manual processes such as managing cash flow, handling physical invoices, entering data, and verifying payment due dates. The departments also face several hurdles such as:

- the risk of duplicate payments or entries

- misplacement of vendor invoices

- inefficient approval protocols

- inaccurate balance sheets..

These challenges can get worsened by broader organizational issues like outdated technology, limited personnel, insufficient planning etc. Issues such as invoice discrepancies and the potential for fraud can make things even more complex. The AP process depends on a functioning interplay of various components. Any minor disruption can lead to unwanted issues such as missed payments.

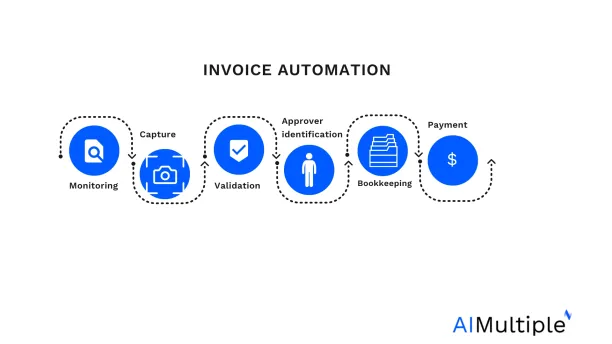

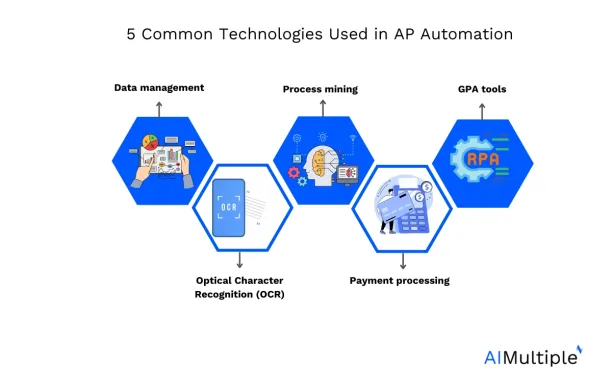

Accounts payable process automation

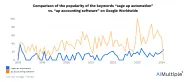

Figure 2.

Businesses need AP Automation because as they grow and handle more transactions, managing accounts payable gets more complicated and demands more resources. Automating this area can speed up the process, free up staff for more complex work, and cut down on mistakes. Common technologies involved in AP automation are:

- Data management

- Optical character recognition (OCR)

- Machine/deep learning

- Payment processing

- General purpose automation tools like RPA

Common benefits of AP automation

With automation, the time it takes to process payments can drop significantly. For example, an automated system might take only 4 days to complete a payment cycle, compared to 17 days with manual methods.2

Automating can also save money by cutting out manual tasks, choosing the best vendors, preventing repeat payments, and grabbing early payment discounts.

Errors are common when invoices are handled manually, leading to repeated payments. Automation helps avoid these mistakes, making the process safer.

Manual accounts payable systems, often based on paper, make it harder to spot fraud since it’s difficult to track what’s happening. Automation can spot suspicious supplier invoices, reducing the risk of fraud from within the company or from suppliers.

AP automation tools

For a detailed comparison of these AP automation tools, check out our vendor selection guide.

Other solutions are:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

- 7 Vic.AI Alternatives to Automate Accounting in 2023

- Top 10 ReadSoft Alternatives / Competitors

- Top 10 Kofax Alternatives/Competitors in 2023

- 14 Rossum AI Competitors/Alternatives in 2023

What else to consider for an efficient AP process?

Tracking KPI

Tracking key performance indicators (KPI) in accounts payable can be important for achieving a stable process. The metrics include:

- Invoice processing time: This measures how long it takes from receiving an invoice to completing its payment.

- Cost-per-invoice: This calculates the total cost involved in processing each invoice, including labor and technology costs.

- Error rate: This tracks the percentage of invoices that contain errors and need reworking.

- Electronic invoice ratio: This measures the percentage of invoices processed electronically versus paper-based invoices.

- Vendor payment accuracy: This assesses the accuracy of payments made to vendors, ensuring the correct amounts are paid on time.

- Discount capture rate: This looks at how often the company takes advantage of early payment discounts offered by vendors.

Vendor management

Vendor management involves negotiating terms that meet the business’s needs, such as payment schedules, prices, and delivery timelines. Maintain a direct & clear communication with vendors about payment terms, invoicing requirements for an efficient accounts payable process.

Compliance

A weak internal auditing & control can result by paying fines. This can easily result in disruption of the AP process. Thus, businesses should regularly check for any changes in the laws that apply to how invoices should be processed and payments made.

Further reading

- In-Depth Guide to Accounts Payable (AP) Automation in 2023

- Accounts Payable (AP) Automation Tools Benchmarking in 2023

- 10 AI Applications in Accounts Payable (AP) Processes for 2023

- Automated Invoice Validation: Benefits & Use Cases in 2023

- Finance Automation in ’23: What It Is, Best Tools & 6 Processes

External links

External Links

- 1. “Digitizing Accounts Payable and Receivable Boost Efficiency and Enable Growth”Retrieved on February 27, 2024.

- 2. “Five benefits to automating your accounts payable process”Retrieved on February 27, 2024.

Comments

Your email address will not be published. All fields are required.