Top 5 Benefits of Journal Entry Automation in 2024

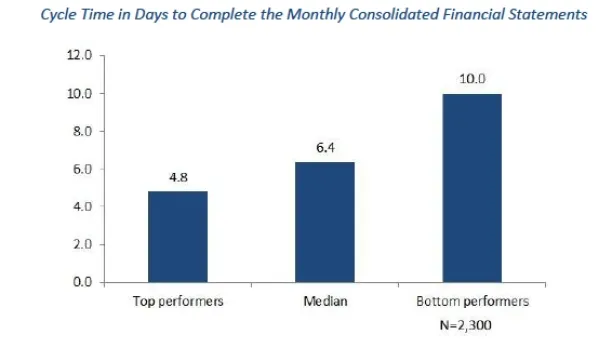

According to a research done by APQC, a “moderately efficient” firm closes its accounts in ~7 calendar days (Figure 1).

Journal entries can take up half of the close cycle because of their error-prone and lengthy nature.1 But they shouldn’t be rushed either, as journal entries are the groundwork for the succeeding steps in the close checklist, such as reconciling the balance sheets.

So inaccurate journal entries could put the whole close in jeopardy.

Journal entry automation can speed of journal entries, and consequently, the financial close process. In this article, we plan to explain in detail how manual journal entry hurts businesses, and why leveraging an automated solution is the way forward.

What are the challenges of manual journal entries?

The following are the downsides a company faces if its workforce are manually entering data into the journal:

1. Time-consuming

Especially if the company is large, with multiple departments and a large volume of transactions, it will take time for accounting teams to sort, identify, verify, and enter each and every transaction.

The average wage of accountants is $200/day. They are an expensive and skilled part of the workforce, who could be spending their time tending to more crucial accounting tasks, such as processing taxes, instead of wasting their entering numbers in a journal.

2. Manual errors and poor journal quality

The close period is short and pressurizes accounting teams. Fatigue and stress can lead to entry errors, which lowers the quality of the journal.

A typical employee makes 118 mistakes/year, and wrong data entries cost the U.S. economy alone $3.1T. Accounting teams will be forced to go back and re-adjust what they’ve done in the previous steps, which could cause them to miss closure deadlines and incur penalties, not to mention the opportunity cost of lost wages for the employer.

3. Approval issues

Some transactions may necessitate a reverse entry or cancellation. For example, a wage accrual in liabilities in one month should be translated into a decrease in cash balances the following month, and the transaction should be reversed after the payroll is finalized. This is why some charges must manually be referred to the appropriate staff for approval. This back-and-forth will further drag out an already lengthy procedure.

4. Fraud

Chaos in the process can provide a wrongdoer appropriate cover for cooking the books. These small changes might go unnoticed in the heat of the moment, but can ultimately result in the destruction of a company’s reputation and ceasing of operations.

In 2020, China-based Luckin Coffee was penalized $180M because of accounting fraud charges, which included misstating revenue, expenses, and net operating loss, all of which stem from incorrect journal entries in the general ledger.

5. Posting

Before the financial statements are prepared, the definitive version of journal entries should be transferred onto the general ledger. This, too, necessitates precision and ample time to accurately complete.

What is a journal entry automation software?

Automated journal entry solutions are able to automatically, and in real-time, thanks to RPA and orchestration tools, input the transactions on to the journal, adjust the entries, and alert the teams when manual interventions are needed.

What are the benefits of journal entry automation?

Leveraging an automated solution for making entries in the journal has the following benefits:

1. Transparent

Because all entries are made by software bots that get the data from electronically-submitted invoices, the possibility of misstatements is minimized. Moreover, the bots log events and create audit trails for financial and tax auditors by preserving all journal entry documents to a centralized cloud-based storage space.

2. Integratabtle

Automated solutions have the capability of being used on top of existing financial management and ERP systems. This will mean that accountants can be assured all transactions that a company makes to personnel, vendors, or outsourced contractors will be logged into the solution.

3. Real-time data entry

All data being logged in real-time means that means that when the accountants review the diary at the end of the month, they’ll find that all of the data they require has been steadily recorded there during the month.

4. Quick interdepartmental referrals

As previously stated, some transactions must be approved by the personnel who performed them, so the entries can be reversed if necessary. Automated solutions enable for the real-time referral of those transactions to the appropriate employees, ensuring that they don’t pile up at the end of the month and become a pain for the accounting staff.

5. Real-time oversight

Cloud-based accessibility to the software means accountants can view in real-time the status of all entries going through, being verified, and recorded. So if some entries need to be reviewed, or if they fail to go through, the software will send them a push-notification.

For more on financial close

If you are interested in learning more about how automation can help your financial close, we have prepared some articles for you to read:

- Top 6 Best Practices for Financial Closing

- Automate Your Financial Close Checklist

- 5 Benefits & 3 Challenges of Financial Close Software

We also have a list of data-driven list of financial close automation software vendors. Go through them, and we will help you pick the best one for your business’ accounting department.

External links

- 1. “What is journal entry?”. Redwood.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.