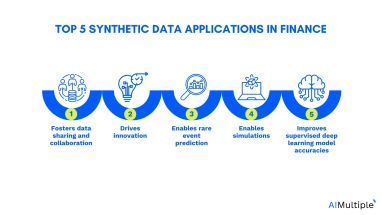

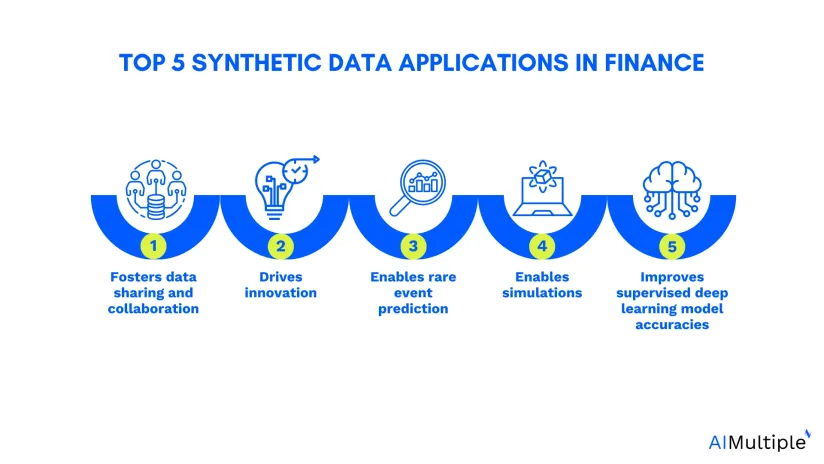

In my eleven years of academic and professional experience, I observe that artificial intelligence has a diverse set of applications in financial services from process automation to chatbots and fraud detection. Financial institutions can leverage synthetic data, or data that is generated artificially based on real data, to overcome privacy (and other) challenges and provide innovative products and services to their customers.

Explore synthetic data finance use cases, benefits and real life examples in financial institutions:

1. Enables data sharing and collaboration

Regulations such as GDPR and CCPA may prevent sharing of financial data both within a company and between institutions. This can hinder valuable collaborations between financial institutions and fintech partners or between teams within an institution.

Providing access permits to third parties can either take months of bureaucratic procedures or it may not even be possible. This makes it hard for a financial institution to evaluate potential partners before developing new products.

Anonymizing sensitive data with traditional data masking techniques before sharing can be susceptible to linkage attacks. These attacks aim to re-identify individuals from an anonymized dataset often by combining it with other publicly available datasets. 87% of the US population can be uniquely identified by combining their gender, birth date, and zip code.1

Synthetic data can eliminate the risks of sharing. Instead of the original dataset, financial institutions can share synthetic data that preserves the important characteristics of the original dataset. Synthetic data generation techniques can be applied to a wide range of data types, from tabular to time series and artificial images.

Real-life example

SIX, a financial institution, struggled with data access due to strict privacy regulations and data silos, limiting data-driven insights. Using a platform that generates synthetic data with privacy-preserving techniques, SIX created secure datasets that maintain the original data’s statistical accuracy.

This allowed SIX’s teams to run predictive models and analyses while complying with regulations, enabling faster insights and secure collaboration. This use case demonstrates how synthetic data can help financial institutions overcome regulatory hurdles, enhance collaboration, and drive competitive advantage.2

2. Drives innovation

The finance sector, with its strict data privacy and compliance standards, often struggles to fully utilize data analytics due to concerns over sensitive information. Synthetic data offers a way forward by enabling financial institutions to simulate realistic scenarios, such as transaction patterns and market movements, without using real customer data.

This not only meets privacy requirements but also allows institutions to test and train machine learning models for use in areas like fraud detection and anti-money laundering.

With synthetic data, banks and financial firms can more effectively analyze patterns, conduct stress testing, and enhance security while managing risks. This approach supports digital transformation and enables the development of innovative solutions across the industry, driving performance without compromising customer data.

3. Enables rare event prediction

Detection of fraudulent transactions is one of the major applications of machine learning in finance. However, a bank transaction dataset that contains fraudulent activities is typically imbalanced: fraudulent activities constitute a small percentage of all activities. It makes challenging for an ML model to learn from this type of dataset to detect new occasions of fraud because small data size can lead to inaccurate results.

Techniques for event prediction

Undersampling and oversampling are two techniques for handling imbalanced datasets.

Undersampling involves removing non-fraud observations to balance the dataset. It requires the dataset to be large because removing observations can create bias.

Oversampling, on the other hand, is generating new artificial instances of fraudulent activity that resemble real fraud. The ML model can then be trained on the balanced dataset to achieve more accurate results. Synthetic data generation techniques can be used to create artificial instances of fraud to obtain a balanced dataset.

Use cases of event prediction

Anti-money laundering (AML) behaviors

Synthetic financial data helps institutions simulate complex anti-money laundering (AML) behaviors to identify patterns and reduce false positives. By analyzing synthetic datasets, financial institutions can develop AI models that learn from historical data to predict suspicious transaction behaviors without exposing original sensitive data.

This approach supports enhanced AML compliance and accurate fraud detection in sensitive financial transactions.

Customer journey events

Synthetic data generation allows banks and financial organizations to examine rare customer journey events across accounts and transaction types, improving insights into uncommon behaviors. By training machine learning models on synthetic datasets that replicate rare customer actions, institutions can better evaluate and understand the impact of these events on risk and customer satisfaction.

Markets execution data

In financial markets, rare market execution data events can impact decision-making and expose vulnerabilities. With AI-generated synthetic data, institutions can replicate historical market events and generate new scenarios for testing model performance. This helps institutions stress test their systems under simulated market conditions and improves risk management practices while maintaining customer privacy.

Payment data for fraud detection

Synthetic datasets are invaluable for simulating rare payment fraud cases, enabling financial institutions to test and refine fraud detection systems. By using synthetic data for fraud detection, financial organizations can effectively train machine learning models to identify patterns in fraudulent transactions and enhance their capabilities for handling emerging fraud scenarios, supporting robust security and transaction monitoring.

4. Enables simulations

Sometimes, financial institutions may want to test strategies under extreme conditions, such as market crashes or app failures. Rather than having an imbalanced dataset of such events, they can lack the data arising from these conditions. Synthetic data can be used to fill these gaps and can help organizations develop strategies against these kinds of events.

5. Improves supervised deep learning model accuracies

Most of the machine learning models and especially deep learning models are data-hungry. Even if a financial institution does not lack data to train an ML model, the accuracy of ML models considerably depends on data size. Synthetic data can be used to increase data size.

In addition to increased data size, labeled data is another advantage of synthetic data for model accuracy. This is especially relevant for supervised learning applications since these types of models learn from labeled data.

Data labeling is a labor-intensive process and manual labeling is prone to errors, which can cause model inaccuracies. Synthetic data comes with correct labels for observations, eliminates the necessity of data labeling efforts, and gives way to more accurate ML models.

Why synthetic data finance is used?

The estimates show that aggregate potential cost savings for North American banks from AI applications would be $70 billion by 2025.3

However, some of these applications have their limitations because financial data is one of the most sensitive and personally identifiable data types. To illustrate, 87% of Americans consider credit card data as moderately or extremely private.4

The same figure is 68% for health and genetic data and 62% for location data. Financial institutions can use synthetic data—artificially generated data modeled on real-world information—to address privacy challenges and unlock new possibilities for developing innovative products and services for customers.

Challenges and considerations

Synthetic data offers many benefits, but it also comes with challenges. It is still a developing technology, and few experts specialize in it. Financial institutions need to be aware of key obstacles before adopting it.5

Accuracy & reliability

Synthetic data must closely match real financial data to be useful. This requires advanced models and ongoing validation. Financial institutions must carefully test their synthetic data or work with a vendor that automates this process.

Regulatory compliance

Laws and regulations around data and AI are constantly evolving. Financial institutions must collaborate with regulators to ensure their synthetic data practices meet compliance standards.

Privacy and security risks

While synthetic data is designed to protect privacy, misuse is still possible. Institutions must apply strong data protection measures to reduce risks.

Ethical and legal issues

Using synthetic data raises ethical and legal concerns. Financial institutions must ensure their practices follow laws and ethical guidelines.

As synthetic data technology improves, its role in finance will grow. Understanding these challenges is key to ensuring safe, compliant, and ethical use while driving innovation.

If you want to learn more about synthetic data, check our other articles on the topic:

- Synthetic data: Pros, Cons, Case studies & AI Applications

- Synthetic Data Generation: Techniques, Best Practices & Tools

- 26 Synthetic Data Statistics: Benefits, Vendors, Market Size

If you are looking for synthetic data generation software, check our data-driven, sortable/filterable list of vendors.

External Links

- 1. Sweeney, L. (2000). Simple Demographics Often Identify People Uniquely.

- 2. Unlocking new possibilities in banking and finance with synthetic data. Syntheticus. Accessed: 11/1/2024.

- 3. AI in Banking. Institute for Development and Research in Banking Technology. Accessed:11/01/2024.

- 4. De Montjoye, Y. A., Radaelli, L., Singh, V. K., & Pentland, A. S. (2015). Unique in the shopping mall: On the reidentifiability of credit card metadata. Science, 347(6221), 536-539.

- 5. Synthetic Data Applications In Finance. Forbes

Comments

Your email address will not be published. All fields are required.