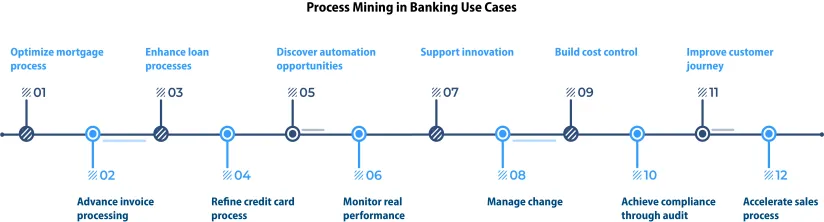

Process mining in banking can manage and optimize the bank product processes, improve key performance indicators (process KPIs) and increase customer satisfaction by discovering automation opportunities, managing the change and complying with regulations.

Process mining can assist banks to automate bank functions and manual lower-value tasks, which 10 to 25% of banks are expected to adopt in next few years.1

Explore top real-life use cases and case studies of process mining in banking sector.

1. Optimize mortgage process

Process mining can help banks to optimize mortgage processes by discovering repetitive steps and reworks. Thus, process mining provides insights to optimize banking operations and communication flow (e.g. communication flow between all branches & headquarters) involving mortgage process.

Real-life examples

In a process mining case study, an anonymous bank investigated their mortgage approval processes and found out that delays in the approval processes are related to the communication problems between front and back-office. Consequently, the bank prepared a new strategy to organize the work and communication flows across these offices.

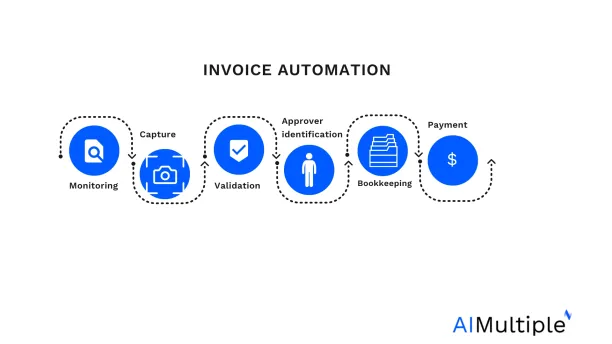

2. Advance invoice processing

Process mining can be employed to discover and visualize invoice processing in order to detect the deviations in invoice process flow. Process mining also provides insights on root causes of these deviations.

Another issue process mining helped detect was the exclusion of dispute status in the invoicing process. Invoices that were correctly registered received a “dispute” status, but these disputes were not considered part of the invoice flow and lacked a clear deadline. As a result, employees would delay processing disputes based on their workload. By incorporating the dispute into the process and setting a deadline, invoices were prioritized, addressing the delay problem.

Real-life example

In a real-life process mining example, a Dutch multinational banking and financial services company implemented process mining to invoice processing in order to detect the bottlenecks in the invoice payment delays. The findings showed that employees lose time by doing tasks manually (e.g. writing reminder emails) which can be automated.

3. Enhance loan processes

Process mining can help banks discover issues in loan processes, which are complicated process as they run through multiple systems. By discovering workflows in loan processes, financial institutions can manage loan processes and take actions to decrease the high lead time problem.

Real-life examples

For example, Piraeus Bank analyzed their loan processes and detect variations in the application processes. Therefore, they shortened their application processes from 35 minutes to 5 minutes on average.

4. Refine credit card process

Process mining can help banks with card issue process analysis to find bottlenecks and time consuming activities.

Real-life example

For example, a process mining case study from KB Card (South Korea) show that firm defined improvement points by analyzing card issue delays, work efficiency per employee and optimum task amount for the departments.

5. Discover automation opportunities

According to process mining trends, organizations used process mining software as an automation enabler by 25% in 2022. Process mining enables banks to understand the multi-level processes that include interactions among employees of front and back offices. By doing so, the financial institutions can identify areas where they can automate to increase efficiency, such as repetitive tasks and human error-prone activities.

Moreover, process mining can streamline deployment of robotic process automation (RPA) by revealing insights about the ongoing automation projects. With process mining, businesses can generate a digital twin of an organization (DTO) to simulate automation scenarios, estimate the expected ROI, predict failure points and improve their success rates.

Learn more how process mining facilitates RPA in 4 steps and what are the differences between them.

Real-life examples

For instance, Credem Bank from Italy leveraged a Process Mining to discover automation opportunities and measure the expected ROI. 2 The bank generated a DTO to simulate an automation scenario for their back office (BO) activities for the next 8 months.

As a result, the bank could decrease the time employees spend on loan processing by 70% and saved around 1.4 million by automating 91 business processes.

6. Monitor real performance

Process mining can help financial institutions evaluate employee behavior and measure overall performance in regions, branches, departments, teams and time periods by automatically measuring process KPIs.

Based on the results, banks can set data-driven benchmarks and improve their banking operations and employee performance to align with these goals.

Real-life examples

For example, a multinational bank process mining case study showed that bank could capture as-is processes in their back office operations in Eastern Europe offices. Bank could optimize their business processes by an average of 16%.

7. Support innovation

By discovering real-time processes, process mining constantly provides insights on process innovation and opportunities which decreases the risk in transformation.

Real-life examples

For example, in an academic study, researchers analyzed loan processes of a bank and found out that clients took longer time to complete their applications. 4 Based on these insights, bank innovated their communicational flow by adopting a different communicational strategy.

8. Manage change

Process mining can help banks update processes when it is required and assess the effectiveness of any potential change in the system. Once the change is implemented, process mining continue monitoring the systems to re-design changes with undesired outcomes.

Real-life examples

For example, in a case study, the Rabobank has been applying process mining over the past years to drive change and continuous improvement.

9. Build cost control

Process mining allows banks to visualize the money flow across processes so that banks can decide in increasing or decreasing expenses in a data-driven manner. With process mining, banks can trim their cost or invest in capabilities.

Real-life examples

VTB Bank, the second-largest Russian bank, implemented process mining to achieve cheaper, faster and the best products for their customers.

10. Achieve compliance through audit

Process mining allows banks to monitor external transaction or any internal process from beginning to end. By discovering the ways business processes are executed, banks can identify fraudulent and abusive behavior like suspicious transactions to take precautions.

Real-life examples

For example, with process mining, banks can detect the points that require a compliance response and explore solutions to mitigate them. Fraud mitigations solutions could include anti money laundering software, RPA for reporting issues and automating, cybersecurity measures, and workload automation tools to generate process data for further reporting and audit.

Explore how process mining capabilities, such as conformance analysis and automated root-cause analysis help auditing and compliance.

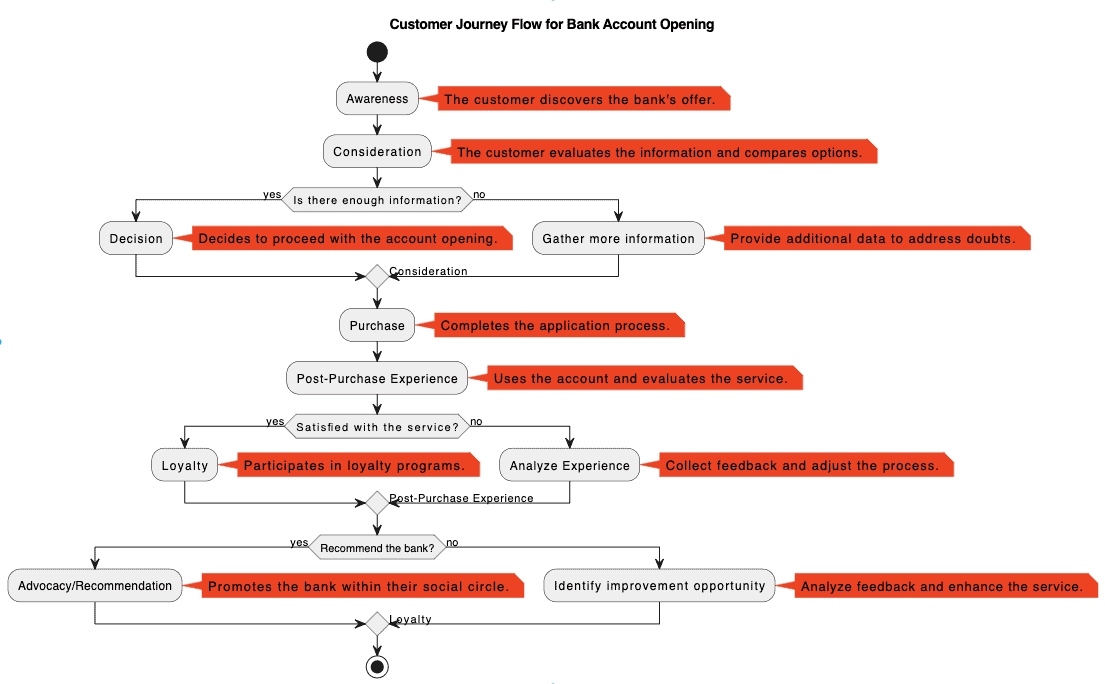

11. Improve customer journey

Process mining can help banks to improve customer journey by understanding customer behavior and change the way they operate based on customer experience. With process mining, banks can control potential customer drop outs, improve customer experience and find new improvement opportunities (e.g. payment methods).

Real-life examples

For example, ING bank Australia branch process mining case study shows how the bank improved their website and call center to improve customer journey while interacting with the bank.

Check out 4-steps guide on process mining customer journey.

12. Accelerate sales process

Process mining help banks to analyze variation, repetitions, waiting times and service levels in sales processes. Based on these findings, banks can improve call center, front and back office services.

Real-life examples

A global mortgage insurance company with offices in the US, Canada and Australia leveraged process discovery for their call center operations, back offices activities. The insurance company claims that by implementing strategies based on the insights they gained through process discovery, they achieved 33.6% more process efficiency in less than 3 months.

Check out process mining case studies for more real-life examples.

Further reading

You can explore more on process mining applications in financial domain by reading our relevant use cases:

If you believe your business can benefit from process mining tools, you can check our data-driven list of process mining software and other automation solutions.

Check out our comprehensive and constantly updated process mining case studies list to learn more real-life examples.

And you can let us find you the right vendor:

External sources

- 1. The transformative power of automation in banking | McKinsey. McKinsey & Company

- 2. Credito Emiliano S.p.A. (Credem) | IBM.

- 3. Blog - Process Mining for Process KPI Reporting.

- 4. Carvallo, Andres; Henning, C.; Razmilic, D.; L ́opez, L.L.; Lee, Jonathan; Salazar Fernandez, Juan P., & Arias, Michael (2017). “Applying Process Mining for Loan Approvals in a Banking Institution.” BPI Challenges 2017. Revisited January 4, 2023.

- 5. Customer Journey Map in Banking: Pain Points and Examples. DANAconnect

Comments

Your email address will not be published. All fields are required.