Businesses are adopting enterprise resource planning (ERP) systems to automate their operations including the accounts payable process. Over 66% of organizations that handle more than 2,500 monthly payables regard ERPs as crucial to manage increased payable volumes.1

Though ERPs provide automation features, processes of reconciling accounts and executing payments can still include numerous manual steps. Thus, effective use of ERP systems in AP automation can depend on using integrations such as APIs and AP automation solutions with native ERP integrations.

If you are interested in AP automation in a specific ERP, explore AP automation in NetSuite, SAGE, Blackbaud or Dynamics.

Read on to explore AP functionality in other ERP systems and integration between ERP and accounts payable automation software.

Key Features of AP modules in ERP Systems

Data transfer & exchange

Native ERP integration fully automates the transfer of data from one system to another. For instance, Native ERP integration allows for two-way data exchange between the ERP system and its applications. With this setup, the ERP can process data from its add-ons and store everything in one central database (ERP). This centralization enables access to real-time data, regardless of location.

Reporting

ERP & AP software integration allows for real-time reporting from all connected software. This gives businesses visibility on their current situation. Also, with all systems linked to the ERP, generating reports becomes simpler. With all of the data included, native integration can create monthly and yearly financial reports.

Sponsored: APRO by PairSoft enhances reporting by automating purchase-to-pay workflows, seamlessly integrating with Oracle Financials Cloud and E-Business Suite to streamline invoice processing, payment gateways, and data management across 180 countries.

Document management

Sponsored: AP tools such as PaperSave include solutions for document management such as:

- Integration with Query allows you to retrieve all documents related to a specific query result with one click.

- Content search: offers the ability to perform a full-text search within documents. The search results highlight relevant information, making it easy to quickly find what you need.

- Unstructured search works similarly to popular search engines like Google, Bing, or Yahoo. PaperSave can conduct broad searches based on record metadata, user-defined metadata, and the content within documents.

- Structured search lets you create detailed and organized queries for record details and content.

Invoice processing & capturing

AP automation software can employ an AI-driven optical character recognition (OCR) to transform scanned documents into data. Once converted, software immediately transfers this data into your accounting system and initiates a series of automated processes.

Cash flow optimization

AP automation modules enables:

- the scheduling of payment processing and the creation of reminders for upcoming invoice due dates. This feature can prevent late fees.

- monitor vendor details and review ongoing payment agreements to make sure they don’t negatively impact cash flow.

- maintain comprehensive transaction data within your ERP dashboard, allowing for cash flow projections.

- configurations based on these projections, determining the best times to conserve or expend funds.

How to increase AP automation in ERP systems?

There are 4 approaches to increase automation levels:

1- Reduce the need for manual processing

Various initiatives can achieve this. Typical ones include:

- Encouraging high volume vendors to integrate to your company’s EDI systems.

- Encouraging lower volume vendors to use vendor portals. This increases structured data input and reduces invoice processing work.

- Simplifying the invoice approval process or leveraging automated invoice validation.

- Leveraging AI-driven audits to minimize fraud.

2- Fully leverage your ERP solution’s AP automation capabilities

Especially on-prem ERP solutions may be outdated and may have missed important updates that can increase automation levels. Updating these solutions and fully leveraging their capabilities can be easy and effective.

3- Extend your ERP solution’s AP automation capabilities

There are various approaches (e.g. native integrations or APIs) to extend ERP solutions. The easiest approach is to leverage solutions that are natively integrated to your business’ ERP solution.

PairSoft offers such solutions for many ERP systems, increasing the AP automation rates. Explore in detail for your ERP system:

Additionally, PairSoft can connect other ERP systems with the help of a universal ERP connector.

4- Analyze your businesses’ specific AP challenges

While we shared recommendations that make sense for most businesses, every business can have specific AP challenges. Analyzing how the AP team spends their time can unlock initiatives to increase their productivity.

Integrating AP solutions with ERP Systems

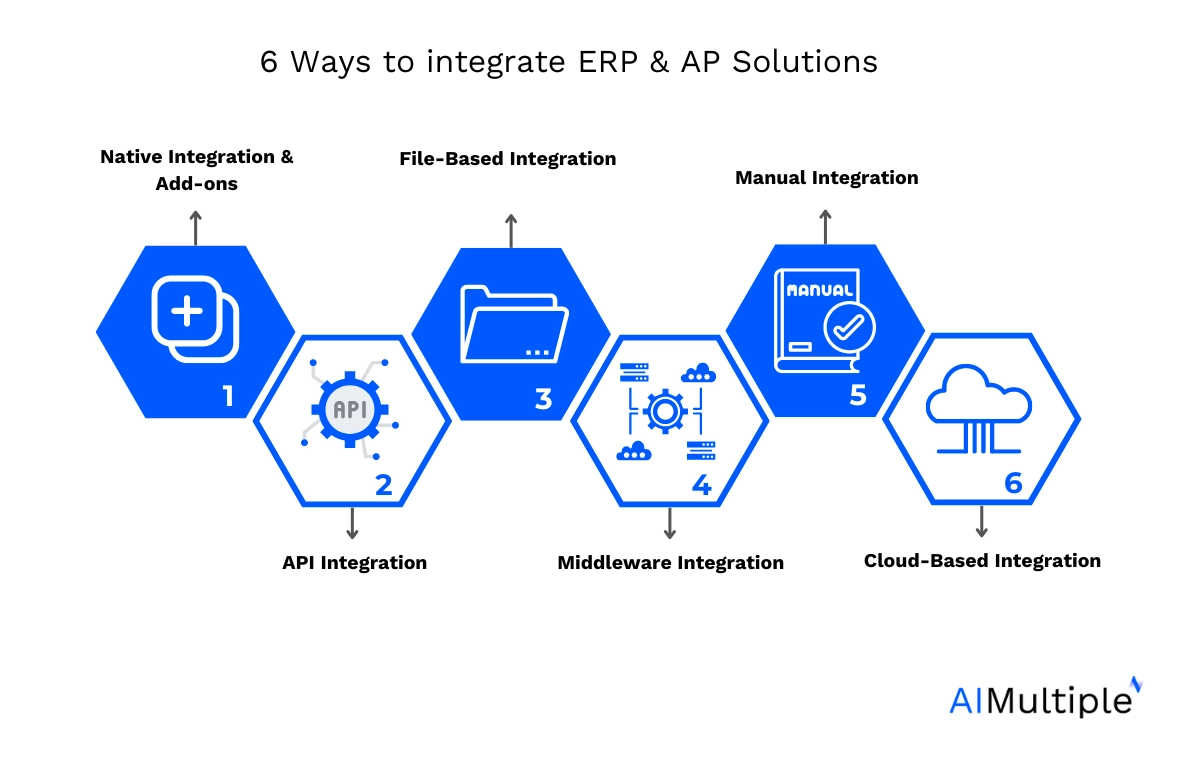

Native integration

This involves using AP solutions that are built as part of the ERP system itself such as software add-ons This means the add-on software is designed to fit into the existing ERP system. This allows users to utilize both the ERP system and the add-on.

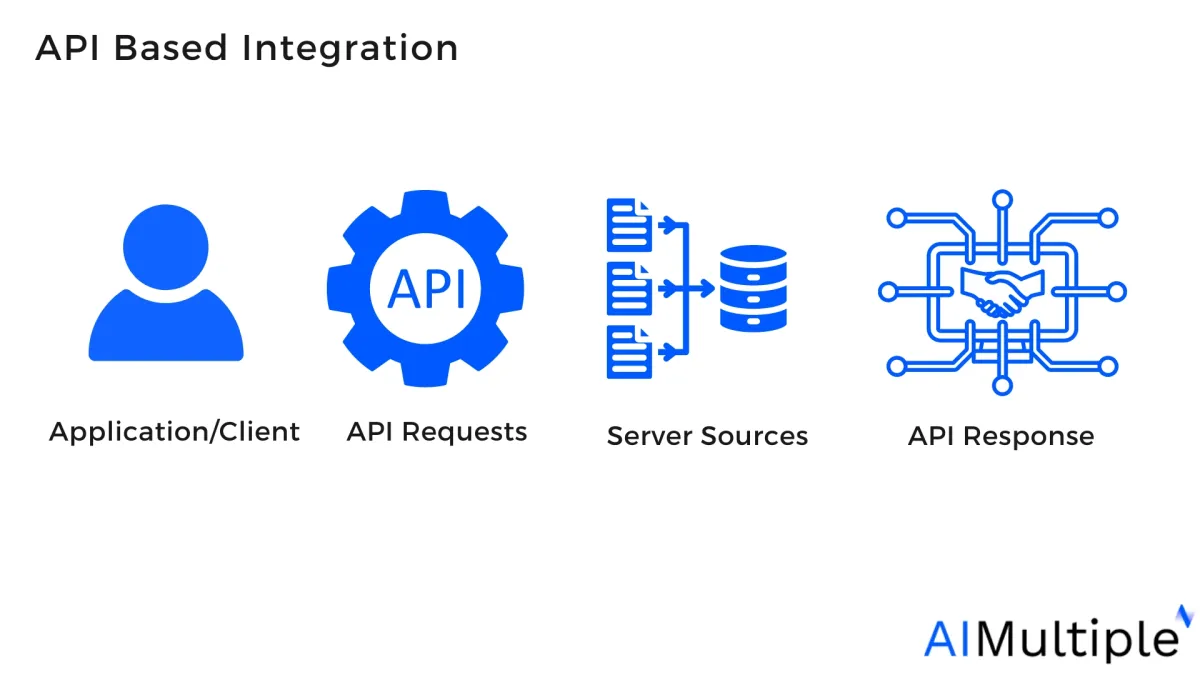

API integration:

Utilizing Application Programming Interfaces (APIs) to connect AP solutions with ERP systems allows for data exchange and access between the two systems. APIs also enable a workflow across various SaaS applications. APIs also allows:

- customization

- encryption for security

- integration with other apps & devices

File-based integration

This implies the exchange of data files (such as CSV or XML files) between the AP solution and the ERP system. This process can typically require some manual intervention to import data.

Middleware integration

Employing a third-party middleware platform to act as an intermediary that facilitates communication between the AP solution and the ERP system. This way is often used when direct integration is not feasible.

Manual integration

Manually entering data from the AP solution into the ERP system. This can be labor-intensive and prone to errors.

Cloud-based integration

For cloud-based ERP systems, integration can be achieved through cloud services that connect AP solutions directly to the ERP system over the internet.

AP integration to ERP systems: sample case

Recovery Healthcare had to deal with a lot of paper invoices every month. They wanted a system that worked with their NetSuite setup, to move away from scanning papers and using emails. Keeping records safe online was also key for them. By using PairSoft with NetSuite, they could now take in invoices from many places and keep them safe online.

This meant they no longer had to keep paper copies, saving staff time and office space. With PairSoft, all their accounts payable paperwork is now digital. They stopped needing space for paper files, shared invoices electronically, stored everything online safely, and could easily get their documents right from NetSuite.2

Key Accounts payable facts in ERP systems

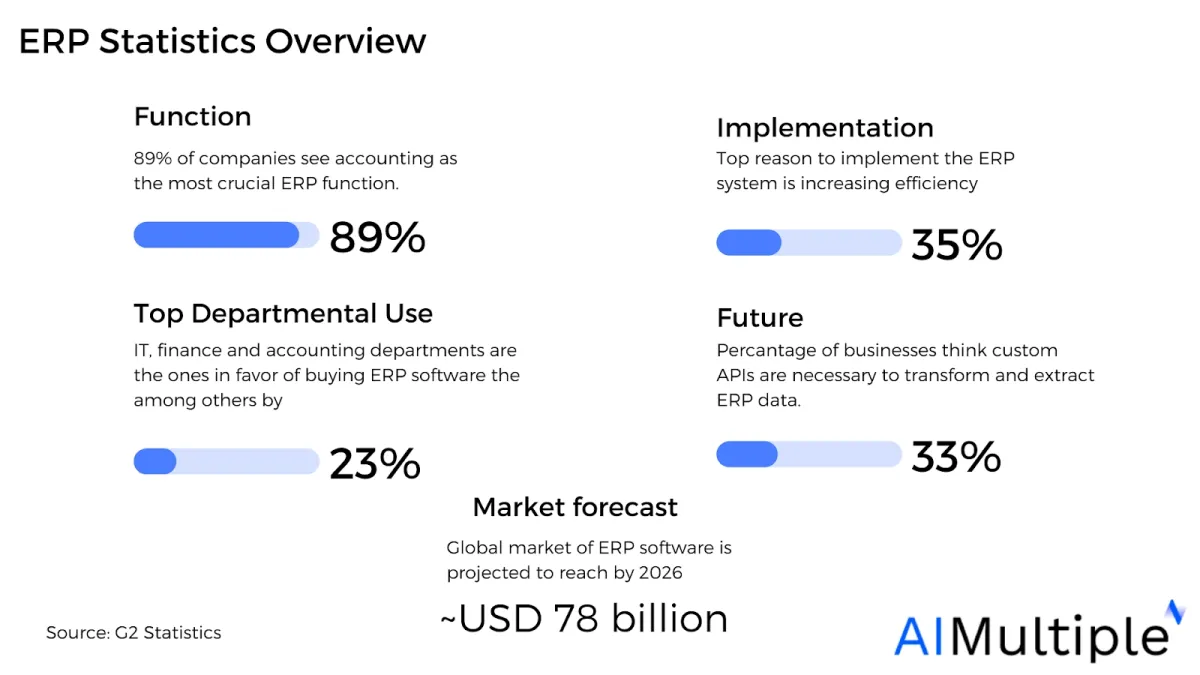

Demand for ERP is still growing: the global market of ERP software is projected to reach ~$80 billion by 2026.3 Recent data shows that along with IT, finance and accounting departments are the ones in favor of buying ERP software the most by %23.4 Also, 89% of companies think that accounting is the most crucial ERP function. See Figure 1:

What to consider while implementing AP in the ERP system?

While implementing AP in an ERP system, consider the following:

- Integration capabilities: ERPs are preferred due to their all-in-one approach. Accounting and AP are core parts of ERP systems. Therefore, buyers need to make sure that the chosen AP solution integrates well with existing ERP modules. Native or API integrations should cover the complete AP process and shouldn’t disrupt workflows or data integrity.

- Scalability: The AP solution should be able to handle increased volumes of invoices and transactions.

- Compliance and security: The system must be encryptable, adhere to regulatory standards and provide secure data handling.

- Customization: The AP module should allow customization to meet specific business processes & requirements.

- Technical support and training: Ensure adequate support and training resources are available to assist with the implementation process and ongoing system use.

- Cost: Consider both the initial implementation cost and ongoing expenses, ensuring they align with the budget and expected return on investment

- End-t0-end approach: AP consists of different steps such as document ingestion, approval etc. To significantly boost automation rates, AP solutions should aim to automate the entire accounts payable process.

Further reading

- In-Depth Guide to Accounts Payable (AP) Automation

- Accounts Payable (AP) Automation Tools Benchmarking

- 10 AI Applications in Accounts Payable (AP) Processes

- Automated Invoice Validation: Benefits & Use Cases

- Finance Automation: What It Is, Best Tools & 6 Processes

- 30+ Accounts Payable Statistics From Reputable Sources

For more AP automation software:

- Dynamics 365 in AP

- NetSuite AP

- Blackbaud AP

- Sage AP

- ReadSoft Alternatives

- Kofax Alternatives

- Rossum AI Competitors

Comments

Your email address will not be published. All fields are required.