3 Ways AI is Changing the Health Insurance Sector in 2024

In 2019, private health insurance spending in the US was nearly $1.2 trillion, representing about 30% of total healthcare spending. It’s a vast market where companies are looking to gain competitive advantage by implementing AI. In health insurance practices, there are many tasks that are traditionally done manually. To automate such tasks, 72% of health insurance executives assess, investing in AI will be one of their top three strategic priorities for 2022.

In this research, we will explain how AI can improve fraud detection, enhance customer service and reduce expenditures in the health insurance sector.

1. Detect fraud more accurately

Health care fraud costs about $300 billion annually in the US. Since health insurance accounts for one-third of healthcare spending, we can roughly say that health insurance fraud costs about $100 billion per year. That’s a significant amount, and as we discussed in our article on insurance pricing, fraud becomes a burden on customers in the form of higher premiums. So effective insurance fraud detection benefits all with the exception of fraudsters.

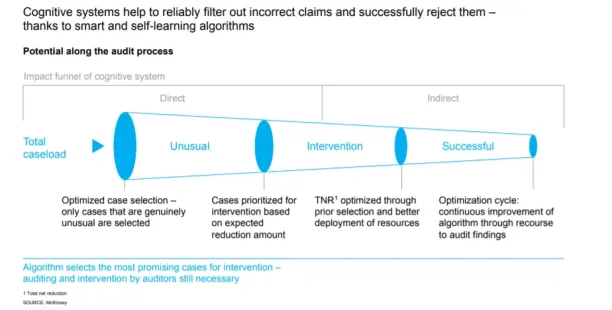

AI models can be effective fraud detectors and preventers as they automate manual workflows. Health insurers generate a huge amount of paperwork by processing claims. Traditionally, insurers manually review the relevance of claims to determine whether or not they are fraudulent. This was both a time-consuming and inefficient process. According to McKinsey, for every 10 health claims submitted, insurers classify up to 7 as unusual, meaning potentially false or fraudulent, based on company policies. Thus, 70% of the claims are reinvestigated by the insurers.

According to Forbes because of this inefficiency of manual fraud detection, investment in AI-based fraud detection is the top priority of firms. NLP-based models reduce the time required to identify suspicious case claims by 75%. NLP models are feeded by dataset of previous fraudulent claims, and by time become more effective fraud detectors. Thus, they can reduce the unrealistic 70% rate of suspicious cases.

2.Improve customer service

According to Deloitte, up to 75% of customer service requests like simple queries of customers can be automated through the use of chatbots. The economic return is equivalent to a 40% reduction in customer service costs. And companies can free employees’ time with up to 97% by using chatbots. So, the insurance sector can benefit from AI-driven chatbots.

Chatbots, on the other hand, can be taught expressly for health insurance needs. For example, they can extract data such as name, residence, age, symptoms, nutrition and sport habits to establish a policy. As a result, insurance companies can acquire new consumers digitally.

Chatbots are also useful for handling insurance claims. For sending first notices of loss (FNOL) and verifying claim progress. Deloitte found that, after COVID-19 Pandemic, insurers adopted digital channels such as mobile apps more, where some insurance companies handle more than half of claims in this way. Chatbots can interact with customers on mobile apps and messaging apps and manage digital and automated claims processing.

It is vital to recognize that. As a generational need, claims processing is shifting from physical to digital. And as a result, health insurers may find it more usual in the coming years to handle claims using chatbots.

3. Reduce health expenditures

Health insurance companies try to encourage their customers to live healthier lives by lowering premiums. For example, if you walk a certain number of steps per day, the health insurance company rewards you with a discount. In 2018, life insurance company John Hancock, announced that it has introduced a new type of health insurance: an interactive policy that collects health data via smartphones and wearables.

This is an example of the integrated use of AI and IoT. Smart devices like smartphones, watches, homes, cars, etc. collect a tremendous amount of data about the customer’s life choices. By using effective AI models, this data is transformed into that person’s premium. Consequently, health insurance companies can conduct an effective and fair underwriting process.

In the near future, this health insurance transformation could be extended to other technologies. For example, digital twins, the computerized replication of any object, including humans, can be used for more accurate health risk analysis.

To find out more about innovative insurance solutions, you can read our Top 7 Innovative Insurtech Companies of 2022: Detailed Guide article.

Further readings

- Top 5 Insurance Technologies & Their Use Cases: In this article, we present five technologies that we believe will most transform the insurance sector. For each sector, we specifically address which insurance practices can be improved by the introduction of a particular technology.

- Insurtech Guide: What it is, Trends, Technologies & Challenges: This article is our general guide that introduces the general trends and insurtech landscape to showcase the magnitude of change that is taking place.

- Cybersecurity Insurance: What is it & why is it important?: Lately, we rely on technology for almost everything we do on a daily basis. As a result, the cost of cyberattacks might stop operations of businesses. This article assesses the rise of new insurance practice that protects companies from cost of cyberattacks.

You can check our lists of AI platforms, AI developments and AI consultants to build AI models more easily.

Our health insurance platforms and insurance suites lists might guide you to find appropriate insurance tools/vendors.

We can help you to identify the best providers that can assist you with your digital transformation to compete in the challenging insurance sector.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.