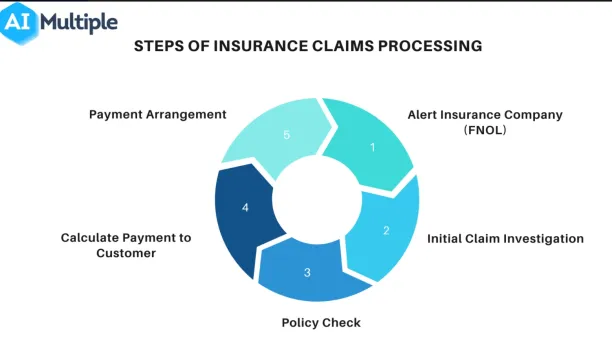

Claims processing includes all the steps during which the insurer checks the necessary information about the loss, policy and the event in order to calculate and pay out its liability to the policyholder. It begins with the submission of the first notice of loss (FNOL) and ends with either the rejection of the customer’s request or the transfer of the money to the customer.

Explore the steps of claims processing and present the seven most important technologies that facilitate claims processing:

7 key technologies enhancing claims processing

In our analysis, we found that 7 technologies directly improve claims processing, namely: Chatbots, optical character recognition (OCR), computer vision, advanced analytics, blockchain, IoT/smart devices, and custom mobile apps.

Table 1. Technologies that improve claims processing

| Technology | First Notice of Loss | Initial Investigation | Check Policy | Payment Calculation | Payment Arrangemet |

|---|---|---|---|---|---|

| Chatbots | ✅ | ❌ | ❌ | ❌ | ✅ |

| Optical Character Recognition | ❌ | ✅ | ✅ | ❌ | ❌ |

| Computer Vision | ❌ | ✅ | ❌ | ❌ | ❌ |

| Advanced Analytics | ❌ | ✅ | ✅ | ✅ | ❌ |

| Blockchain | ❌ | ❌ | ❌ | ✅ | ✅ |

| IoT / Smart Devices | ✅ | ✅ | ✅ | ❌ | ❌ |

| Custom Mobile Apps | ✅ | ❌ | ❌ | ❌ | ✅ |

1. Chatbots

NLP-driven chatbots use AI to talk to customers on websites or apps. They help with:

- Reporting a claim (called First Notice of Loss or FNOL)

- Answering questions

- Arranging payments

They guide customers to take pictures or videos and explain what documents are needed. This speeds up the start of the claim.

But not everyone likes chatbots. For example, 22% of business insurance customers still prefer talking to brokers.1 People with complex claims may also want human help.2

Even so, chatbots can increase customer satisfaction—especially with simpler claims.3

2. Optical character recognition (OCR)

OCR reads and understands handwritten or printed documents. It helps with:

- Investigating claims

- Checking the insurance policy

Insurers often receive paper reports, like police reports, medical records, and witness statements. OCR turns these into digital text, saving time and effort.

3. Computer vision

Computer vision lets computers understand images and videos. It helps insurers:

- Analyze photos or videos of damage

- Estimate the cost of repairs

- Speed up investigations

Some insurance companies are also already using AuT for the initial claim investigation. The intelligent drones, which are equipped with computer vision models, examine the insured object—especially after natural disasters. This tech is still new, but it’s expected to grow quickly by 2030.4

4. Advanced analytics

Advanced analytics use smart algorithms to find patterns and make predictions. These tools help with:

- Estimating costs

- Detecting fraud

- Checking if a claim fits the policy

Insurers use data from reports, photos, and customer behavior (like browsing or location history). These tools help them spot false claims or predict how much to pay.

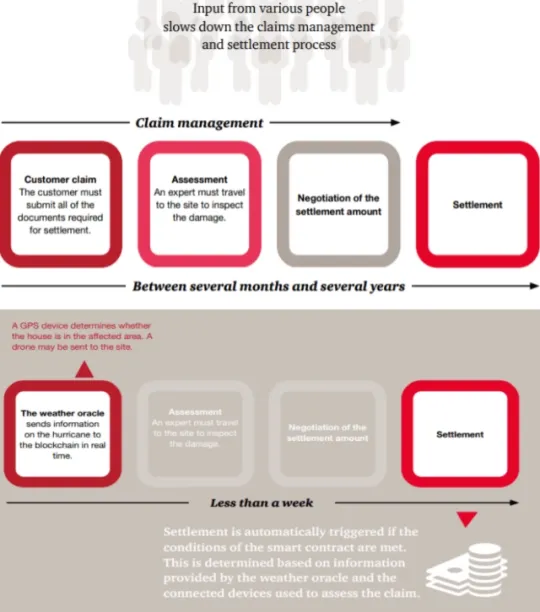

5. Blockchain

Blockchain is a secure way to store and share data. It makes claims processing faster and safer.

One powerful use of blockchain is smart contracts. These are agreements written in code. When certain conditions are met, the contract runs on its own. For example:

- A hurricane hits.

- A smart sensor records damage.

- A smart contract checks the storm’s speed and damage photos.

- If all checks pass, payment is sent automatically.

This skips several steps of the claims process. It also improves payment security, since blockchain was designed to manage digital transactions.

Figure 1. How blockchain speeds up claims processing

Source: PwC5

6. IoT/Telematics

IoT stands for Internet of Things—smart devices that connect and share data. Examples include:

- Smart cars

- Smartwatches

- Home assistants

- Drones

- Smart factories

For more details, read

These devices help with:

- Reporting the damage (Step 1)

- Investigating the damage (Step 2)

- Verifying the claim (Step 3)

For example, if a car’s airbags deploy, the system can alert the insurer automatically. In health insurance, smartwatches can track health issues. Drones can also inspect damage and collect evidence.

IoT devices help insurers get data faster and make better decisions.

7. Custom mobile apps

Since 2017, more people now use mobile devices than desktop computers.6 On average, each person owns about 2.5 mobile devices.7

Custom insurance apps make claims easier. Customers can:

- File a claim

- Track its progress

- Get updates about repairs

This helps companies save time and assign staff to more complex tasks. With no-code or low-code tools, insurers can build apps quickly, without hiring many developers.

Why is claims processing important?

Claims processing is one of the most important parts of the insurance business. It affects both company profits and customer satisfaction.

Nearly 70% of an insurance company’s expenses come from handling claims.8 Effective claims handling is linked to effective insurance fraud detection and prevention, as most of the fraud types like hard fraud or double dipping fraud occur at the claims processing related times.

Still, only about 10% of claim costs come from fraud.9 That means most claims (around 90%) are from real customers who have faced serious problems. Helping these people quickly and fairly is key to trust. It’s no surprise that 87% of customers say they would switch insurance providers if the claims process is slow or unfair.10

Claims processing steps

1. Alert the insurance company (FNOL)

The first step is telling the insurance company about the damage or theft. This is called the First Notice of Loss (FNOL).

You can do this by:

- Calling your insurance broker

- Using the company’s website or mobile app

Some insurers use smart devices (IoT) to get alerts automatically. But even then, you still need to file the FNOL. This report includes key details about the incident, your policy, and what happened. It helps the insurer decide if they are responsible for paying the claim.

2. Initial claim investigation

After receiving the FNOL, the insurance company starts its investigation.

The goal is to estimate how much the claim might cost.

They may:

- Review photos or videos of the damage

- Interview witnesses if needed

- Use tools like AI or claim adjusters to gather evidence

3. Check policy

Next, the insurer checks your policy.

They look at:

- What is covered

- Any limits or rules

- Whether the claim fits the terms of the policy

For example, if the damage happened during illegal activity (like drunk driving), the insurer may deny the claim. If the claim meets all rules, they move forward with payment.

4. Calculate payment to customer

To figure out how much money should be paid, the insurer may bring in experts (like engineers or health professionals).

They also might suggest trusted repair shops, hospitals, or dentists to help you fix the problem.

5. Arrange payment

Once the repair or service is done, the insurer collects payment details.

There are two options:

- The insurer pays the service provider directly

- The insurer pays you, and you handle the costs

If you are paid directly, the insurer will work with you to agree on the payment amount, account details, and timing.

External Links

- 1. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2021/02/future-of-small-and-medium-business-commercial-insurance.pdf

- 2. What’s next for digital consumers | McKinsey. McKinsey & Company

- 3. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2021/02/future-of-small-and-medium-business-commercial-insurance.pdf

- 4. Five areas of focus for adopting the next generation of claims management | McKinsey. McKinsey & Company

- 5. https://www.pwc.com/gx/en/insurance/assets/blockchain-a-catalyst.pdf

- 6. Global mobile traffic 2024| Statista. Statista

- 7. Number of mobile devices worldwide 2020-2025| Statista. Statista

- 8. Emerging trends in claims transformation | Deloitte Insights. Deloitte

- 9. Emerging trends in claims transformation | Deloitte Insights. Deloitte

- 10. AI in Insurance Claims Processing: The Revolution.

Comments

Your email address will not be published. All fields are required.