Top 3 Ways AI Improves Insurance Claims Processing in 2024

Claims processing is one of the most important insurance operations. 87% of customers say that the effectiveness of claims processing influences their decision to choose a vendor (see Figure 1).

Figure 1: Claims processing influence on customers

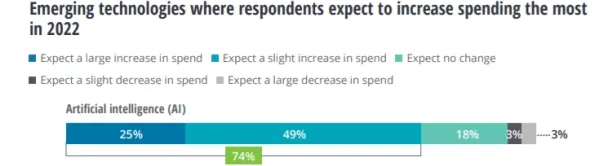

Before the introduction of AI/ML models, most claims processing tasks were done manually. As a result, insurance companies spend too much time and labor on this process. In addition, human labor is prone to errors and is not capable of working 24/7. Therefore, insurance companies started to invest in AI(see Figure 2).

In this article, we present what kind of AI models can be used for which parts of claims processing to help executives with their investment decision.

Figure 2: AI Investments of Insurance Companies

1. Automate data capturing and FNOL with NLP

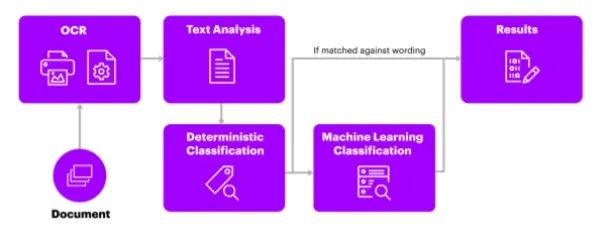

NLP is a type of AI that identifies text data and derives meaning from it. Consequently, NLP provides automated claims processing for insurance companies because it works with written documents and language. Two main applications of NLP specifically improve claims processing, namely optical character recognition (OCR) and chatbots.

- OCR: It is an AI based technology that recognizes handwritten digits and text. Due to regulations, insurers often rely on paper-based forms and printed documents. Thus, OCR becomes a key enabler for improving operational efficiency. Instead of manually typing information, insurers can benefit from OCR-driven models to automate data capturing from paper-based documents.

- Chatbots: Insurance chatbots can speed up the submission of damage reports. Before, customers had to wait for experts for the first notice of loss (FNOL). Today, NLP-driven chatbots guide customers to take videos and photos of the damage, which can be instantly converted into a damage description.

2. Speed up claims adjustment with computer vision

Computer vision is the technique by which AI models can derive meaning from visual inputs such as images and videos. Computer vision models help claims adjusters by analyzing geospatial information (GIS) collected from satellites and videos or images captured by customers or drones. For example, insurtech companies are using drones equipped with computer vision technology to instantly assess damage to cars, factories, homes, disasters, etc.

3. Detect Fraud with advanced analytics

Advanced analytics are good at detecting and preventing fraud. The FBI estimates that fraudulent claims cost more than $40 billion annually in the U.S. alone. As a result, it is a burden on insurers, forcing them to raise premium prices.

Traditionally, insurers manually check the relevance of claims to determine whether they are fraudulent or not. This has been a time-consuming and inefficient process. For instance, according to McKinsey, for every 10 health insurance claims submitted, insurers classify up to 7 as unusual, meaning potentially false or fraudulent, based on company policy. Re-investigating 70% of claims is an unrealistic suspicion rate that shows that people are not effective fraud detectors.

By combining monitored and unsupervised ML models and using behavioral analytics, insurance companies can reduce the cost of fraud more effectively.

To learn more about insurance trends you can read our IoT insurance, blockchain insurance, low-code insurance and digital twins in insurance articles.

It might also be beneficial for your firm to check our AI platforms, AI developments and AI consultants lists to more efficiently deploy your AI/ML models.

Finally, our list of insurance suites might assist your business.

If you are looking for an insurtech to cooperate with, we can help.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.