Insurtech

Top 5 Insurance Technologies & Their Use Cases in 2024

Digital transformation is on the agenda in all industries, including insurance. Using technology as a lever, insurtech companies have initiated a rapid transformation in the insurance sector. Incumbents are taking swift action to integrate this new environment. However, there are so many technology solutions and insurers’ technology investments vary.

4 Insurance Practices that can be Improved with NLP in 2024

The insurance industry generates large amounts of text data due to claims, insurance policies, and customer relationships. This makes it difficult for insurance CIOs to take advantage of their unstructured data using traditional techniques. Emerging technology that understands and analyzes contextual data contained in texts can be beneficial to insurance practices.

Impact of the Low/No-Code Platforms on the Insurance Sector in '24

Low/no-code/codeless practices democratize and accelerate the software development process thanks to their graphical interface that reduces or eliminates the need to write code. It is an opportunity for insurers, pushing them to develop solutions that solve their business problems quickly.

Cybersecurity Insurance in 2024: Practice of Future

Employees now work from anywhere and on any device. KPMG study shows 87% of businesses are embracing hybrid/remote working in the post-pandemic era. The rise of the mobile workforce makes traditional network and cybersecurity solutions of companies ineffective.

6 Ways IoT will Change the Insurance Sector in 2024

The rapid proliferation of internet of things (IoT) devices will change the insurance sector in both positive and negative ways (see Figure 1).

3 Ways Blockchain Will Transform Insurance Operations in 2024

The image above illustrates the ineffective practices of the insurance sector. Blockchain technology has the potential to improve core insurance practices such as detecting fraudulent claims, automating claims processing, and improving the underwriting by enhancing flow of information. These improvements give insurance companies a competitive advantage. 1.

AI in Underwriting: Data-driven Insurance Operations in 2024

Insurance is the art of pricing risk. AI increases both efficiency and accuracy of the risk assessment process, creating competitive advantages for insurers that use the technology. From deep learning to RPA and chatbots, applications of artificial intelligence enable insurance companies to conduct processes faster and more profitably.

Top 10 Insurance Chatbots Applications & Use Cases in 2024

Today around 85% of insurance companies engage with their insurance providers on various digital channels. To scale engagement automation of customer conversations with chatbots is critical for insurance firms. The problem is that many insurers are unaware of the potential of insurance chatbots.

5 RPA Use Cases & 10 Case Studies in Insurance Industry in '24

Robotic Process Automation technology offers a wide range of benefits to insurance companies, from shifting the workforce to more valuable tasks to reducing manual errors in claims processing/ fraud detection processes.

Top 10 AI Use Cases & Applications Insurers Must Know in 2024

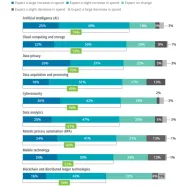

According to Deloitte, in order to enhance their operational efficiency, insurers spended the most on AI technology. In 2022, for instance, 74% of insurance executives planned to increase their investment in AI (see Figure 2). Many insurance operations, such as: Can be automated by AI technologies such as OCR, document processing, chatbots, and affective computing.