Impact of the Low/No-Code Platforms on the Insurance Sector in '24

Low/no-code/codeless practices democratize and accelerate the software development process thanks to their graphical interface that reduces or eliminates the need to write code. It is an opportunity for insurers, pushing them to develop solutions that solve their business problems quickly.

Why is low/no-code development important to insurance companies?

The insurance landscape is changing rapidly due to technological developments, customer preferences and external shocks such as the Covid pandemic. As a result, insurers must adapt their tools, systems and products accordingly to survive in such a challenging environment.

Despite the demand for quick response of insurers to technological improvements, prior to low/no-code development, creating software was time and resource intensive. In addition, this process was dependent on the existence of an elite engineer and development team, which are not available to every company.

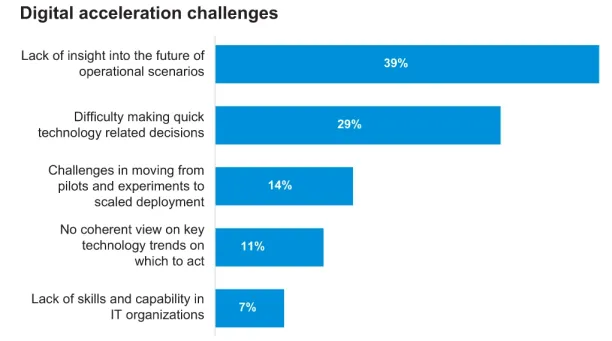

As KPMG found, 7% of insurance companies do not have the IT capacity to implement digital solutions in their business. In addition, 39% of companies struggle to implement digital solutions because the benefits of implementing a costly technology solution today carry uncertain results for the future.

What are the benefits to insurance companies of low/no code developments?

By using low/no-code development, insurance companies can:

- Decrease sunk costs of their IT investments significantly,

- Quickly adapt to the changing environment,

- Increase their operational efficiency by eliminating the negative effects of skills differentials among their employees.

Sunk cost reduction

Insurance companies are looking to reduce legacy technology debt or software development costs in order to invest in technology. Low/no-code software development provides this opportunity.

Technology is improving rapidly. Therefore, insurance companies’ previous technology investments become ineffective in a short period of time. This reduces the attractiveness of investing in technological solutions.

There are many reasons for these high costs. Some of the reasons are,

- The need for a top team of developers.

- The development and deployment process has many different cycles that take time.

- Software must be closely monitored to avoid performance degradation.

Low/no-code developments reduce these costs in two ways:

- It speeds up the software development process.

- It reduces or eliminates the need for an elite engineering team.

Fast adaptation to the rapidly changing environment

Low/no-code development offers companies the ability to deliver faster applications by reducing or eliminating the time-consuming code-writing process.

As the recent Covid pandemic shows, we live in a rapidly changing environment. And evolutionary biology teaches us: “It is not the strongest species that survives, nor the most intelligent. It is the one that is best able to adapt to change.” We can apply the same logic to companies. Consequently, their response time to environmental changes is critical to their survivability. However, the software development process with traditional IT teams lags significantly compared to the low/no code development process. Such a delay could be fatal for insurance companies.

Nulling the negative effects of skill differentials among workers

Low/no-code software development decreasing negative impact of skill gap among employees thanks to the democratization of software development process.

Deloitte showed, 68% of managers think there is a significant skill gap among employees. However, the process of code writing and model building require effective communication between employees from different departments to understand the business problem that engineers are trying to solve.

In insurance practice, developers need to understand the dynamics of the insurance sector in order to solve insurers’ problems. Such a process is challenging when there are significant skill gaps between employees. It’s as if your employees no longer speak the same language.

Low/no-code software development reduces this problem thanks to the process of writing little or no code. People who know the business problems well can develop software systems that solve their business problems thanks to the democratization of software development. Therefore, the need for effective communication between different departments becomes less significant which reduces the negative effects of skills differentials among workers.

What are the challenges of low/no-code development for insurance practices?

Low/no-code development have following limitations and challenges for insurance practices:

- It is not possible to develop any software solutions for your business because low/no-code platforms use a limited number of templates to create software.

- When you develop software with low/no-code platforms, it is difficult to add new features due to integration issues.

- Most low/no-code platforms are cloud-based. Therefore, your data may not be fully secured.

Further reading

Here are three articles that highlight the various aspects of the digitization of the insurance sector:

- Ultimate Guide to Cloud Computing in the Insurance Sector: Like no/low-code platforms, cloud-based platforms also help insurers perform a relatively cheaper and faster digital transformation.

- Ultimate Guide to Insurance as a Service in 2024: Insurtech companies are helping incumbents digitize core insurance processes such as risk assessment, underwriting, claims processing and fraud detection through their subscription-based services. The ease of adoption and use of such services prepares incumbents for the challenges of today’s insurance market.

- 6 Ways IoT will Change the Insurance Sector in 2024: The cloud of smart devices and telematics has the potential to completely change the insurance practices we have known for centuries. Only insurance companies that fully understand what the IoT offers to insurance companies might survive in this challenging market landscape.

You can also check our articles on low/no-code development:

- Top 17 Open Source Low Code Development Platforms

- 42 Low Code/ No code Statistics from reputable sources

- No code / low code RPA tools enabling faster RPA in 2024

- Low/ No code development: What it is, how it works, use cases

You can also check our insurance suites and low/no code lists where we introduce top platforms.

If you need more information about the latest trends of insurance sector or no/low code platforms, we can help.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.