Top 4 Technologies that Automate Insurance Underwriting (2024)

The insurance sector is experiencing rapid change with the proliferation of insurtech companies that are using technologies such as digital twins, blockchain, cloud computing and more to improve core insurance practices like underwriting, claims processing and fraud detection. This forces incumbents to search ways to adapt to this competitive environment.

Underwriting is arguably the most important part of the insurance where insurers price risk. Therefore, improving it is a strategic decision for insurance companies to remain in competition.

The challenge is, although interpretation of a significant amount of data is required for effective underwriting, today’s customers want to purchase insurance policies quickly: A report by Accenture shows that 85% of customers are not satisfied with the speed of the underwriting process. Such a situation forces insurance companies to use RPA and AI/ML models and application programming interfaces (APIs) to automate the underwriting process. In this article, we explore automated underwriting technologies.

Why is underwriting automation important now?

Automating underwriting helps insurance companies for the following reasons:

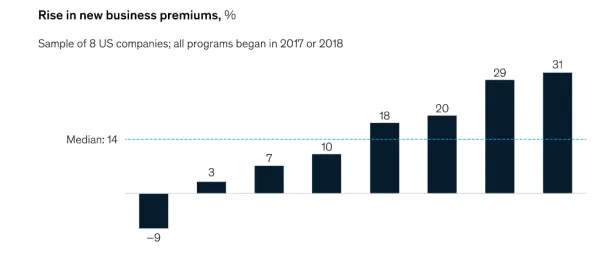

It shortens the time for risk assessment and ensures customer satisfaction. McKinsey predicts that by 2030, most underwriting processes will take seconds, thanks to AI/Ml models based on internal and external data sources such as the IoT. As we mentioned earlier, customers expect fast underwriting while purchasing an insurance policy. Figure 1 illustrates how health insurers are increasing revenue after streamlining their underwriting process.

According Accenture, underwriting departments at insurance companies still employ many people who spend more than 50% of their time doing repetitive tasks like data entry. Automation helps free up employee time for more efficient tasks like finding new policy models to please P&C customers.

Insurance companies are starting to use big data for behavioral analytics that ensure more effective underwriting. We produced nearly 65 zettabytes of data in 2020, which is about 70 trillion gigabytes of data. No doubt, insurance companies only use a small portion of this data. Nevertheless, the human brain is not designed to accurately interpret that much data in a short period of time.

Figure 1: Change in revenue of eight health insurance companies two years after automating their underwriting processes.

What are the technologies that automate underwriting?

There are three major technological breakthroughs that automate the underwriting process:

AI/ML models

1. Advanced analytics

As we have already mentioned, the underwriting process aims to price risk. In this context, insurers interpret data to measure it. In the case of automobile insurance, for example, insurers evaluate data such as drivers’ previous accidents, drivers’ age, drivers’ gender, value/segment of the vehicle, etc. Thanks to smart cars, insurers now also take into account new variables such as full braking per mile, miles driven, frequency of driving, location of driving and average speed, etc.

All these variables have some unique correlation coefficient with the probability of a loss. Advanced analytics and behavioral analytics are suitable tools for calculating coefficients quickly and precisely. Consequently, they support insurers in risk scoring.

By subscribing to the cloud computing services offered by insurtech companies, insurers can utilize these technologies.

2. NLP

Natural language processing (NLP) derives meaning from human languages. NLP models are useful tools for automating underwriting, since the insurance sector uses many documents as data sources and the analysis of some of the documents is a necessity due to regulations such as 4.

As mentioned earlier, data entry takes up a significant amount of underwriters’ time. NLP models can automate data extraction from questionnaires, previous court records, medical reports, etc. It is important to note that the insurance sector deals with many handwritten documents due to regulations. A subset of NLP, optical character recognition (OCR), has been developed specifically for extracting data from such documents. Thus, OCR models also help insurers to automate underwriting.

For more on how AI models are changing underwriting, see our article on AI in underwriting.

3. RPA

Most insurance processes rely on document processing, which requires an understanding of documents. Therefore, RPA by itself is not a promising technology for automating underwriting. However, combining it with AI/ML models can speed up the risk assessment process as follows:

- Collection of data from external and internal sources.

- Filling in the required areas in documents according to guidance of NLP models.

- Analyze the history of customer claims and offer a premium based on past results.

4. APIs

An API is a software intermediary that allows two applications to communicate and exchange information with each other. APIs allow insurance companies to build an integrated application ecosystem. With the help of APIs, insurers can extend the value of the global view of an underwriting automation system to their customer relationship management platforms, cloud systems, IoT networks, and other external data sources.

Insurance companies benefit from big data that comes from external resources such as IoT. By leveraging this data, insurance companies know their customers better, can offer them tailored products, and perhaps most importantly, perform more effective underwriting that ensures fair pricing for customers.

In order to understand more about the use cases of APIs in the insurance Industry read, Top 6 API Use Cases in the Insurance Industry.

You can also look at our top underwriting software platforms list to find the correct tool that improve your underwriting capabilities.

If you are looking for an insurtech to automate your underwriting, we can help:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.