Nonprofit Accounting in 2024: Key Insights & Challenges

The achievement of a nonprofit’s goals requires good financial management and accounting as transparent accounts can help get recognition from donors and organizations rating nonprofits. Given the different structure and objectives of nonprofit organizations, it is important for them to leverage solutions that are geared to solve their challenges.

This article provides detailed information on how nonprofit accounting differs from other types of accounting, the documents you need to master when conducting this activity, and the potential problems you may encounter.

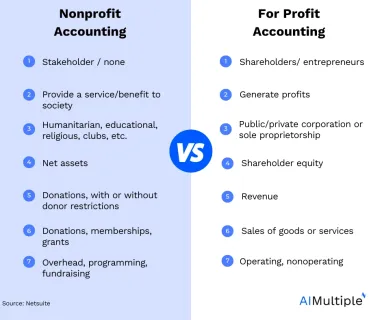

Featured image is based on Netsuite.

Nonprofit accounting basics & differences from for profit accounting:

Nonprofit accounting focuses on tracking and reporting on the use of funds in alignment with the organization’s mission, rather than maximizing profits.

For profit entries: In for profit entities, the accounting operation is focused on:

- profit generation

- shareholder value

- capital growth

Nonprofits: Nonprofit operations rely on:

- donations

- grants

- fundraising

The difference between these two types leads to different practices. While for profit organizations focus on income, expenses and provide statements like balance sheet and income statement, nonprofit accounting uses different types of financial statements that we explain below. These serve to provide transparency to donors, members, and regulatory bodies rather than focusing solely on financial performance. Below, we explain 3 core practices for nonprofit accounting.

Revenue recognition

Nonprofit organizations record revenue when it becomes measurable. This process varies based on the type of revenue:

- Donations: Realized the time the donation is pledged or received, depending on whether it’s conditional. Conditional donations become revenue only when the conditions are met.

- Grants: Recorded as revenue when the nonprofit has satisfied the grant’s predicted performance obligations. This might involve reaching certain milestones.

- Service income: For services provided by the nonprofit, such as fees from educational programs or ticket sales for events, revenue is recognized when the service is rendered.

Expense management

Nonprofit organizations should categorize expenses both to control their operations and keep the accountability. Program expenses are mostly related to the organization’s mission-critical activities. They include:

- costs incurred for services

- projects

- initiatives

- administrative expenses

- day-to-day operational costs (office rent, salaries & more).

and fundraising costs such as

- event hosting costs

- marketing for campaigns

- salaries of fundraising personnel.

Nonprofit organizations should monitor and manage these costs. ERP software are commonly used in this goal. For examples analyzed in-depth, check:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation in 2024

- Blackbaud Accounts Payable (AP) Automation in ’24: In-Depth Review

- Sage Accounts Payable (AP) Automation in ’24

Fund accounting

Nonprofits adopt fund accounting to organize their financial activities into separate funds, each with a distinct purpose. This method allows targeted tracking and reporting.

Let’s say a nonprofit has a fund dedicated to 3 distinct purposes:

- educational programs

- research

- general operational costs

In fund accounting, each fund operates like an independent entity with its own set of financial statements. This makes financial management easier.

Real life example

Institution

The Cancer Research Institute (CRI), a nonprofit organization focused on immunotherapy to tackle all kinds of cancer. They use Blackbaud’s Raiser Edge (ERP) as a solution.1

Challenges

- handling paper documents manually

- problems with donation correspondences

- overwhelming record-keeping tasks

- donor communication

- audit preparation.

Solution & implementation

- PaperSave, a solution natively integrates with Blackbaud’s Raiser’s Edge, scanned papers directly into the system, including donation correspondences.

- Donor and transaction data became accessible and searchable.

- CRI could train employees: “It’s easy and intuitive to train new team members. PaperSave is right there in Raiser’s Edge as a plug-in.”

Results & benefits

- record keeping improved significantly -company claims by %95-

- reduced manual data entry

- better compliance with accessible & searchable records.

Financial statements & key documents for nonprofits

Nonprofits prepare specific financial statements to reflect their financial status and activities, distinct from those of for profit entities.

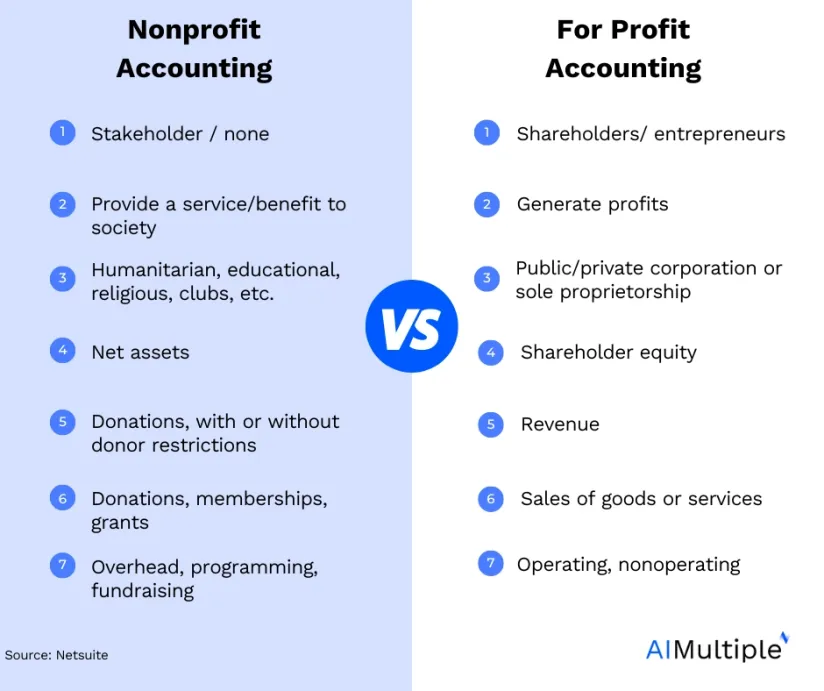

The Statement of Financial Position

Similar to a balance sheet but adapted for nonprofit organizations (Figure 1). It details the organization’s:

- assets: cash, investments, property

- liabilities: accounts payable, loans

- net assets: categorized based on donor restrictions at a particular point in time

Figure 1. Statement of financial position example. Source:2

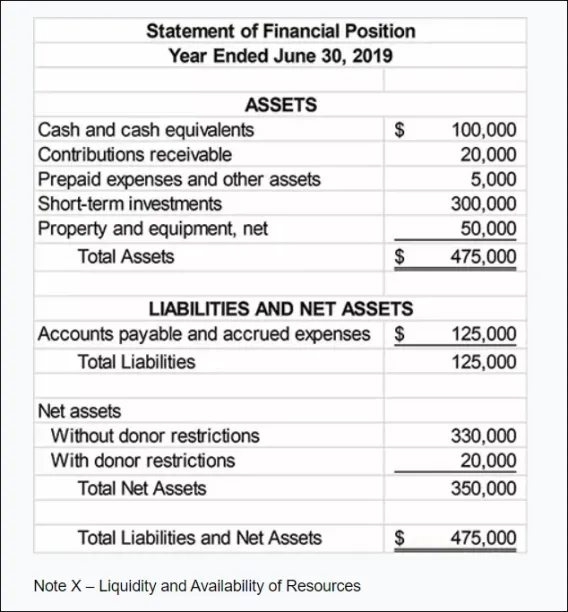

The Statement of Activities

Provides a view of the organization’s financial performance over a period (Figure 2). Reports on:

- revenues: like donations, grants, and service fees

- expenses :broken down by program, administrative, and fundraising categories

- changes in net assets: shows how funds are raised and spent in alignment with the nonprofit’s mission.

Figure 2. Statement of activities example. Source:3

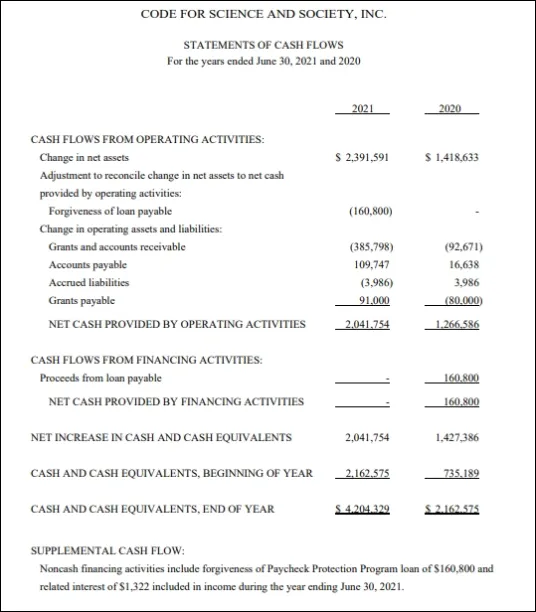

The Statement of Cash Flows

Tracks the inflows and outflows of cash within the organization, categorized into operating, investing, and financing activities (Figure 3). It shows how the nonprofit manages its cash resources.

Figure 3. Statement of cash flow example. Source:4

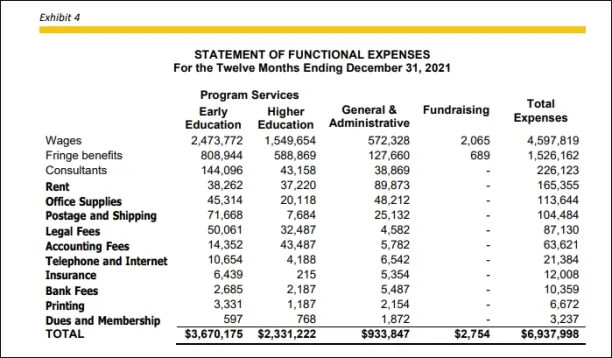

The Statement of Functional Expenses

The Statement of Functional Expenses (Figure 4) is a report used by nonprofits to show how they spend their money in different areas. It breaks down expenses into 3 groups:

- administrative costs: rent, payroll, and utilities.

- program expenses: tours, collections, or outreach expenses

- fundraising expenses: makes it clear how much money goes into each part

Figure 4. Statement of functional expenses example Source:5

Internal controls & compliance requirements

Internal controls and financial oversight in nonprofit organizations involve processes and policies designed to safeguard assets, prevent fraud, and guarantee the accurate use of funds.

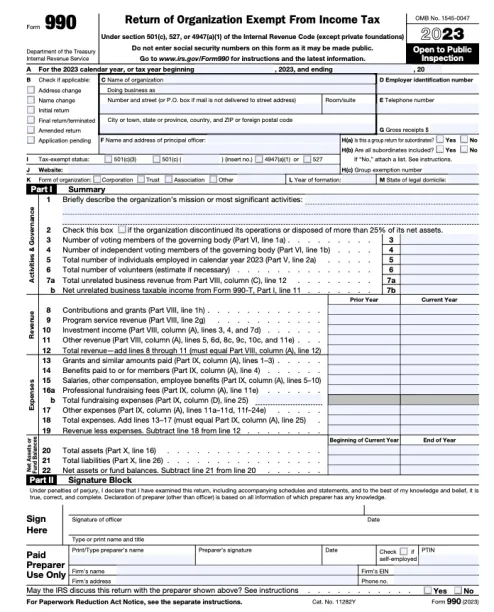

In the US, nonprofits are generally exempt from federal income taxes under Section 501(c)(3) of the Internal Revenue Code.

However, all nonprofits must file Form 990 annually with the IRS.6

Form 990 details the organization’s financial activities such as:

- revenue sources

- expenses

- compensation of key employees

- commitment to nonprofit status requirements.

State-level requirements can also vary, including registration for fundraising activities, sales and use taxes, and property tax exemptions.

Figure 5. First page of Form 990 (Return of Organization Exempt From Income Tax) Source: IRS

Challenges of nonprofit accounting

Revenue recognition

Determining when and how to record different types of revenue is a challenge. For example, donations can be recognized after receiving, but grants may come with conditions that delay recognition until specific criteria are met. This complexity requires careful tracking and judgment to ensure revenues are recorded accurately and in the correct period.

Volunteer labor valuation

Many nonprofits rely heavily on volunteers, but accounting standards generally do not allow the recognition of volunteer services as income or expense unless the services:

- create or enhance non-financial assets

- require specialized skills, are provided by individuals possessing those skills.

This can make it difficult for nonprofits to fully account for the value that volunteers provide.

Ethical considerations

Nonprofit accounting goes beyond mere compliance with laws and regulations; they imply the integrity and accountability essential in managing funds entrusted by donors, grantors, and the public. Ethical financial management in nonprofits involves transparent reporting, honest communication about the use of funds.

FAQ

What are the key differences between nonprofit and for-profit accounting?

Nonprofit organizations focus on tracking and reporting resources allocated to their mission-driven activities, unlike for-profit accounting, which centers on profit generation and shareholder value. The emphasis in nonprofit bookkeeping is on accountability and stewardship of funds rather than on profitability.

What are generally accepted accounting principles (GAAP) and why are they important for nonprofit organizations?

Generally accepted accounting principles are a set of rules and standards that guide financial reporting for entities, including nonprofit organizations. They ensure consistency, transparency, and reliability in the presentation of financial data, helping stakeholders assess the organization’s financial health accurately.

What financial statements are essential for a nonprofit organization?

Key financial statements for a nonprofit include the Statement of Financial Position (similar to a balance sheet), the Statement of Activities (similar to an income statement but detailing revenues and expenses by function), and the Statement of Cash Flows. These documents provide a comprehensive view of the organization’s financial health.

How does a nonprofit organization recognize income, especially from donations and grants?

Income recognition in nonprofit organizations must align with the Financial Accounting Standards Board guidelines, often requiring income from donations and grants to be recognized when any associated conditions are met or when the funds are received if there are no conditions.

What are functional expenses and why are they important in nonprofit accounting?

Functional expenses categorize costs by the purpose within the organization, such as program services, fundraising, and administration. This classification is crucial for nonprofit organizations to demonstrate how resources are allocated in support of their mission and to ensure compliance with donor restrictions and reporting requirements.

Can nonprofit organizations generate a surplus, and how is it reflected in their financial statements?

Yes, nonprofit organizations can generate a surplus, which is reflected in the Statement of Activities. Rather than indicating profit, a surplus shows that the organization has managed its resources effectively, providing financial stability and supporting future mission-driven activities.

What role does the Financial Accounting Standards Board (FASB) play in nonprofit accounting?

The FASB establishes accounting and financial reporting standards for entities in the United States, including nonprofit organizations. Its guidelines ensure that financial statements are prepared consistently and transparently, aiding in the accurate assessment of an organization’s financial health.

What are the challenges in managing and reporting restricted funds in nonprofit bookkeeping?

Managing and reporting restricted funds involve tracking and ensuring that these funds are used strictly according to donor stipulations. This requires robust accounting systems and internal controls to segregate restricted from unrestricted funds and to demonstrate compliance with restrictions in financial reporting.

Further reading

- Enterprise Invoice Processing: 4 Guidelines & 3 Solutions in 2023

- Accounts Payable in Accounting: Process, Duties & Automation

- Accounts Payable ERP Integration in ’24: 6 Ways & 5 Features

- 30+ Accounts Payable Statistics From Reputable Sources in 2024

- Accounts Payable Process in ’24: 8 Steps, Challenges & Tools

External links

External Links

- 1. “Cancer Research Institute Boosts Donor Experience with PairSoft” Accessed on 3 April 2024

- 2. “ Instrumentl” Accessed on 3 April 2024

- 3. “Instrumentl” Accessed on 3 April 2024

- 4. “Instrumentl” Accessed on 3 April 2024

- 5. “Instrumentl” Accessed on 3 April 2024

- 6. “Return of Organization Exempt From Income Tax” Accessed on 3 April 2024

Comments

Your email address will not be published. All fields are required.