StableCoin: How firms like Tether print fiat & what to watch out for

Before proceeding, please read our disclaimer on investment related articles.

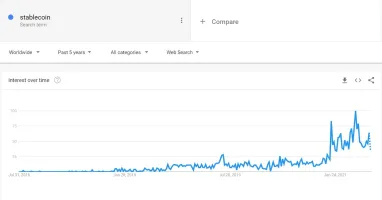

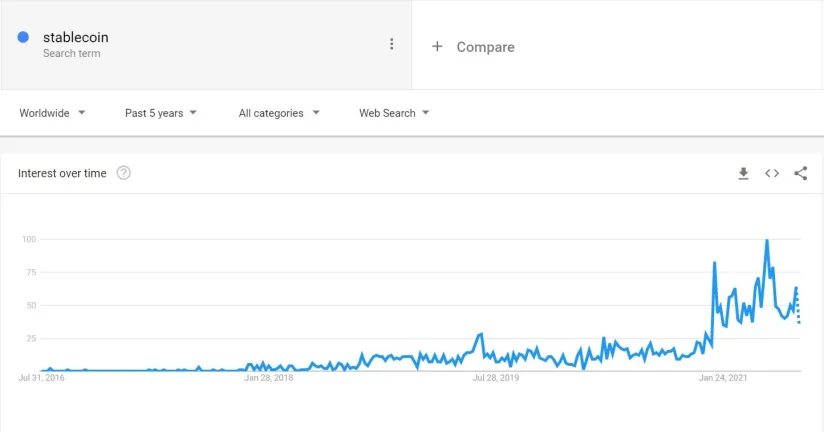

StableCoins are cryptocurrencies whose value is pegged to traditional assets such as national fiat money or gold to reduce price volatility. StableCoins first appeared in 2014 when Tether Limited announced their cryptocurrency Tether (USDT) which was pegged to the USD. As Tether volume started taking off in 2017, other organizations started launching their own StableCoins such as Gemini (GUSD), USD Coin (USDC), and Paxos Standard Token (PAX).

With more than 60 StableCoins listed on crypto exchanges, by the end of July 2021, the market cap of StableCoins reached ±$116B which is getting close to the size of Bitcoin market cap at US$800 billion. However, StableCoins face challenges that may limit their growth and adoption, such as regulatory requirements and government issued competitor tokens.

What is a StableCoin?

StableCoins represent a tokenized version of the underlying assets to which they are pegged and do not suffer from the volatility of a typical cryptocurrency. However, unlike USD or gold, StableCoins benefit from the cryptocurrency feature of performing instant, secure transactions.

What are the types of StableCoins?

There are different ways to categorize StableCoins:

Centralization

There are 2 main ways to describe StableCoins based on the issuing authorities:

Centralized

Centralized StableCoins have stable prices and are less vulnerable to hacks because no actual collateral is held on the blockchain. However they require custodians who store the collateral, and auditors to ensure that collateral backups physically exist.

Decentralized

On the other hand, decentralized StableCoins live on the blockchain and benefit from the decentralized environment of transactions and transfers. Nonetheless, they are more volatile than centralized StableCoins.

Collateralization

According to the backup collateral of a StableCoin, StableCoins can be categorized into 4 types. The type of collaterization also dictates centralization. For example, fiat backed stable coins have to be centralized.

Centralized coins by collateralization

Fiat backed StableCoins

This type of StableCoin is centralized and has a fiat currency (US dollar, Euro, Yen) as collateral, which means that the StableCoin issuing organization has 1$ for each 1$ worth of a StableCoin. These StableCoins have the least price fluctuation as they are directly linked to the price of the actual fiat.

However, not all centralized fiat backed StableCoins are equal. For example,

- the collateral could be verified by 3rd parties

- The issuing authorities could share details on how they collateralize

- The issuing authorities share little to no data on collateralization (e.g. the case of Tether)

Precious metal backed StableCoins

These StableCoins use precious metal such as gold, silver, or platinum as collateral, much like traditional fiat currencies. They enable users to invest in precious metals and perform transactions in a faster and more convenient way. For example, AgAu claim that they store physical gold and silver in Switzerland and sell customers tokens via smart contracts that grant users ownership of a gram of the chosen metal.

These coins may or may not be lower fee way to invest in precious metals. Other alternatives like ETCs (Exchange Traded Commodities) like Xetra-Gold traded in Frankfurt also offer lower fee (e.g. ~1%) methods to invest in precious metals.

Decentralized cryptocurrency backed StableCoins

Crypto-backed StableCoins are decentralized tokens issued with cryptocurrencies as collateral. To ensure that these StableCoins remain stable, issuers follow different protocols to overcollateralize these tokens. For instance, when a user buys a $10 worth of crypto-backed StableCoin, it will be tied to an underlying crypto asset worth $20, so if the underlying crypto loses value, the StableCoin will still have a built-in collateral and can remain at ±$10. These StableCoins typically are prone to higher volatility due to spikes or plunges in the price of the underlying cryptocurrency.

Non-collateralized StableCoins

Non-collateralized StableCoins do not use any asset as collateral. In order to keep the coin price stable, an algorithm is set up to release more tokens or cut from the supply when the token’s price fluctuates more than the underlying pegged asset. These StableCoins are decentralized and independent from any central entity, but they require continuous growth in order to succeed because if the coin price plunges, there is no collateral to liquidate the coin back into.

What is an example of a StableCoin?

USD backed StableCoins

By market cap, the most popular StableCoin is Tether, followed by USD Coin, Binance USD, Dai, TerraUSD, and TrueUSD. All these coins are pegged to the USD with a 1-to-1 ratio (e.g. one StableCoin can be traded for one USD) and they are all backed by ETH to represent a tokenized version of the USD.

Other fiat backed StableCoins

- EURS: pegged to Euro

- KRWB: pegged to Korean Won

- GYEN: pegged to the Japanese Yen

Precious metal backed StableCoins

- Tether Gold: pegged to the price of an ounce of gold

- Silverlink: pegged to the price of 1 gram of 0.999 certified silver

Crypto backed StableCoins

- BTCB: pegged to Bitcoin

- Dai: pegged to USD but backed by Ethereum

Non collateralized StableCoins

- AMPL

- DefiDollar

- Frax

What are strange aspects of the current StableCoin market?

Private companies like Tether issuing unbacked fiat is strange enough. It is like setting up your company’s own central bank.

In addition, StableCoins are traded extremely frequently. By the end of July 2021, the market cap of StableCoins reached ±$116B with a daily trading volume of ±$65B. Almost half of the market cap is traded daily. To compare, only a few percentage points of the market cap seems to be traded daily in other markets like Nasdaq and Bitcoin:

- Nasdaq average daily trading volume was approximately US$169 billion in 2013. Market capitalization of listed companies was US$30 trillion in 2018.

- Bitcoin trading volume is around $26 billion and market cap is around 800 billion as of July 2021.

What is the point of a StableCoin?

StableCoin creators claim that these tokens hold the best of both worlds, because they have the benefits of fast, consistent, and cheap transactions, and they do not suffer from the volatility of decentralized cryptocurrencies such as Bitcoin or DogeCoin. Therefore, they have the following benefits:

- Enable peer-to-peer transactions

- 24/7 availability

- No monitoring authority

- Easy cross-boarder payments and remittance using a non-fluctuating currency

Other than the obvious use cases, people can make money out of StableCoins by staking their tokens on exchanges in order to earn interest with time. For instance, Gemini USD (GUSD) provides 8.6% in annual interest, and Tether and USDC provide 10%.

These are incredibly high interest rates on USD since the central bank pays almost 0%. The interest rates for lending and borrowing are influenced by supply and demand. In case of StableCoins, there is a high volume of loans and a low supply from lenders, which makes the return for lenders high and the interest rate for borrowers high. It is interesting that borrowers are choosing to pay such high interest rates where reputable businesses can enjoy loans at a few percentage points of interest at most. Therefore borrowers must be not creditworthy companies or individuals.

Are StableCoins a good investment?

Although they seem to bring advantages to users and high interest to those that stake them, StableCoins still face challenges that limit their ability to provide significant wealth on the long run. Here are some of the current challenges:

- Issuing authorities may not have good governance: Auditing is required to ensure that issuing organizations have the reserves backing up their tokens. In 2021, Tether Limited were involved in a lawsuit against New York’s attorney general who claimed that Tether did not have enough cash reserves to back all the tether tokens in circulation. Their explanation on their reserves was also high level and not audited by any 3rd party.

- Fiat currencies haven’t always been a good investment: National currencies tend to have a declining values due to inflation. If we compare the price of $1 a hundred years ago in 1921, it will be equivalent to ±$15 today in 2021, at an average inflation rate of 2.76% per year.

- There is a strong competitor around the corner: Several governments are considering issuing a digital form of their national currencies called central bank digital currencies (CBDC) which will provide the same availability and consistency of a StableCoin while being completely regulated and monitored by government authorities. Therefore, governments will prefer their own CBDCs and may enforce laws banning StableCoins. For example, the Chinese government proposed a law in 2020 which bans all yuan-pegged StableCoins clearing the way for the Digital Yuan to be launched by the People’s Bank of China (PBoC). Even more recently, in June 2021, chair of the Federal Reserve Jerome Powell announced that: “You wouldn’t need StableCoins; you wouldn’t need cryptocurrencies, if you had a digital U.S. currency”.

Investing in cryptocurrency will always involve risks and tricks. In order to help you avoid scams we’ve created an in-depth guide to choose a winning cryptocurrency project and avoid scammy ones. We’ve also investigated different cryptocurrency projects which promise users wealth while providing them with nothing. Feel free to read:

And if you are interested in exploring the cryptocurrency market and statistics, feel free to read our article 44 Cryptocurrency Stats: History, market, adoption, users & crimes.

Finally, this is our initial look on StableCoin, feel free to let us know what you think in the comments.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.