Digital Yuan in 2024: China's Attempt to Replace USD

The digital yuan is the second central bank digital currency after the Bahamian Sand dollar, and the first issued by a major economy. The e-CNY is currently undergoing public testing with ±750k lottery-chosen participants to test its usability and effects on domestic and international transactions, as well as between offline devices. As of August 2021, the digital yuan trials have reached ~$5.3B in transactions. Chinese authorities have announced that they plan on using e-CNY during the Beijing 2022 Winter Olympic Games and throughout the various Olympic venues.

Though some economists expect USD to lose its reserve currency status, which would be a major world development, digital yuan’s impact on this is still early to assess. We have analyzed the current conditions:

What is the digital yuan?

The digital yuan, also called e-CNY, e-Yuan, digital RMB, Yuan Cryptocurrency, or Digital Currency Electronic Payment (DCEP) is the virtual form of Chinese renminbi issued by the People’s Bank of China. e-CNY is not meant to replace Chinese renminbi but to be circulated alongside deposit accounts and other payment methods. However, in contrast to regular cash, digital yuan cannot be pickpocketed and does not require carrying extra change in your pocket.

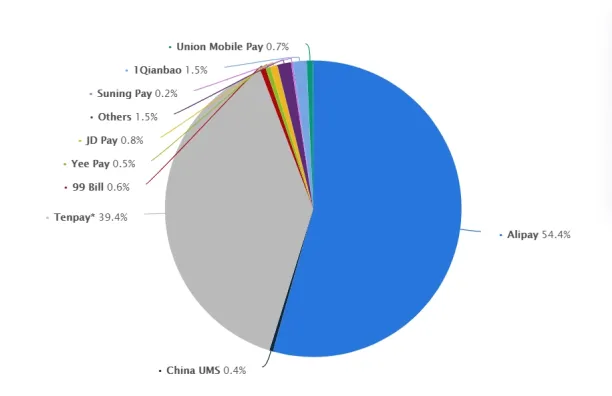

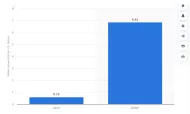

China as one of the world’s most digitized payment markets is also leading currency digitization. China’s total transaction value of mobile payments was estimated at ±350 trillion yuan (±$54 trillion) in 2019 via ±100 billion mobile payment transactions in the country. These statistics make China a great candidate for digitalization of the monetary system.

To get a better grasp of government digital currencies, feel free to read our article on central bank digital currencies (CBDC).

What are digital yuan’s benefits?

According to Mu Changchun, director of the Digital Currency Research Institute of China’s central bank, adopting digital currency will protect the Chinese currency sovereignty and legal currency status, as well as allow controlled anonymity. He claims that this will be achieved by:

- Allowing partially anonymous payments while preventing money-laundering and terrorist-financing

- Enabling international transactions in developing or US sanctioned countries

- Globalizing the Chinese currency allowing it to be a competitor to the USD in the international financial system

In addition, digital yuan:

- Removes banks from the cash ecosystem with the central bank working directly with customers. Fewer middleman may mean more efficient transactions

- Can bring a new layer of flexibility to cash distribution. In times of financial crisis, central banks can

- immediately distribute money (instead of the inefficient check distribution which took place in the US)

- provide money with expiration dates

- provide money that can only be spent on certain goods and services aimed to kickstart the economy

What is digital yuan’s level of adoption?

Chinese firms are participating in testing the digital yuan in their business to gain competitive advantage by becoming the first to introduce the central bank’s digital payment method to their services. For example JD.com, a retail giant, has started using e-CNY for:

- B2C payments on their website

- B2B payments to partner firms

- Cross-bank settlements

- Payroll distribution

Other businesses include:

- Bilibili, a streaming and video sharing platform

- DiDi Chuxing, similar to Uber, a mobile transportation platform that offers app-based transportation services.

- Meituan Dianping, similar to Amazon, China’s largest wholesale and delivery platform for products

Digital yuan vs. Alipay and WeChat pay

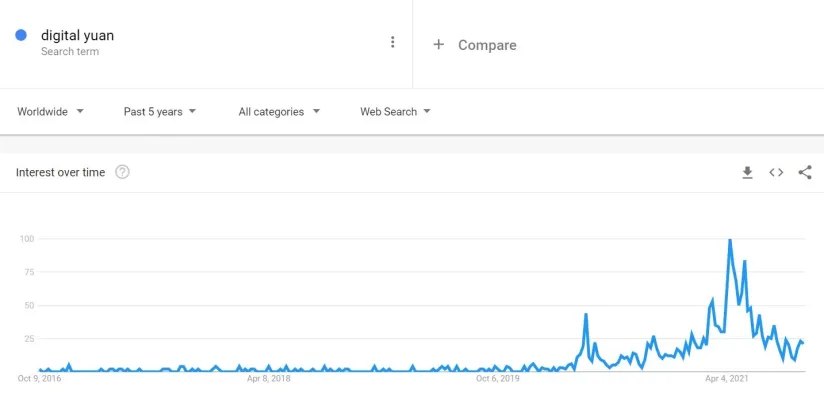

Alipay and WeChat pay, previously called TenPay, are platforms used as wallets for online payments. Alipay is similar to PayPal. It is owned by Alibaba and was first used for payments on their website, then grew to become a payment method for different services as well. On the other hand, WeChat pay is a digital wallet featured in the messaging app WeChat. According to the Chinese IResearch group, these two platforms make up ±93% of the online payment providers market.

Digital yuan will have benefits over Alipay and WeChat pay in the following manner. Digital yuan

- is backed by the state unlike Alipay and WeChat pay. This makes the currency more trusted in China as it is very unlikely for a state backed currency to default on its obligations while Alipay or WeChat could possibly go bankrupt. For example, Alipay received a ±$3 billion fine in 2021. Alipay is financially liquid to survive such challenges but it is still a more risky platform compared to one backed by the central bank.

- could be universally accepted in China, especially if it is enforced by law. There are still stores where AliPay or WeChat are not accepted.

- Digital yuan allows offline transactions which are not available in Alipay or WeChat

- Digital yuan transactions require only having a digital wallet, whereas Alipay and WeChat require the availability of an active bank account to withdraw money from.

Can digital yuan unseat US dollar as a reserve currency?

Successful financial experts like Ray Dalio predict that US dollar will lose its reserve currency status. Making Chinese currency easier to adopt and use could accelerate that.

However, according to Eswar Prasad, an economics professor at Cornell, the digital yuan will not put a dent in the USD status as the dominant global reserve currency because the US dominated the global economic system, maintains deep and liquid capital markets, and a still-robust institutional framework.

Will digital yuan replace cryptocurrency?

Chinese authorities banned ICOs in 2017 and announced that it would crack down on exchanges. These actions were taken on the basis that it is not issued by a legal system, and due to the fear of stoking financial instability and triggering capital flight. However, mining is allowed and China holds the first place in the global Bitcoin mining hashing power (i.e. the amount of processing power that devices use to build a blockchain), and before the ban in 2016 Bitcoin transactions done using Chinese yuan constituted 93% percent of all Bitcoin transactions globally.

The digital yuan will be based on the same blockchain technology used for cryptocurrency, but it will be in a centralized manner with a third-party authority regulating transactions. We speculate that digital yuan will attain great popularity among the Chinese population because:

- It is as stable as the Chinese fiat currency. Lack of stability is a critical factor hampering adoption of cryptocurrencies

- It is issued by a legal authority

- The Chinese population is accustomed to using digital wallets:

Although rolling out a new currency affects the competition, we believe that the adoption of digital yuan will not heavily impact the cryptocurrency market in China. The cryptocurrency market is already banned and the mining, which is a business activity, could be seen as a production activity that does not trigger capital flight.

However, as of late September 2021, China regulators banned cryptocurrency transactions, and stated that they will “work to cut off financial support and electricity supply for mining”. This new regulation caused a plunge in cryptocurrency prices around the world, especially Bitcoin which lost ~5% of its worth in less than 24 hours after China’s announcement. Such regulations could increase the digital yuan’s adoption as less competition exists in the landscape.

Further reading

To learn more about different types of digital currencies, feel free to read our articles:

- Top 10 Best Cryptocurrency Exchange Platforms in 2021

- Crypto investment best practices

- Pi-Network and Bee-Network

If you are interested in blockchain technology, you may find these articles interesting:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow onNext to Read

Anti Money Laundering Algorithms in 2024: Tackling AML with AI

Central Bank Digital Currency (CBDC): In-Depth Guide in 2024

Fintech industry landscape in 2024: 100 most funding companies

Along with the status as global reserve currency, the nation that provides it often has the worlds strongest military. While the US has been militarily aggressive around the world to protect its status as the global reserve nation, it still maintains the semblance of a democratic republic and a relatively decentralized society. China has no such proclivity. It is a deeply centralized and authoritarian society and if the world accepts the digital yuan as the global reserve, authoritarianism will prevail in the world fueled by the Chinese military. This is an affront to civilization and therefore, the world will reject it based on that alone.

Comments

Your email address will not be published. All fields are required.