44 Cryptocurrency Stats: History, market, adoption, users& crimes

Bitcoin is the oldest decentralized cryptocurrency and has the largest market cap within the industry:±$640B as of June 2021. The market of cryptocurrencies launched on blockchains since 2009 has been growing exponentially in the past few years. Many different cryptocurrencies such as Ether, LiteCoin and even joke coins like DogeCoin, and Shiba Coin have been launched.

Governments are also responding to this mostly unregulated financial instrument. They have been trying to embrace some aspects of the cryptocurrency technology via central bank digital currencies such as the digital yuan, in efforts to trigger innovation. In addition, there has been efforts to regulate cryptocurrencies (e.g. by banning financial institutions from acting as crypto exchanges and conducting other crypto related business.

In this article we explore statistics about cryptocurrencies and future expectations about the blockchain monetary system.

Cryptocurrency history

- In 1983, David Chaum, an American cryptographer, created an anonymous cryptographic electronic money called ecash which was the first untraceable digital currency. It required software to enable money withdrawal, and a key to be sent to a recipient.

- In 1996, the National Security Agency published a paper describing the cryptocurrency system, called: “How to Make a Mint: the Cryptography of Anonymous Electronic Cash”.

- In 2009, the first cryptocurrency was launched under the name “Bitcoin” by an anonymous creator who goes by the name “Satoshi Nakamoto”.

- In 2011, other cryptocurrencies made a debut, such as Litecoin, Namecoin and Swiftcoin.

- In 2011, Kraken, a crypto exchange was founded.

- In June 2012, another crypto exchange, Coinbase, was founded

- In 2013, DogeCoin was launched as a joke to mock the concept of cryptocurrencies.

- In March 2018, the word cryptocurrency was added to the Merriam-Webster Dictionary.

- In 2021, Coinbase was the first major crypto exchange to go public. It went public in Nasdaq and lost ±35% of its value since the IPO as of June 2021.

Market size

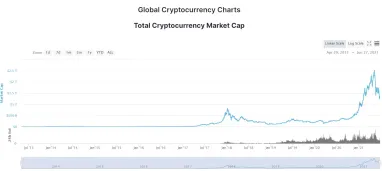

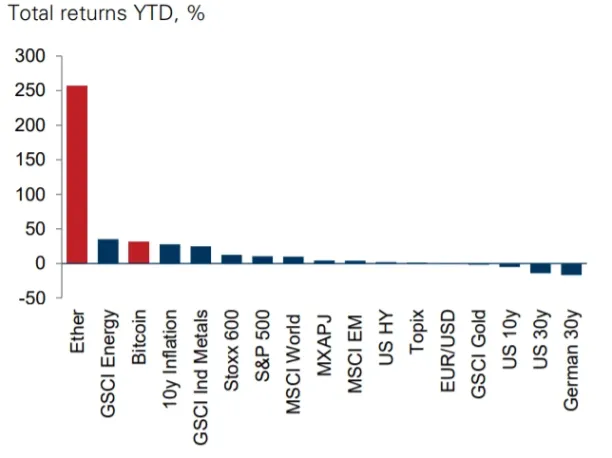

- The cryptocurrency market cap rose ±178,471% from ±$1.5B in 2013 to ±$2.5 Trillion in May 2021 (Coin market cap)

- Global spending on blockchain solutions is projected to reach ±$6.6B by the end of 2021, and ±$19B by 2024. (IDC)

- In 2013, Bitcoin held ±97% of the total cryptocurrency market. (Coin market cap)

- In June 2021, Bitcoin has the largest proportion of the market with 44%, followed by Ethereum at ±17%, Tether at ±4%, Binance coin at ±3.5%, and Cardano coin at ±3%. (Coin market cap)

- In January 2021, the cryptocurrency market lost ±$150B (17%) in 24 hours when Bitcoin and Ether coin prices dropped. (Coin market cap)

- More than 10 crypto billionaires lost ±$15.5B value from their Bitcoin, Gemini, XRP, FTX tokens, and Coinbase stocks, during the May 2021 market crash (Forbes)

- A Goldman Sachs report about cryptocurrency predicted that Ethereum will have a better saving value than Bitcoin by 2025 because most decentralized finance (DeFi) applications are being built on the Ethereum network, and most non-fungible tokens (NFTs) issued are purchased using Ether.

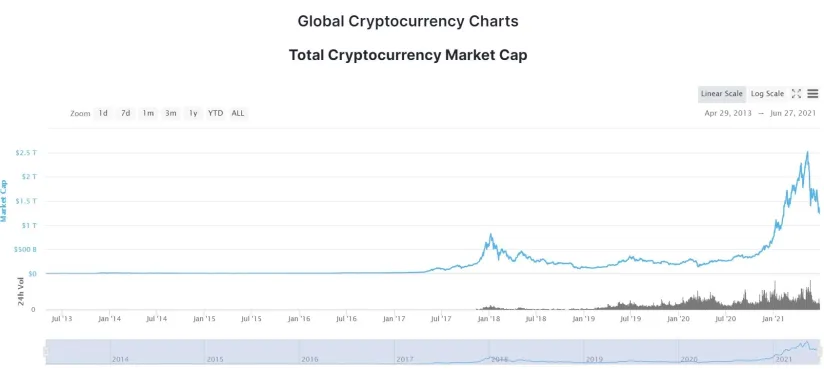

- Among many assets, Ether and Bitcoin had the highest percentage of YTD total returns as of May 2021. This graph excludes other crypto like Dogecoin which had even stronger returns. (Goldman Sachs)

Adoption

- Deploying blockchain technology in financial institutions will generate savings up to $27B on cross-border settlement transactions before the end of 2030. (Juniper)

- Countries which have accepted Cryptocurrency trading are:

- USA: Bitcoin is categorized as property for taxation purposes

- China: In 2017, China banned ICO, and now considers cryptocurrencies as illegal tenders.

- EU: Cryptocurrencies and crypto assets are categorized as qualified financial instruments (QFI) in the EU. However, EU countries have clarified that VAT/GST does not apply in the conversion of conventional (fiat) currency to Bitcoin. Transactions involving Bitcoins for products and services are subject to VAT/GST and other taxes (such as income-tax).

- Japan: The Payment Services Act acknowledges Bitcoin and other digital currencies as legal property in Japan.

- Canada: Canada Revenue Agency considers Bitcoin transactions as barter (transaction of goods for goods), the generated income as business income, and bitcoin exchanges as a service.

- Australia: Cryptocurrencies are categorized as property required to follow the Anti-Money Laundering and Counter-Terrorism Financing Act, and subject to tax.

- El Salvador: In June 2021, El Salvador Congress approved the adoption of Bitcoin as a form of payment within the country.

- Global companies have started accepting Bitcoin and other cryptocurrencies as payment methods as of 2021, such as Microsoft, Tesla, Starbucks, AXA insurance, Amazon, Visa, PayPal, Air Baltic, Coca Cola, Expedia, OverStock, Subway, Shopify.

- As of June 2021, there were ±22,000 Bitcoin ATMs around the world, with +18,000 in the US alone. (Coin ATM Radar)

- Top uses for cryptocurrencies are: (Binance Research)

- Hodling (39%)

- Staking and lending (22%)

- Payments (11%)

- Among 16,000 cryptocurrency users: (Binance Research)

- 52% consider crypto investing as a means of income not a hobby

- 15% say that it is their primary income source

User statistics

- The number of crypto asset owners rose 190% from ±5 million in 2016 to ±101 million in Q3 2020 (Cambridge Business School)

- User demographics are: (Cambridge Business School)

- 79% male, 21% female

- 58% are under 34

- 82% have a bachelor’s degree or higher

- 36% have an annual income over US$100k

- There are +300M cryptocurrency owners around the world in 2021. (TripleA)

Cryptocurrency activity by country

- Unless you have access to detailed data from all exchanges, it is not possible to be precise about country of trading activity in crypto currencies. However in 2020, the highest trading volume of Bitcoin by country was estimated to be (LocalBitcoins, Paxful, Bisq):

- US: ±$1.52B

- Russia: ±$420M

- Nigeria: ±$400M

- Europe: ±204M

- China: ±$198M

- UK cryptocurrency users have increased by 558% since 2018 when just 3% of the population owned cryptocurrency. (Finder)

- Nigeria has the highest volume of Google search about “Cryptocurrency”, followed by St. Helena, Singapore, Cyprus, and UAE. (Google Trends)

- The most popular coin in North America is Bitcoin, accounting for 72% of the total transactions. (Chainalysis)

- Africa has the smallest cryptocurrency economy of any region with ±$8B worth having been received and ±8.1B sent on-chain (Chainalysis)

- India led the world in fiat remittances received at ±$69B. (World Bank Migration and Development report)

- The East Asia cryptocurrency market is dominated by professional traders, with roughly 90% of all volume transferred by East Asia is attributed to professional-sized (above $10,000 worth of cryptocurrency) transfers. (Chainalysis)

- The Middle East accounts for only 15% of the global cryptocurrency market as of June 2020 with Turkey ranking #1 in transactions. (Chainalysis)

Crypto crimes

- Latin America has the largest volume of crypto transactions to illicit accounts (1.6% of the total transaction). (Chainalysis)

- In 2019, ±$4.5B worth of cryptocurrency was transferred for criminal activities. (Reuters)

- In 2020, major crypto thefts, hacks, and frauds totaled $1.9 billion. (CipherTrace)

- Half of all blockchain thefts in 2020, which were estimated at ±$129M, were DeFi-related hacks. (CipherTrace)

- A third of cross-border Bitcoin volume is sent to exchanges with demonstrably weak KYC. (CipherTrace)

- In Russia, the share of cryprominers’ attacks was estimated to be ±2% of users. (Comparitech)

- In 2020, Ireland, United Kingdom, France, Germany, Sweden, Switzerland, Denmark, Netherlands, Norway and Finland encountered the smallest number of ransomware threats, with only 0.01% of machines coming across them every month. (Specopssoft)

- Ransomware crimes rose by 311% year over year, which the firm says was due to Covid-prompted work-from-home measures opening up vulnerabilities for companies. (Chainalysis)

- There are crypto related scams popping up every day. We identified a crypto project, Smart Trade Coin, as a potential scam. Within months of publishing our article, numerous users reported losing ±95% of their savings in the platform.

Investing in cryptocurrency is a tricky, and several projects have a potential to be a scam. To avoid getting scammed, feel free to check our in-depth guide on cryptocurrency investment to choose the right opportunity, and our comprehensive list of cryptocurrency exchanges.

Sources:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.