Dogecoin: The Rise and Fall of the Joke Coin in 2024

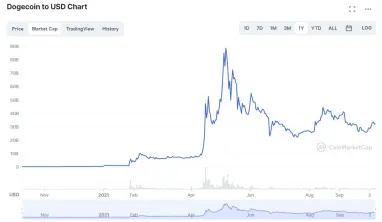

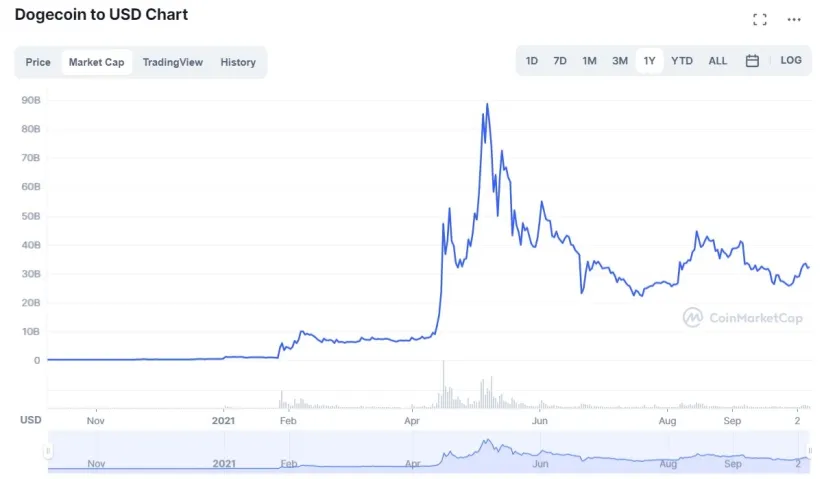

Dogecoin, the most popular meme coin, has witnessed a rollercoaster pricing recently. In the first two weeks of May 2021 alone, the market cap dropped from ~$92 billion to ~$46 billion, and as of October 2021, the market cap reached ~$32B. The joke coin was first put on the market in 2013 and had no use cases except for a few fundraising opportunities launched by fans on reddit. However, celebrity influencers such as Elon Musk and Snoop Dog created a hype over the coin giving it exposure in the past year making it the 6th top cryptocurrency and encouraging the creation of other dog inspired joke coins such as Shiba Inu coin, DogeFi, and UnderDog.

Although it gained popularity recently, Dogecoin doesn’t have impactful use cases, therefore it doesn’t seem like a reliable investment for the long term. As of June 2021, it is trading at about half of its peak value (achieve in May 2021).

Before proceeding, please read our disclaimer on investment related articles.

What is Dogecoin?

Dogecoin is an open-source decentralized cryptocurrency created by software engineers Billy Markus and Jackson Palmer. It was launched with the symbol of the Shiba dog meme in 2013 to mock trending Bitcoin cryptocurrency at the time.

At its earlier stages in December 2013, it was priced at ~$0.0002, but developers implemented a random block reward feature providing an opportunity to win coins if miners could successfully mine the currency, and Doge price rose 9x in January 2014 to $0.0018. In March 2014, the reward was fixed as the number of users grew exponentially. With increasing interest in the project, it was later taken over by scammers and there were cases where users ended up losing real money that were intended for donations.

Differences between Doge and Bitcoin

Doge is similar to Bitcoin and other cryptocurrencies in regard to decentralization and peer-to-peer transaction ability, however, there are many differences between the two:

Mining algorithms

Both Bitcoin and Dogecoin use proof-of-work hashing functions. However, Bitcoin miners use SHA-256 function, whereas Dogecoin uses Scrypt. The SHA-256, requires only computing power to run the algorithm, whereas Scrypt relies on both computing power and a large memory.

Block solving time

Bitcoin block time is estimated at 10 minutes. Dogecoin mining is 10x faster with a block time of 1 minute.

Reward

Whenever a miner adds a new block to the blockchain they are rewarded with a specific amount of tokens. Bitcoin miners are awarded with 12.5 coins per block, however, the reward for a bitcoin miner changes after every 210k blocks are mined (~4 years). On the other hand, Dogecoin miners receive a constant reward of 10,000 tokens per block.

Inflation

Doge was initially launched with a limited supply of a 100 billion tokens, but unlike Bitcoin which remains with a limited supply of 21 million tokens, Doge’s developers removed the limit to promote the use of the token and discourage hodling (e.g. buy and hold strategy in order to sell when prices are high). Doge currently has an infinite inflationary supply with $5 billion doge per year.

However, Doge’s inflation rate will drop with time due to the existing fixed reward which will be divided by a growing capital base. According to Nasdaq, By 2040, Dogecoin’s inflation rate would have dropped to just 2.4%, or roughly the same as U.S. dollars today, and by 2060, it would be 1.6%, making it deflationary relative to dollars.

Does Dogecoin have real-world use cases?

Although it was launched as a joke, Dogecoin’s website gained ~1 million visitors in the first month, and Dogecoin community endorsed the coin by making it a medium of donation and fundraising, and it was finally accepted as a payment method by different businesses in US and Canada.

Donations

Some reddit fundraising examples include:

- ~$30,000 worth of Dogecoin was donated to support Jamaica Bobsleigh team to go to Sochi Winter Olympics in 2014.

- ~$6,000 worth of Dogecoin donated to an Indian luger to sponsor his Sochi Olympics participation.

Additionally, Doge was used as a tip for encouraging interesting or noteworthy social media content.

In 2020, legitimate associations started accepting Dogecoin in the form of donations, such as the American Cancer Society, and Experiment.com (previously known as Microryza).

Payment method

In 2021, some companies decided to start accepting Dogecoin as a form of payment for PR purposes. These companies include:

- Dallas Mavericks: American professional basketball team announced they would accept Dogecoin to pay for tickets and fan merchandize online.

- Post Oak Motor Cars: A Texan luxury car dealership company, announced that accept customers to pay using Dogecoin. They previously announced that they accept Bitcoin in payments in 2018.

- AirBaltic: The Latvian airline stated that they accept Dogecoin to pay for flight tickets and other airline services in partnership with BitPay. BitPay is a payment operator system which converts the cryptocurrency into national currencies (e.g. USD or Euro) at the daily exchange rate.

Other companies include: Strange Donut, Burger Bear, Vapeur Canada, Mike Connell Ministries, etc.

On the other hand, Elon Musk asked in a poll on May 11th if Dogecoin should be accepted as a payment method for Tesla cars and 72% of the >3 million people that voted said “yes”. However, Tesla’s CEO has yet to announce a final decision about the coin. However, given that Tesla no longer accepts even bitcoin as a payment method, Dogecoin is unlikely to be accepted soon.

Why did Dogecoin price drop?

Up until January 2021, the Dogecoin price was stable at ~$0.009, but suddenly pushed up to ~$0.600 when Elon Musk tweeted that he bough Doge for his son so he can be a “Toddler Hodler” and said that Dogecoin was “his favorite cryptocurrency”. The price rose exponentially reaching ~$0.6 in May, and was expected to rise even higher when Musk was intended to speak about Doge in his Saturday Night Live appearance on May 15th. His statement that Dogecoin is a “hustle” and “created as a joke”, brought down its value 35% in 24 hours.

The price dropped possibly for several reasons including:

- Musk’s advice to audience to invest “in caution”

- Musk’s tweets about mining’s environmental costs

- China announcing the launch of the People’s bank digital yuan and banning the use and trade of cryptocurrency

For example, on May 19th, the price dropped again 25%, along with its competitor Shiba coin which dropped 35%.

Is Dogecoin a good investment?

If you want to create long term wealth in a reliable way, we don’t think so. As long as a cryptocurrency doesn’t have real world use cases and relies only on the “Elon Musk Effect” it will have high volatility making it a risky investment, especially when you cannot estimate when it is the right time to exit before the bubble pops.

However, if you have a high appetite for risk and can be better than others in predicting where the price will go, this speculative asset can generate and has generated significant wealth. Probably having a relatively simple algorithm for buying or short selling Doge based on the sentiment in celebrity tweets could yield significant value and we expect Wall Street to be playing that game soon if they are not already doing it. For example, researchers have investigated pump and dump like behavior in Doge.

To avoid making wrong investments in cryptocurrency, feel free to read our guide: Read before you invest in crypto to avoid scams & pick winners

For more on cryptocurrency

To learn more about investments in cryptocurrency, you might find these articles interesting:

We’ve also checked other cryptocurrency projects which are attracting attention but which we don’t think will generate significant value for their holders:

However, these are our opinions, feel free to let us know what you think in the comments section.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.