Cryptocurrency ETFs for Institutional Investors Capital in 2024

In a 2022 NASDAQ survey on cryptocurrency ETFs found that more than 70% of financial advisors will be more likely to invest in cryptocurrency if crypto spot ETFs were offered.

Similar to traditional exchange-traded funds (ETFs) which represent an index or a basket of stocks focused on a specific product or service, cryptocurrency ETFs track the value of a basket of one or more cryptocurrencies or digital tokens.

Instead of trading on a cryptocurrency exchange, ETFs are traded on an exchange like the NYSE or Nasdaq. This ease of use comes with some hefty management fees (2%) and other limitations so users need to be aware of the pros & cons of crypto ETFs.

Before proceeding, please read our disclaimer on investment related topics.

How do cryptocurrency ETFs work?

In traditional ETFs, the fund provider must own the underlying assets that it is tracking in order to sell shares to investors who buy a portion of the fund. However, shareholders do not own the underlying assets in the fund.

In the same manner, cryptocurrency ETF providers must own a digital token or currency (e.g. Bitcoin or Ethereum) in order to provide potential shareholders with exposure to it. Then, the shareholders of that ETF would be owning the digital token as a share in a market like NYSE.

Are there cryptocurrency ETFs?

The US approved the Bitcoin future ETFs in 2021. Since the approval, a handful of Bitcoin future ETFs has been created such as :

- ProShares’ Bitcoin Strategy ETF (BITO)

- ProShares Short Bitcoin ETF (BITI)

However, there are no spot cryptocurrency ETFs in US yet as securities and exchange commission (SEC) has rejected Bitcoin spot ETFs from asset management companies like Grayscale and VanEck.

Until September 2022, Bitcoin holds the record for being the largest and most liquid cryptocurrency, which makes it the best candidate for ETFs to track, followed by Ethereum and Binance coin.

On the other hand, Canada was the first country to approve a Bitcoin ETF in North America with the ticker BTCQ, and it has approved more cryptocurrency ETFs like:

- Purpose Ether ETF (ETHH),

- CI Galaxy Ethereum ETF (ETHX),

- Ether ETF (ETHR).

All ETFs currently trade on the Toronto Stock Exchange (TSE).

Bitcoin ETFs have been approved in countries like:

- Australia

- Brazil

- UAE

Blockchain ETFs

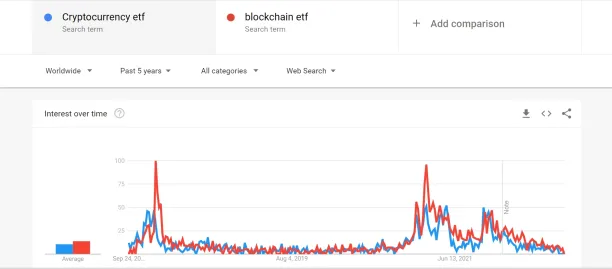

Cryptocurrency ETFs have reached the same level of popularity as their underlying technology, blockchain. The underlying technology is widely tracked by ETFs. Blockchain ETFs track the stocks of companies that invest in blockchain technology, development, research, or utilization.

Here’s a list of currently available ETFs include:

| ETF name | Ticker | Expense Ratio | Issuer |

| Amplify Transformational Data Sharing ETF | BLOK | 0.71% | Amplify |

| Reality Shares Nasdaq NexGen Economy ETF (BLCN) | BLCN | 0.68% | Reality Shares |

| First Trust Indxx Innovative Transaction & Process ETF | LEGR | 0.65% | First Trust |

| Capital Link Global Fintech Leaders ETF | KOIN | 0.95% | Innovation Shares LLC |

| VanEck Vectors Digital Transformation ETF | DAPP | 0.65% | VanEck |

Cryptocurrency asset managers

Another way to gain exposure to cryptocurrency without diving into the blockchain technology is through asset managing firms, such as Osprey or Grayscale Investment Trust (GBTC). These types of funds allow the user to actually own the digital token without creating digital wallets, keys, and storage for the cryptocurrency, in exchange for a management fee. These firms have a limited number of shares (unlike ETFs, which can always create new shares). However, their management fee are higher when compared to ETFs. For example Grayscale Investment Trust management fee is 2.0% while ProShares’ Bitcoin Strategy ETF (BITO) management fee is 0.95%.

Cryptocurrency ownership vs. cryptocurrency ETFs

The prices of cryptocurrency ETFs fluctuate with the currencies they track. However, they have different advantages and disadvantages in comparison to direct investment in cryptocurrency. Here we evaluate both ETFs like Purpose Ether ETF (ETHH) and exchange-traded asset managers like Grayscale Investment Trust (GBTC).

Pros of ETFs

- ETFs are easier to invest in than cryptocurrency:

- ETFs can be sold, bought, and held using traditional brokerage accounts

- ETFs do not require setting up a digital wallet whose password may be lost

- ETFs are issued by regulated companies which reduces the risk of fraud, scandals, or collapses associated with cryptocurrency investments.

- ETFs hold a basket of digital tokens and currencies instead of just one, allowing diversity in investments and minimize the impact of lost if a specific currency price drops.

- Unlike cryptocurrencies, cryptocurrency ETFs are regulated by some governments which make them eligible for investments via government-regulated tax plans, such as the Canadian Registered Retirement Savings Plan (RRSP) and the Tax Free Savings Account (TFSA) which allow their user to invest in crypto ETF and unlock tax efficiency benefits.

Cons of ETFs

- Cryptocurrency ETFs do not make the shareholder owner of a cryptocurrency. This imposes some limitations on cryptocurrency use, for example the shareholders are not able to:

- exchange their Bitcoin for an Ethereum and vice versa

- benefit from the decentralized financial system provided by cryptocurrencies

- Cryptocurrency ETF management fees are considered high in comparison to regular ETFs. For example, ProShares’ Bitcoin Strategy ETF has an expense ratio of 0.95%. This is more than 2x the fees charged by gold ETFs (0.4%).

Additionally, ETFs may have inaccurate tracking of cryptocurrency prices if they track multiple digital assets at a time. For example, a rise of 10% in Bitcoin may not reflect as a 10% rise on the price of an ETF that tracks both Ethereum and Bitcoin.

To learn more about cryptocurrency and blockchain

If you are looking to get into blockchain and cryptocurrency investments, you may find these articles helpful:

- In-depth Guide to Blockchain Consulting & Consultants [2022]

- Decentralized Applications DApps: In-depth Guide 2021

And if you are looking to invest in a blockchain solution, check our data-driven hub of blockchain services, and reach out to us for guidance:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.