Please read our disclaimer on investment related articles.

Tether (USDT) is a stablecoin with a claimed value where 1 USDT equals 1 US dollar. Tether Limited, the centralized authority of USDT, has the ability to print tether and therefore is claiming to print something equivalent to US dollars. Tether is not a central bank, bank or regulated in any way by any country other than British Virgin Islands. It is not audited, has been fined by financial regulators for financial misconduct and revealed that its stablecoin is mostly not backed by the US dollar. Yet, tether still trades at about a dollar. Why?

Financial scams are unravelled when asset holders demand compensation at the same time (e.g. during a bank run) and when the financial institution can not compensate its customers. However, such a bank run could be avoided and scams could go on for very long times or possibly indefinitely if

- asset holding is concentrated in the hands of a few

- asset holders are part of the scam or are vested in the success of the scam

- regulators do not take action

In tether’s case, all of these 3 are correct:

- About a hundred accounts are claimed to control most of the circulation.

- Account holders are likely to be exchanges that take advantage of tether to minimize their dealings with regulated banks which is necessary to deal in US$. This is a guess but we know at least that Bitfinex exchange and Tether Limited claim to be owned by the same individual. Another potential use case is exchanges using Tether to drive up the price of cryptos. Academics have identified correlation between BTC spikes and Tether printing.

- Tether Limited is in British Virgin Islands and is without any financial licenses. Therefore it is not regulated as a financial institution. US authorities can only fine Tether Limited which they have already done. US regulators can not shut down its operations. Sometimes Tether Limited claims to be regulated but by regulation they refer to their registration to FINCEN, Financial Crimes Enforcement Network. However, this registration only means that they can submit suspicious activities to FINCEN. FINCEN clearly states that registering to it does not imply that FINCEN provides any guarantees on their operations.

So we expect tether to continue as long as all these hold:

- Crypto exchanges remain liquid and need it to exist. A run on exchanges could bring down tether but given that exchanges are becoming public, their ability to satisfy high demand is increasing.

- Stablecoins are not regulated. Regulation that stops individuals or institutions from holding onto unregulated stablecoins could end Tether. Tether is attracting regulatory attention:

- There is already a bill in the US House of Representatives for regulating stable coins.

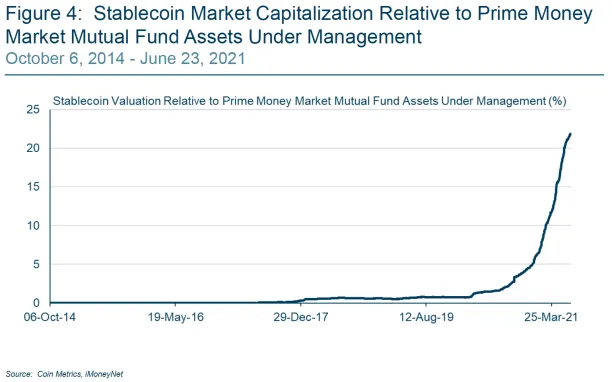

- Boston Federal Reserve has listed Tether among financial stability challenges. One of the exhibits included Tether is listed below.

- Central banks launching digital currencies like the digital yuan will also limit use cases specific to stablecoins.

- In February 2021, Tether paid a $18.5 million fine after settling with Attorney General of the State of New York (AOG) regarding “cover-up to hide the apparent loss of $850 million dollars of co-mingled [sic] client and corporate funds”.

- In October 2021, Commodity Futures Trading Commissions (CFTC) fined Tether $41 million for incorrectly claiming sufficient dollar reserves backing up tethers.

- Tether is not replaced by stablecoins that are backed by currency like USD Coin USDC or Facebook’s Diem which is partnering with a bank. This may happen over time as those that benefited from Tether see the regulatory risks increasing.

Does Tether have legitimate use cases?

Instantaneous unregulated funds transfers without exchange rate risk. Tether’s daily volume is more than its market cap, showing a significant transaction volume. Using non-stable crypto currencies introduces exchange rate risk in transfers, therefore Tether can be seen as a safer way to complete short term funds transfers.

The risk is that if Tether’s price suddenly collapses, those transfers could fail. As long as short term users see that risk to be low, it could enable funds transfers. In the long term, we expect stablecoins that are backed by currency to be used more widely for such transfers due to the regulatory risk in Tether.

Why is Tether possibly a scam?

Tether Limited is unlikely to be able to back all the Tether in circulation with USD even though it claims to be a stablecoin provider. In addition, it is an opaque, unregulated institution, already fined by financial authorities.

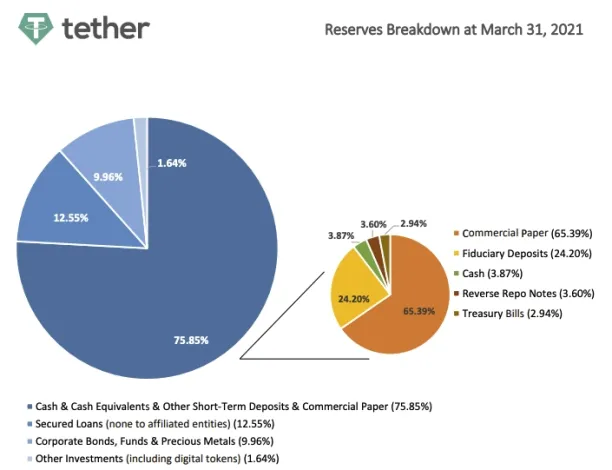

Tethers are not backed by USD. As of March/2021, only a few percentage points of its tethers were backed by cash or equivalents (e.g. cash and treasury bills) as seen below. The value of reserves like commercial papers can not be evaluated without more transparency and an audit.

It is also true for banks do not back all their deposits with cash equivalents. This approach is called fractional banking. However, banks are regulated and provide significant transparency into where they keep their money which is not the case with Tether. Tether Limited also provides no legal guarantees to convert tethers to dollars.

The organization is misleading. The CTO claims that they provided data on backing of Tether due to demands from the crypto community. However, this disclosure came about most probably because they are required by NY Attorney General to increase their transparency.

The organization is opaque. The breakdown it provides regarding how it backs its currency is an unaudited pie chart with no details on any of the assets involved.

Tether executives are facing a criminal probe into their actions in the initial days of the currency.

Who is Tether enriching?

Owners of Tether Limited. Tether places funds in interest bearing instruments like commercial paper and loans with returns. These returns become fully owned by Tether Limited since tether’s price is pegged to 1 US$. So when investors invest in tether, investors get no returns but Tether Limited earns from the USD investors invested in tether.

What is next?

With governments launching central bank digital currencies and moving to regulate tether, tether is unlikely to retain its market impact in the long term. However, regulation moves slowly and it is hard to estimate when such changes will take place.

If regulation is passed to limit tether’s exposure in the US, that could have ripple effects on the crypto industry if exchanges indeed use it to push crypto prices. Based on historical price movements, Tether printing and bitcoin price movements were correlated.

Hope you don’t keep your funds in Tether and avoid crypto scams. To help you avoid crypto scams, we looked at numerous other potential crypto scams from projects like Pi Network that may only waste users’ time to outrageous anonymous projects like Smart Trade Coin that collect users’ cryptoexchange passwords with promises of future wealth.

Finally, this is our initial look at tether, feel free to give us feedback in the comments.

![Timestope is possibly a big waste of time for its users [2025]](https://research.aimultiple.com/wp-content/uploads/trends/6713f735d9a18-190x128.png.webp)

Comments

Your email address will not be published. All fields are required.