Smart Contracts: What Are They & Why They Matter in 2024

One of the biggest challenges organizations are facing is the lack of trust while engaging with another party. Due to the lack of trust and transparency, organizations act cautiously and spend significant time and money on intermediaries while finalizing agreements.

Smart contracts can improve this by removing the intermediaries in cases when contract conditions can be observed publicly. These contracts build trust and transparency between two parties by using blockchain technology. They enable the creation of immutable and accessible contracts.

What is a smart contract?

A smart contract is a computer code that runs on blockchain and enables secure value exchange. Smart contracts can remove the need for a mediator when two parties want to exchange valuable digital or physical assets. It is an application of blockchain relying on a decentralized, immutable public ledger. Smart contracts can be built on platforms like Ethereum Virtual Machine or Solidify.

Smart contracts record contracts as computer code that contains the conditions of the contract. When all conditions are met, the contract is activated.

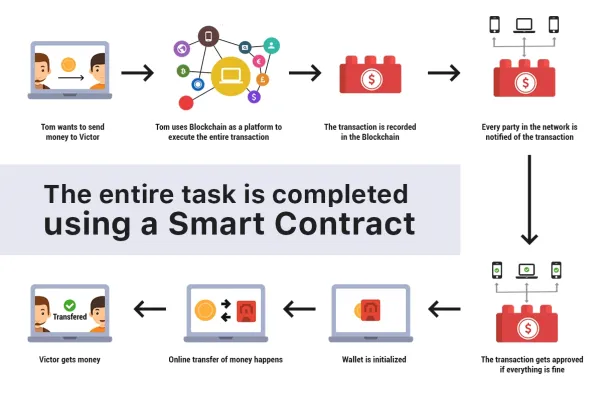

How does it work?

Working principle of smart contracts can be examined in five steps:

- Offer: The transaction process starts with an offer of the first party. The first party writes its terms in the form of an “if-then” statement, then places it into the blockchain.

- Negotiation: Terms are visible to any party on the blockchain so that two parties can negotiate on contract terms.

- Approval: Once two parties agree upon terms and triggering events such as due date, expiration date, strike price or other conditions, the contract becomes immutable and cannot be changed by any party.

- Satisfying Conditions: After each party approves the contract, smart contracts can self-verify the conditions that are placed inside a contract by interpreting real-time data.

- Transaction: When the triggering event occurs, the transfer of assets such as stock, real estate, information, intellectual property, and digital/nondigital funds happen.

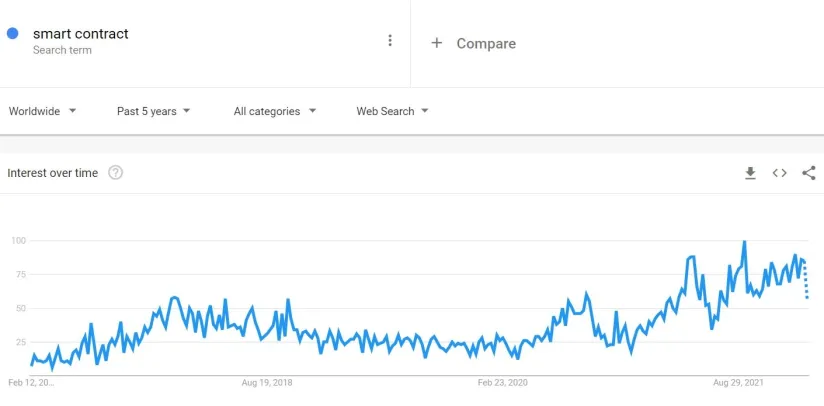

Why is it important now?

Smart contracts are an emerging technology that can increase efficiency in various industries. As the technology matures, more organizations are expected to take advantage of it to reduce costs and enable fast and secure transactions.

Smart contracts market is expected to reach 300 USD Million by 2023 with 32% CAGR since it is

- Cost-effective: Smart contracts can replace agents that mediate agreements in cases where agreement terms can be observed publicly and digitally. For example, in legal processes that are dependent upon traditional torts, property, civil procedure, evidence or contract analysis, smart contracts can replace lawyers by automating manual processes.

- Time-Saving: Due to intermediaries and paperwork of traditional contracts, it takes time to finalize an agreement. Since smart contracts eliminate the need for intermediaries, they can be completed faster.

- Secure: Blockchain technology makes transactions more secure due to its decentralized structure. For instance, if hackers want to change the dollar amount in a transaction, they would need to control at least more than 50% of all computing power on the blockchain. Though the technology does not make the system unhackable, it certainly makes the process harder.

- Accurate: Since smart contracts are written as computer code, there will be fewer parties to make manual mistakes during the process of contract preparation.

What are the common use cases?

- DeFi

- NFTs

- Financial data recording

- Health care

- Insurance

- Logistic

- Real estate

To understand more about smart contract use cases, read Top 9 Smart contract use cases.

What are the leading smart contract development companies?

- Coin Fabric

- Cyber Infrastructure Inc

- Eleks

- HashCash Consultants

- Intellectsoft

- Leeway Hertz

- Quest Global Technologies

- S-Pro

- Solulab Inc

- Sumatosoft

- Uniwebb

If you believe your business can leverage smart contact, feel free to check out our data-driven lists of vendors and development services.

And if you still have questions about smart contracts, we’d like to help:

This article was originally written by former AIMultiple industry analyst Atakan Kantarci and reviewed by Cem Dilmegani

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow onNext to Read

PSBT vs Smart Contracts: Detailed Comparison in 2024

A Deep Dive into Smart Contract NFT in 2024

Bitcoin Smart Contracts in 2024: Challenges & Solutions

I bought smart contracts through a platform that shut down do I lose my smart contracts? If not how do I obtain them

The aim of smart contracts is to reduce reliance on a single centralized authority. So as long as there are transaction processors in the system, the contract should still be realized.

Btw, is this a theoretical question or do you have a specific application in mind?

Comments

Your email address will not be published. All fields are required.