5 Reasons For Intercompany Accounting Automation in 2024

Intercompany accounting is an accounting practice of reconciling payments between two subsidiaries of a parent company. During the financial close manually

- Sorting through transactions

- Cross-matching transactions

- Eliminating duplicates and erroneous transactions

Can be time-consuming and erroneous, especially if there’s limited visibility into them.

According to a survey done by Deloitte, 54% of the 4,000 accounting professionals surveyed manually processed their intercompany reconciliations, with limited counter-party visibility to support reconciliation and elimination.

In this article, we plan to have an in-depth look into what intercompany reconciliation is, how it’s done, and how can automation of the procedure help companies reconcile their balances more transparently and efficiently.

What is intercompany accounting?

Intercompany accounting is sorting through, identifying, and eliminating, off of the parent company’s balance sheets, the transactions that made between subsidiaries.

For instance, Mars Inc. owns M&M’s and Snickers. If M&M’s and Snickers make a transaction between each other, that should neither show as a revenue nor a cost on Mars Inc.’s balance sheet. As far as Mars is concerned, money has gone from one pocket to another, and it should be identified, matched, and reconciled as such.

However, it doesn’t mean that intercompany transactions should not be recorded nowhere. If M&M’s had paid Snickers $100, that amount will show up on the former’s account payables and the latter’s receivables.

Note that these transactions should be reconciled off the parent company’s financial documents, regardless of the direction of the transaction (i.e. from subsidiary to parent company, vice versa, or between two subsidiaries).

Why is intercompany accounting important?

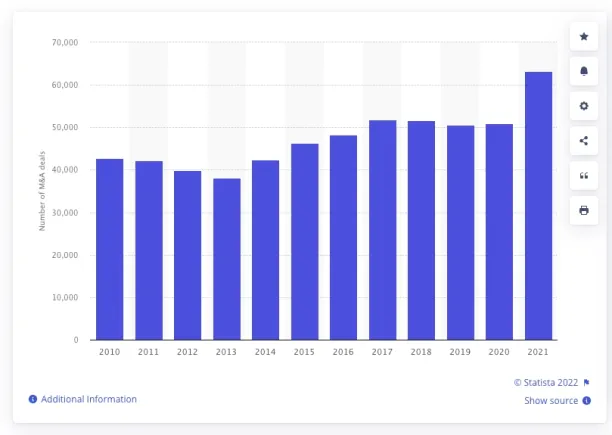

According to Statista, the number of mergers and acquisitions (M&A) has been growing since 2010 (Figure 1). This means there is a growing number of subsidiaries sprouting up around the world, which calls for increased accurate and transparent accounting.

ICR is important because it eliminates intercompany’s transactions from the parent company’s balance sheet, only keeping external transactions.

Double entries (i.e., entries made on the subsidiary and the parent company’s accounts) would give the impression that the parent company has had more volume of transactions and economic activity than it has had in reality. That raises the risk of overstating revenues, or cooking the books.

How is intercompany accounting done?

In financial close, prior to the journal entry, accounting teams have to identify which transactions have to go on the journal. One type of eliminable transactions that won’t make it on the journal is intercompany deals.

For relatively smaller companies, this can be done manually. The accountants will:

- Look at the list of all transactions

- Identify intercompany transactions

- Verify the nature, amount, and date of the intercompany transactions

- Eliminate intercompany transactions

But for larger companies with increased dependency and transactions on each other, sorting through, identifying, and eliminating intercompany transactions can be error-prone, time-consuming, and tiresome.

Why should businesses automate intercompany accounting?

Intercompany accounting should be automated because it has the following benefits to the bookkeeping of a company:

1. Consolidated transactions data

Intercompany accounting automation solutions are integrated with different business systems (e.g. CRM, purchasing software). Therefore, they can extract sales data from different platforms and keep a single version of the truth in a centralized data warehouse. This means that the risk of overlooking transactions is minimized.

2. Settling accounts

Let’s say subsidiary A is in the U.S., and subsidiary B is in Europe, with A having paid $100 to B. You can leverage web scrapers to automatically extract and apply exchange rates, to see if the deposited euro sum matches $100. Otherwise, RPA bots can alert the user of the discrepancy. This will increase the accuracy of payments and increase the resilience of the accounts.

Intercompany accounting software will automatically settle international transactions.

3. Faster close

Especially for large companies, having the benefit of working with clean data will make for a quicker close.

This means accountants do not have to waste their time first identifying the removable transactions. Intercompany accounting uses RPA and machine learning to identify and eliminate recurring and periodic transactions between two subsidiary companies.

4. Viewable dashboards

For accountants to report intercompany transactions at the parent company, there needs to be constant communication and transparency. Doing this manually over calls, emails, and messages takes time and is error prone.

But cloud-based accessibility of automated solutions means all concerned personnel will be able to see which transactions have been cleared off, and why (i.e. looking at each transaction’s invoice and information).

5. Integration

Vendors usually offer their financial automation solution as an ecosystem. So if the internal transactions are reversed in ICR, the transactions that are left will automatically be entered on the journal, get reconciled again, and get posted on the financial statements. The benefit of integrated solutions will speed up the financial close and the record-to-report (R2R) procedure.

Adjacent to reconciliation, if there are any lapses in payments or receivables (see point 2), the software uses orchestration to connect with other automated procedures, such as account receivable automation software or account payable to streamline the collection/payment process until the debt is settled.

For more on financial close

We have prepared some articles for you to read to acquaint yourself more with the other technologies for the financial close process, read:

- 4 Ways to Successfully Automate Financial Close

- Automate Your Financial Close Checklist

- 5 Benefits & 4 Challenges of Financial Close Software

If you think your business would benefit from a financial close solution, we have a data-driven list of vendors prepared.

For broader accounting use cases, we have data driven list of vendors for automated accounting software solutions.

Go through them, and we will help you pick the best ones tailored to your needs:

Cem is the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per Similarweb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Sources:

AIMultiple.com Traffic Analytics, Ranking & Audience, Similarweb.

Why Microsoft, IBM, and Google Are Ramping up Efforts on AI Ethics, Business Insider.

Microsoft invests $1 billion in OpenAI to pursue artificial intelligence that’s smarter than we are, Washington Post.

Data management barriers to AI success, Deloitte.

Empowering AI Leadership: AI C-Suite Toolkit, World Economic Forum.

Science, Research and Innovation Performance of the EU, European Commission.

Public-sector digitization: The trillion-dollar challenge, McKinsey & Company.

Hypatos gets $11.8M for a deep learning approach to document processing, TechCrunch.

We got an exclusive look at the pitch deck AI startup Hypatos used to raise $11 million, Business Insider.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.