Top 5 Retail Monitoring Best Practices & KPIs in 2024

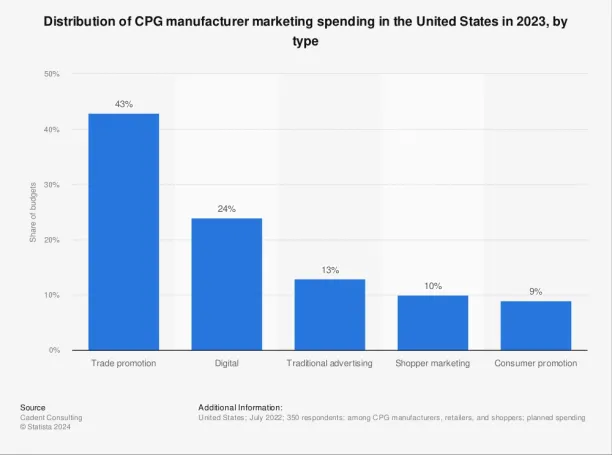

Figures indicate that companies continue to allocate the majority of their marketing budget to trade promotion activities (Figure 1).1 This emphasizes the importance of retail monitoring activities, such as planogram audits and retail data analytics, for companies to succeed in brick-and-mortar stores and the dynamic retail environment. For CPG (Consumer Packaged Goods) and FMCG (Fast-Moving Consumer Goods) brands, real-time retail monitoring can significantly improve business performance by transforming challenges into growth opportunities.

To successfully navigate the complexities of the retail industry, CPG companies must adopt a strategic approach to monitoring their retail operations. In this article, we discuss the top 5 best practices and KPIs essential for effective retail monitoring.

Figure 1. Distribution of CPG marketing spending in 2023

What is retail monitoring?

Retail monitoring for Consumer Packaged Goods (CPG) companies involves keeping a close eye on how their products are performing in stores and online marketplaces. This can include planogram audits, tracking sales data, monitoring inventory levels, and understanding consumer buying behaviors in retail stores.

Why is it important for CPG brands to monitor their retail end?

Retail monitoring is essential for CPG brands or FMCG companies because how they execute their retail end can make a big impact on the consumer’s buying decision. Through retail monitoring, companies can do the following:

- Adherence to planograms: Ensuring products are displayed according to predefined planograms or layouts, affecting visibility and accessibility.

- Effectiveness of planograms: Evaluating if the current product arrangements effectively attract customers and encourage purchases.

- Success of in-store trade marketing: Assessing the impact of promotional activities and in-store marketing campaigns on consumer behavior and sales.

- Identifying successful trade marketing efforts: Differentiating between high and low-performing marketing initiatives to allocate resources more efficiently.

- Leverage store layout data: Analysing how store design influences shopper interaction with products and using that data to enhance product placement.

Top 5 best practices for effectively monitoring the retail end

This section highlights some of the best practices that CPG brands can use to have better control over the retail end of their supply chain.

1. Regular retail audits

Retail audits are a pivotal element of retail monitoring and optimization. These audits are essential for verifying that products and promotional items are presented and available as planned, aligning with strategies aimed at optimizing sales and improving the shopping experience for customers. Effective retail audits include:

- Conducting regular planogram audits through crowdsourcing services.

- Creating a comprehensive retail audit checklist

- Leveraging digital tools to minimize human errors

- Engaging with brand representatives

- Implementing mystery shopping

- Reviewing results and optimizing practices

For more on retail audit best practices.

2. Accurate inventory management

Effective inventory management is the backbone of a successful retail end. It involves maintaining the right balance of stock to meet demand without overstocking or understocking. CPG companies can utilize various strategies to aid in minimizing the risk of stockouts and ensure that consumers find what they’re looking for on store shelves.

Key strategies for CPG companies to refine inventory management and optimize retail stock levels include:

2.1. Implementation of advanced inventory systems

Adopt cutting-edge inventory management software that provides accurate and real-time data on stock levels, enabling proactive replenishment and reduction of overstock situations.

2.2. Utilization of mobile tracking apps

Leverage mobile applications for continuous inventory monitoring and management, allowing for immediate updates and adjustments from anywhere, at any time.

2.3. Data-driven forecasting

Employ predictive analytics and demand forecasting to anticipate demand more accurately, ensuring that inventory levels are aligned with consumer buying patterns and seasonal trends, thus minimizing the risk of stockouts.

3. Enhancing customer experience with data analytics

In today’s retail environment, personalizing the customer journey is no longer optional; it’s imperative. By analyzing data on buying patterns, preferences, and behavior, CPG companies can tailor their trade marketing strategies and in-store experiences to meet the unique needs of their customers. Utilizing tools that provide actionable insights enables businesses to create a more engaging and satisfying shopping experience, ultimately fostering loyalty and driving sales.

3.1. Real-life example

Outdoor equipment producer, Black diamond, utilized a customer data software to halve its cost-per-acquisition and double its return on ad spend. This was achieved through data-driven insights from the retail end that informed its customer acquisition and retention strategies across various channels.efn_note]Customer segmentation in retail: 6 powerful client case studies. Lexer. Accessed: 29/Feb/2024.[/efn_note]

4. Competitive analysis and benchmarking

Understanding the strategies and performance of other competitors is critical for CPG or FMCG companies aiming to stay competitive. This involves monitoring and analyzing the marketing tactics, pricing strategies, and product offerings of competitors. By gaining insights into the competition, CPG brands can refine their own strategies, identify new opportunities for differentiation, and make the right decisions to optimize their market position.

4.1. Working with a crowdsourcing service provider

You can collaborate with a crowdsourcing service provider that offers store check or POS (Point of Sale) check services through a global network of contributors. These contributors can visit stores on behalf of the company to gather information about what the brand’s competitors are doing to enhance their retail strategies.

5. Building a collaborative network with stakeholders

Having a regular flow of data from the retail end is important. Retail monitoring is not a solitary endeavor; it requires the collaboration and coordination of various stakeholders, including retailers, suppliers, and logistics partners. By establishing a strong network and clear communication channels, consumer goods manufacturers can ensure that all parties are aligned with the brand’s goals and strategies. This collaborative approach facilitates smoother operations, from inventory management to in-store marketing, leading to improved business performance and customer satisfaction. You can consider the following:

5.1. Data exchange

Implementing shared platforms for data exchange allows both producers and retailers to access insights on sales and stock levels. This helps in making timely decisions about inventory and promotions, ensuring products meet consumer demand efficiently.

5.2. Collaborative marketing

By co-developing marketing campaigns and promotional strategies, producers and retailers can ensure their efforts are in sync, leading to more impactful brand visibility and consumer engagement at the retail level.

Retail monitoring KPIs

Consumer product goods (CPG) companies rely on various key performance indicators (KPIs) to monitor retail performance effectively. Here are five essential retail monitoring KPIs every CPG company should track:

1. Sell-through rate

This metric gauges the percentage of inventory sold within a specific period, indicating demand and inventory management effectiveness, critical for brick-and-mortar stores and inventory management.

2. Retail compliance

Ensuring products adhere to display and promotional standards in stores is crucial for maintaining retail space visibility and improving customer experience.

3. On-shelf availability

Monitoring stock levels to prevent stockouts and ensure products are available for purchase is vital for customer satisfaction and maximizing sales.

4. Market share

Analyzing the proportion of sales captured within a product category or segment, offering insights into competitiveness and consumer preferences.

5. Point-of-Sale (POS) data

Leveraging real-time sales data from checkout systems to track performance, identify trends, and make data-driven decisions is crucial for optimizing strategies and business performance.

Final thoughts

In the ever-changing retail industry, staying informed and adaptable is key to success. By implementing these best practices in retail monitoring, CPG companies can not only overcome the challenges posed by both brick-and-mortar and e-commerce channels but also harness the opportunities they present. Effective retail monitoring enables businesses to gain a comprehensive understanding of their retail operations, make informed decisions, and ultimately drive revenue and brand growth in a competitive market.

FAQs for retail monitoring

What is the difference between retail audit and retail monitoring?

Retail audit and retail monitoring are closely related but serve different purposes. A retail audit is a more specific, periodic evaluation focused on compliance and performance against predefined standards, such as product placement, pricing, and promotional activities within stores.

Retail monitoring, on the other hand, is an ongoing process that tracks the day-to-day operations and performance of retail activities, providing continuous feedback and insights to optimize retail strategies and consumer engagement.

Can retail monitoring be automated?

Activities like inventory scanning, price tracking, and sales data analysis can be automated using technologies like RFID and data analytics. However, tasks like quality control of products and direct customer interactions still require human involvement due to the need for nuanced assessment and adaptability.

Further reading

If you need further help in finding a vendor or have any questions, feel free to contact us:

External resources

External Links

- 1. Cadent Consulting. (December 7, 2022). Distribution of CPG manufacturer marketing spending in the United States in 2023, by type [Graph]. Statista. Accessed: 01/March/2024.

Comments

Your email address will not be published. All fields are required.