Robotic process automation (RPA) has been a valuable opportunity for businesses, with a payback period of just 9 months, shorter than most other digital technologies, as RPA stats show. However, RPA has limitations, such as its inability to automate using unstructured data. Hyperautomation addresses this by combining advanced technologies to deliver end-to-end automation, overcoming the challenges faced by RPA.

- Robotic Process Automation

- Intelligent Business Process Management Suites (iBPMS)

- Process Mining

- Artificial Intelligence/ Machine Learning

- Natural Language Processing (NLP)

- Optical Character Recognition (OCR)

- Digital Twin of an Organization (DTO).

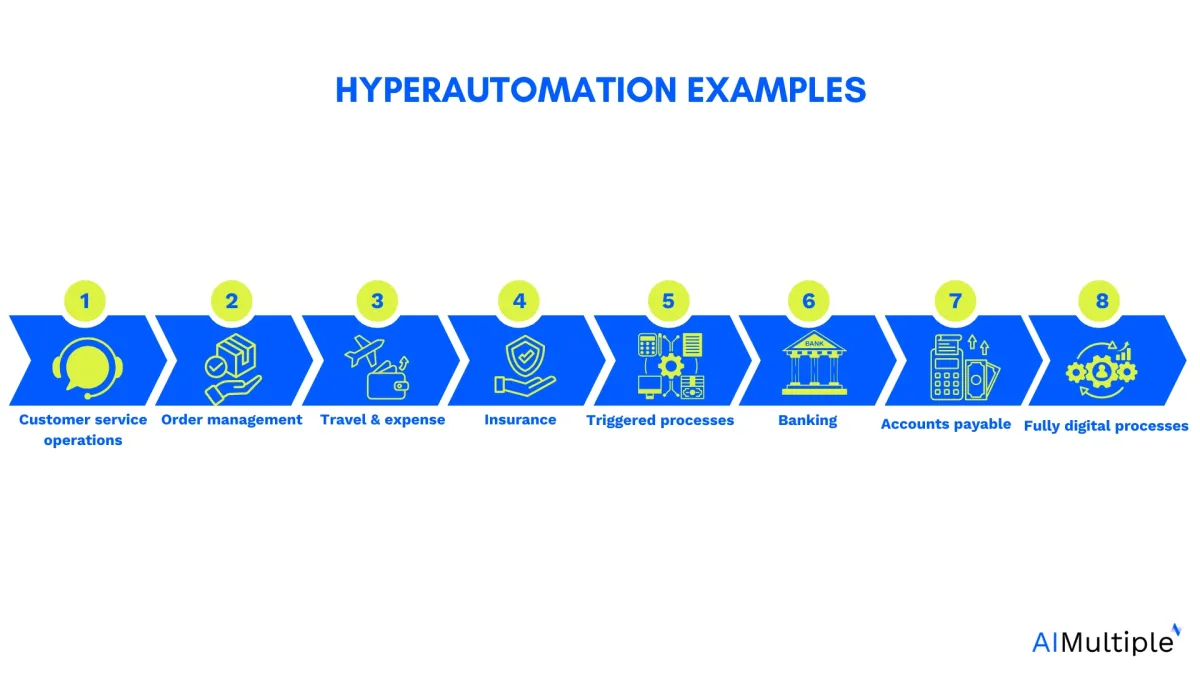

12 repetitive processes where hyperautomation is possible with today’s technology, scroll down:

What is hyperautomation used for?

There are 2 types of processes where hyperautomation can be leveraged:

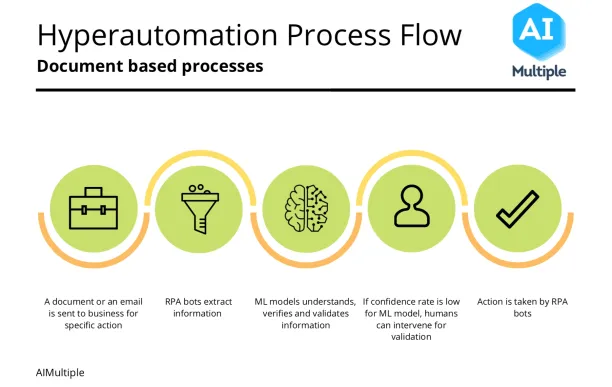

1. Processes triggered by incoming documents or email:

In these processes,

- Incoming documents or emails are collected by a script or RPA bot. These documents or emails can contain semi-structured or unstructured data.

- Document or email is processed using a machine learning model which extracts machine-readable data from the document

- Machine-readable data is validated using rules or ML models. For example, invoices could be validated for VAT compliance or to ensure that they are not fraudulent.

- Validated data is enriched by database lookups or ML models. For example,

- Supplier ID can be looked up from the company’s master data

- Cost center can be added to the invoice based on the company’s historical transactions

- If the confidence level of the machine learning model is low, the output can be reviewed by a human using a human-in-the-loop software

- Finally, this validated and enriched machine-readable data is passed to the next system of record (e.g. ERP)

2. Fully digital processes:

Not all processes require unstructured or semi structured data. Some processes get triggered with structured data from the client or the company’s internal processes. These should be already automated or are candidates for an easy automation implementation.

The following are the specific process candidates for hyperautomation across common business functions like finance, sales, marketing and customer service, as well as industries like insurance and banking:

1. Accounts Payable (AP)

Accounts payable process includes receiving, processing, and paying out invoices from suppliers that provided goods or services to the company. Manual processing

- is expensive

- leads to longer processing times,

- increases the risk of errors

With the addition of machine learning and document extraction technologies such as Optical Character Recognition (OCR) to the RPA, businesses can automate most of the tasks in AP processes.

For more on AP automation, feel free to check our comprehensive article on the topic.

2. Travel & Expense

Travel & Expense (T&E) processes involve paperwork and repetitive tasks that can be automated through hyperautomation. Some T&E processes are:

- collecting employees’ travel expense paper receipts

- extracting data from receipts

- checking receipts to see whether they are compliant with the expense policies of the company

- completing payments or requesting approval on items that are not in line with expense policies

You can also check our in-depth article on travel & expense automation.

3. Claims handling

Claims handling is a broad category seen in various settings. We will mainly focus on insurance claims and workplace claims.

Insurance claims

Insurers can automate almost the entire claims processing without interruption from humans. Claims handling includes the following processes:

- claims intake: extracting data from documents

- claims assessment: understanding and analyzing claims to identify whether they are in line with the customers’ policy

- claims settlement: automating transactions for valid claims

Workplace claims

Workplace claims, or HR claims, refer to processing requests and claims made by employees to the HR department of a company in regards to vacation requests, expense reimbursements, complaints, and more.

4. Order to Cash (O2C)

Order management involves processes such as

- retrieving emails and relevant attachments

- extracting information about what customers want. Some possibilities are

- new order

- order update

- order cancellation

- updating internal systems based on the newly placed order or modifications to existing orders

- taking necessary actions regarding customer query

For more on order management, feel free to check our related article.

5. Other document processing

Manual document processing poses a challenge across industries. Different industries need to process different documents such as invoices, bill of lading, purchase orders, receipts, pay slips, medical records, and prescription. Businesses can automate the processing of these documents via hyperautomation. Document automation involves the following steps:

- Document processing

- data extraction

- validation

- enrichment

- In some cases, document generation will also be necessary. For example, orders may need to be generated from the quotes sent from suppliers. This includes:

- data capture

- transforming data to the desired format

- arranging content

- generating output document

With the combination of OCR and machine learning, a business can automate document processing end-to-end.

For more on document automation, please check our related article.

6. Customer Service Operations

Three technologies are involved in the end-to-end automation of serving simple customer requests:

- NLP: Understanding customer input (e.g. email, document, query) understanding

- Machine learning algorithms to classify customer requests and match them to potential actions

- RPA bots or scripts for output (e.g. sending response emails or messages)

Hyperautomation builds on this by analyzing employee communications to identify customer preferences, enhancing personalized experiences. It also facilitates intelligent ticket routing and data-driven decision-making.

7. Lead generation from anonymous site visitors

Most visitors do not provide companies with their contact information. Using IP and other data, website/mobile app owners can identify the businesses that are browsing their digital applications. This data can be automatically fed into an outreach platform which can identify relevant profiles in those companies based on the profiles of companies’ customers.

For example, if a company sells to the specialists in the procurement department, those profiles would be prioritized. The outreach platform could

- display advertising to these profiles

- send a series of emails to these profiles and once they respond, they can be routed to the sales team

All touchpoints until sales rep responses can be automated in this process.

8. Underwriting processing

Traditional underwriting relies on manual labor in data collection, data extraction, and risk scoring. AI can help insurers automate manual tasks and improve risk assessment.

For more, check our article on AI in underwriting and insurance underwriting.

9. Redaction for privacy preservation

Redaction is necessary to protect personal data. For example, in the US courts subpoena insurers for their customers’ medical records and insurers need to ensure that those records include only the requested data and nothing more. For example, Nonpublic Personal Information (NPI), such as Social Security numbers or telephone information, needs to be removed.

ML based solutions can automatically identify NPI and remove it from documents.

10. Anti Money Laundering (AML)

To prevent fraud in transactions, companies can either work with end-to-end AML solutions or combine RPA bots to provide automation:

- RPA bots collect related data and processes to validate customer records

- Fraud detection models identify unusual patterns through ML algorithms

- RPA bots perform follow-up actions

11. Loan underwriting

The underwriting process of loan transactions can also be automated via RPA & AI. It includes these steps:

- collect data from external and internal sources

- fill required data fields in internal systems

- assess risk via ML models

- analyze the historical transactions of customers and provide pricing & interest options

12. Banking customer onboarding

In banking, customer onboarding is a document-heavy area due to know-your-customer (KYC) regulations. The processes involve:

- identity verification

- screening

- customer due diligence

- scoring

- reporting

- account activation

Automation of customer onboarding is provided by

- pre-trained bots to extract information from documents, input data into their systems and build risk profiles via machine learning

- human-in-the-loop and machine learning models to enable verification and validation of information

- intelligent bots are trained by historical data to improve their accuracy.

Top 4 trends in enterprise hyperautomation

Hyperautomation is one of the top 12 strategic technology trends of 2022 according to Gartner. It is a business approach that aims to identify and automate all business and IT processes that can be automated.

1. Intelligent automation that goes beyond routine processes

Robotic process automation (RPA) has been one of the most popular technologies in the shift to digital transformation in the enterprise. However, hyperautomation requires automation tools to have cognitive abilities for end-to-end process automation. That is why intelligent automation is one of the core technologies within hyperautomation efforts. It is the combined use of RPA with artificial intelligence (AI) technologies such as:

- Machine learning

- Natural language processing (NLP)

- Intelligent document processing (IDP)

- Optical character recognition (OCR)

- Conversational AI

and more. AI-powered automation can execute rule-based as well as more complex processes end-to-end and work with both structured and unstructured data. This helps improve process efficiency and free up employee time for more value-added tasks.

Most of the major RPA vendors provide either built-in cognitive capabilities or marketplaces to add customized cognitive capabilities for intelligent automation. Feel free to check our article on RPA marketplaces for more.

2. Process mining is one of the core hyperautomation technologies

Automating business and IT processes is at the core of hyperautomation, so it is important for businesses to have visibility over the processes to be able to determine which processes to automate and how to automate them. Process mining enables businesses to:

- Understand the as-is state of their existing processes,

- Identify process improvement opportunities,

- Prepare processes to get the most from automating them.

It is reported that by using process mining during RPA implementation, businesses can increase the business value by 40% while reducing RPA implementation time by 50% and RPA project risk by 60%.

The synergy between process mining and automation is evident and major intelligent automation vendors have either integrated process mining capabilities in their solutions or partnered with process mining vendors for integration.

3. Digital twins will go hand in hand with hyperautomation

As hyperautomation involves a holistic approach to automation in an organization, it can benefit from creating a digital twin of an organization (DTO). A DTO is a virtual representation of an entire organization including products, services, processes, employees, and other assets.

The market for digital twins is expected to be $36 billion by 2025 and the enterprise hyperautomation efforts can be one of the driving forces of digital twin adoption in business.

A DTO helps:

- Analyze individual processes and the interactions between them,

- Identify inefficiencies of products, services, or processes,

- Run simulations and conduct predictions about the outcomes of changes in processes, products, or services.

Digital twins provide real-time visibility and intelligence over entire processes and assets of businesses. This can help businesses develop strategies for their hyperautomation initiatives and analyze how to:

- Improve processes before automation,

- Automate them,

- Manage the relationship and integration between different automated processes.

Another emerging trend for digital twins is the integration between process mining and DTOs, as latest process mining news show. Some process mining vendors offer DTO capabilities to help businesses facilitate their automation journey and de-risk process modifications.

Read our complete guide on process mining and digital twins for more.

4. Low-code and no-code tools enable everyone to automate

Since hyperautomation requires rapid identification and automation of as many processes as possible, the democratization of AI/ML development and bot creation becomes a crucial part of it.

Low-code and no-code AI and RPA tools enable non-technical personnel, called citizen developers, to create AI and automation applications with a visual and drag-and-drop interface. According to Gartner’s low code statistics, 70% of new applications developed will use low-code or no-code technologies by 2025. Low and no-code development provides benefits such as:

- Easier involvement for domain experts that know the details of business processes,

- Reduced time for developing and programming automation applications,

- Reduced necessity to invest in hiring or training technical staff,

- Simplified management and maintenance of automation bots.

FAQs

What is hyperautomation?

Hyperautomation refers to the integration of multiple automation technologies, including robotic process automation (RPA), artificial intelligence (AI), machine learning tools, and data analytics, to automate complex and routine tasks across an organization.

Unlike traditional automation, which typically focuses on automating repetitive and manual tasks, hyperautomation enables organizations to transform more comprehensive processes across finance, supply chain management, customer services, and beyond.

With the ability to connect automation tools to existing systems, hyperautomation technologies streamline data entry, customer interactions, and compliance monitoring with minimal human intervention. By automating data management and document processing tasks, hyperautomation improves data accuracy and drives efficient operations.

Organizations implementing hyperautomation gain valuable insights from automated processes, using advanced analytics to make informed decisions. This technology fosters digital transformation and is widely used by financial institutions, the banking sector, and other industries aiming to boost employee productivity, optimize business processes, and enhance overall customer satisfaction.

Benefits of Hyperautomation

Hyperautomation offers organizations significant benefits, primarily by streamlining processes that were once time-consuming and manual. By automating routine tasks, such as data entry, payroll processing, and financial reporting, businesses reduce operational costs and improve efficiency across multiple processes.

Hyperautomation technologies also enhance data quality, enabling companies to monitor compliance, manage regulatory reporting, and ensure data accuracy. In the banking sector and other financial organizations, automating repetitive processes helps reduce human errors and operational risks. Hyperautomation further empowers supply chain processes and supplier management, leading to better inventory and expense management. Through data-driven insights, organizations identify potential risks, optimize business processes, and gain insights from customer interactions.

This hyperautomation innovation stack not only minimizes manual effort but also drives customer satisfaction, business growth, and employee productivity by using AI-powered virtual assistants and automation tools for valuable customer services.

Further reading

Explore more on hypterautomation through our comprehensive articles:

Comments

Your email address will not be published. All fields are required.