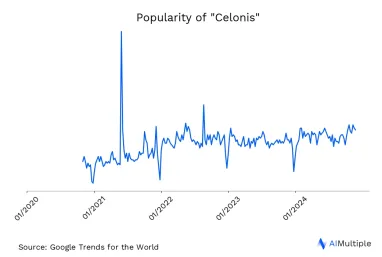

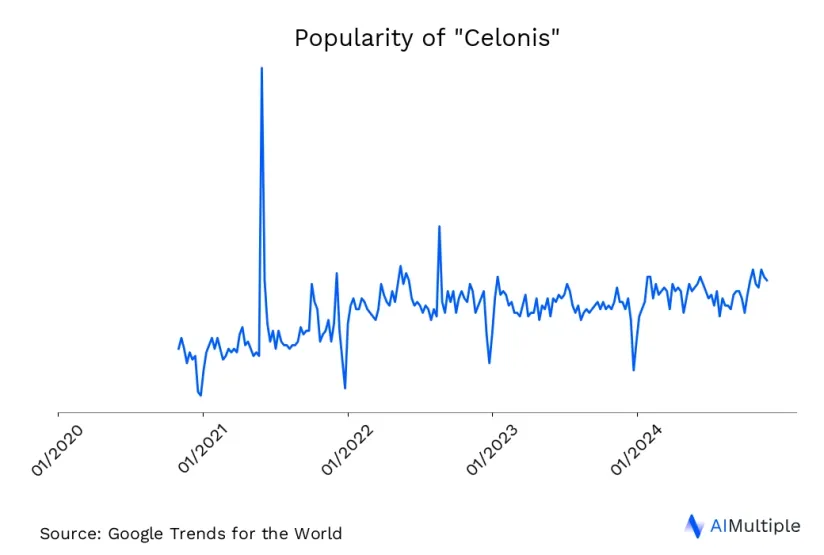

Celonis claims to be the process mining market leader with 60% market share. Its popularity has been increasing over the last 5 years (See Figure 1). However, recent acquisitions from tech giants, such as Myinvenio by IBM and Minit by Microsoft, have created formidable competitors. A good understanding of Celonis process mining and its competitors is necessary to find the right process mining software for your company.

Therefore, our research explains Celonis as a firm, mentions its products and compares it to its competitors.

What is Celonis?

Celonis was founded in 2011 and raised the bar after launching a scalable process mining solution, Intelligent Business Cloud, in 2018 and Celonis Execution Management System in 2020. 1 Today, the firm operates between 20-30 countries with two headquarters in Munich, Germany, and New York City, USA.

Read our comprehensive analysis to learn about leading process mining vendors.

Is Celonis owned by SAP?

No, SAP is not an investor or owner of Celonis. Celonis is a partner of SAP and offers data connectors and applications to capture and analyze event logs data registered in SAP, ERP systems. Celonis also provides this functionality for other non-SAP systems as well.

Explore how to leverage process mining in SAP in detail.

What products does Celonis offer?

Celonis process mining provides products with on-premise, cloud, and hybrid options. These products can be found under three license types:

- Academic.

- Commercial.

- Free trial. Learn what Celonis free trial offers and compare it to other process mining vendors with free trials.

Celonis bundles all its products under Celonis EMS:

Celonis Execution Management System (EMS)

Celonis Execution Management System (EMS) is a low-code environment that includes:

- Connectors to gather data from desktops, documents, and other systems to automatically deploy automations

- Task mining to capture user interactions

- Process intelligence to map processes, find inefficiencies and suggest improvements

What are the latest developments in Celonis EMS

What are the Celonis AI developments?

Celonis has significantly advanced its AI capabilities to enhance the EMS’s capabilities in process intelligence and operational efficiency. 2 These AI advancements include:

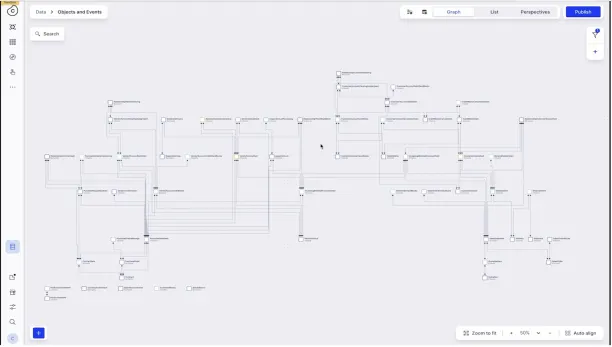

Process intelligence graph (PI Graph)

Introduced in 2023, the Celonis Process Intelligence (PI) Graph is a system-agnostic digital twin of a business, designed to provide a comprehensive view of operations. It integrates unique business contexts such as KPI definitions and improvement opportunities, helping organizations understand, optimize, and scale processes seamlessly.

Features

- Unified process data to extract and standardize process data from any system without disrupting existing tools, combining it with Celonis’ decade of process knowledge and AI.

- Seamless data integration to connect with 100+ pre-built connectors for ERPs, CRMs, data warehouses, SAP, Salesforce, and enable real-time streaming via Apache Kafka. Custom extractors and task mining further enrich process insights.

- End-to-End process cisibility to create a digital twin by mapping business objects (e.g., orders, invoices) and events (e.g., order creation, invoice payment), allowing users to track inefficiencies and improvement opportunities.

- Scalability & reusability to deploy standardized objects and events once and reuse them across multiple processes and future use cases.

- Knowledge hub to serve as a centralized repository for KPIs, records, and strategic objectives. By integrating Celonis’ AI-powered process knowledge, businesses can extract insights faster and drive continuous process improvement.

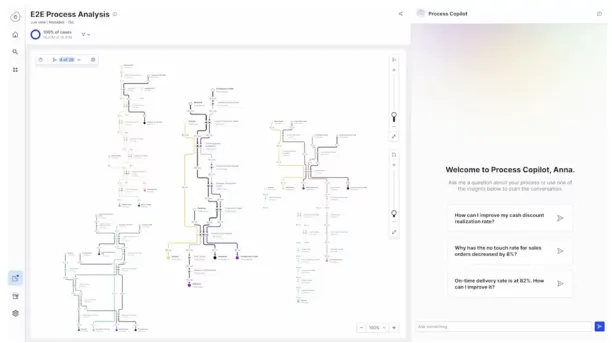

Celonis process copilot

Celonis Process Copilot is a generative AI-powered digital assistant, launched in 2023 but currently in beta, that helps businesses analyze and optimize processes using natural language. As part of the CeloAI suite, it enables users—technical and non-technical alike—to uncover insights and act on process improvements efficiently.

Features

- Conversational AI to query business processes in natural language to get real-time insights.

- LLM-Powered Intelligence to democratize access to process insights, making data-driven decisions accessible to all.

- Automated Recommendations to suggest questions, insights, and opportunities based on key performance indicators (KPIs).

- Smart Filters & Actions to read, apply, and recommend filters in Process Explorer, enabling better analysis. Users can also export data, download charts, and generate emails with insights.

- Process Intelligence Integration to help AI understand workflows, driving more effective process optimizations.

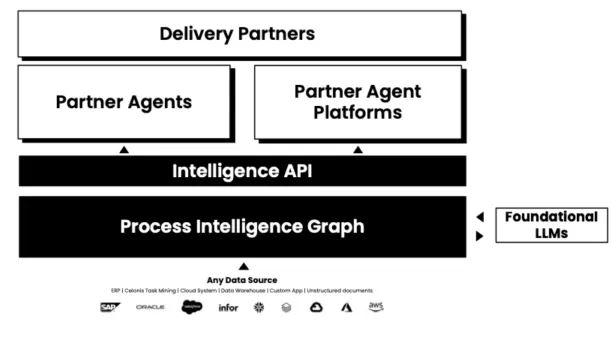

AgentC

Launched in 2024, Celonis AgentC is a suite of AI agent tools, integrations, and partnerships that enables businesses to develop and deploy AI agents in leading AI platforms. Powered by Celonis Process Intelligence, these AI agents understand how businesses operate and drive automation, optimization, and smarter decision-making.

Features

- AI Agent development to create AI agents on Microsoft Copilot Studio, IBM watsonx Orchestrate, Amazon Bedrock Agents, and open-source environments like CrewAI. Businesses can also use pre-built AI agents from partners like Rollio and Hypatos.

- Process intelligence-powered AI to bridge the gap between large language models (LLMs) and business processes, feeding AI with contextual business rules, KPIs, and process insights for more effective decision-making.

- AI assistant builder to help organizations build AI assistants within Celonis. These assistants classify data, provide recommendations, and reason through complex tasks such as customer service ticket prioritization or credit block removal.

- Scalable AI orchestration to support enterprises with consulting partners like Accenture, IBM Consulting, and EY, helping them deploy and scale AI solutions tailored to their needs.

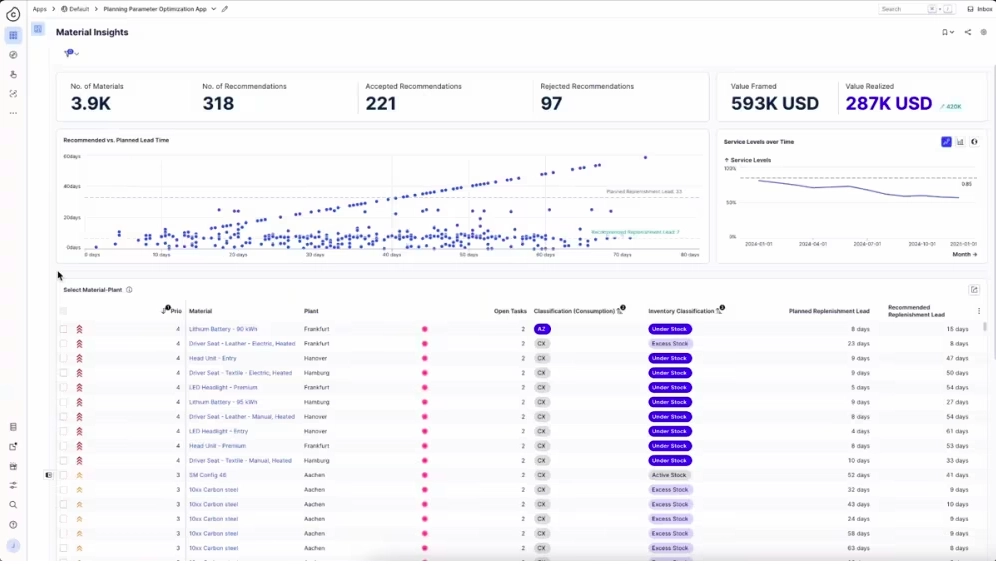

AI-powered applications

Launched in 2023, Celonis AI-powered applications integrate process intelligence and AI to optimize enterprise processes, decision-making, and automation. These applications enhance efficiency, cost savings, and operational accuracy by leveraging AI-driven insights and machine learning.

Features

- Planning parameter optimization app to provide material planners with updated parameters based on evolving consumption patterns using ML models, improving supply chain efficiency.

- Free-text requisition app to enhance procurement by automatically converting free-text requisitions into structured purchase orders (POs), reducing manual processing and maverick spending.

- Duplicate invoice checker to strengthen financial operations by detecting duplicate invoices using ML algorithms, preventing costly errors often missed by traditional ERP systems.

- AI-driven process intelligence to provide real-time process insights by analyzing workflows across departments and systems, helping businesses identify inefficiencies and automation opportunities.

- Object-centric process mining to create a digital twin of enterprise operations, feeding process intelligence into third-party AI applications for enhanced orchestration. Explore more on object centric process mining.

What are the Celonis EMS developments in 2022?

- Celonis acquired Process Analytics Factory (PAF), a company developing process mining for Power BI. This way, Celonis integrated the Microsoft Power platform into EMS, improving business intelligence and connecting to the Microsoft Community.

Check out Celonis EMS demo video for more:

Capabilities

According to the Celonis website, Celonis process mining features include:

- Process discovery

- Conformance checking

- Process simulation

- Predictive analytics

- Automated root cause analysis

- Task mining

Data extraction

Celonis Process Mining can pull data from various sources, such as Postgres, HANA, or Amazon Redshift. It also offers connectors to ERP (e.g., SAP), CRM (e.g., Salesforce and ServiceNow), and other systems to extract real-time data on business processes.

Celonis Task Mining collects data by recording user activities through an app, called workforce productivity. The tool automatically creates a dataset with screen records and analyzes them in terms of employee experience and performance metrics.

For more on how Celonis task mining works, read our task mining article.

Read our process mining software comparison to learn and compare these process mining capabilities in detail.

Is Celonis an ETL tool?

Yes, Celonis collects data from cloud-based applications and on-premise systems and creates a table containing steps involved in the given process with the help of Extract, Transform, Load (ETL) tools. Once the table is ready, Celonis Process Mining analyzes the data to map and develop process KPIs.

Celonis alternatives

The process Mining market was projected to grow by 40% to 50% last year, as market size stats indicate. Such growth suggests increasing competition. Currently vendors like IBM and UiPath are Celonis’ main competitors. Discover such Celonis alternatives and explore Celonis’ shortcomings.

Process mining vendors offer additional capabilities to remain agile in a competitive market. Process mining trends show that in the following years, there will be more:

- Integrated tools and capabilities like automation platforms

- Additional features such as DTO and predictive analytics

- Actionable process mining solutions

- Vendors adopting AI/ ML

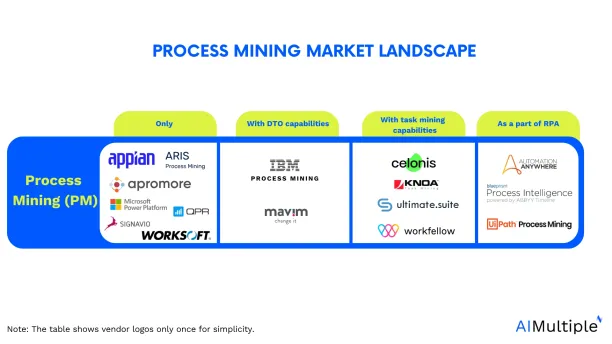

Figure 3 is a vendor schema locating process mining vendors based on their capabilities of digital twin of an organization (DTO), task mining and a part of RPA platform. The schema is prepared according to company websites. Note that the schema excludes vendors that have less than 30 employees.

Is Celonis a unicorn company?

Yes, Celonis is a unicorn company since the company achieved a valuation of $1 billion, earning it unicorn status in 2018.7 Also, Handelsblatt, a leading German business newspaper, has recognized Celonis as a unicorn company in 2021.8

Is Celonis a big company?

Yes, Celonis is considered a significant player in the enterprise software industry. Celonis employs over 3,000 people across more than 20 global offices, serving a diverse clientele of over 1,400 businesses worldwide.9 As of 2023, the company reported revenues of $771 million, underscoring its substantial market presence 10

How to get the free plan of Celonis

Celonis offers a free plan that provides access to its process and task mining features, as well as the Celonis Studio.

- Visit Celonis Academic Sign-up to sign up using your academic or work email address.

- Check your inbox for the invitation email and click on the link.

- Log into your personal account and begin exploring the platform.

Example Data Sets:

You can find potential event logs to upload into Celonis at these resources:

Real-life case studies of Celonis

Check out articles and lists below to discover real-life use cases with examples for all process mining software including Celonis:

Further Reading

If you are interested, you can also read our articles about process mining below:

If you want to compare Celonis to different vendors, check out our data-driven and comprehensive process mining software list.

If you are interested in alternatives tools to process mining like other process intelligence software, process analysis tools or process improvement techniques, check out:

- Process modeling

- Task mining

- Automated process discovery tools

- The digital twin of an organization (DTO)

External sources

- 1. Celonis Showcases Latest Process Intelligence and AI Innovations at Next 2025.

- 2. Celonis Next 2024: Process Intelligence and AI take center stage within the enterprise.

- 3. Process Intelligence Graph: Process Data + Knowledge | Celonis.

- 4. Celonis Process Copilots: GenAI companions help business increase process intelligence.

- 5. Enterprise AI unleashed: AgentC lets companies develop agents in leading AI platforms powered with Celonis Process Intelligence.

- 6. Celonis Next 2024: Process Intelligence and AI take center stage within the enterprise.

- 7. The first “unicorn” from TUM - TUM.

- 8. Celonis Awards & Recognition.

- 9. Frequently Asked Questions | Celonis Process Intelligence.

- 10. How Celonis hit $771M revenue and 500 customers in 2023..

Comments

Your email address will not be published. All fields are required.